Global Flight Digital Inspection System Market Research Report: Forecast (2026-2032)

Flight Digital Inspection System Market - By System (Precision Approach Path Indicator (PAPI), Instrument Landing System (ILS), Very High Frequency (VHF) Omni-Directional Range (VO...R), Distance Measuring Equipment (DME), Others), By Component (Software, Hardware, Services), By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft), By Architecture (On-board Integrated Systems, Portable, Ground-Based Reference System), By Technology (Drone-based Inspection, AI-powered Analytics, Sensor-based Systems, Others), By Inspection Type (Commissioning / Site Acceptance, Periodic Routine, Special/Emergency), By End User (Air Navigation Service Providers (ANSPs), Airport Operators, MRO Service Providers & Airlines, Military Aviation Authorities (Defense), And others Read more

- Aerospace & Defense

- Dec 2025

- Pages 198

- Report Format: PDF, Excel, PPT

Global Flight Digital Inspection System Market

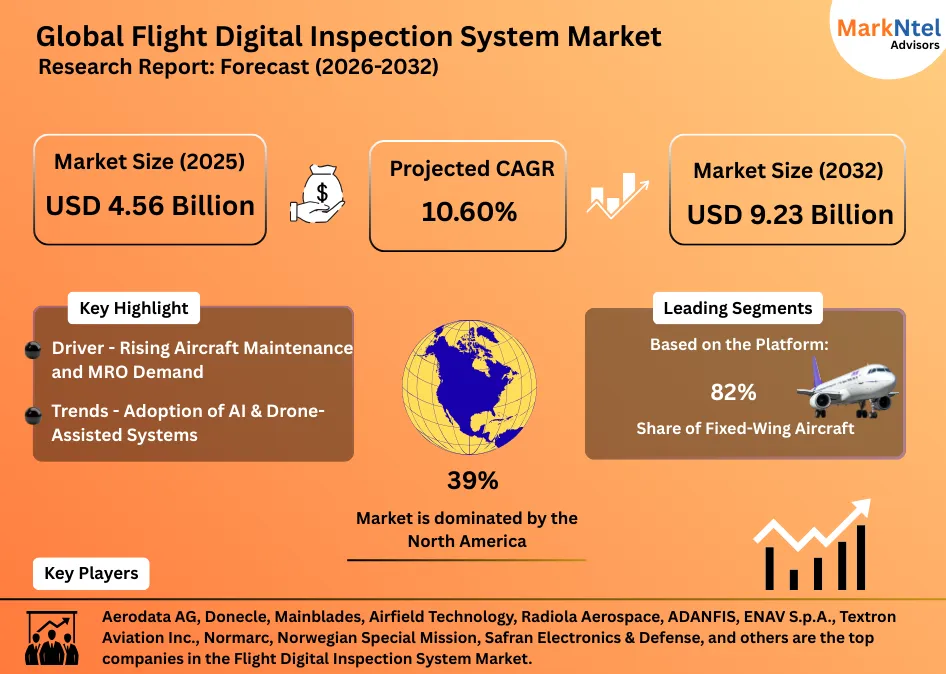

Projected 10.60% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 4.56 Billion

Market Size (2032)

USD 9.23 Billion

Largest Region

North America

Projected CAGR

10.60%

Leading Segments

By the Platform: Fixed-Wing Aircraft

Global Flight Digital Inspection System Market Report Key Takeaways:

- Market size is valued at around USD4.56 billion in 2025 and is projected to reach USD9.23 billion by 2032. The estimated CAGR from 2026 to 2032 is around 10.60%, indicating strong growth.

- By Region, North America leads the Flight Digital Inspection System Market by holding a market share of about 36% in 2025.

- By Platform, Fixed Wing Aircraft represented a significant market share of about 82% in the Global Flight Digital Inspection System Market in 2025.

- By Architecture, the On-board Integrated Systems segment represented a major share of the Global Flight Digital Inspection System Market, accounting for about 64% in 2025.

