GCC Water Treatment Equipment Market Research Report: Forecast (2024-2030)

GCC Water Treatment Equipment Market - By Type (Process Equipment, Mud Treatment, Filtration Systems, Disinfection, Diversions & Screens, Others), By Application (Municipal, Indust...rial), By Process (Primary, Secondary, Tertiary) and other Read more

- Environment

- Mar 2024

- Pages 140

- Report Format: PDF, Excel, PPT

Market Definition

Water treatment equipment refers to devices and systems designed to improve the quality of water by removing impurities, contaminants, and pollutants. These tools employ various methods, such as filtration, chemical treatment, and disinfection, ensuring water meets regulatory standards for consumption, industrial processes, or environmental discharge, and promoting health and sustainability.

Market Insights & Analysis: GCC Water Treatment Equipment Market (2024-30):

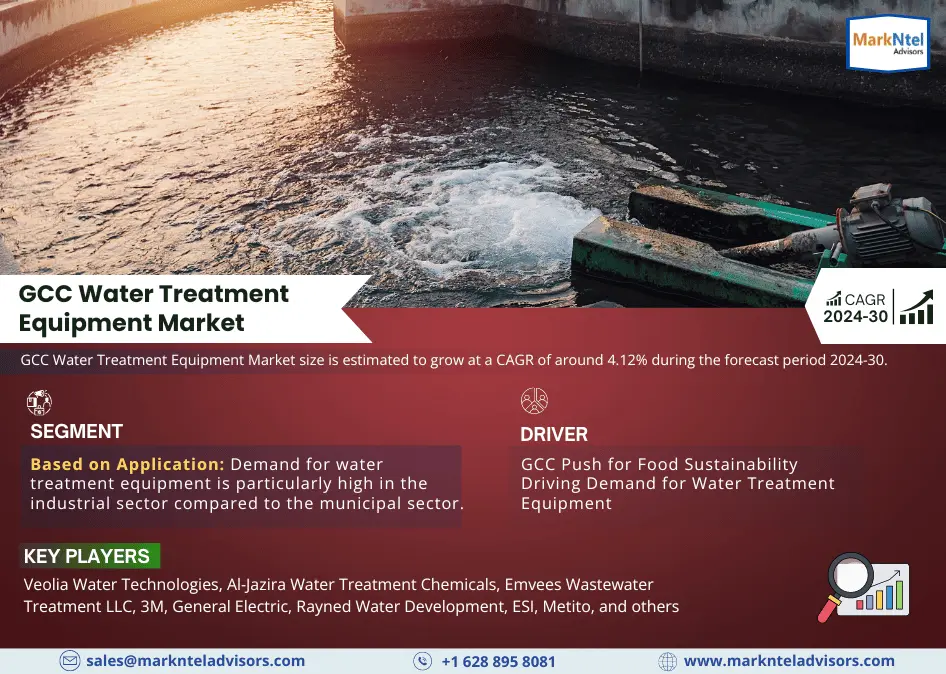

The GCC Water Treatment Equipment Market size is estimated to grow at a CAGR of around 4.12% during the forecast period, i.e., 2024-30. Rapid urbanization and population growth are placing substantial pressure on water resources in the region, and necessitating efficient water treatment solutions for domestic consumption. Moreover, the GCC is heavily industrializing to diversify its economy, resulting in heightened water demand for industrial processes and cooling systems. This industrial expansion is propelling the need for advanced water treatment equipment to ensure sustainable water usage and compliance with environmental standards.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 4.12% |

| Country Covered | The UAE, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain |

| Key Companies Profiled |

Veolia Water Technologies, Al-Jazira Water Treatment Chemicals, Emvees Wastewater Treatment LLC, 3M, General Electric, Rayned Water Development, ESI, Metito, Nalco Ecolab, Wetico, Others |

| Unit Denominations | USD Million/Billion |

According to the World Bank, the citizens in GCC use over 560 liters/capita/day (LPCD) of water each day to carry out day-to-day household, industrial, and commercial activities. The stats are more than triple the world average of 180 LPCD which portrays a huge consumption pattern in the country. However, as groundwater sources in Saudi Arabia continue to diminish as a result of environmental issues, the need for efficient water treatment systems for the use and reuse of water is foreseen to augment.

