China Laboratory Informatics Market Research Report: Forecast (2024-2030)

China Laboratory Informatics Market Report - By Product Type (Electronic Lab Notebooks (ELNs), Laboratory Information Management Systems (LIMS), Chromatography Data Systems (CDS), ...Electronic Data Capture (EDC), Enterprise Content Management Systems (ECM), Others (Scientific Data Management Systems (SDMS), Laboratory Execution Systems (LES), Clinical Data Management Systems (CDMS), etc.)), By Components (Service, Software), By End User (Life Sciences Industry, [Pharma & Biotechnology, Biobanks & Bio Repositories, Molecular Diagnostics & Clinical Research Labs, Others (Contract Service Organisation, Academic Research Institutes, etc.)], Chemical Industry, Food & Beverage, Agriculture, Others (Petrochemical Refinery, Oil & Gas Industry, Environment Testing Laboratories, etc.)), By Deployment Model (Remote Hosting, On-Premise Model, Cloud-based Model), and Others Read more

- Healthcare

- Jun 2024

- Pages 121

- Report Format: PDF, Excel, PPT

Market Definition

Laboratory informatics is the use of advanced software & technology for the collection of data in laboratory settings, which can then be analyzed to formulate the results. The use of laboratory informatics across laboratories of healthcare, chemical, food & beverage, etc., would allow the researchers to easily collate & analyze the data & predict results.

Market Insights & Analysis: China Laboratory Informatics Market (2024-30):

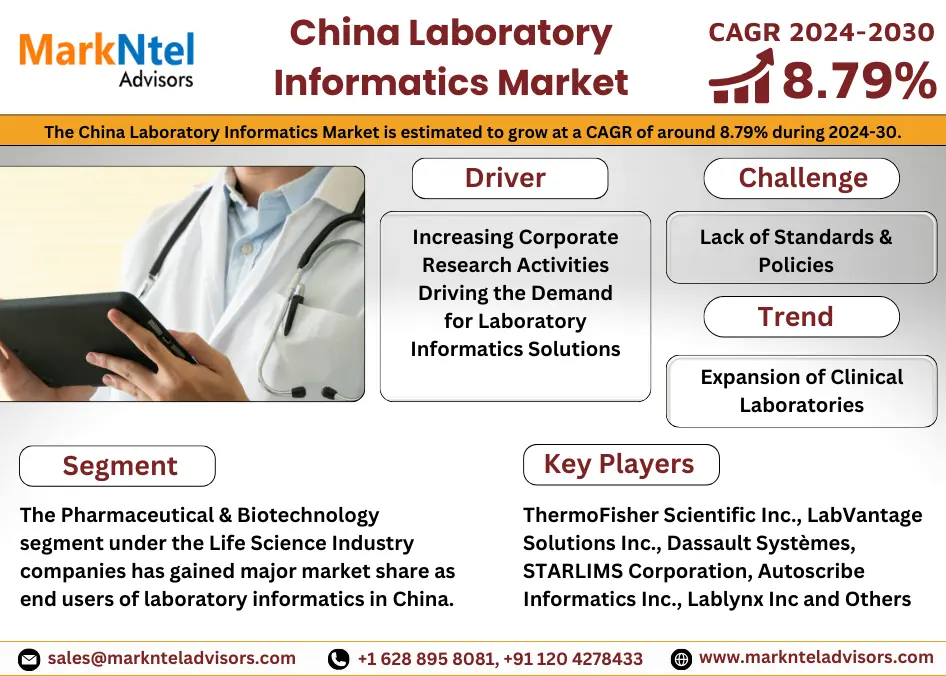

The China Laboratory Informatics Market is estimated to grow at a CAGR of around 8.79% during the forecast period, i.e., 2024-30. The major factors responsible for this market growth included the expansion of research laboratories across China and increasing R&D investments in the country. In recent years, the country has been largely facing geopolitical tensions, which have been impacting its economic growth. Hence, observing these impacts on economic growth, the government of China has initiated aligning its spending toward research & development, to become a technological powerhouse across the globe.

