GCC Furniture Rental Market Research Report: Forecast (2024-2030)

By Product Type (Indoor Furniture, [Bedroom Furniture, Dining Furniture, Office Furniture, Kitchen Furniture, Living Room Furniture, Storage Furniture], Outdoor Furniture), By Type... of Furniture (Bed, Sofa & Couch, Table & Desk, Chair & Stool, Wardrobes & Dresser, Others (Nightstand, storage benches, etc.)), By Material (Wood, Plastic, Others (Leather, Glass, Metal, etc.)), By End-Users (Residential, Offices, Healthcare Sector, Retail, Others (Government Agencies, Entertainment sector, etc.)), By Country (The UAE, Saudi Arabia, Oman, Qatar, Kuwait, Bahrain), By Company (ARREKA, Arena Group PLC, Innovative Hiring, Style Works, Risala Furniture, CORT, Chapter One, Indigo Living Limited, Lafeef, The Furniture Rental Company and others) Read more

- FMCG

- Oct 2023

- Pages 145

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: GCC Furniture Rental Market (2024-30):

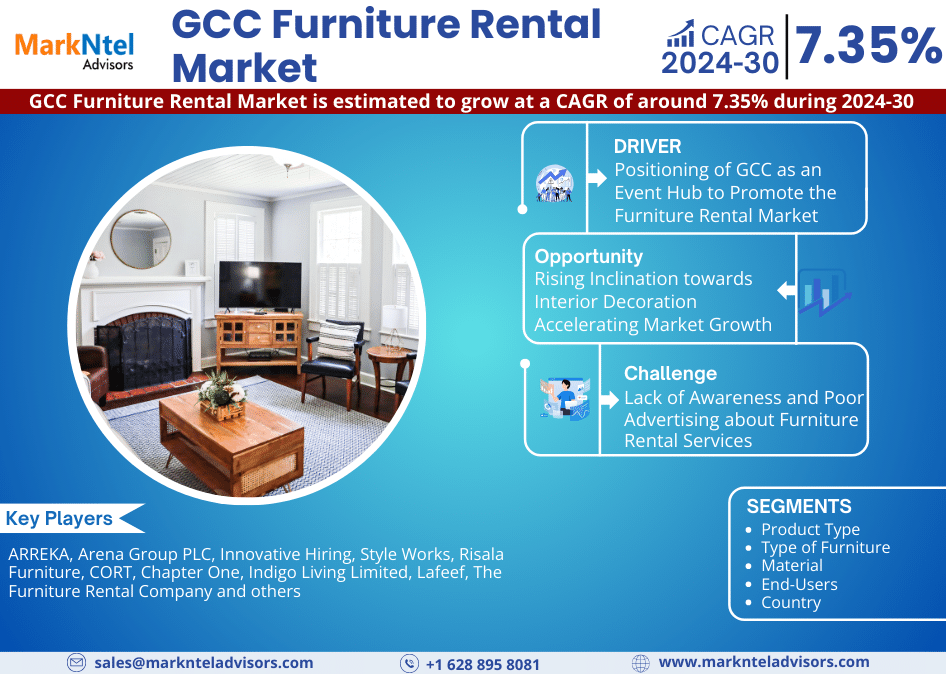

GCC Furniture Rental Market is estimated to grow at a CAGR of around 7.35% during the forecast period, i.e., 2024-30, due to the significant construction of hotels, multi-cuisine restaurants, resorts, etc. The retail & hospitality sector would likely foresee significant growth in the GCC Furniture Rental Market in the forecast years, as the inbound tourists are rising across the region mainly for occupational purposes.

In addition, the GCC region is known for its dynamic economy, attracting a significant expatriate population and businesses. As a result, there is a consistent demand for rental furniture for both residential and commercial purposes. They offer lucrative employment opportunities, tax benefits, and a high standard of living, which attract a significant expatriate population. These expats often opt for rental furniture as it provides flexibility, convenience, and cost-effectiveness during their stay in the region.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 7.35% |

| Country Covered | The UAE, Saudi Arabia, Oman, Qatar, Kuwait, Bahrain |

| Key Companies Profiled | ARREKA, Arena Group PLC, Innovative Hiring, Style Works, Risala Furniture, CORT, Chapter One, Indigo Living Limited, Lafeef, The Furniture Rental Company and others |

| Unit Denominations | USD Million/Billion |

Furthermore, the GCC region has witnessed a significant expansion in the e-commerce sector which is driven by the widespread adoption of smartphones in this region and a further surge in internet subscribers, the procedure for furniture rental has significantly become more convenient and economical for the population in the GCC region. For instance,

- In 2021, as reported by the CIPS (Chartered Institute of Procurement & Supply) the rising acceleration in the e-commerce platform in the GCC region, predicted the elevation in the e-commerce market to double to USD 50 billion in the next five years.

