Global Endoscopy Equipment Market Research Report: Forecast (2024-2030)

By Product (Endoscopes, [Rigid, Flexible, Capsule, Disposable, Robot-assisted], Visualization System, [Endoscopic Camera, Standard Definition (SD) Visualization System, High Defin...ition (HD) Visualization System,] Accessories, Others (Fluid Flushing Device, Valves, etc.)), By Application (Gastrointestinal (GI) Endoscopy Equipment, Laparoscopy, Obstetrics/Gynecology Endoscopy Equipment, Arthroscopy, Urology Endoscopy Equipment (Cystoscopy), Bronchoscopy, Others (ENT Endoscopy Equipment, Neuro Endoscopy Equipment, etc.)), By End User (Hospitals, Ambulatory Care Centers, Specialty Clinics), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific) By Company (Arthrex Inc., B Braun Melsungen, Boston Scientific Corporation, CONMED Corporation, Ethicon Endo-Surgery, LLC (Johnson & Johnson), FUJIFILM Holdings Corporation, Intuitive Surgical, Inc., Karl Storz SE & Co. KG, Machida Endoscope Co., Ltd., Medtronic Plc (Covidien), Olympus Corporation, PENTAX Medical (HOYA), Richard Wolf GmbH, Smith & Nephew Plc, Stryker Corporation, and others) Read more

- Healthcare

- Nov 2023

- Pages 188

- Report Format: PDF, Excel, PPT

Market Definition

Endoscopy is a non-surgical procedure conducted to examine an individual's digestive tract or any other internal tissues or organs using an endoscope, i.e., a flexible tube with a camera & light attached. This procedure is performed typically by gastroenterologists for the early diagnosis & treatment of chronic health conditions, such as GERD (Gastroesophageal Reflux Disease), stomach ulcers, celiac disease, GI (Gastrointestinal) disorders, or any other problem related to the digestive tract of an individual.

Market Insights & Analysis: Global Endoscopy Equipment Market (2024-30):

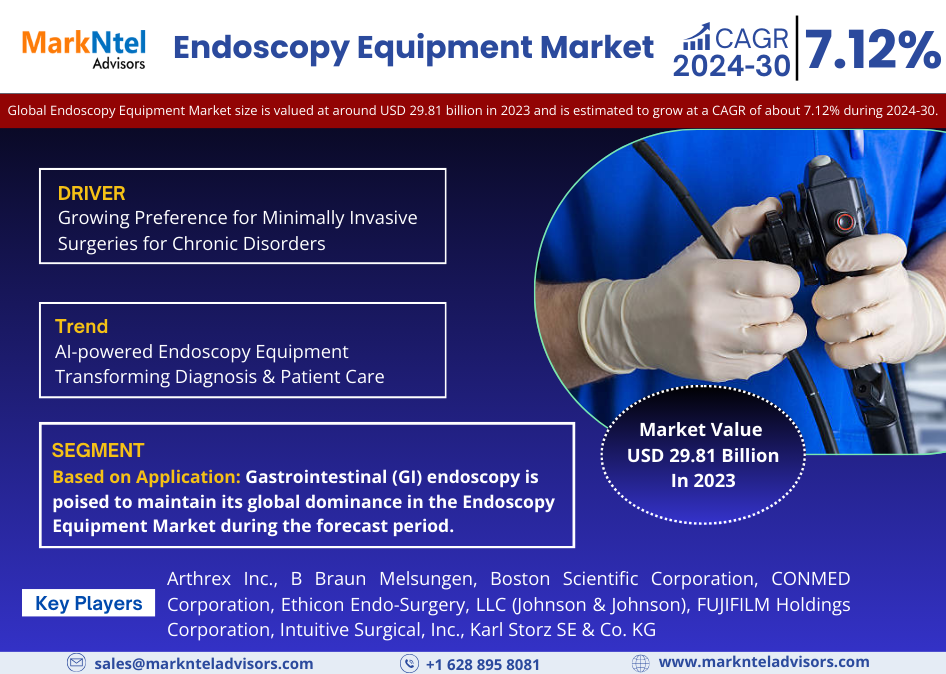

The Global Endoscopy Equipment Market size is valued at around USD 29.81 billion in 2023 and is estimated to grow at a CAGR of about 7.12% during the forecast period, i.e., 2024-30. The market expansion is primarily fueled by the rising incidence of chronic diseases and the increasing awareness among patients regarding the availability of early detection & diagnosis through Minimally Invasive Surgical (MIS) procedures.