In addition, governments of GCC nations are enacting stringent regulations to protect water bodies and ecosystems, compelling industries to adopt sophisticated water treatment technologies. These initiates combined are expected to propel the demand for advanced water treatment equipment for enhanced industrial and economic efficiency during the forecast period.

GCC Water Treatment Equipment Market Driver:

GCC Push for Food Sustainability Driving Demand for Water Treatment Equipment – The GCC region grapples with severe water scarcity, exacerbated by arid climates and population growth. In addressing this challenge, the region is striving to enhance food sustainability through innovative agricultural practices, including precision agriculture and hydroponics. These methods, while reducing the reliance on traditional water-intensive farming, necessitate efficient water treatment solutions. The increasing emphasis on local food production to achieve food security goals aligns with the deployment of water treatment equipment in the designated areas.

Additionally, advanced irrigation technologies, often part of sustainable agriculture initiatives, require treated water for optimal results. Therefore, the push for food sustainability not only highlights the need for judicious water use but also accentuates the demand for water treatment equipment as a crucial component in ensuring the success of these agricultural practices in the water-scarce GCC region. Thus, rising demand for water treatment equipment is anticipated to augment the size & volume of the market in the coming years.

GCC Water Treatment Equipment Market Opportunity:

Surging Initiatives for Sustainable Water Management to Offer Lucrative Opportunities – With a growing awareness of water scarcity challenges and a commitment to environmental sustainability, governments across the GCC are intensifying efforts to enhance water efficiency and quality. These initiatives include investing in advanced water treatment technologies to optimize water usage in agriculture, industry, and domestic sectors. For instance,

- In 2023, the government of Bahrain took certain measures to use clean energy sources in future water projects. This led to the demand for and requirement for sustainable water treatment equipment.

- In 2023, Kuwait adopted the Paris Agreement to reduce the impact of climate change, for which it is going to implement sustainable water practices for the water treatment process and implement a 15% renewable energy source by Vision 2035.

As the GCC strives for a diversified and resilient economy, the focus on sustainable water management has become paramount. Consequently, the implementation of robust water treatment systems aligns with these goals, creating a heightened demand for equipment that ensures efficient water recycling, purification, and adherence to international quality standards. Therefore, increasing focus on sustainable water management is augmenting the growth & expansion of the GCC Water Treatment Equipment Market.

GCC Water Treatment Equipment Market Challenge:

Fluctuations in Oil Prices Restrict Market Growth & Expansion – The GCC economies are heavily reliant on oil revenues, and fluctuations in oil prices directly influence government budgets and spending capabilities. During periods of low oil prices, governments often face financial constraints, leading to reduced allocations for infrastructure projects, including water treatment facilities. The cyclical nature of the oil market creates uncertainty and hampers long-term planning for water infrastructure development. As a result, the funding and implementation of crucial water treatment projects may be delayed or scaled down, limiting the region's ability to address growing water scarcity issues. This scenario drives negligible demand for water treatment equipment in the GCC region.

GCC Water Treatment Equipment Market Trend:

Increasing Deployment of Advanced Water Treatment Systems in the Industrial Sector – In the GCC region, countries like Saudi Arabia, the UAE, and Qatar are actively investing in sectors such as manufacturing, petrochemicals, and mining to foster sustainable economic growth. This industrial expansion, driven by ambitious development agendas, is resulting in heightened water usage for production processes and cooling systems. Thus, economies are increasingly opting to deploy advanced water treatment equipment running on renewable energy to sustain the uprising demand. As the industrial sector continues to flourish in the region, the demand for advanced water treatment systems is foreseen to intensify to ensure efficient water recycling, reduce environmental impact, and comply with stringent regulations.

GCC Water Treatment Equipment Market (2024-30): Segmentation Analysis

The GCC Water Treatment Equipment Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the regional level. According to the analysis, the market has been further classified as:

Based on Application:

- Municipal

- Residential

- Non-Residential

- Industrial

- Oil & Gas

- Pulp & Paper

- Chemicals

- Food & Beverages

- Others (Mining, Pharmaceuticals, etc.)

In the GCC region, the demand for water treatment equipment is particularly high in the industrial sector compared to the municipal sector. The rapid industrialization and economic diversification initiatives in countries like the United Arab Emirates, Saudi Arabia, and Qatar have led to a surge in water-intensive industries such as chemicals, petrochemicals, manufacturing, and power generation. These industries necessitate large quantities of water for their processes, creating a heightened demand for effective water treatment solutions.

