Global Electrophysiology Market Research Report: Forecast (2023-2028)

By Product (Electrophysiology Laboratory Devices (3D Mapping Systems, Electrophysiology Recording System, Radio Frequency (RF) Ablation Systems, Intracardiac Echocardiography (ICE)... Ultrasound Imaging Systems, Electrophysiology X-Ray Systems, Electrophysiology Remote Magnetic and Robotic Navigation Systems), Electrophysiology Ablation Catheters (Cryoablation Electrophysiology Catheters, Radiofrequency (RF) Ablation Catheters, Microwave Ablation (MWA) Systems, Laser Ablation Systems), Electrophysiology Diagnostic Catheters (Conventional Electrophysiology Diagnostic Catheters, Advanced Electrophysiology Diagnostic Catheters, Ultrasound Electrophysiology Diagnostic Catheters), Access Devices, Other Products), By Indication Type (Atrial Fibrillation, Atrial Flutter, Atrioventricular Nodal Reentry Tachycardia (AVNRT), Wolff-Parkinson-White Syndrome (WPW), Other Indications), By End User (Hospitals & Cardiac Centers, Ambulatory Surgery Centers), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Company (Abbott, Medtronic, Boston Scientific Corporation, Koninklijke Philips N.V., General Electric Company, Siemens Healthineers International AG, Stereotaxis Inc, Merit Medical Systems, APN Health LLC, Osypka Medical, Japan Lifeline Co Ltd, Johnson & Johnson, Biotronik, Microport Scientific Corporation, Cathrx Ltd., Others (Cook Medical, Teleflex Incorporated, etc.)) Read more

- Healthcare

- Aug 2023

- Pages 189

- Report Format: PDF, Excel, PPT

Market Definition

Electrophysiology is the branch of physiology, primarily concerned with the electrical properties of biological cells and tissues. It involves measurements of voltage changes or electric current or manipulations on a wide variety of scales from single ion channel proteins to whole organs like the heart.

Market Insights & Analysis: Global Electrophysiology Market (2023-28)