The swift FDA approvals for endoscopic technologies, the continuous investment in healthcare infrastructure improvement, and the growing disposable income of individuals, enabling them to afford endoscopic procedures, are other pivotal factors expected to propel the industry's growth in the forecast period.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 7.12% |

| Regions Covered | North America: USA, Canada, Mexico |

| South America: Brazil, Argentina, Rest of South America | |

| Europe: The UK, Germany, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Singapore, Rest of Asia-Pacific | |

| Middle East & Africa: Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa | |

| Key Companies Profiled | Arthrex Inc., B Braun Melsungen, Boston Scientific Corporation, CONMED Corporation, Ethicon Endo-Surgery, LLC (Johnson & Johnson), FUJIFILM Holdings Corporation, Intuitive Surgical, Inc., Karl Storz SE & Co. KG, Machida Endoscope Co., Ltd., Medtronic Plc (Covidien), Olympus Corporation, PENTAX Medical (HOYA), Richard Wolf GmbH, Smith & Nephew Plc, Stryker Corporation, and others |

| Market Value (2023) | USD 29.81 Billion |

The endoscopy industry is expanding rapidly due to the increasing prevalence of gastrointestinal diseases and obesity. Functional gastrointestinal disorders (GIDs) such as IBS, functional constipation, etc., can affect different parts of the gastrointestinal tract, including the stomach, intestines, and esophagus. On the other hand, unhealthy lifestyles & poor dietary habits are stimulating the incidence of obesity and, subsequently, GI disorders like Esophageal Adenocarcinoma, Erosive Esophagitis, (GERD) Gastroesophageal Reflux Disease, and Colorectal Polyps, among others. Hence, with the increasing prevalence of such diseases, different endoscopes are being increasingly adopted by hospitals & other healthcare facilities globally.

As a result, healthcare facilities around the world are increasingly using different kinds of endoscopes, such as capsule endoscopes, reusable vs disposable endoscopes, and robot-assisted vs AI-based endoscopes. All of these factors point to a promising future for the Global Endoscopy Equipment market.

Global Endoscopy Equipment Market Driver:

Growing Preference for Minimally Invasive Surgeries for Chronic Disorders – The demand for endoscopy equipment has been experiencing a substantial surge owing to a rise in minimally invasive surgeries. This is mainly due to the growing awareness among patients grappling with a range of health issues, such as orthopedic disorders, neurological conditions, GERD, cancer, and others. Due to this, patients are increasingly inclined towards minimally invasive surgical (MIS) procedures as they offer numerous advantages, such as reduced postoperative discomfort, quicker recovery times, and shorter hospital stays. These benefits enhance the effectiveness of treatments and provide more cost-efficient and safer treatment compared to conventional open surgeries.

Consequently, there is a rapid demand for endoscopic equipment. This heightened demand is fueled by the need to diagnose and treat the substantial patient population dealing with chronic disorders, hence collectively enhancing the Global Endoscopy Equipment Market size during 2024-30.

Global Endoscopy Equipment Market Trend:

AI-powered Endoscopy Equipment Transforming Diagnosis & Patient Care – Artificial Intelligence (AI) and Machine Learning are revolutionizing the field of endoscopy by significantly enhancing diagnostic capabilities and procedure guidance. AI-powered solutions for real-time image analysis have emerged as a prominent trend in the Global Endoscopy Equipment Market. These technologies can detect abnormalities, such as lesions or tumors, during procedures with greater accuracy & speed. As healthcare providers increasingly emphasize the need for efficiency and precision, the integration of AI & machine learning into endoscopy devices is on the rise. This heightened technological demand has led to collaborative efforts among endoscopy equipment manufacturers to develop & introduce AI-integrated products to the market. For instance,

- In 2023, Medtronic and NVIDIA joined forces to create an AI platform for medical devices, integrating NVIDIA's healthcare and edge AI technologies into Medtronic's GI Genius™ intelligent endoscopy module, enhancing physicians' ability to detect polyps linked to colorectal cancer.

