UAE District Cooling Market Research Report: Forecast (2025-2030)

UAE District Cooling Market Share - By Production Technique (Free Cooling, Absorption Cooling, Electric Chillers, Others), By Application (Hospitality, Healthcare, Commercial & Ret...ail, Government & Transportation, Industrial, Residential) and Others Read more

- Environment

- Mar 2025

- Pages 92

- Report Format: PDF, Excel, PPT

Market Definition

District cooling system delivers chilled water and space conditioning to consumers. Such systems are used in various locations, including homes, shopping centers, lodging facilities, dining establishments, cold storage warehouses, workplaces, companies, campuses, and military sites.

Market Insights & Analysis: UAE District Cooling Market (2025-30)

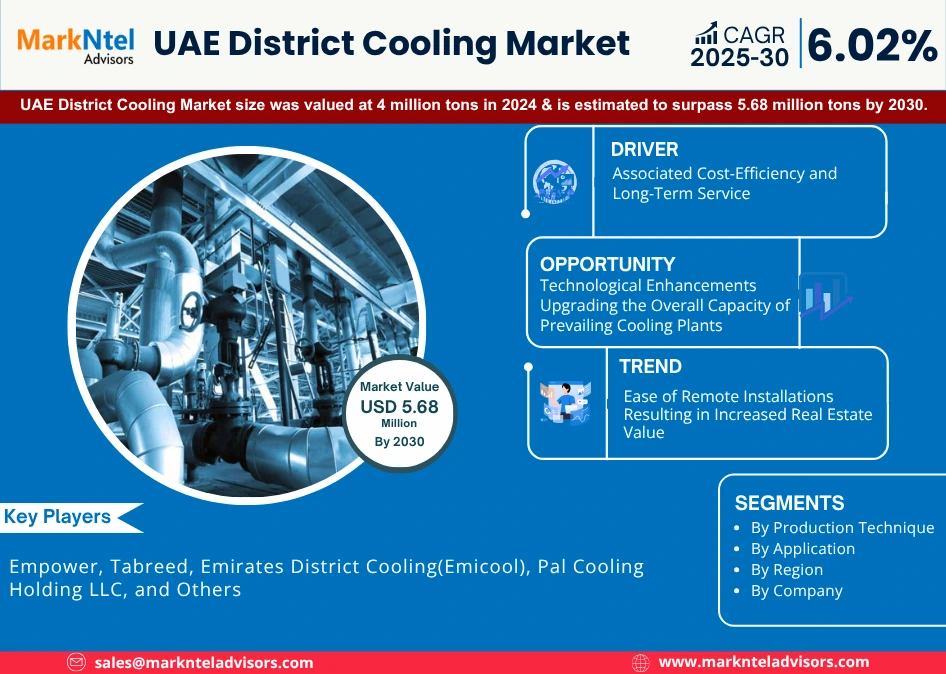

The UAE District Cooling Market size was valued at 4 million tons in 2024 & is estimated to surpass 5.68 million tons by 2030. Along with this, the industry is also projected to grow at a CAGR of around 6.02% during the forecast period, i.e., 2025-30.. The UAE is taking the lead in the development of district cooling as a significant energy-efficient utility sector chosen by the governments of the Gulf nations. The Middle East and Africa region is crucial to reversing climate change and advancing global efforts to cut carbon emissions. In arid climates, cooling is a constant and energy-intensive operation, hence district cooling offers significant energy savings.