This upsurge in the adoption of the e-commerce platform in the GCC region empowers customers to effortlessly and affordably rent different styles of furniture based on their choice with convenience in their purchase.

Moreover, various events such as wedding anniversaries, birthday parties, cooperate gatherings, etc are organized and overseen by event managers, hotels, and diverse commercial venues. Based on the varied themes, these events necessitate distinct furniture and ambiance arrangements, which is driving the demand for affordable and stylish furniture. This upwelling in the demand for furniture rental in such events contributes to the expansion of the furniture rental market share in the GCC region and is anticipated to increase the market size in the upcoming years as well.

Additionally, in recent years the rising trend towards rented apartments is escalating in major cities of the GCC region including Dubai, Riyadh Abu Dhabi, etc. This is driven by the increase in the working population which is relocating to the urban area and is seeking affordable and aesthetic furniture. This enhances the demand and the market size of furniture rental in this region and is expected to accelerate the market share during 2024-2030.

GCC Furniture Rental Market Driver:

Positioning of GCC as an Event Hub to Promote the Furniture Rental Market – The GCC region has long been a global hub for hosting & organizing major international events. With the rise of the UAE, Saudi Arabia, Qatar, etc., as an event hub, the number of furniture rental companies has increased across the region. Hosting numerous events, conferences, trade shows, and exhibitions in the GCC requires a vast amount of event furniture, including seating, booths, tables, and décor. Event organizers opt for furniture rental to create visually appealing and functional event spaces. Thus, upcoming events are acting as a driving force for equipment rental companies, opening up a massive potential market for furniture rental companies across the GCC region.

Furthermore, the UAE, Saudi Arabia, Qatar, etc., government is pushing its capabilities to increase the number of events held in the country each year. For instance, the DBE (Dubai Business Events) captured around 120 events in 2021 and now plans to capture over 400 global events in 2025. Such initiatives for substantial growth in the event sector increase the market size of outdoor furniture and it is anticipated to elevate the GCC Furniture Rental Market in the coming years.

GCC Furniture Rental Market Opportunity:

Rising Inclination towards Interior Decoration Accelerating Market Growth – Over the past few years, the population in various countries of the GCC region such as Kuwait, Qatar, the UAE, etc. notably engaged in the realm of interior designing and decoration. Interior designs tend to change rapidly which further prompts the customer to upgrade their furniture aligning with the latest trends. Also, the market for furniture rental in the GCC region has experienced significant growth, driven by the flexibility it offers in adapting to evolving design trends without the financial commitment of long-term furniture ownership. Moreover, in alignment with global sustainability initiatives, renting furniture embodies the concept of waste reduction and actively promotes the circular economy by facilitating the return of used furniture to rental services.

As the population is showing mounting affinity towards innovative interior designing pursuits, rental furniture emerging as a versatile solution to achieve the desired interior aesthetics. This inclination toward interior decoration is emerging and driving the market share of GCC Furniture Rental over the past few years and is projected to escalate the market share in the upcoming years as well.

GCC Furniture Rental Market Challenge:

Lack of Awareness and Poor Advertising about Furniture Rental Services – In the GCC region, inadequate awareness about furniture rental and poor advertising negatively impact the market growth. The lack of awareness among the population about furniture rental services leads customers to stick with the traditional approach of buying expensive furniture. This leads to a drastic impact on the potential growth of the furniture rental market in the region.

In addition, furniture rental provides flexibility, a wide array of choices, and affordability, but a lack of awareness hinders its adoption among the population seeking economical furniture solutions across the region. Furthermore, a significant challenge is the perceived insecurity among potential customers. This further doubts about the quality of rental furniture arise because customers think it's made from used materials. Hence. it acts as a barrier, dampening the potential demand for furniture rental in the GCC region. Therefore, factors such as lack of awareness, poor advertising, and lack of confidence among the population are expected to hamper the market growth in the coming years.

GCC Furniture Rental Market Trend:

The Rapid Expansion of the Real-Estate Industries Propelling the Market Growth – Over the recent years, the GCC region has been witnessing an escalation in the expansion of the real estate industries across major countries such as the UAE, Saudi Arabia, etc. The expansion in this industry significantly proliferates the construction of residential and commercial properties throughout the region. These new developments demand the growing necessity to furnish these spaces to attract potential buyers and tenants. This further escalates the demand for rental furniture services to furnish these areas based on the diverse preferences and affordability range.

