EMEA Organic Baby Food Market Research Report: Forecast (2022-2027)

By Type (Milk Formula, Prepared Baby Food, Dried Baby Food), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Store, Online Retail Stores), By Ingredients (Grains & ...Cereals, Dairy, Vegetables, Fruits), By Country (Germany, The UK, France, Italy, Spain, Russia, Turkey, Egypt, Saudi Arabia, The UAE, Israel, South Africa), By Competitors (Abbott Laboratories, Danone S.A., Nestlé S.A., Hero Group, The Kraft Heinz Company, Amara Organics, Plum Organics, The Hain Celestial Group, Inc., Baby Gourmet Food Inc., Hipp GmbH & Co. Vertrieb KG, Blendina, Organix) Read more

- Food & Beverages

- Jun 2022

- Pages 215

- Report Format: PDF, Excel, PPT

Market Definition

Organic baby food is produced & processed without using pesticides, chemicals, growth hormones, and other antibiotics. Organic food is also kept free from Genetically Modified Organisms (GMO), making it suitable for baby food products. Further, as these organic foods are free from chemical pesticides, fungicides, and fertilizers, they are considered to be more beneficial for the infant’s digestive systems that are susceptible to the food in the early stages of food transition from mother’s milk to solid food. Accounting for the health benefits as well as a surge in the healthier eating habits in the regions such as Europe & Middle Eastern countries in general, the demand for organic baby food products would further escalate in the coming years.

Market Insights

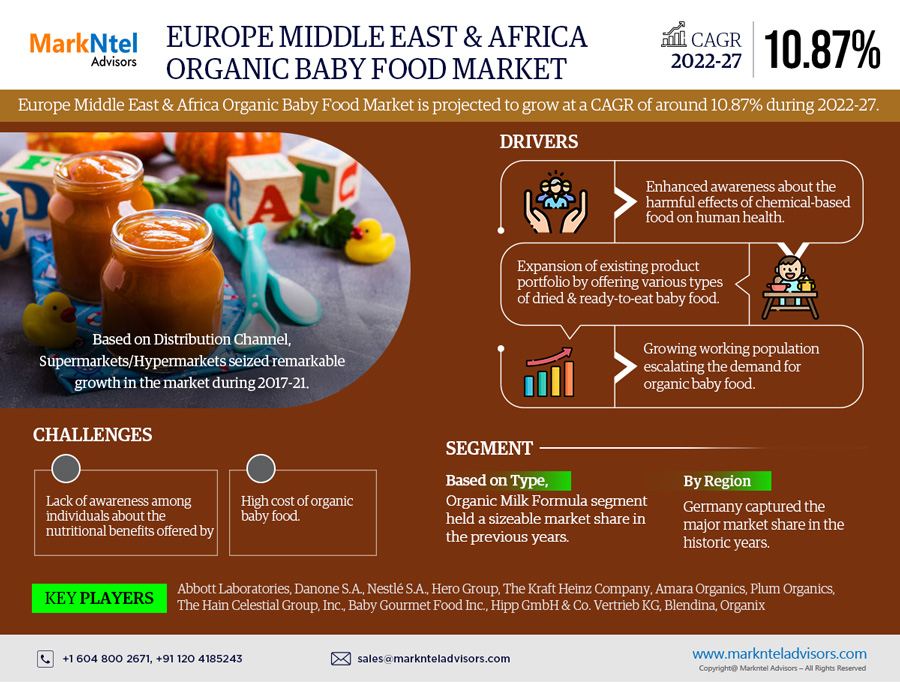

The Europe Middle East & Africa Organic Baby Food Market is projected to grow at a CAGR of around 10.87% during the forecast period, 2022-27. The factors attributing to the growth of the Organic Baby Food market include increasing adoption of organic food in the high-income countries as well as enhanced awareness about the harmful effects of chemical-based food on human health. Concerning the given factors, parents are getting more inclined toward the usage of chemical-free food as the early years of children are crucial in their development & growth. Further, with several health benefits associated with organic baby food, the manufacturers are increasingly focused on the expansion of their existing product portfolio by offering various types of dried & ready-to-eat baby food to cater to a wide variety of kids of different age groups.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) |

10.87% |

| Country Covered | Germany, The UK, France, Italy, Spain, Russia, Turkey, Egypt, Saudi Arabia, The UAE, Israel, South Africa |

| Key Companies Profiled | Abbott Laboratories, Danone S.A., Nestlé S.A., Hero Group, The Kraft Heinz Company, Amara Organics, Plum Organics, The Hain Celestial Group, Inc., Baby Gourmet Food Inc., Hipp GmbH & Co. Vertrieb KG, Blendina, Organix, Others |

| Unit Denominations | USD Million/Billion |

In addition, with the growing population of working women in Europe Middle East & African countries, including Germany, France, Italy, Turkey, UAE, Saudi Arabia, South Africa, Israel, etc., the demand for organic baby food has increased noticeably, which, in turn, has largely contributed to the growth of the organic baby food products. In 2019, according to the Annual Economic Report of the UAE, the percentage of women working in the private sector was about 44.3%, which was recorded to be 41.6% in 2017, as per the World Bank database.

