US Ginger Market Research Report: Forecast (2025-2030)

US Ginger Market Size, Growth & Industry Analysis - By Product Type (Fresh Ginger, Dried Ginger, Ginger Pickle, Ginger Oil, Ginger Powder, Crystalized Ginger, Ginger Extracts [Oleo...resin], Others), By End-User (Food & Beverage, Pharmaceuticals/Nutraceuticals, Cosmetics & Personal Care, Household/Retail, Others), By Distribution Channel (Supermarkets/Hypermarkets, Wholesale/Direct Distribution, Grocery Stores, Specialty & Health Food Stores, Convenience Stores, Online Retail) and Others Read more

- Food & Beverages

- Sep 2025

- Pages 108

- Report Format: PDF, Excel, PPT

US Ginger Market

Projected 5.50% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2025)

USD 2.26 Billion

Market Size (2030)

USD 3.12 Billion

Base Year

2024

Projected CAGR

5.50%

Leading Segments

By Type: Fresh Ginger

Market Insights & Analysis: US Ginger Market (2025-30):

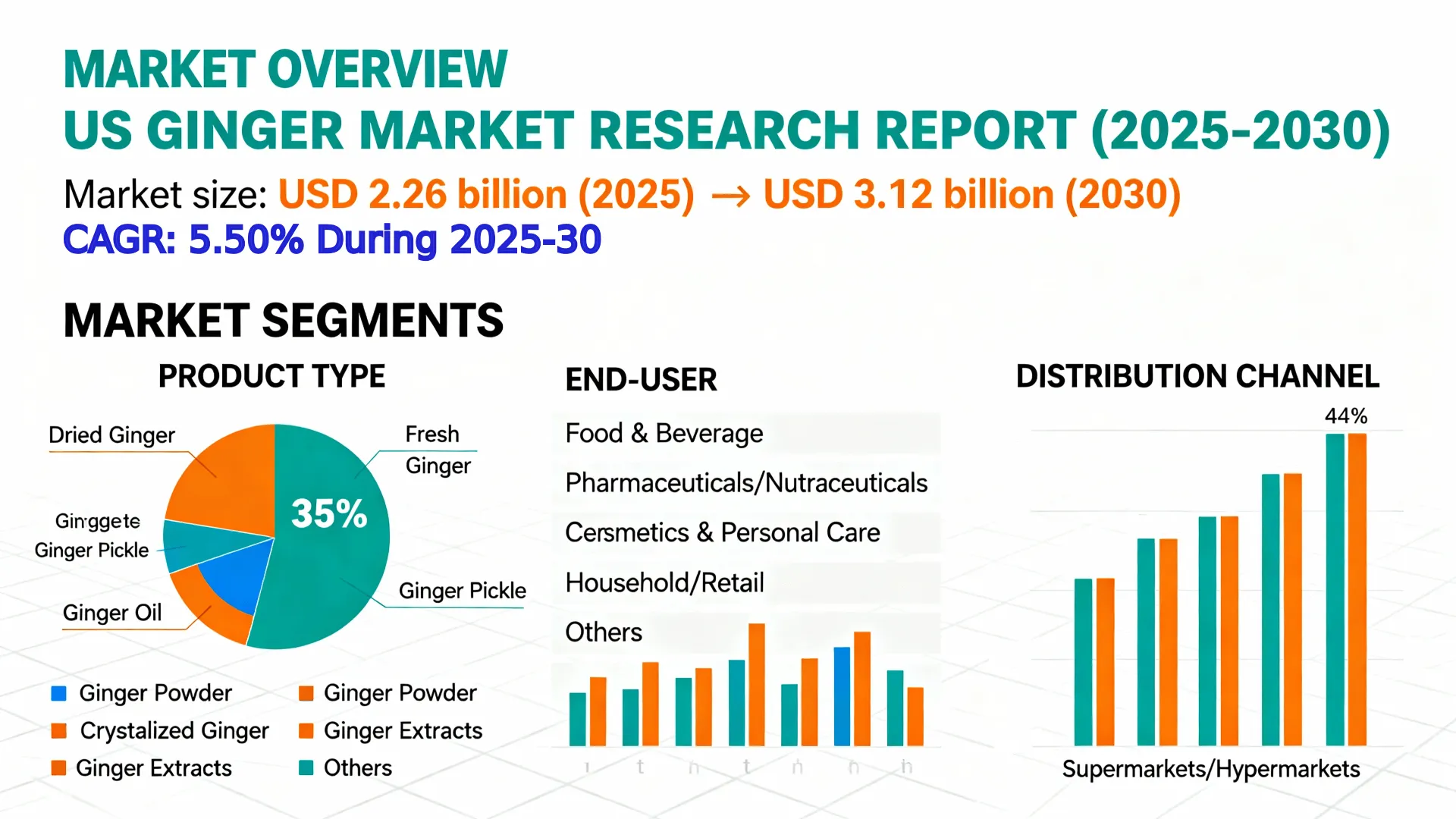

The US Ginger Market size is valued at around USD 2.26 billion in 2025 and is expected to reach USD 3.12 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.50% during the forecast period, i.e., 2025-30. The US Ginger Market is significantly growing due to several growth factors, including the rising culinary tourism in the country, the increasing health consciousness, the widespread acceptance of ginger-based drinks and beverages, the active support by the US government, and the rapid adoption of ginger-based nutraceuticals like supplements, etc.

One of the most prominent growth factors is the rising demand for ginger coming from the rising cosmetics and personal care sector in the country, especially in the manufacturing of face serums, face masks, moisturizers, etc. For instance, recently in 2024, the Sabinsa Corporation launched high-gingerol products for sports health. Similarly, Hanamoa Co., Ltd. (2025) introduced a ginger-infused skincare product called Ginger6 Brightening Serum in the US. Additionally, the government of the United States is actively promoting the local cultivation of ginger by drafting various initiatives and heavily investing in these farming projects, contributing to the potential market growth.

Moreover, the adoption of the ginger-infused dietary supplements and functional foods in the United States is positively shaping the growth trajectory of the Ginger Industry, as the dietary supplements have become an essential part of many consumers in the country, and the ginger infusion is enhancing their health-improving properties and efficiency, thus augmenting the size & volume of the market. However, the limited local production facilities are hindering the market growth.

US Ginger Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Fresh Ginger, Dried Ginger, Ginger Pickle, Ginger Oil, Ginger Powder, Crystalized Ginger, Ginger Extracts [Oleoresin], Others |