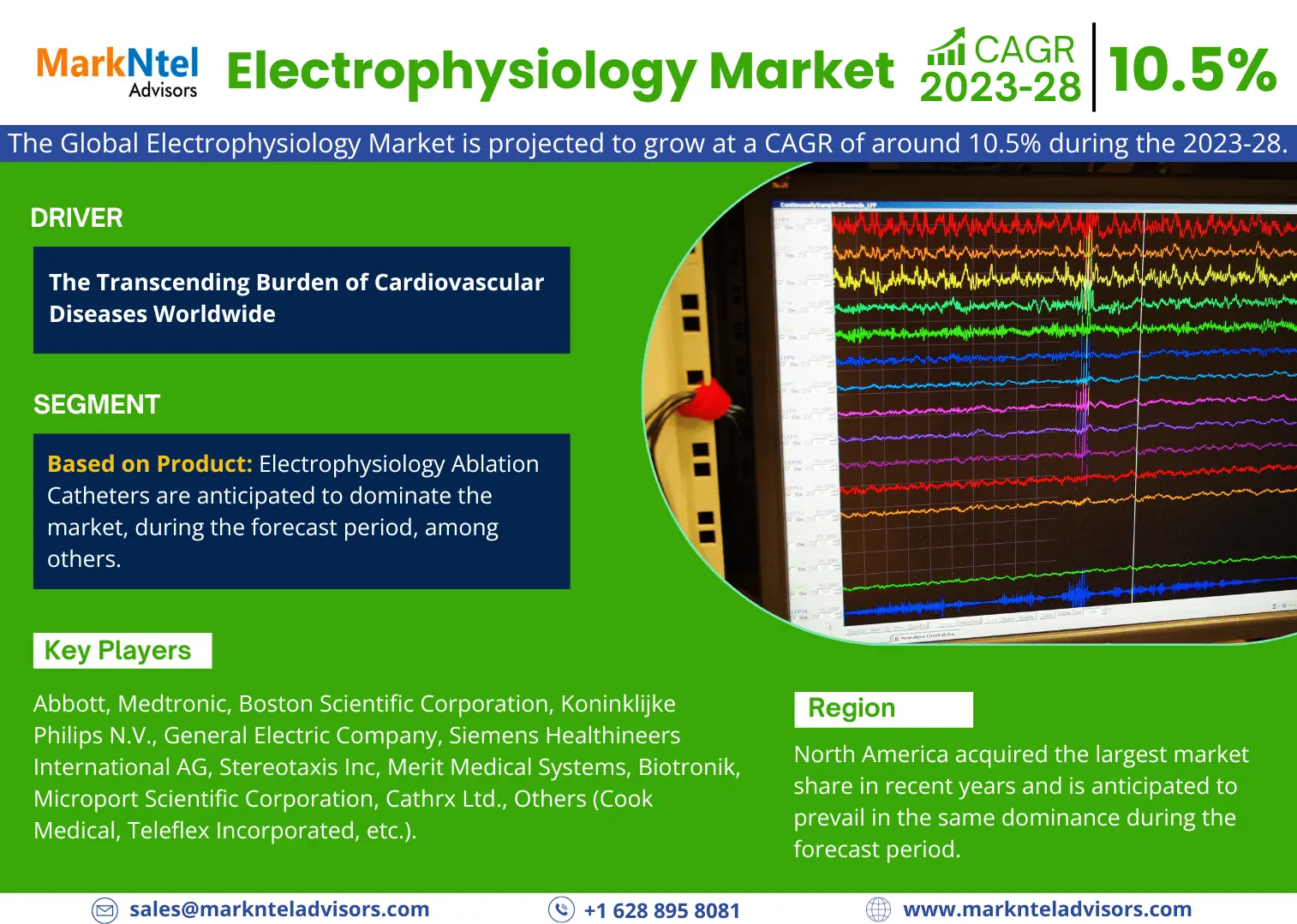

The Global Electrophysiology Market is projected to grow at a CAGR of around 10.5% during the forecast period, i.e., 2023-28. The market is largely driven by the intensifying burden of cardiac arrhythmias worldwide. The emerging need for high precision and controlled cardiac diagnostic and ablation procedures paired with conducive reimbursement policies is observed to be a solid booster to the adoption of minimally invasive electrophysiology therapies. Atrial Fibrillation, Atrial Flutter, Wolff-Parkinson-White (WPW), Ventricular Tachycardia, And Atrioventricular Nodal Reentry Tachycardia all have rising prevalence and incidence rates. Besides, in order to facilitate better sterility, safety, and affordability, the key market players have switched to disposable catheters for intermittent cardiac procedures, making the demand for disposable catheters skyrocket in the coming years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 10.5% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina | |

| Middle East & Africa: The UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | Abbott, Medtronic, Boston Scientific Corporation, Koninklijke Philips N.V., General Electric Company, Siemens Healthineers International AG, Stereotaxis Inc, Merit Medical Systems, APN Health LLC, Osypka Medical, Japan Lifeline Co Ltd, Johnson & Johnson, Biotronik, Microport Scientific Corporation, Cathrx Ltd., Others (Cook Medical, Teleflex Incorporated, etc.). |

| Unit Denominations | USD Million/Billion |

Moreover, the integration of telemedicine with electrophysiology catheters and devices has smoothly eliminated the need for a visit to hospitals and clinics for electrophysiology monitoring. The incorporation of robust and innovative technologies in electrophysiology devices provides the required impetus to the augmenting demand for safer, affordable, and minimally invasive diagnosis and therapies of cardiac arrhythmias. Besides, the next-generation technologies of advanced cardiac mapping, telerobotics, and remote and real-time monitoring, are likely to influence the market dynamics for electrophysiology devices, therapies, and procedures.

Global Electrophysiology Market (2023-28): Segmentation Analysis

The Global Electrophysiology Market study from MarkNtel Advisors analyses the major trends in each sub-segment and includes predictions for the period 2023–2028 at the global, regional, and national levels. The market has been segmented in our analysis based on product.

