GCC PVC Pipes Market Research Report: Forecast (2023-2028)

GCC PVC Pipes Market - By Type (Flexible PVC, Rigid PVC), By Application (Water Supply, Plumbing, HVAC, Wire Cables, Others (Irrigation, etc.), By End User (Construction, Oil & Gas..., Healthcare, Industrial (Manufacturing), By Sales Channel (B2B, B2C, Distributor & Dealers, Online), and others Read more

- Buildings, Construction, Metals & Mining

- May 2023

- Pages 152

- Report Format: PDF, Excel, PPT

Market Definition

PVC Pipes are plastic pipes fabricated using chlorine & ethylene. They are usually hollow & cylindrical-shaped and are widely used to carry substances that could flow from them, such as fluid, powder, etc. They are rust-proof & durable, have low weight, and are tough to deteriorate. These pipes are primarily used within the water piping system of buildings, water treatment plants, for irrigation purposes, and several other things.

Market Insights & Analysis: GCC PVC Pipes Market (2023-28)

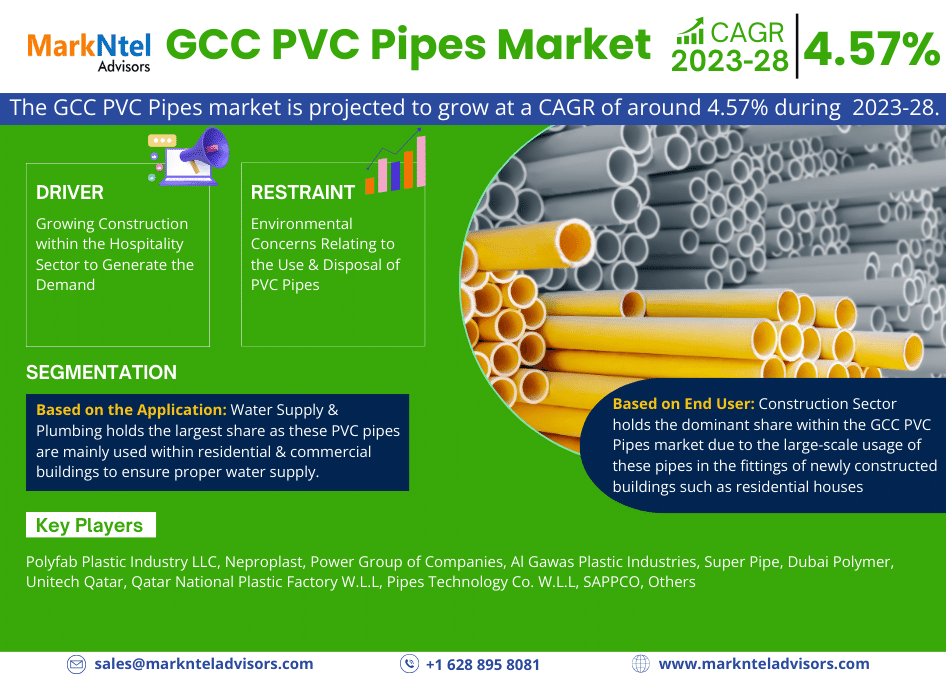

The GCC PVC Pipes market is projected to grow at a CAGR of around 4.57% during the forecast period, i.e., 2023-28. The major factor attributing to its growth is the development within the construction sector in the GCC countries such as the UAE, Saudi Arabia, Qatar, Oman, etc. The region has been witnessing massive construction & infrastructural development of hotels, malls, airports, residential buildings, and others. The construction of these buildings requires the fitting of these pipes for the purpose of maintaining proper water supply & plumbing within the building.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 4.57% |

| Country Covered | The UAE, Saudi Arabia, Oman, Kuwait, Bahrain, Qatar |

| Key Companies Profiled | Polyfab Plastic Industry LLC, Neproplast, Power Group of Companies, Al Gawas Plastic Industries, Super Pipe, Dubai Polymer, Unitech Qatar, Qatar National Plastic Factory W.L.L, Pipes Technology Co. W.L.L, SAPPCO, Others |

| Unit Denominations | USD Million/Billion |

Along with it, the region is witnessing the expansion of some water treatment plants, and in these plants, the requirement of these pipes is enormous as they are required to maintain the flow of water. As these pipes are durable, lightweight, and low on budget, therefore they are the preferred choice among developers & are also gaining popularity among the regional population as they can easily withstand the harsh & hot climatic conditions within the GCC region.

Further, the oil & gas industry is another major end-user of PVC pipes, as these pipes are used to create the injecting lines in order to pass the pressured water into the oil reservoir to make the oil recover better. Apart from it, these pipes are highly durable in terms of chemical resistance, due to which, they are preferred to transport chemicals such as acids, brines, etc. Owing to the listed factors, there has been growing adoption of these pipes, mainly in the construction sector of the GCC region. This, in turn, is creating a positive market outlook for the growth of the market during the forthcoming period.