| By End-User | Food & Beverage, Pharmaceuticals/Nutraceuticals, Cosmetics & Personal Care, Household/Retail, Others |

| By Distribution Channel | Supermarkets/Hypermarkets, Wholesale/Direct Distribution, Grocery Stores, Specialty & Health Food Stores, Convenience Stores, Online Retail |

US Ginger Market Driver:

Rising Demand for Ginger-Based Beverages – The market growth is driven by the demand for ginger-based beverages in the US due to growing health consciousness among individuals. Ginger has significant health benefits, including immunity-boosting digestive, anti-inflammatory properties, which contribute to its inclusion in different beverages. Consequently, the US is among the top three producers of ginger-based drinks globally. For instance, Reed’s Inc. has a 30,000 sq. foot manufacturing facility in Los Angeles, California, spread across more than 25,000 different locations in the United States. This facility produces a significant variety of ginger-based drinks, including ginger beer, zero sugar extra ginger beer, etc., increasing the demand for ginger in the country. Similarly, Rachel’s Ginger Beer company processes about 1,500 pounds of ginger per week to produce ginger beer, increasing the market growth.

Additionally, the rising exports of these ginger-based beverages are further increasing the demand for fresh ginger and driving the market growth. For instance, in 2024-25, the US witnessed a surge in the exports of a soft drink called ginger ale, with more than 2,000 shipments showing a 23% growth as compared to the previous fiscal year, thus actively driving the market growth.

US Ginger Market Opportunity:

Government-led Initiatives Offering Lucrative Growth Opportunities– The rising support of the US government to encourage the local production and cultivation of ginger in the United States to avoid import dependence is offering ample growth opportunities to the Ginger Market in the United States. The USDA (2024) invested in different programs, such as the Specialty Crop Block Grant Program (SCBGP), promoting local cultivation of specialty crops, including ginger. For instance, the Illinois Department of Agriculture allocated about USD525,000 to increase the ginger production in the country.

Additionally, another USDA-led program (2024) called Ginger Propagation and Production Protocol Development for Niche Markets aimed to increase the production of baby ginger to support small-scale farming in the United States. Similarly, an SARE-funded program called “Ginger Production in the Northeast” is focused on the production of ginger cultivation, especially in the north-eastern parts of the country, including New York, Rutgers University (New Jersey), and Virginia State University. These kinds of efforts are offering lucrative growth opportunities for the market players to increase their market size & volume.