Furthermore, there has been a notable upsurge in the expansion of furnished studios and flats, which are specifically designed for short-term tenants, particularly the working population, in the GCC region over the past few years. This elevates the requirement of effective furnishers for the set-up in these spaces. These factors are emerging as driving factors that are surging the market size of rental furniture in the GCC region and are anticipated to elevate the market in the forthcoming years as well.

GCC Furniture Rental Market (2024-30): Segmentation Analysis

The GCC Furniture Rental Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment. It includes predictions for the period 2024–2030 at the regional level. According to the analysis, the market has been further classified as:

Based on the Material:

- Wood

- Plastic

- Others (Leather, Glass, Metal, etc.)

During 2019-2023, the demand for wood-based rental furniture witnessed considerable growth in the GCC Furniture Rental Market. Wooden furniture offers customization to match specific interior design requirements as compared to others. Rental providers offer different wood finishes and styles to meet customer preferences and the overall aesthetic of the rental property.

Furthermore, wooden sofas, couches, and chairs are often equipped with plush cushions and upholstery, combining style with comfort. This makes wood-based seating ideal for rental properties where both aesthetics and comfort are essential. Hence, due to such factors, business organizations need wooden furniture for temporary furnished office spaces used for short-term projects, meetings, or conferences, which is further anticipated to enhance the market size during 2024-2030.

Based on the End Users:

- Residential

- Offices

- Healthcare sector

- Retail

- Others (Government Agencies, Entertainment Sector, etc.)

The rapid construction of offices & retail buildings such as shopping malls, business parks, etc., across the GCC region, has positively impacted the demand for furniture rental in the last few years. The presence of a rich lifestyle and high disposable income among the citizens of the GCC has led to the establishment of numerous shopping complexes and office buildings across the region. Thus, renting office furniture is a cost-effective solution for businesses, particularly startups and organizations with short-term or temporary office space requirements.

Additionally, renting office furniture allows businesses to allocate their capital to core operations rather than investing it in depreciating assets. Consequently, as businesses continue to seek cost-effective, adaptable, and sustainable solutions for their office furnishing needs, the demand for office furniture rental is expected to grow further in the GCC, aligning with the evolving dynamics of the regional business landscape.

GCC Furniture Rental Market (2024-30): Regional Projections

Geographically, the GCC Furniture Rental Market expands across:

- The UAE

- Saudi Arabia

- Oman

- Qatar

- Kuwait

- Bahrain

The UAE dominates the GCC Furniture Rental Market with a considerable share during the period of 2019-2023. The UAE, particularly the major cities such as Abu Dhabi and Dubai, has substantial progression in the hospitality sector as the country is the hub for the major events relating to the cooperate conferences and the international sports. For instance, entities like ADNEC (Abu Dhabi National Exhibition Company), are strategizing for the expansion of the infrastructures, aiming to attract and hold the majority of the international events in the UAE regions. This expansion for the uplifting the national and international events in the UAE upsurges the demand for rental furniture based on the themes and demand of the diverse events.

In addition, the surging government initiatives for digitization of the healthcare sector have fueled the establishment of smart hospitals in the country. The country's economic diversification plan also includes medical tourism as a core component of the Abu Dhabi Economic Vision 2030 plan. Based on all these factors the UAE is dominating the GCC Furniture Rental Market and expected to hold leading position in the coming years as well.

Gain a Competitive Edge with GCC Furniture Rental Market Report

- GCC Furniture Rental Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC Furniture Rental Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

GCC Furniture Rental Market Research Report (2024-2030) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumption

- Executive Summary

- GCC Furniture Rental Market Trends & Insights

- GCC Furniture Rental Market Dynamics

- Drivers

- Challenges

- GCC Furniture Rental Market Hotspots & Opportunities

- GCC Furniture Rental Market Regulations & Policies

- GCC Furniture Rental Market Supply Chain Analysis

- GCC Furniture Rental Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type

- Indoor Furniture- Market Size & Forecast 2019-2030, (USD Million)

- Bedroom Furniture- Market Size & Forecast 2019-2030, (USD Million)

- Dining Furniture- Market Size & Forecast 2019-2030, (USD Million)

- Office Furniture- Market Size & Forecast 2019-2030, (USD Million)

- Kitchen Furniture- Market Size & Forecast 2019-2030, (USD Million)

- Living Room Furniture- Market Size & Forecast 2019-2030, (USD Million)

- Storage Furniture- Market Size & Forecast 2019-2030, (USD Million)

- Outdoor Furniture- Market Size & Forecast 2019-2030, (USD Million)