Based on Product,

- Electrophysiology Laboratory Devices

- 3D Mapping Systems

- Electrophysiology Recording System

- Radio Frequency (RF) Ablation Systems

- Intracardiac Echocardiography (ICE) Ultrasound Imaging Systems

- Electrophysiology X-Ray Systems

- Electrophysiology Remote Magnetic and Robotic Navigation Systems

- Electrophysiology Ablation Catheters

- Cryoablation Electrophysiology Catheters

- Radiofrequency (RF) Ablation Catheters

- Microwave Ablation (MWA) Systems

- Laser Ablation Systems

- Electrophysiology Diagnostic Catheters

- Conventional Electrophysiology Diagnostic Catheters

- Advanced Electrophysiology Diagnostic Catheters

- Ultrasound Electrophysiology Diagnostic Catheters

- Access Devices

- Other Products

Here, Electrophysiology Ablation Catheters are anticipated to dominate the market, during the forecast period, among others. With radiofrequency ablation, and cryoablation acquiring prominent shares, ablation catheters are likely to gain traction in the coming years, owing to associated technological improvements. A catheter is a small tube inserted into the blood artery, and catheter ablation is a type of heart ablation therapy used to treat irregular heart rhythms. Ablation, a minimally invasive process that uses catheters to destroy the heart's damaged electrical circuits, is the basis for how ablation catheters function. It is basically a procedure that restores the functionality of your heart by carefully removing any abnormal tissue. With the aid of ablation catheters, abnormal heart tissues that could cause erratic heartbeats, can be regulated. Thus, these aspects continue to account for accelerating demand for Ablation Catheters, encouraging market expansion in the projected time frame. For instance,

- In February 2022, Medtronic announced that FDA expanded approval for the Freezor Xtra Cardiac Cryoablation Focal Catheters, the first and only ablation catheters that received approval to treat pediatric Atrioventricular Nodal Reentrant Tachycardia (AVNRT) patients.

Global Electrophysiology Market Regional Projection

Geographically, the Global Electrophysiology Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Here, North America acquired the largest market share in recent years and is anticipated to prevail in the same dominance during the forecast period. It owes principally to the massive investments by the governments of different countries in the region in the healthcare sector, including the electrophysiology units, and conducting numerous research & development activities to bring innovations in the diagnosis, treatment, and care of heart patients. According to CDC, Heart disease is the leading cause of death for men, women, and people of most racial and ethnic groups in the United States. In fact, every 34 seconds, one person succumbs to cardiovascular disease here. The key factors backing such alarming condition is the high blood pressure, high blood cholesterol, and smoking. The data clearly hints at the immediate need to address the crisis with effective treatment techniques and procedures, thereby generating growth opportunities for the leading players to increase their offerings and cater to the burgeoning requirements. Furthermore, exhibiting large-scale investment to develop patient-oriented electrophysiology systems, the region is all set to have an advanced healthcare infrastructure in the future and hints toward a lucrative outlook for the market. For instance,

- In January 2022, Abbott received approval from the United States Food and Drug Administration for the EnSite X EP System with EnSite Omnipolar Technology (OT), a new cardiac mapping platform available in the U.S. and across Europe, intended to treat cardiac arrhythmias.

Regulatory Landscape in the Global Electrophysiology Market

The U.S.A

- The policies governing reimbursement span a wide spectrum of electrophysiological devices. Hospital outpatient, extensive electrophysiological testing, catheter ablation, intracardiac echo / transeptal access (add-on services), esophageal recording, and induction of arrhythmia are frequently covered by a reimbursement system.

- The standard healthcare system has fostered the electrophysiology industry making it more accessible to the public. For instance, the U.S. enforced the Affordable Care Act making healthcare facilities accessible to around 40 million uninsured U.S. citizens.

Global Electrophysiology Market Recent Developments

- In May 2022, CathVision declared that ECGenius EP Recording System, a new high-fidelity and low-noise solution, has been given FDA approval. The device successfully diagnosed and treated complex atrial arrhythmias during tests.

- In March 2022, The National Institute of Cardiology in Warsaw, Poland, used Stereotaxis to launch a robotic electrophysiology course. The program's goal is to teach doctors how to treat arrhythmias using the Genesis Robotic Magnetic Navigation System.

- In January 2022, a deal was made for Medtronic PLC to buy the majority of Affera, Inc. The company produces equipment that aids in the treatment of cardiac arrhythmia. The acquisition, which aims to increase Medtronic's market share in the electrophysiology sector, shall be finalized by the first quarter of 2023.