Thus, the growing need for organic baby food by women professionals to feed their babies led companies to insert new product portfolios in the baby food segment, thereby accelerating the market of organic baby food in Europe Middle East & Africa regions during the forecast period.

Key Trends in the Market

- Growing Investment by the Baby Food Manufacturers in the Organic Baby Food Industry

The growing concerns of parents regarding their infant’s health have influenced the organic food market drastically in recent years. Further, to provide healthier diets to their children to safeguard them from vitamins & minerals deficiency, parents are seeking natural & organic baby food products. Consequently, the growing demand for chemical-free foodstuffs among parents has pushed manufacturers to produce a variety of organic baby food products with additional nutrition value. This led companies to invest heavily in organic baby food products to bring out some innovation in the segment to revitalize the declining category.

Impact of Covid-19 on the Europe Middle East & Africa Organic Baby Food Market

The Organic Baby Food segment saw an increase in demand during COVID-19 due to factors, such as increased consumer awareness of healthier food alternatives. Similarly, people began looking for organic baby food products with improved nutrition to improve children's health. Furthermore, as the goods were available & people preferred to purchase healthy products for their children & families, online sales channels coincided with this trend by providing easy availability of organic baby food as easy door-step delivery.

Moreover, post-COVID-19, the demand for different brands of organic baby food products raised significantly as the restrictions were slowly eased. Additionally, the expansion of organic product offerings by different companies as well as the ease of purchase was observed in the respective period. Consequently, this growing trend has further driven the market of organic baby food products in the EMEA region & is estimated to propel the demand in the forthcoming years.

Market Segmentation

Based on the Type:

- Milk Formula

- Prepared Baby Food

- Dry Baby Food

Of them all, the Organic Milk Formula segment held a sizeable market share in the Europe Middle East & Africa region. The demand for milk formula comes in the initial years (6 months to 2 years), for an infant during the food transition from mother’s milk to solid food. During this process, the digestion systems of the kids are considered to be sensitive to food, due to which consumers prefer to use organic milk to reduce digestion-related issues. Furthermore, several leading companies, such as Nestle, HiPP, etc., have extensively grown their existing product categories under the baby milk formula segment to tap the growth potential in the baby food segment.

Based on the Distribution Channel:

- Supermarket/Hypermarket

- Convenience Store

- Online Retail Store

- Other Distribution Channel (Discount Stores, Specialty Stores, etc.)

Among them, the Supermarket/Hypermarket distribution channel seized remarkable growth in the Organic Baby Food market during 2017-21 in Europe Middle East & Africa regions. Unflinching availability of supermarkets/hypermarkets during the period of COVID-19 has played a crucial role in the segment sustaining its major market share for the sales of organic packaged food. Thus, supportive government policies in countries such as the UAE, Saudi Arabia, Qatar, Germany, France, and others in Europe Middle East & Africa region, have increased the revenue share of hypermarkets & supermarkets. However, with the advent of the coronavirus pandemic, consumers were more prone to adopt online platforms due to worldwide mobility restrictions.

In lieu of this, the online retail stores' showed impressive growth during the historical period for the sales of organic food in the EMEA region. Further, the online sales channels witnessed a surge in demand for organic baby food due to the increasing supply chain availability & the growing number of online customers with available online transactions. Moreover, due to the larger availability of organic baby food brands for comparison, lucrative offers on brands, economical pricing, etc., online sales channels are largely preferred by the consumers, thereby expected to grow in the upcoming years.

Country Landscape

Geographically, the Europe Middle East & Africa Organic Baby Food Market expands across:

- Germany

- The UK

- France

- Italy

- Spain

- Russia

- Turkey

- Egypt

- Saudi Arabia

- The UAE

- Israel

- South Africa

Of all the countries, Germany captured the major market share in organic baby food in the Europe Middle East & African countries. Multiple factors such as growing health awareness, the presence of a large number of organic brands as well as an increasing population of working women professionals have played a vital role in the growth of the Organic Baby Food market in Germany. Moreover, some of the leading companies in the Organic Baby Food market are HiPP, Alete, Goodforgrowth, etc., which have expanded their product portfolios, collaborating with other baby food product companies to launch new products in the organic baby food segment. Therefore, these developments would further escalate the market of organic baby food products in the country in the upcoming years. For instance:

- In 2018, the Hero Group entered into a strategic partnership with German organic baby food company Goodforgrowth GmbH to strengthen its product portfolio in the area of organic & natural foods for babies & toddlers.

Recent Developments by the Leading Companies

- In 2020, Danone announced to invest significantly in organic baby milk facilities in France to reinvigorate the category as well as fulfill the increasing consumer demand for organic and natural products.