Science & technology investment has amplified, specifically in Beijing, as its government has been excessively announcing investments for R&D purposes to transform its economic growth. This increase in R&D activities in science & technology laboratories has also accelerated the demand for laboratory informatics in the country, as they have been observed to excessively reduce data interpretation time during research. Thus, it also helped in expanding the market growth of laboratory informatics in China during the historical years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 8.79% |

| Region Covered | North, East, South Central, South West, North West, North East |

| Key Companies Profiled | ThermoFisher Scientific Inc., LabVantage Solutions Inc., Dassault Systèmes, STARLIMS Corporation, Autoscribe Informatics Inc., Lablynx Inc., Waters Corporation, Zifo Technologies Pvt. Ltd., Caliber Technologies, Agilent Technologies, and Others |

| USD Denominations | USD Million/Billion |

Moreover, the country has also been focusing on modernizing its industrial sector through the use of advanced technology to boost manufacturing capabilities. This has been further driving the investment in research activities for industrial sectors to pool the resources that would be required for research activities, and also for manpower required. Therefore, as industrial research activities have been boosted, the demand for laboratory informatics solutions has also accelerated. This was primarily because the industrial research process requires the development of critical pathways & instruments, which need excessive calculation & analysis.

Furthermore, the food & beverages (F&B) sector is another major end-user of laboratory informatics solutions across China. As the Chinese government has been focusing on becoming self-sufficient in terms of technology, companies in the food sector have been focusing on investing in R&D activities to enhance their production processes. Also, the F&B sector is expanding across the country with the introduction of several startups in the convenience food segment. As the number of companies would increase, the demand for research laboratories for food & beverages would also grow for testing purposes to launch new products in the market. Hence, this would further help in the market growth of laboratory informatics services in the forecast years.

China Laboratory Informatics Market Driver:

Increasing Corporate Research Activities Driving the Demand for Laboratory Informatics Solutions – China has been one of the top countries spending the maximum amount of budget on research & development activities. This go-ahead approach of the government towards becoming a technological hub has also encouraged the corporate sector to invest actively in R&D activities. Moreover, the corporate sector in China has also received government support in the form of incentives on taxes and subsidies to encourage investing in R&D activities. Further, the government is also supporting the corporate sector through indirect funding and high-tech research infrastructure provision. Therefore, a hefty amount of R&D funding has been made in recent times by corporate companies as they focus on developing products based on native technology. For instance:

- In 2023, the World Intellectual Property Organization has expressed that the corporate companies of China have invested a collective of about USD 237.9 billion in R&D in 2022. The main companies participating in the investment were Huawei & Tencent, among about 679 firms.

Hence, as corporate R&D expenditure has increased, the demand for laboratory informatics services has also amplified. This, in turn, has been increasing corporate R&D expenditure which has emerged as a major market driver for Laboratory Informatics Companies in China.

China Laboratory Informatics Market Challenge:

Lack of Standards & Policies – In China, laboratory informatics software has not been well regulated and also lacks standards & policies related to them, which has emerged as a major market challenge. This has been primarily, because of the lack of regulations has been affecting the credibility of laboratory informatics solutions. As laboratory informatics solutions have been used across R&D facilities, any data breach might affect the entire research process of the end-user organizations.

Also, as these solutions are not well regulated, installation of unprotected solutions might also result in cyberattacks on the end user organizations, and the provider would not be held responsible. Hence, the fear of data breaches and cyber-attacks, coupled with the lack of regulatory environment has been hampering the adoption of laboratory informatics services. Consequently, this challenge has affected the growth of the market for laboratory informatics.

China Laboratory Informatics Market Trend:

Expansion of Clinical Laboratories – Clinical laboratories have been expanding in China over the past few years, which has become a huge emerging market trend. The demand for clinical laboratories has increased as pharmaceutical manufacturers are speeding up the processes of developing new drugs, vaccines, and biologics across the country. This is mainly due to the large number of tests, such as viral vector testing and bioanalytical testing, which have been required during clinical trials and the development of new drugs. Hence, to cater to this emerging market trend, wherein the demand for clinical testing solutions is growing, several companies have been expanding their coverage of clinical testing laboratories across the country.

Hence, as clinical laboratories have been expanding, it has helped drive the market for laboratory informatics in China. Also, as the country is largely focusing on research & development activities in the life sciences sector, this would further emerge as a new market trend and would drive the need for laboratory informatics services in the coming years as well.