In the region's new and developing megacities, where district cooling has established a firm footing, this benefit is being realized. Since, 70% of the total electricity consumption goes into air conditioning in Dubai, the government is planning to meet its 40% cooling needs from district cooling by 2030. The use of district cooling in Dubai alone has been found to save close to 650GWh of electricity in 2020.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | 4 Million Tons |

| Market Value by 2030 | 5.68 Million Tons |

| CAGR (2025–30) | 6.02% |

| Top Key Players | Empower, Tabreed, Emirates District Cooling(Emicool), Pal Cooling Holding LLC, and Others |

| Segmentation | By Production Technique (Free Cooling, Absorption Cooling, Electric Chillers, Others), By Application (Hospitality, Healthcare, Commercial & Retail, Government & Transportation, Industrial, Residential) and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Moreover, due to a robust project pipeline sector, the UAE district cooling industry saw little to no operating delays, in contrast to other markets that experienced adverse effects or delays due to government restrictions and lockdowns enforced to stop the spread of COVID-19. The market is expected to be further boosted by robust construction activities, projects, and company partnerships for technical progress across the nation. Moreover, with the new set of rules to be introduced, the district cooling industry wiould likely become more effective & customer-focused as it would promote transparency & establish stakeholder accountability. Additionally, it would enable consumers to understand the cost-effectiveness of district cooling, in turn, instigating demand, further impacting the UAE District Cooling Market size.

UAE District Cooling Market Driver:

Associated Cost-Efficiency and Long-Term Service - Due to the accompanying cost-efficiency and long-term service, many businesses in the country are implementing district cooling systems. As a result of using 50% less energy than air conditioners, district cooling systems require less initial expenditure and ongoing maintenance. Airports, business buildings, university campuses, and residential towers are examples of large-scale establishments in the UAE that benefit significantly from district cooling. The system is based on a central cooling plant that cools its grid using a network of insulated underground pipes transporting chilled water. In addition, the equipment's ability to run without issue for up to 30 years encourages the adoption of new technologies, thereby propelling industry growth further.

UAE District Cooling Market Opportunity:

Technological Enhancements Upgrading the Overall Capacity of Prevailing Cooling Plants - Further, the overall capacity of the existing cooling plants and ongoing development projects is expected to witness an upgradation with technological advancements. For instance, Empower has awarded contracts totaling $51.73 million (AED190 million) for developing its fourth district cooling plant in Dubai's Business Bay. Upon completion, the Business Bay project, which consists of six district cooling plants, will be the largest district cooling project in the world, with a total cooling capacity of 350,000RT thanks to the new plant's 50,000RT output.

In addition, key market participants in the UAE collect cold water for use in their operations from oceans, seas, rivers, lakes, and other waste-cooling energy sources and then distribute it via DC system networks to urban companies. Therefore, easy cooling production techniques, cheap operating costs, and a favorable client base made possible by the technology will increase demand for it.

UAE District Cooling Market Challenge:

High Initial Capital and Installation Costs– A primary challenge restricting the growth of the UAE district cooling market is the high upfront capital required for system installation and infrastructure development. District cooling systems demand significant investments to establish centralized cooling plants and extensive distribution networks, with costs for large-scale projects often ranging from $200 million to $500 million, depending on scale and complexity. These substantial financial requirements act as a barrier, particularly for small and medium-sized enterprises, and can delay or limit the widespread adoption of district cooling solutions.

UAE District Cooling Market Trend:

Ease of Remote Installations Resulting in Increased Real Estate Value - Another factor contributing to the growing popularity of these cooling systems in the UAE is their ability to be installed remotely, which boosts real estate value by freeing up additional space for other operational needs, increases business operational efficiency, and fuels the expansion of the district cooling market. Moreover, due to the expanding use of cooling systems in oil and gas refineries, production facilities, and manufacturing plants, the market is anticipated to expand across the industrial sector. These systems will enhance the outlook for the industry as temperatures rise and sustainability becomes more of a priority in the UAE.

UAE District Cooling Market (2025-30): Segmentation Analysis

The UAE District Cooling Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the country level. Based on the analysis, the market has been further classified as:

Based on Application:

- Hospitality

- Healthcare

- Commercial & Retail

- Government & Transportation

- Industrial

- Residential

- Others (Religious Institution, etc.)

The Residential segment captured a significant market share in the historical period. The growth can be attributed to the escalating population across the country, increasing the demand for high-class infrastructure projects along with extensive government initiatives toward the construction of housing projects, thus propelling the need for efficient cooling systems in the UAE. Additionally, since energy consumption in the country is largely driven by the residential sector, the demand for energy-efficient district cooling systems is swiftly augmenting across the UAE. Thus, large-scale residential projects are imposing a considerable impact on the district cooling market.