Additionally, industrial wastewater often contains complex pollutants and chemicals, which require specialized treatment technologies to meet stringent environmental regulations. The need to comply with these regulations and ensure sustainable water usage practices has driven industries to invest significantly in advanced water treatment equipment. Besides, the food and beverage sector has been growing at an exponential rate in recent decades and is becoming a significant contributor to the economic growth of the Gulf region. The governments across the GCC countries are taking initiatives to improve their food security by increasing investment across the food sector through long-term plans and policy changes to improve the food & beverages industry. For instance,

- In 2023, the UAE hopes to top the Global Food Security Index via its National Strategy for Food Security by 2051. The UAE government has also made significant investments of approximately USD 196 million in the food industry project to accomplish the objective of food security.

Thus, continued efforts made by the GCC nations to improve their industrial infrastructure and boost economic revenue from non-oil sectors are substantially influencing the share of the industrial segment in the GCC Water Treatment Market.

Based on Type:

- Process Equipment

- Mud Treatment

- Filtration Systems

- Granular/Sand Filtration

- Adsorption

- Reverse Osmosis

- Micro Filtration

- Disinfection

- Chlorine

- UV

- Ozone

- Diversions & Screens

- Others (Meters, Membranes, etc.)

Filtration systems hold a major share of the market. The demand for filtration systems outpaces that for other water treatment equipment due to their versatility, effectiveness, and cost-efficiency. Filtration systems are crucial for removing impurities, particles, and contaminants from water, making them suitable for a wide range of applications across both municipal and industrial spaces. Moreover, filtration systems are relatively simple to install and operate, requiring less maintenance compared to some alternative technologies, owing to which they are widely used across residential spaces. Besides, the diversity of applications, from potable water supply to industrial processes, positions filtration systems as versatile solutions. The effectiveness of these methods in mitigating specific regional water quality issues, such as high salinity, also contributes to their prominence.

Further, the continued efforts of the governments of GCC nations to increase the reuse of wastewater resources are notably augmenting the demand for efficient filtration systems, including reverse osmosis plants. These initiatives are foreseen to support the demand for filtration systems in the GCC Water Treatment Equipment Industry in the coming years as well. For instance,

- In 2022, the UAE's minister of energy and infrastructure invested a huge amount of around. USD 2.08 billion in a desalination plant using reverse osmosis technology for recycling and reusing the wastewater.

GCC Water Treatment Equipment Market (2024-30): Regional Projections

Geographically, the GCC Water Treatment Equipment Market expands across:

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

Among them, Saudi Arabia holds a substantial share in the GCC Water Treatment Equipment Market. The country faces significant water scarcity challenges, with limited freshwater resources and increasing demand driven by population growth and industrial expansion. This compels Saudi Arabia to invest heavily in water treatment technologies to ensure sustainable water supply for domestic, agricultural, and industrial needs. Additionally, the government's focus on economic diversification and industrialization has led to increased water usage in sectors such as petrochemicals and mining, further driving the need for advanced water treatment solutions.

Moreover, Saudi Arabia's commitment to environmental sustainability and meeting international water quality standards emphasizes the importance of robust water treatment infrastructure. According to the International Trade Administration, Saudi Arabia built over 133 new water treatment facilities in 2021, an increase of over 14.66% as compared to the previous year. In 2022, the Saudi government further announced over 60 more projects for the development of water treatment facilities to position itself as the world’s largest water desalination market. Consequently, the combination of water scarcity, economic development goals, and environmental considerations positions Saudi Arabia as the primary driver of water treatment equipment demand in the GCC region.

GCC Water Treatment Equipment Industry Recent Development:

- In 2023: Emvees Waste Water Treatment LLC, announced plans to develop and install an industrial wastewater treatment plant with Ultrafiltration (UF) and Reverse Osmosis (RO) equipment for sustainable solutions in the UAE.

- In 2022: Veolia Water Technologies, a manufacturer of water treatment technologies and solution provider, announced its collaboration with Saudi Arabia’s Alfanar Projects to develop advanced wastewater treatment technologies and address the growing demand for efficient water management solutions with an investment of USD 453 million in Saudi Arabia.