- Leading Flight Digital Inspection System companies are Aerodata AG, Donecle, Mainblades, Airfield Technology, Radiola Aerospace, ADANFIS, ENAV S.p.A., Textron Aviation Inc., Normarc, Norwegian Special Mission, Safran Electronics & Defense, and others.

Market Insights & Analysis: Global Flight Digital Inspection System Market (2026-32):

The Global Flight Digital Inspection System Market size is valued at around USD4.56 billion in 2025 and is projected to reach USD9.23 billion by 2032. Along with this, the market is estimated to grow at a CAGR of around 10.60% during the forecast period, i.e., 2026-32.

The Global Flight Digital Inspection System Market is strengthening as aviation investment, aircraft production, and government modernization plans expand inspection requirements worldwide. For instance, the International Civil Aviation Organization (ICAO) highlights that global air traffic has increased by 2% in 2024, increasing aircraft utilization and inspection frequency across commercial fleets. Higher utilization places pressure on maintenance teams to complete inspections faster without compromising safety.

Additionally, aircraft manufacturing output is gradually recovering and expanding. Boeing resumed production increases on the 737 program in 2024, following regulatory clearance, while Airbus continues to stabilize high monthly output across single-aisle programs, adding thousands of aircraft that will enter service and require routine digital visual inspections over their operating lives. As production volumes rise, inspection demand grows not only for new aircraft acceptance but also for in-service maintenance.

Additionally, government-led aviation expansion programs are directly supporting inspection demand. China’s Civil Aviation Administration (CAAC) plans to operate over 450 civil airports by 2035, compared with about 260 in the early 2020s, significantly increasing aircraft movements, regional fleets, and inspection workloads. Similarly, India’s National Civil Aviation Policy and UDAN program continue to expand regional air connectivity, increasing the number of aircraft operating from smaller airports where rapid, drone-based inspections offer clear efficiency advantages.

Likewise, governments are modernizing aviation safety and oversight systems. The European Union’s SESAR program and the U.S. FAA’s NextGen modernization initiatives emphasize digital safety, surveillance, and compliance, indirectly reinforcing the adoption of image-based and data-driven inspection technologies. These programs increase expectations for accuracy, traceability, and digital records in maintenance processes.

Global Flight Digital Inspection System Market Recent Developments:

- 2025: Aerodata AG unveiled the AeroForce-X, a German-built medium-altitude, long-endurance unmanned aerial vehicle designed to enhance intelligence, surveillance, reconnaissance, and electronic missions with up to 40-hour endurance and a 1.3-tonne payload capacity.

- 2025: Safran Electrical & Power opened a new production and maintenance facility in Singapore’s Seletar Aerospace Park to manufacture and service aerospace electrical systems, including power converters, distribution units, and aircraft batteries, strengthening its Asia-Pacific footprint.

Global Flight Digital Inspection System Market Scope:

| Category | Segments |

|---|---|

| By System | Precision Approach Path Indicator (PAPI), Instrument Landing System (ILS), Very High Frequency (VHF) Omni-Directional Range (VOR), Distance Measuring Equipment (DME), Others), |

| By Component | Software, Hardware, Services), |

| By Platform | Fixed-Wing Aircraft, Rotary-Wing Aircraft), |

| By Architecture | On-board Integrated Systems, Portable, Ground-Based Reference System), |

| By Technology | Drone-based Inspection, AI-powered Analytics, Sensor-based Systems, Others), |

| By Inspection Type | Commissioning / Site Acceptance, Periodic Routine, Special/Emergency), |

| By End User | Air Navigation Service Providers (ANSPs), Airport Operators, MRO Service Providers & Airlines, Military Aviation Authorities (Defense), And others |

Global Flight Digital Inspection System Market Driver:

Rising Aircraft Maintenance and MRO Demand

Rising aircraft maintenance and MRO demand is a strong driver for flight digital inspection systems as global fleets grow and aircraft utilization intensifies. For instance, the International Air Transport Association (IATA) reports that global airlines spent around USD93.9 billion on maintenance, repair, and overhaul (MRO) in 2023, underscoring the scale of inspection-related activity worldwide. As fleets expand, inspection frequency rises across line maintenance, base checks, and heavy overhauls.