- Indoor Furniture- Market Size & Forecast 2019-2030, (USD Million)

- By Type of Furniture

- Bed- Market Size & Forecast 2019-2030, (USD Million)

- Sofa & Couch- Market Size & Forecast 2019-2030, (USD Million)

- Table & Desk- Market Size & Forecast 2019-2030, (USD Million)

- Chair & Stool- Market Size & Forecast 2019-2030, (USD Million)

- Wardrobes & Dresser- Market Size & Forecast 2019-2030, (USD Million)

- Others (Nightstand, storage benches, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- By Material

- Wood- Market Size & Forecast 2019-2030, (USD Million)

- Plastic- Market Size & Forecast 2019-2030, (USD Million)

- Others (Leather, Glass, Metal, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- By End-Users

- Residential- Market Size & Forecast 2019-2030, (USD Million)

- Offices- Market Size & Forecast 2019-2030, (USD Million)

- Healthcare Sector- Market Size & Forecast 2019-2030, (USD Million)

- Retail- Market Size & Forecast 2019-2030, (USD Million)

- Others (Government Agencies, Entertainment sector, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- By Country

- The UAE

- Saudi Arabia

- Oman

- Qatar

- Kuwait

- Bahrain

- By Company

- Competition Characteristics

- Market Shares & Analysis

- By Product Type

- Market Size & Analysis

- The UAE Furniture Rental Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2019-2030, (USD Million)

- By Type of Furniture- Market Size & Forecast 2019-2030, (USD Million)

- By Material- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- UAE Furniture Rental Market Pricing Analysis, 2023

- Average Rental By Type of Furniture

- Bed

- Sofa & Couch

- Table & Desk

- Chair & Stool

- Wardrobes & Dresser

- Others (Nightstand, storage benches, etc.)

- Average Rental By Type of Furniture

- Market Size & Analysis

- Saudi Arabia Furniture Rental Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2019-2030, (USD Million)

- By Type of Furniture- Market Size & Forecast 2019-2030, (USD Million)

- By Material- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Saudi Arabia Furniture Rental Market Pricing Analysis, 2023

- Average Rental By Type of Furniture

- Bed

- Sofa & Couch

- Table & Desk

- Chair & Stool

- Wardrobes & Dresser

- Others (Nightstand, storage benches, etc.)

- Average Rental By Type of Furniture

- Market Size & Analysis

- Oman Furniture Rental Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2019-2030, (USD Million)

- By Type of Furniture- Market Size & Forecast 2019-2030, (USD Million)

- By Material- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Oman Furniture Rental Market Pricing Analysis, 2023

- Average Rental By Type of Furniture

- Bed

- Sofa & Couch

- Table & Desk

- Chair & Stool

- Wardrobes & Dresser

- Others (Nightstand, storage benches, etc.)

- Average Rental By Type of Furniture

- Market Size & Analysis

- Qatar Furniture Rental Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2019-2030, (USD Million)

- By Type of Furniture- Market Size & Forecast 2019-2030, (USD Million)

- By Material- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Qatar Furniture Rental Market Pricing Analysis, 2023

- Average Rental By Type of Furniture

- Bed

- Sofa & Couch

- Table & Desk

- Chair & Stool

- Wardrobes & Dresser

- Others (Nightstand, storage benches, etc.)

- Average Rental By Type of Furniture

- Market Size & Analysis

- Kuwait Furniture Rental Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2019-2030, (USD Million)

- By Type of Furniture- Market Size & Forecast 2019-2030, (USD Million)

- By Material- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Kuwait Furniture Rental Market Pricing Analysis, 2023

- Average Rental By Type of Furniture

- Bed

- Sofa & Couch

- Table & Desk

- Chair & Stool

- Wardrobes & Dresser

- Others (Nightstand, storage benches, etc.)

- Average Rental By Type of Furniture

- Market Size & Analysis

- Bahrain Furniture Rental Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2019-2030, (USD Million)

- By Type of Furniture- Market Size & Forecast 2019-2030, (USD Million)

- By Material- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Bahrain Furniture Rental Market Pricing Analysis, 2023

- Average Rental By Type of Furniture

- Bed

- Sofa & Couch

- Table & Desk

- Chair & Stool

- Wardrobes & Dresser

- Others (Nightstand, storage benches, etc.)

- Average Rental By Type of Furniture

- Market Size & Analysis

- GCC Furniture Rental Market Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Companies Profile

- AREEKA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Arena Group PLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Innovative Hiring

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Style Works

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Risala Furniture

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CORT

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Chapter One

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Indigo Living Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lafeef

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Furniture Rental Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- AREEKA

- Companies Profile

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making