- In 2017, Danone announced to expand its organic presence in the baby food market through its investment arm Danone Manifesto Ventures, in the French baby food start-up company Yooji. The company offers portion-sized organic products without salt or additives.

Market Dynamics:

Key Driver: Rise in Working Woman Population in the EMEA Region to Positivity Impact the Market Growth

The working woman population in the region, especially in Europe & the Middle East, has grown in the historical years, due to which the demand for baby food products has grown extensively. According to the European Commission, Europe had 67 per cent of working-class women, which was significantly higher than other regions such as the Middle East and Africa, resulting in higher consumer adoption of organic baby food.

Moreover, with the high rate of working women, the availability of home-cooked food to the kids has significantly decreased. Furthermore, with the growing awareness among working women about the benefits of organic baby food for their babies, the demand for the Organic Baby Food market has witnessed a surge in the EMEA region.

Possible Restraint: Premium Pricing of Organic Baby Food Products to Hinder the Market Growth

The cost of organic products is higher because the majority of these products are made from plant extracts, which are considered a costly ingredient in the production of organic products, limiting the adoption of organic baby food products. Besides, the usage of chemical-free fertilizer, pesticides, and fungicides leads to lowered production output compared to conventional farming, further keeping the prices of raw materials at a premium.

Moreover, the other reason acting as a restraining factor in the growth of the Organic Baby Food market is due to lack of awareness among individuals regarding the nutritional benefits offered by these organic baby food products, hence acts as a challenge to the growth of Organic Baby Food market in the countries of EMEA region.

Growth Opportunity: Rising Organic Farming Boost the Production of Organic Baby Food Products

Growing health concerns among parents regarding their infant health seized the demand for more natural & organic baby food products in the Europe Middle East & Africa region. The growing demand for chemical-free products has necessitated the scope for organic farming in the region. Organic farming is a method that is used to promote sustainability, thus offering numerous health & environmental benefits. Further, to promote sustainable economic development, governments of EMEA countries, including Saudi Arabia, the UAE, Germany, France, etc., have taken necessary initiatives to promote organic farming to offer various food products in the market. For instance:

- In 2021, European Union announced Green Deal Plan to boost organic food production in the region. It also aims to enhance the production & consumption of organic products by providing 25% of agricultural land available for organic farming by 2030.

Additionally, these initiatives would create several opportunities for new market players to launch new organic food products in the market of the EMEA region, thereby inclining the growth of the Organic Baby Food market in the foreseen years.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Europe Middle East & Africa Organic Baby Food Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Europe Middle East & Africa Organic Baby Food Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Europe Middle East & Africa Organic Baby Food Market based on the competitive landscape?

- What are the key results derived from surveys conducted during the Europe Middle East & Africa Organic Baby Food Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Market Segmentation

- Assumptions

- Preface

- Executive Summary

- Impact of COVID-19 on Europe Middle East & Africa (EMEA) Organic Baby Food Market

- Europe Middle East & Africa (EMEA) Organic Baby Foods: Start-Up Ecosystem

- Series of Funding

- Key Expansion Plans

- Operational Geography

- Others

- Europe Middle East & Africa (EMEA) Organic Baby Food Market Trends & Insights

- Europe Middle East & Africa (EMEA) Organic Baby Food Market Dynamics

- Drivers

- Challenges

- Europe Middle East & Africa (EMEA) Organic Baby Food Market Regulations & Policies

- Europe Middle East & Africa (EMEA) Organic Baby Food Market Value Chain Analysis

- Europe Middle East & Africa (EMEA) Organic Baby Food Market Hotspots & Opportunities

- Europe Middle East & Africa (EMEA) Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Milk Formula

- Prepared Baby Food

- Dried Baby Food

- By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Store

- Online Retail Stores

- Other Distribution Channels

- By Ingredients

- Grain & Cereals

- Dairy

- Vegetables

- Fruits

- Others

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Russia

- Turkey

- Egypt

- Saudi Arabia

- The UAE

- Israel

- South Africa

- Rest of Europe Middle East & Africa

- By Company

- Competition Characteristics

- Market Share of Leading Companies, By Revenues

- By Type

- Market Size & Analysis

- Germany Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- The UK Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- France Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- Italy Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- Spain Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- Russia Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- Turkey Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- Egypt Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- Saudi Arabia Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- The UAE Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- Israel Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- South Africa Organic Baby Food Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Distribution Channel

- Market Size & Analysis

- Europe Middle East & Africa (EMEA) Organic Baby Food Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Competition Matrix

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Competition Matrix

- Company Profiles

- Abbott Laboratories

- Danone S.A.

- Nestlé S.A.

- Hero Group

- The Kraft Heinz Company

- Amara Organics

- Plum Organics

- The Hain Celestial Group, Inc.

- Baby Gourmet Food Inc.

- Hipp GmbH & Co. Vertrieb KG

- Blendina

- Organix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making