Additionally, Airbus projects the global commercial aircraft fleet to nearly double by 2042, driven by passenger growth and the replacement of aging aircraft. A larger fleet directly translates into higher inspection volumes, especially for mandatory visual and structural checks. Additionally, aircraft utilization has increased as air traffic rebounds, leading to more flight cycles per aircraft, which accelerates wear and triggers more frequent inspections. Together, expanding fleets, higher utilization, aging aircraft, and workforce constraints are structurally increasing MRO demand, making faster, AI-enabled digital inspection systems an essential efficiency solution rather than an optional upgrade.

Global Flight Digital Inspection System Market Trend:

Adoption of AI & Drone-Assisted Systems

Enhanced AI and imaging technologies are driving a major shift in the flight digital inspection system market by automating aircraft surface checks with drones and machine vision, reducing manual effort and increasing accuracy. By 2024, Jet Aviation received approval from the Swiss Federal Office of Civil Aviation to use the automated drone systems for regulated image-based inspections, marking a significant regulatory milestone.

Similarly, in 2025, HAECO launched drone-assisted aircraft inspection trials at its U.S. facilities in partnership with Donecle, using autonomous UAVs to improve structural, paint, and lightning damage detection while enhancing safety and efficiency. Meanwhile, Mainblades has advanced high-resolution imaging and AI software in its drone inspection solutions that capture detailed aircraft surface imagery and automatically highlight possible defects, enabling operators to detect anomalies down to the millimeter scale with AI assistance.

Global Flight Digital Inspection System Market Challenges:

High Initial & Maintenance Costs

High capital and operating costs hinder the adoption of digital flight-inspection systems because airlines, MROs, and national authorities must invest heavily in hardware, software, training, and integration while balancing tight maintenance budgets. For instance, early adopters such as Donecle required external funding of about USD6.1 million in 2023 to scale drone-inspection offerings, illustrating that suppliers themselves need capital before customers can benefit at scale.

Additionally, operators face integration costs, including adding automated inspection drones or digital image analytics require hangar adaptations, certified workflows, and skilled analysts, which increase operating expenses and slow ROI. Consequently, high upfront CAPEX, ongoing training and data-management costs, plus competing budget priorities (e.g., FAA and national ATC modernization spending) constrain procurement of digital inspection systems despite demonstrated efficiency gains.

Global Flight Digital Inspection System Market (2026-32) Segmentation Analysis:

The Global Flight Digital Inspection System Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on the Platform:

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

The fixed-wing aircraft segment dominates this market and holds about 82% market share because fixed-wing airplanes account for the vast majority of aircraft in active commercial service worldwide and require frequent, structured inspections. For instance, the International Air Transport Association reports that the global commercial aircraft fleet reached about 30,300 active aircraft by mid-2025, of which narrow-body and wide-body jets together represent well over 90%. These fixed-wing aircraft operate high daily flight cycles, directly increasing inspection frequency.

Additionally, fixed-wing aircraft dominate flight hours and maintenance spending. For reference, global aircraft maintenance, repair, and overhaul (MRO) expenditure exceeded USD 100 billion in 2024, according to data from the aviation industry and airline associations, with commercial fixed-wing fleets accounting for the largest share of this spending. Higher MRO budgets enable the faster adoption of digital inspection tools, including tablet-based checks, high-resolution imaging, AI-supported defect detection, and drone inspections.

Similarly, regulatory frameworks worldwide support digital inspections for fixed-wing aircraft. Authorities such as the Federal Aviation Administration and European Union Aviation Safety Agency permit electronic maintenance records and digital documentation, making large-scale deployment feasible for airlines and MROs.

Based on Architecture:

- On-board Integrated Systems

- Portable

- Ground-Based Reference System

On-board integrated systems dominate the global flight digital inspection system industry, accounting for about 64% market share because they provide continuous, high-quality aircraft data and support real-time diagnostics throughout flight operations. Unlike portable or ground-based tools, these systems are permanently installed on aircraft and automatically capture flight, navigation, and systems data, which is directly linked to maintenance records and regulatory logs.