Global Electrophysiology Market Key Driver:

The Transcending Burden of Cardiovascular Diseases Worldwide - An alarming rise in the number of cardiac arrhythmias has compelled innovations in the manufacturing of electrophysiology devices. According to WHO, around 17.9 million people succumb to Cardiovascular diseases (CVDs) every year, accounting for 32% of total deaths worldwide. Out of 5, four CVD deaths are due to strokes and heart attacks, with one-third of these deaths occurring in people under 70. Likewise, as per Canadian government health statistics, one out of twelve Canadians lives with heart disease. Backed by behavioral risk factors such as unhealthy diet, physical inactivity, and excess alcohol and tobacco consumption, the patient pool is expected to surge in the coming years, presenting the need for more effective electrophysiology devices. As a result, the market is expected to enthrall in the coming years.

Do You Need Further Assistance?

- The sample report seeks to acquaint you with the layout and the overall research content.

- The deliberate utilization of the report may further streamline operations while maximizing your revenue.

- To gain an unmatched competitive advantage in your industry, you can customize the report by adding more segments and specific countries suiting your needs.

- For a better understanding of the contemporary market scenario, feel free to connect to our knowledgeable analysts.

Frequently Asked Questions

Global Electrophysiology Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Electrophysiology Market Regulations & Policies

- Global Electrophysiology Market Trends & Insights

- Global Electrophysiology Market Dynamics

- Growth Drivers

- Challenges

- Global Electrophysiology Market Hotspot & Opportunities

- Global Electrophysiology Market Outlook, 2018- 2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- Electrophysiology Laboratory Devices

- 3D Mapping Systems

- Electrophysiology Recording System

- Radio Frequency (RF) Ablation Systems

- Intracardiac Echocardiography (ICE) Ultrasound Imaging Systems

- Electrophysiology X-Ray Systems

- Electrophysiology Remote Magnetic and Robotic Navigation Systems

- Electrophysiology Ablation Catheters

- Cryoablation Electrophysiology Catheters

- Radiofrequency (RF) Ablation Catheters

- Microwave Ablation (MWA) Systems

- Laser Ablation Systems

- Electrophysiology Diagnostic Catheters

- Conventional Electrophysiology Diagnostic Catheters

- Advanced Electrophysiology Diagnostic Catheters

- Ultrasound Electrophysiology Diagnostic Catheters

- Access Devices

- Other Products

- Electrophysiology Laboratory Devices

- By Indication Type

- Atrial Fibrillation

- Atrial Flutter

- Atrioventricular Nodal Reentry Tachycardia (AVNRT)

- Wolff-Parkinson-White Syndrome (WPW)

- Other Indications

- By End User

- Hospitals & Cardiac Centers

- Ambulatory Surgery Centers

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Revenue Shares

- By Product

- Market Size & Analysis

- North America Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- By End User

- By Country

- The US

- Canada

- Mexico

- The US Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Canada Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Mexico Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Market Size & Analysis

- South America Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- By End User

- By Country

- Brazil

- Argentina

- Brazil Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Argentina Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Market Size & Analysis

- Europe Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- By End User

- By Country

- The UK

- Italy

- Germany

- France

- Spain

- Others

- The UK Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Italy Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Germany Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- France Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Spain Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- By End User

- By Country

- Saudi Arabia

- The UAE

- South Africa

- Rest of the Middle East & Africa

- Saudi Arabia Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- The UAE Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- South Africa Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- By End User

- By Country

- China

- Japan

- India

- Australia

- Others

- China Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Japan Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- India Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Australia Electrophysiology Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- By Indication Type

- Market Size & Analysis

- Market Size & Analysis

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Solutions Offered, Business Segments, Financials, Future Plans)

- Abbott

- Medtronic

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- General Electric Company

- Siemens Healthineers International AG

- Stereotaxis Inc

- Merit Medical Systems

- APN Health LLC

- Osypka Medical

- Japan Lifeline Co Ltd

- Johnson & Johnson

- Biotronik

- Microport Scientific Corporation

- Cathrx Ltd.

- Others (Cook Medical, Teleflex Incorporated, etc.)

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making