US Ginger Market Challenge:

Limited Domestic Production Hindering Market Growth– The market growth is hindered by the limited domestic production of ginger in the country, due to which it largely depends on ginger imports from foreign markets. For instance, in 2023, the United States produced only about 660 tons of ginger locally, which is less than 1% of the total consumption of ginger in the country in that year, showing a large gap between the rising demand and supply, causing hindrance to this market. Additionally, in 2023, the US imported about 1,00,000 tons of ginger from countries like China, Peru, India, etc., showing a heavy import reliance.

Moreover, it resulted in fragmented supply chains, causing delays in the ginger deliveries. For instance, in 2024, due to extreme weather conditions, the major exporters China and Peru faced a 30-40% decrease in ginger harvest, disrupting global supply chains, including the ginger markets of the United States, thus hindering smooth market growth.

US Ginger Market Trend:

Ginger-based Nutraceutical Products Gaining Traction – The market landscape is changing due to the adoption of ginger-based nutraceutical products, including dietary supplements and functional food items, in the United States, as ginger has bioactive properties, including antioxidants, anti-inflammatory, and immunity-boosting properties.

Several key companies, such as Nutraland USA, GNGR Labs, Now Foods, EZStrip Ease, etc., have actively started manufacturing ginger-based nutraceutical products in the country. For instance, Nutraland USA (2024) unveiled a ginger-based product called Actiz!ng, which is highly beneficial in physical fitness, weight management, and sexual health. Similarly, in 2025, the GNGR Labs produced a functional food, including a fresh organic ginger shot to improve the overall health of individuals. These kinds of launches are rapidly transforming the US Ginger Market positively.

US Ginger Market (2025-30): Segmentation Analysis

The US Ginger Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Product Type:

- Fresh Ginger

- Dried Ginger

- Ginger Pickle

- Ginger Oil

- Ginger Powder

- Crystalized Ginger

- Ginger Extracts (Oleoresin)

- Others

Out of these, fresh ginger is leading the market, accounting for more than 35% of the market share. This is leading due to the high consumption of fresh ginger by US consumers in both household and food services, as ginger has medicinal properties naturally. In 2023, fresh ginger accounts for almost 88% of the total ginger imports in the US. For instance, the US (2023) imported more than 90,000 metric tons of fresh ginger from international markets to fulfill the rising demand. Additionally, the demand is coming from the rising growth of the Asian cuisine culinary culture in the US, which significantly involves the utilization of ginger as an active ingredient in many dishes. For instance, out of all the US restaurants, 12% are Asian-based restaurants, with approximately 75,000 outlets across the United States, increasing the demand for fresh ginger, thus contributing to the dominance of fresh ginger in this market.

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Wholesale/Direct Distribution

- Grocery Stores

- Specialty & Health Food Stores

- Convenience Stores

- Online Retail

Among these, the supermarkets and hypermarkets hold the largest market share of about 44%. The dominance is due to the widespread physical presence of these distribution channels in most parts of the United States. There are around 75,000 supermarkets and hypermarkets in the country, with a large number of stores within these. Such markets have a wider audience, consumer preference, trust, and customer loyalty to specific offline shops.

Additionally, these are the facilities that have a wider reach and accessibility even in rural and remote areas in the country. For instance, out of the total supermarkets and hypermarkets in the US, 25-30% of these are present in rural and remote areas. This has increased the accessibility and affordability of purchasing ginger from local markets, thus attracting a large pool of customers. For instance, a famous branded supermarket called Piggly Wiggly has a strong rural expansion. Similarly, a few branches of Walmart Supercenters are also present in rural areas of the US.

US Ginger Industry Recent Development:

- 2024: The Ginger People (California Natural Products) launched Ginger Rescue Lozenges, designed to help with nausea and digestive relief. Made from natural ginger, these lozenges target consumers looking for simple, plant-based wellness solutions. The product expands their functional ginger range and supports the growing demand for natural remedies in the U.S. market.

- 2024: Spice World Inc. launched refrigerated diced garlic, peeled ginger in pouch bags, and Garlic & Ginger seasoning blends, showcased at New England Produce Council Expo and Global Produce & Floral Show (Atlanta, US).