These advancements in endoscopy equipment hold the potential to facilitate early disease detection and elevate the overall standard of patient care, consequently fueling the demand for endoscopy equipment in the foreseeable future.

Global Endoscopy Equipment Market (2024-30): Segmentation Analysis

The Global Endoscopy Equipment Market study by MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment & includes predictions for the period 2024–2030 at the global level. In accordance to the analysis, the market has been further classified as:

Based on Product:

- Endoscopes

- Rigid

- Flexible

- Capsule

- Robot-assisted

- Visualization System

- Endoscopic Camera

- SD Visualization System

- HD Visualization System

- Accessories

- Others

Flexible Endoscopes hold the dominating share of the Global Endoscopy Equipment Market. Flexible endoscopy (FE) is preferred as the first-line therapeutic, owing to its capability to perform under sedation & LA (Local Anesthesia) and cost-effectiveness as it doesn't require patient hospitalization. These devices have become a cornerstone in various medical procedures, including GI endoscopy, Laparoscopy, Urology Endoscopy, OGD (Esophagogastroduodenoscopy), Bronchoscopy, Sigmoidoscopy, Laryngoscopy, Pharyngoscopy, Nasopharyngoscopy, Rhinoscopy, and Colonoscopy.

Their widespread adoption can be attributed to their ability to access viscera & cavities, improve safety & efficiency, and offer enhanced ergonomic features. Thus, the escalating demand for flexible endoscopes, driven by the need for early detection & diagnosis of chronic diseases on a global scale, promises significant growth opportunities for the market in the forecast years.

Based on Application:

- Gastrointestinal (GI) Endoscopy

- Laparoscopy

- Obstetrics/Gynecology Endoscopy

- Arthroscopy

- Urology Endoscopy (Cystoscopy)

- Bronchoscopy

- Others (ENT Endoscopy, Neuro Endoscopy, etc.)

Gastrointestinal (GI) endoscopy is poised to maintain its global dominance in the Endoscopy Equipment Market during the forecast period. The increasing prevalence of functional GI diseases and the expanding global geriatric population are some influential aspects pushing the industry ahead. The growing number of upper GI procedures and the rising utilization of endoscopes as a primary tool for early detection & diagnosis of GI conditions are contributing to this trend.

Furthermore, the escalating cases of colorectal cancer (CRC) and GI disorders like dyspepsia, irritable bowel syndrome, and constipation among both young adults and the elderly are expected to stimulate the market in the coming years.

Global Endoscopy Equipment Market (2024-30): Regional Projection

Geographically, the Global Endoscopy Equipment Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

North America is the largest market for endoscopy in the world and is expected to remain so in the coming years. This is due to the increasing prevalence of chronic diseases such as cancer and gastrointestinal disorders, the rising demand for elective endoscopy procedures, the aging of the population, and the need for modern healthcare facilities supported by high government & private sector spending are a few aspects contributing in the regional market expansion.

Across the entire region, the United States is the market leader for endoscopy. This is due to the high incidence of colorectal cancer (CRC) and the growing demand for effective endoscopy diagnosis and treatment. The industry leaders are investing heavily in research and development (R&D) to introduce new and innovative products to improve endoscopy performance and accuracy. They are also doing mergers and acquisitions (M&A) and strategic partnerships (SSPs) to increase their product range and geographical reach.