Market Dynamics

Significant Driver: Growing Construction within the Hospitality Sector to Generate the Demand

The countries like the UAE, Saudi Arabia, and Oman have emerged as global tourist spots for business tours, leisure tourism, and family functions, as a result of which the country is actively promoting the construction & refurbishing of hotels, lounges, malls, etc. The development of these buildings requires the fittings of PVC pipes to maintain the water supply, the functioning of the HVAC system, and district cooling, thereby generating the demand for these pipes in the country.

In recent years GCC has witnessed global events such as Dubai Expo 2020 & FIFA World Cup, owing to which, the region has experienced a massive influx of visitors for tourism purposes, leading to the construction of new luxury hotels to occupy a large number of visitors. Further, the relaxation of the COVID-19 restriction also played a significant role in expanding tourism within the country. For instance:

- In 2022, the government of Dubai stated that between January-March 2022, Dubai observed nearly 4 million visitors compared to around 1.27 million visitors in 2021. Hence, this placed Dubai at 1st rank in global hotel occupancy rate with about 82%.

The growth in the number of visitors resulted in the construction of new hotels & the refurbishment of the existing ones, which, in turn, generated the demand for PVC Pipes to maintain the water supply & plumbing requirements. Further, the construction of new hotels & buildings also required the installation of HVAC & district cooling. The setting up of this centralized cooling system also demands the fitting of these pipes which are thermally more stable & chemical resistant & therefore are ideal for centralized cooling systems. Thus, the building of new hotels & the installation of centralized cooling systems in them generates augmented demand for these pipes, upscaling the sales bar of the market in the coming years.

Possible Restraint: Environmental Concerns Relating to the Use & Disposal of PVC Pipes

The use of plastics is leading to several environmental concerns, such as soil degradation, water pollution, impact on human health, etc. As a result, the government is restricting the use of plastics & plastic-based products. PVC pipes are also a type of synthetic plastic made up of Polyvinyl Chloride, a type of chlorine that is capable of releasing Chlorofluorocarbons (CFCs), which destroy the ozone layer and also take several years to decompose. As a result, the usage of these pipes becomes a cause of concern for environmental sustainability.

Further, the government in the country is proactively working on curtailing the use of plastic-derived products. Hence, these developments would restrain the growth of the market, as they can lower the adoption of these pipes among the different end-user groups in the following years.

Growth Opportunity: Rising Production Capacity of Clean Fuels

The growing environmental concerns & the movement toward a sustainable economy have enhanced the adoption of cleaner fuels such as natural gas, clean ammonia, clean hydrogen, etc. As a result of this, GCC countries, like the UAE, Saudi Arabia, Qatar, and several others, are constantly working on expanding their clean fuel production capacity & diverging from traditional oil & petroleum production.

The construction of a new production facility & expansion of the existing ones is anticipated to generate greater demand for these pipes, as the plants require the fitting of these pipes to transport water in a pressurized manner to the natural gas fields for drilling & exploration purposes. These pipe fittings are also needed to transport the wastewater & other fluids generated to the storage facility & disposal wells. At the clean hydrogen & clean ammonia production units, the fittings of these pipes are needed to maintain the ventilation system & the transportation of the gases. For instance:

- In 2023, Brooge Energy announced the collaboration with Siemens Energy to construct a green hydrogen & green ammonia production facility in Abu Dhabi, UAE. The production facility would allow the country to export green ammonia to the neighboring countries & emerge as a key player within the region for producing clean energy.

The construction of a new production facility in the coming years is anticipated to generate increased demand for PVC pipe fittings, hence contributing in enhancing the GCC PVC Pipes Market size during 2023-28.

Key Trend: Growing Adoption of PVC Pipes in the Fiber Optic Cables

GCC countries such as the UAE, Saudi Arabia, Oman, and Kuwait are working on diversifying their economy & also improving the digital ecosystem of the country. These countries are constantly working on providing faster & more secure internet connectivity to attract technology companies to the country & emerge as a digital hub in the region. To achieve this, more secure fiber optic cables are being laid down under the sea & underground. These cable lines are covered with the coating of PVC pipes as they are more durable, can easily withstand harsh conditions, and can secure fiber optic cables. For instance:

- In 2022, Saudi Arabia & Greece announced the East to Med Data Corridor to connect Europe with Asia. The fiber optics, as laid down, would pass through Saudi Arabia via land & sea routes.

The laying down of fiber optic cable in the country would require the installation of fiber optic cable lines, that in turn would require these pipes to provide an outer covering to these cables. Thus, the laying down of fiber optic cable is anticipated to boost the demand for these pipes in the country in the coming years.

Market Segmentation

Based on the Application:

- Water Supply

- Plumbing

- HVAC

- Wires & Cables

- Others (Irrigation, etc.)

Water Supply & Plumbing holds the largest share as these PVC pipes are mainly used within residential & commercial buildings to ensure proper water supply. The growth within the construction sector would generate the need for these pipes to be installed in the buildings to maintain water supply & also to support the centralized AC systems installed in these buildings. As these pipes are installed along with the HVAC or District Colling services to transport the gases & also to carry out the wastewater to the storage well. The construction of new buildings in the GCC countries would result in expanded demand, which, in turn, would facilitate the growth of the market during 2023-2028.