Based on Production Technique:

- Free Cooling

- Absorption Cooling

- Electric Chillers

- Others (Heat Pumps, etc.)

Electric chillers will likely gain traction in the coming years owing to their dependable coefficient. Large-scale projects can be finished quickly and effectively by organizations with the usage of a variety of DC technologies. Among the well-known technologies are electric and absorption chillers. However, because of their superior coefficient performance, electric chillers are recommended. These chillers are more widely accepted because they use up 50% less floor space than absorption chillers. Conversely, using absorption chillers in the energy system helps reduce the amount of cooling powered by electricity while also lowering carbon dioxide emissions.

UAE District Cooling Industry Recent Development:

- In 2024: Empower initiated the construction of a new district cooling plant in Deira district. The plant, which follows the main construction contract, will cater buildings within the Deira. This project is a pivotal element of the Deira Enrichment Project, aimed at revitalizing the district with residential communities, commercial spaces, and modern offices while maintaining Deira's cultural and heritage values.

- In 2024: Emirates Central Cooling System Corporation (Empower) and the AI Habtoor Group have signed an agreement for the supply of district cooling services to the AI Habtoor Tower.

Gain a Competitive Edge with Our UAE District Cooling Market Report

- UAE District Cooling Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- UAE District Cooling Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The UAE District Cooling Market Trends & Insights

- The UAE District Cooling Market Dynamics

- Growth Drivers

- Challenges

- The UAE District Cooling Market Growth Hotspot & Opportunities

- The UAE Upcoming Projects & their Execution Time Frame

- The UAE District Cooling Market Porter’s Five Forces Analysis

- The UAE District Cooling Market PESTEL Analysis

- The UAE District Cooling Market SWOT Analysis

- Digital Transformation in the UAE District Cooling Market

- The UAE District Cooling Market Value Chain

- The UAE District Cooling Market Supply Analysis

- The UAE District Cooling Policy & Regulation

- By Energy Strategy

- The UAE District Cooling Market, By Projects, 2025

- New Renewable Energy Projects

- Solar

- Wind

- Others

- Ongoing & Upcoming Cooling Plants

- New Renewable Energy Projects

- The UAE District Cooling Market Analysis, 2020- 2030F

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Tons of Refrigeration)

- Market Share & Outlook

- By Production Technique

- Free Cooling

- Absorption Cooling

- Electric Chillers

- Others (Heat Pumps, etc.)

- By Application

- Hospitality

- Healthcare

- Commercial & Retail

- Government & Transportation

- Industrial

- Residential

- Others (Religious Institution, etc.)

- By Region

- Dubai

- Abu Dhabi

- Sharjah & Northern Emirates

- By Company

- Market Share (USD Million/Tone of RT)

- Competition Characteristics

- By Production Technique

- Market Size & Outlook

- Dubai District Cooling Market Analysis, 2020- 2030F

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Tons of Refrigeration)

- Market Share & Outlook

- By Production Technique

- By Application

- Market Size & Outlook

- Abu Dhabi District Cooling Market Analysis, 2020- 2030F

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Tons of Refrigeration)

- Market Share & Outlook

- By Production Technique

- By Application

- Market Size & Outlook

- Sharjah & Northern Emirates District Cooling Market Analysis, 2020- 2030F

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Tons of Refrigeration)

- Market Share & Outlook

- By Production Technique

- By Application

- Market Size & Outlook

- The UAE District Cooling Market Key Strategic Imperatives for Success & Growth

- Competitive Benchmarking

- Competition Matrix

- Operating & Revenue Model

- Product Portfolio

- Target Markets

- Pricing Analysis

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, Target Clients etc.)

- Empower

- Tabreed

- Emirates District Cooling(Emicool)

- Pal Cooling Holding LLC

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making