Gain a Competitive Edge with Our US Ginger Market Report

- US Ginger Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- US Ginger Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- US Ginger Market Policies, Regulations, and Product Standards

- US Ginger Market Supply Chain Analysis

- US Ginger Market Trends & Developments

- US Ginger Market Dynamics

- Growth Drivers

- Challenges

- US Ginger Market Hotspot & Opportunities

- US Ginger Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Square Meters)

- By Product Type

- Fresh Ginger – Market Size & Forecast 2020–2030, USD Million

- Dried Ginger – Market Size & Forecast 2020–2030, USD Million

- Ginger Pickle – Market Size & Forecast 2020–2030, USD Million

- Ginger Oil – Market Size & Forecast 2020–2030, USD Million

- Ginger Powder – Market Size & Forecast 2020–2030, USD Million

- Crystalized Ginger – Market Size & Forecast 2020–2030, USD Million

- Ginger Extracts (Oleoresin)– Market Size & Forecast 2020–2030, USD Million

- Others – Market Size & Forecast 2020–2030, USD Million

- By End-User

- Food & Beverage – Market Size & Forecast 2020–2030, USD Million

- Pharmaceuticals/Nutraceuticals – Market Size & Forecast 2020–2030, USD Million

- Cosmetics & Personal Care– Market Size & Forecast 2020–2030, USD Million

- Household/Retail– Market Size & Forecast 2020–2030, USD Million

- Others (Animal Feed)– Market Size & Forecast 2020–2030, USD Million

- By Distribution Channel

- Supermarkets/Hypermarkets – Market Size & Forecast 2020–2030, USD Million

- Wholesale/Direct Distribution– Market Size & Forecast 2020–2030, USD Million

- Grocery Stores– Market Size & Forecast 2020–2030, USD Million

- Specialty & Health Food Stores – Market Size & Forecast 2020–2030, USD Million

- Convenience Stores – Market Size & Forecast 2020–2030, USD Million

- Online Retail – Market Size & Forecast 2020–2030, USD Million

- By Region

- Northeast

- Midwest

- South

- West

- By Product Type

- US Fresh Ginger Market Outlook, 2025–2030

- By Revenues (USD Million)

- By Volume (Million Square Meters)

- By End-User– Market Size & Forecast 2020–2030, USD Million

- By Distribution Channel– Market Size & Forecast 2020–2030, USD Million

- US Dried Ginger Market Outlook, 2025–2030

- By Revenues (USD Million)

- By Volume (Million Square Meters)

- By End-User– Market Size & Forecast 2020–2030, USD Million

- By Distribution Channel– Market Size & Forecast 2020–2030, USD Million

- US Ginger Pickle Market Outlook, 2025–2030

- By Revenues (USD Million)

- By Volume (Million Square Meters)

- By End-User– Market Size & Forecast 2020–2030, USD Million

- By Distribution Channel– Market Size & Forecast 2020–2030, USD Million

- US Ginger Oil Market Outlook, 2025–2030

- By Revenues (USD Million)

- By Volume (Million Square Meters)

- By End-User– Market Size & Forecast 2020–2030, USD Million

- By Distribution Channel– Market Size & Forecast 2020–2030, USD Million

- US Ginger Powder Market Outlook, 2025–2030

- By Revenues (USD Million)

- By Volume (Million Square Meters)

- By End-User– Market Size & Forecast 2020–2030, USD Million

- By Distribution Channel– Market Size & Forecast 2020–2030, USD Million

- US Crystalized Ginger Market Outlook, 2025–2030

- By Revenues (USD Million)

- By Volume (Million Square Meters)

- By End-User– Market Size & Forecast 2020–2030, USD Million

- By Distribution Channel– Market Size & Forecast 2020–2030, USD Million

- US Ginger Extracts (Oleoresin) Market Outlook, 2025–2030

- By Revenues (USD Million)

- By Volume (Million Square Meters)

- By End-User– Market Size & Forecast 2020–2030, USD Million

- By Distribution Channel– Market Size & Forecast 2020–2030, USD Million

- US Ginger Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competitor Characteristics

- Company Profiles

- Spice World Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Truly Ginger USA, LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Ginger People (California Natural Products)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Frontier Co-op

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- McCormick & Company, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Monterey Bay Herb Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Badia Spices Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Naturevibe Botanicals LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Starwest Botanicals, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Spice World Inc.

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making