China Laboratory Informatics Market (2024-30): Segmentation Analysis

The China Laboratory Informatics Market study by MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024-2030 at the country level. As per the analysis, the market has been further classified as:

Based on Product Type:

- Electronic Lab Notebooks (ELNs)

- Laboratory Information Management Systems (LIMS)

- Chromatography Data Systems (CDS)

- Electronic Data Capture (EDC)

- Enterprise Content Management Systems (ECM)

- Others (Scientific Data Management Systems (SDMS), Laboratory Execution Systems (LES), Clinical Data Management Systems (CDMS), etc.)

Laboratory Information Management Systems have dominated the Laboratory Informatics Market as they can be effectively integrated with laboratory instruments. In this way, it enables organizations to automate lab workflows and hence has been largely preferred by them. Other added advantages of LIMS software are the capacity for tracking & managing samples in the laboratories, all of which further help a laboratory to ease its management process, as such, the software adoption in China is increasing.

In the last few years, China has also been seeing a rise in the number of agricultural research projects forwarded to boost agriculture production activities within the country. In addition to this, the sector has been in the process of developing post-harvest freshness technology for their agricultural produce, which would help the products maintain their freshness for the longer run. Therefore, with enhanced research & activities in agriculture, these organizations are projected to adopt LIMS solutions to ease their research process in the upcoming years.

Based on End User:

- Life Sciences Industry

- Pharma & Biotechnology

- Biobanks & Bio Repositories

- Molecular Diagnostics & Clinical Research Labs

- Others (Contract Service Organizations, Academic Research Institutes, etc.)

- Chemical Industry

- Food & Beverage

- Agriculture

- Others (Petrochemical Refinery, Oil & Gas Industry, Environment Testing Laboratories, etc.)

The Pharmaceutical & Biotechnology segment under the Life Science Industry companies has gained major market share as end users of laboratory informatics in China. These companies actively pursue research & development activities in their organization for the expansion of new & more effective pharmaceutical products. Also, they actively integrate laboratory informatics technology into their research workflow as it helps in excessively simplifying the process of research activities.

Furthermore, observing the high level of cost-effectiveness in both production & logistics has been attracting multinational pharmaceuticals and biotechnology companies to escalate their investment in China. Also, the extensively advanced research infrastructure of the country attracts big players to invest in R&D activities. Hence, as more companies expand across the country, and invest in R&D activities, the demand for laboratory facilities is expected to grow further in the coming years.

China Laboratory Informatics Industry Recent Development:

- 2023: STARLIMS Corporation announced the successful integration of STARLIM solutions in the Taide Pharmaceutical laboratory, which would allow the automation process, and help in the digital management of upstream & downstream inspection processes.

- 2023: Agilent Technologies launched several laboratory software solutions and services at the 11th Munich Shanghai Analytical and Biochemical Exhibition. It also introduced a new Agilent MassHunter software suite, which would help in the analytical testing of laboratories using GC/MS.

Gain a Competitive Edge with Our China Laboratory Informatics Market Report

- China Laboratory Informatics Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- China Laboratory Informatics Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumptions

- Executive Summary

- China Laboratory Informatics Market Pricing Analysis

- China Laboratory Informatics Market Trends & Developments

- China Laboratory Informatics Market Dynamics

- Growth Drivers

- Challenges

- China Laboratory Informatics Market Hotspots & Opportunities

- China Laboratory Informatics Market Policies & Regulations

- China Laboratory Informatics Market Analysis, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type

- Electronic Lab Notebooks (ELNs)- Market Size & Forecast 2019-2030F, (USD Million)

- Laboratory Information Management Systems (LIMS)- Market Size & Forecast 2019-2030F, (USD Million)

- Chromatography Data Systems (CDS)- Market Size & Forecast 2019-2030F, (USD Million)

- Electronic Data Capture (EDC)- Market Size & Forecast 2019-2030F, (USD Million)

- Enterprise Content Management Systems (ECM)- Market Size & Forecast 2019-2030F, (USD Million)

- Others (Scientific Data Management Systems (SDMS), Laboratory Execution Systems (LES), Clinical Data Management Systems (CDMS), etc.)- Market Size & Forecast 2019-2030F, (USD Million)

- By Components

- Service- Market Size & Forecast 2019-2030F, (USD Million)

- Software- Market Size & Forecast 2019-2030F, (USD Million)

- By End User

- Life Sciences Industry- Market Size & Forecast 2019-2030F, (USD Million)

- Pharma & Biotechnology- Market Size & Forecast 2019-2030F, (USD Million)