For instance, Airbus Skywise enables airlines to collect and analyze aircraft health data in real time, supporting predictive maintenance and helping operators reduce aircraft-on-ground (AOG) events. Similarly, Boeing’s airplane health-management programs embed sensors, telemetry, and analytics within aircraft to monitor component performance and anticipate failures before they cause operational disruptions.

Global Flight Digital Inspection System (2026-32): Regional Projection

North America holds around a 36% share of the Global Flight Digital Inspection System Market, supported by its large aircraft base, high maintenance spending, and rapid digital adoption. For instance, according to the Federal Aviation Administration (FAA), daily U.S. air traffic in 2024 averaged about 45,000 flights per day, indicating a very large operational fleet supporting domestic and international routes.

Additionally, North America accounts for a significant portion of global aviation maintenance activity. For reference, North America represents the single largest regional contributor due to dense airline and MRO infrastructure.

Similarly, regulatory readiness accelerates adoption. FAA guidance allowing electronic maintenance records and digital inspection documentation reduces compliance risks and shortens implementation timelines. Likewise, the presence of major aerospace OEMs and MRO leaders, such as Boeing and large U.S.-based maintenance providers, enables early integration of AI, imaging, and drone-based inspection tools.

Gain a Competitive Edge with Our Global Flight Digital Inspection System Market Report

- Global Flight Digital Inspection System Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Flight Digital Inspection System Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Flight Digital Inspection System Market Policies, Regulations, Product Standards

- Global Flight Digital Inspection System Market Trends & Development

- Global Flight Digital Inspection System Market Dynamics

- Growth Drivers

- Challenges

- Global Flight Digital Inspection System Market Hotspot & Opportunities

- Global Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- Precision Approach Path Indicator (PAPI)

- Instrument Landing System (ILS)

- Very High Frequency (VHF) Omni-Directional Range (VOR)

- Distance Measuring Equipment (DME)

- Others

- By Component- (USD Million)

- Software

- Hardware

- Services

- By Platform- (USD Million)

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- By Architecture- (USD Million)

- On-board Integrated Systems

- Portable

- Ground-Based Reference System

- By Technology- (USD Million)

- Drone-based Inspection

- AI-powered Analytics

- Sensor-based Systems

- Others

- By Inspection Type- (USD Million)

- Commissioning / Site Acceptance

- Periodic Routine

- Special/Emergency

- By End User- (USD Million)

- Air Navigation Service Providers (ANSPs)

- Airport Operators

- MRO Service Providers & Airlines

- Military Aviation Authorities (Defense)

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share & Analysis

- By System- (USD Million)

- Market Size & Analysis

- North America Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- By Country

- The US

- Canada

- Mexico

- The US Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Canada Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Mexico Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- South America Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Size & Analysis

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Argentina Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Europe Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- By Country

- The UK

- Germany

- France

- Norway

- Italy

- Spain

- Russia

- Rest of Europe

- The UK Vehicle Maintenance & Servicing Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Germany Vehicle Maintenance & Servicing Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- France Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Norway Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Italy Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Spain Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Russia Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Size & Analysis

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- By Country

- Saudi Arabia

- UAE

- Qatar

- Turkey

- South Africa

- Rest of Middle East & Africa

- Saudi Arabia Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- UAE Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Qatar Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Turkey Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- South Africa Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Asia-Pacific Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Size & Analysis

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- By Country

- China

- India

- Japan

- South Korea

- Thailand

- Singapore

- Australia

- China Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- India Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Japan Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- South Korea Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Thailand Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Singapore Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Australia Flight Digital Inspection System Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By System- (USD Million)

- By Component- (USD Million)

- By Platform- (USD Million)

- By Architecture- (USD Million)

- By Technology- (USD Million)

- By Inspection- (USD Million)

- By End User- (USD Million)

- Market Size & Analysis

- Global Flight Digital Inspection System Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Aerodata AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Donecle

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mainblades

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Airfield Technology

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Radiola Aerospace

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ADANFIS

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ENAV S.p.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Textron Aviation Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Normarc

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Norwegian Special Mission

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Safran Electronics & Defense

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Aerodata AG

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making