Based on End User:

- Construction

- Oil & Gas

- Healthcare

- Industrial (Manufacturing)

Here, Construction Sector holds the dominant share within the GCC PVC Pipes market due to the large-scale usage of these pipes in the fittings of newly constructed buildings such as residential houses, hotels, malls, etc. In these buildings, these pipes are required for plumbing, providing duct & ventilation to the centralized air conditioning system, transporting wastewater, etc. The large-scale migration within the GCC countries has resulted in an increased demand for housing & residential buildings. Hence, the government is focusing on developing new residential areas & smart cities. For instance:

- In 2023, Samana Developers announced the construction of a new residential project named Samana Wave 2 in Jumeirah Village Circle, comprising 170 apartments.

The newly constructed building would generate a higher need for these pipes & fittings, thereby creating a positive market scenario for the manufacturers in the GCC region in the upcoming years.

Regional Projection

Geographically, the market expands across:

- The UAE

- Saudi Arabia

- Oman

- Kuwait

- Bahrain

- Qatar

Among all the GCC countries, Saudi Arabia holds the maximum share of the GCC PVC Pipes market due to the wide-scale presence of the oil & gas industry. The massive infrastructural development & the construction of new buildings are also augmenting the demand for these Pipes to support the plumbing & water supply as well as the ventilation needs of these buildings. Furthermore, in the coming years, owing to heavy construction in the country & the rising residential projects, such as the NEOM City project, the country is anticipated to lead the regional market.

Recent Developments in the GCC PVC Pipes Market

- 2022: Reliance Industries Ltd. announced to collaborate with RSC, an Abu Dhabi-based chemical derivative company to launch EDC & PVC. The production facility would be established in Ruwais Industrial Zone, with an investment of nearly USD2 billion.

Gain a Competitive Edge with GCC PVC Pipes Market Report

- GCC PVC Pipes Market Report by Markntel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC PVC Pipes Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- GCC PVC Pipes Market Import & Export Analysis

- GCC PVC Pipes Market Trends & Insights

- GCC PVC Pipes Market Dynamics

- Drivers

- Challenges

- GCC PVC Pipes Market Hotspots & Opportunities

- GCC PVC Pipes Market Outlook, 2018-2028F

- Market Size & Outlook

- By Revenue (USD Million)

- By Volume (Thousand Tons)

- Market Share & Outlook

- By Type

- Flexible PVC

- Rigid PVC

- By Application

- Water Supply

- Plumbing

- HVAC

- Wire Cables

- Others (Irrigation, etc.)

- By End User

- Construction

- Oil & Gas

- Healthcare

- Industrial (Manufacturing)

- By Sales Channel

- B2B

- B2C

- Distributor & Dealers

- Online

- By Country

- The UAE

- Saudi Arabia

- Oman

- Kuwait

- Bahrain

- Qatar

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Type

- Market Size & Outlook

- The UAE PVC Pipes Market Outlook, 2018-2028F

- Market Size & Outlook

- By Revenue (USD Million)

- By Volume (Thousand Tons)

- Market Share & Outlook

- By Type

- By Application

- By End User

- Market Size & Outlook

- Saudi Arabia PVC Pipes Market Outlook, 2018-2028F

- Market Size & Outlook

- By Revenue (USD Million)

- By Volume (Thousand Tons)

- Market Share & Outlook

- By Type

- By Application

- By End User

- Market Size & Outlook

- Oman PVC Pipes Market Outlook, 2018-2028F

- Market Size & Outlook

- By Revenue (USD Million)

- By Volume (Thousand Tons)

- Market Share & Outlook

- By Type

- By Application

- By End User

- Market Size & Outlook

- Kuwait PVC Pipes Market Outlook, 2018-2028F

- Market Size & Outlook

- By Revenue (USD Million)

- By Volume (Thousand Tons)

- Market Share & Outlook

- By Type

- By Application

- By End User

- Market Size & Outlook

- Bahrain PVC Pipes Market Outlook, 2018-2028F

- Market Size & Outlook

- By Revenue (USD Million)

- By Volume (Thousand Tons)

- Market Share & Outlook

- By Type

- By Application

- By End User

- Market Size & Outlook

- Qatar PVC Pipes Market Outlook, 2018-2028F

- Market Size & Outlook

- By Revenue (USD Million)

- By Volume (Thousand Tons)

- Market Share & Outlook

- By Type

- By Application

- By End User

- Market Size & Outlook

- GCC PVC Pipes Market Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Polyfab Plastic Industry LLC

- Neproplast

- Power Group of Companies

- Al Gawas Plastic Industries

- Super Pipe

- Dubai Polymer

- Unitech Qatar

- Qatar National Plastic Factory W.L.L

- Pipes Technology Co. W.L.L

- SAPPCO

- Other

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making