Global Endoscopy Equipment Industry Recent Development:

- 2023, Karl Sortz acquired AventaMed, with the aim of becoming a cutting-edge collaborator for ENT surgeons in their pursuit of advanced endoscopic treatments, thus empowering various healthcare facilities to provide more effective solutions for their patients

- 2023, Fujifilm Holdings Corporation announced the expansion of its endoscopy solutions portfolio by unveiling the Clutch Cutter and Fush Knife in India.

Gain a Competitive Edge with Our Global Endoscopy Equipment Market Report

- Global Endoscopy Equipment Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Endoscopy Equipment Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

Global Endoscopy Equipment Market Research Report (2024-2030) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Endoscopy Equipment Market: Background & Overview

- Global Endoscopy Equipment Market Porter’s Five Forces Analysis

- Global Endoscopy Equipment Market Trends & Developments

- Global Endoscopy Equipment Market Dynamics

- Drivers

- Challenges

- Global Endoscopy Equipment Market Regulation & Policy, By Country

- Global Endoscopy Equipment Market Hotspot & Opportunities

- Global Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Product

- Endoscopes- Market Size & Forecast 2019-2030, USD Million

- Rigid- Market Size & Forecast 2019-2030, USD Million

- Flexible- Market Size & Forecast 2019-2030, USD Million

- Capsule- Market Size & Forecast 2019-2030, USD Million

- Disposable- Market Size & Forecast 2019-2030, USD Million

- Robot-assisted- Market Size & Forecast 2019-2030, USD Million

- Visualization System- Market Size & Forecast 2019-2030, USD Million

- Endoscopic Camera- Market Size & Forecast 2019-2030, USD Million

- Standard Definition (SD) Visualization System- Market Size & Forecast 2019-2030, USD Million

- High Definition (HD) Visualization System- Market Size & Forecast 2019-2030, USD Million

- Accessories- Market Size & Forecast 2019-2030, USD Million

- Others (Fluid Flushing Device, Valves, etc.)- Market Size & Forecast 2019-2030, USD Million

- Endoscopes- Market Size & Forecast 2019-2030, USD Million

- By Application

- Gastrointestinal (GI) Endoscopy Equipment- Market Size & Forecast 2019-2030, USD Million

- Laparoscopy- Market Size & Forecast 2019-2030, USD Million

- Obstetrics/Gynecology Endoscopy Equipment- Market Size & Forecast 2019-2030, USD Million

- Arthroscopy- Market Size & Forecast 2019-2030, USD Million

- Urology Endoscopy Equipment (Cystoscopy)- Market Size & Forecast 2019-2030, USD Million

- Bronchoscopy- Market Size & Forecast 2019-2030, USD Million

- Others (ENT Endoscopy Equipment, Neuro Endoscopy Equipment, etc.)- Market Size & Forecast 2019-2030, USD Million

- By End User

- Hospitals- Market Size & Forecast 2019-2030, USD Million

- Ambulatory Care Centers- Market Size & Forecast 2019-2030, USD Million

- Specialty Clinics- Market Size & Forecast 2019-2030, USD Million

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competition

- Competition Characteristics

- Market Share Analysis

- By Product

- Market Size & Analysis

- North America Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Canada Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Mexico Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Argentina Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- Germany

- The UK

- Spain

- France

- Italy

- Rest of Europe

- Germany Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- The UK Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Spain Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- France Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Italy Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- Saudi Arabia

- The UAE

- South Africa

- Rest of the Middle East & Africa

- Saudi Arabia Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- The UAE Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- South Africa Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Country

- China

- Japan

- South Korea

- Australia

- India

- Singapore

- Rest of Asia-Pacific

- China Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Japan Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- South Korea Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Australia Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- India Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Singapore Endoscopy Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Competitive Outlook

- Company Profiles

- Arthrex Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- B Braun Melsungen

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Boston Scientific Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CONMED Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ethicon Endo-Surgery, LLC (Johnson & Johnson)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- FUJIFILM Holdings Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Intuitive Surgical, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Karl Storz SE & Co. KG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Machida Endoscope Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Medtronic Plc (Covidien)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Olympus Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PENTAX Medical (HOYA)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Richard Wolf GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Smith & Nephew Plc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Stryker Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Arthrex Inc.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making