- Biobanks & Bio Repositories- Market Size & Forecast 2019-2030F, (USD Million)

- Molecular Diagnostics & Clinical Research Labs- Market Size & Forecast 2019-2030F, (USD Million)

- Others (Contract Service Organisation, Academic Research Institutes, etc.)- Market Size & Forecast 2019-2030F, (USD Million)

- Chemical Industry- Market Size & Forecast 2019-2030F, (USD Million)

- Food & Beverage- Market Size & Forecast 2019-2030F, (USD Million)

- Agriculture - Market Size & Forecast 2019-2030F, (USD Million)

- Others (Petrochemical Refinery, Oil & Gas Industry, Environment Testing Laboratories, etc.) - Market Size & Forecast 2019-2030F, (USD Million)

- Life Sciences Industry- Market Size & Forecast 2019-2030F, (USD Million)

- By Deployment Model

- Remote Hosting- Market Size & Forecast 2019-2030F, (USD Million)

- On-Premise Model- Market Size & Forecast 2019-2030F, (USD Million)

- Cloud-based Model- Market Size & Forecast 2019-2030F, (USD Million)

- By Region

- North

- East

- South Central

- South West

- North West

- North East

- By Company

- Market Share & Analysis

- Competition Characteristics

- By Product Type

- Market Size & Analysis

- China Electronic Lab Notebooks (ELNs) Market Analysis, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type

- Cross-Disciplinary- Market Size & Forecast 2019-2030, (USD Million)

- Specific- Market Size & Forecast 2019-2030, (USD Million)

- By Components- Market Size & Forecast 2019-2030, (USD Million)

- By Industry- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Model- Market Size & Forecast 2019-2030, (USD Million)

- By Product Type

- Market Size & Analysis

- China Laboratory Information Management Systems (LIMS) Market Analysis, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type

- Multi-Purpose- Market Size & Forecast 2019-2030, (USD Million)

- Purpose-Built- Market Size & Forecast 2019-2030, (USD Million)

- By Components- Market Size & Forecast 2019-2030, (USD Million)

- By Industry- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Model- Market Size & Forecast 2019-2030, (USD Million)

- By Product Type

- Market Size & Analysis

- China Chromatography Data Systems (CDS) Market Analysis, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type

- Standalone Software- Market Size & Forecast 2019-2030, (USD Million)

- Integrated Software- Market Size & Forecast 2019-2030, (USD Million)

- By Components- Market Size & Forecast 2019-2030, (USD Million)

- By Industry- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Model- Market Size & Forecast 2019-2030, (USD Million)

- By Product Type

- Market Size & Analysis

- China Electronic Data Capture (EDC) Systems Market Analysis, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Clinical Trial Phase

- Phase I- Market Size & Forecast 2019-2030, (USD Million)

- Phase II- Market Size & Forecast 2019-2030, (USD Million)

- Phase III- Market Size & Forecast 2019-2030, (USD Million)

- Phase IV- Market Size & Forecast 2019-2030, (USD Million)

- By Components- Market Size & Forecast 2019-2030, (USD Million)

- By Industry- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Model- Market Size & Forecast 2019-2030, (USD Million)

- By Clinical Trial Phase

- Market Size & Analysis

- China Enterprise Content Management Systems (ECM) Market Analysis, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type

- Document Management - Market Size & Forecast 2019-2030, (USD Million)

- Web Content Management - Market Size & Forecast 2019-2030, (USD Million)

- Digital Asset Management - Market Size & Forecast 2019-2030, (USD Million)

- eDiscovery- Market Size & Forecast 2019-2030, (USD Million)

- Others (Record Management, Case Management, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- By Components- Market Size & Forecast 2019-2030, (USD Million)

- By Industry- Market Size & Forecast 2019-2030, (USD Million)

- By Deployment Model- Market Size & Forecast 2019-2030, (USD Million)

- By Product Type

- Market Size & Analysis

- China Laboratory Informatics Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Thermo Fisher Scientific Inc.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- LabVantage Solutions Inc.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dassault Systèmes

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- STARLIMS Corporation

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Autoscribe Informatics Inc.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lablynx Inc.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Waters Corporation

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Zifo Technologies Pvt. Ltd.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Caliber Technologies

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Agilent Technologies

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Thermo Fisher Scientific Inc.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making