Gain a Competitive Edge with Our GCC Water Treatment Equipment Market Report

- GCC Water Treatment Equipment Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC Water Treatment Equipment Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- GCC Water Treatment Equipment Market Trends & Developments

- GCC Water Treatment Equipment Market Dynamics

- Drivers

- Challenges

- GCC Water Treatment Equipment Market Supply Chain & Value Chain Analysis

- GCC Water Treatment Equipment Market Hotspot & Opportunities

- GCC Water Treatment Equipment Market Regulations & Policy

- GCC Water Treatment Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Type

- Process Equipment - Market Size & Forecast 2019-2030F, (USD Million)

- Mud Treatment - Market Size & Forecast 2019-2030F, (USD Million)

- Filtration Systems- Market Size & Forecast 2019-2030F, (USD Million)

- Granular/Sand Filtration- Market Size & Forecast 2019-2030F, (USD Million)

- Adsorption- Market Size & Forecast 2019-2030F, (USD Million)

- Reverse Osmosis- Market Size & Forecast 2019-2030F, (USD Million)

- Micro Filtration- Market Size & Forecast 2019-2030F, (USD Million)

- Disinfection- Market Size & Forecast 2019-2030F, (USD Million)

- Chlorine- Market Size & Forecast 2019-2030F, (USD Million)

- UV- Market Size & Forecast 2019-2030F, (USD Million)

- Ozone- Market Size & Forecast 2019-2030F, (USD Million)

- Diversions & Screens- Market Size & Forecast 2019-2030F, (USD Million)

- Others (Meters, Membranes, etc.) - Market Size & Forecast 2019-2030F, (USD Million)

- By Application

- Municipal- Market Size & Forecast 2019-2030F, (USD Million)

- Residential- Market Size & Forecast 2019-2030F, (USD Million)

- Non-Residential- Market Size & Forecast 2019-2030F, (USD Million)

- Industrial- Market Size & Forecast 2019-2030F, (USD Million)

- Oil & Gas- Market Size & Forecast 2019-2030F, (USD Million)

- Pulp & Paper- Market Size & Forecast 2019-2030F, (USD Million)

- Chemicals- Market Size & Forecast 2019-2030F, (USD Million)

- Food & Beverages- Market Size & Forecast 2019-2030F, (USD Million)

- Others (Mining, Pharmaceuticals, etc.)- Market Size & Forecast 2019-2030F, (USD Million)

- Municipal- Market Size & Forecast 2019-2030F, (USD Million)

- By Process

- Primary- Market Size & Forecast 2019-2030F, (USD Million)

- Secondary- Market Size & Forecast 2019-2030F, (USD Million)

- Tertiary- Market Size & Forecast 2019-2030F, (USD Million)

- By Country

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

- By Competition

- Market Share & Analysis

- Top Selling Brands

- Competition Characteristics

- By Type

- Market Size & Analysis

- The UAE Water Treatment Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Type- Market Size & Forecast 2019-2030F, (USD Million)

- By Application - Market Size & Forecast 2019-2030F, (USD Million)

- By Process - Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Saudi Arabia Water Treatment Equipment Market Outlook, 2019-2030D

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Type - Market Size & Forecast 2019-2030F, (USD Million)

- By Application - Market Size & Forecast 2019-2030F, (USD Million)

- By Process - Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Qatar Water Treatment Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Type - Market Size & Forecast 2019-2030F, (USD Million)

- By Application - Market Size & Forecast 2019-2030F, (USD Million)

- By Process - Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Kuwait Water Treatment Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Type - Market Size & Forecast 2019-2030F, (USD Million)

- By Application - Market Size & Forecast 2019-2030F, (USD Million)

- By Process - Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Oman Water Treatment Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Type - Market Size & Forecast 2019-2030F, (USD Million)

- By Application - Market Size & Forecast 2019-2030F, (USD Million)

- By Process - Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- Bahrain Water Treatment Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Type - Market Size & Forecast 2019-2030F, (USD Million)

- By Application - Market Size & Forecast 2019-2030F, (USD Million)

- By Process - Market Size & Forecast 2019-2030F, (USD Million)

- Market Size & Analysis

- GCC Water Treatment Equipment Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Veolia Water Technologies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al- Jazira Water Treatment Chemicals

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Emvees Wastewater Treatment LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- 3M

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- General Electric

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rayned Water Development

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ESI

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Metito

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nalco Ecolab

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Wetico

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Veolia Water Technologies

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making