India Catalysts Market Research Report: Forecast (2025-2030)

India Catalysts Market - By Type (Heterogeneous, Homogeneous), By Process (Recycling, Regeneration, Rejuvenation), By End-User (Petrochemicals & Refining, Chemicals, Automotive, Ph...armaceuticals, Others), and others Read more

- Chemicals

- Sep 2025

- Pages 130

- Report Format: PDF, Excel, PPT

India Catalysts Market

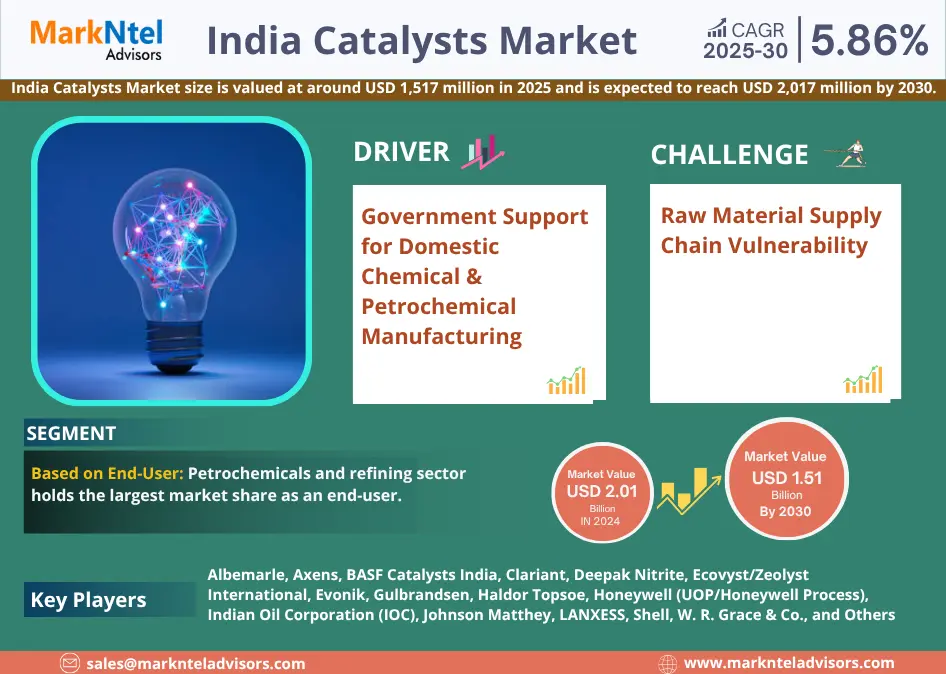

Projected 5.86% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2025)

USD 1.51 Billion

Market Size (2030)

USD 2.01 Billion

Base Year

2024

Projected CAGR

5.86%

Leading Segments

By Type: Heterogeneous

Market Insights & Analysis: India Catalysts Market (2025-30):

The India Catalysts Market size is valued at around USD 1,517 million in 2025 and is expected to reach USD 2,017 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.86% during the forecast period, i.e., 2025-30. The market growth is driven by several factors, which include the expanding chemicals and petrochemicals sector of the country. For instance, as per government statistics, the production, installed capacity, and exports of petrochemicals have been steadily growing year over year, and as the operations continue to grow, it is driving the demand for catalysts that improve yield, selectivity, and process efficiency.

Moreover, the market growth is driven by policy initiatives aimed at promoting domestic production to reduce the country’s dependency on imports. For instance, the government’s Make in India and Production-Linked Incentive (PLI) schemes incentivize local manufacturing and chemical processing. Similarly, there is a large support for investments in manufacturing, infrastructure development, and regulatory streamlining in the country. These policies are driving the local adoption of advanced catalysts and are creating opportunities for the local players in the country.

Furthermore, there is an increasing push for sustainability and green chemistry in the chemical sector of the country, as exhibited by the Department of Chemicals and Petrochemicals explicitly advocating the use of catalysts rather than stoichiometric reagents to minimize waste. This, in addition to the rising global environmental, social, and governance (ESG) pressures, is increasing the demand for catalysts that are durable, regenerative, less toxic, and bio- or nano-based. Therefore, these factors are augmenting the size & volume of the Indian Catalysts Industry.

India Catalysts Market Scope:

| Category | Segments |

|---|---|

| By Type | Heterogeneous, Homogeneous |

| By Process | Recycling, Regeneration, Rejuvenation |

| By End-User | Petrochemicals & Refining, Chemicals, Automotive, Pharmaceuticals, Others), and others |

India Catalysts Market Driver:

Government Support for Domestic Chemical & Petrochemical Manufacturing – The market growth is primarily driven by the support for domestic chemical and petrochemical manufacturing via the Production Linked Incentives (PLI) schemes, which are expanding the capacity and adoption of efficient catalyst technologies as PLI schemes tie financial rewards to output. For instance, the government’s PLI expansion across 14 strategic sectors has already committed USD19.84 billion in investments to increase the manufacturing output, export potential, and upstream demand for chemical inputs. This is reducing the dependency on imports and benefiting local players from preferential treatment, lower duties, or subsidies, thereby making local catalyst production more competitive.

Moreover, the lower import barriers for certain chemical feedstocks are reducing costs for both catalyst producers and end users, thereby driving the market growth. This also includes the development of petrochemical investment regions, plastic parks, ports, and roads in the country. For instance, the domestic demand is increasing across downstream sectors such as automotive, pharmaceuticals, and specialty chemicals, thereby driving the need for catalysts that improve efficiency and lower emissions. Therefore, this is driving the size & volume of the Catalysts Industry in India.

India Catalysts Market Opportunity:

Increasing Demand for Catalysts in Green Systems – There is growing demand for catalysts in green hydrogen and electrolyzer systems, alongside the country seeking to produce 5 million metric tons of green hydrogen annually by 2030 under the National Green Hydrogen Mission. This is driving investments in hydrogen generation and components for making it viable, which include electrolyzers and catalysts used for water splitting and related reactions. Similarly, the Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme provides incentives for manufacturing electrolyzers, thereby driving the demand for catalysts that are compatible with electrochemical systems.

Moreover, the reduction in the total cost of green hydrogen due to declining renewable electricity costs and improving grid integration in the country is making projects financially feasible. This is increasing the demand for catalysts that can operate under variable load conditions or intermittent power supply, thereby creating opportunities for players who can supply catalysts optimized for electrolyzers, green hydrogen production, both domestically and internationally.

India Catalysts Market Challenge:

Raw Material Supply Chain Vulnerability – The country’s raw material supply chain is vulnerable to global factors, as it imports important feedstocks such as platinum group metals, ceria/zirconia washcoat materials, and rare earth oxides from global suppliers. This is due to the underdeveloped domestic mining, refining, and processing capabilities despite the country having large reserves of rare earth elements (REEs) in coastal sands and hard rock areas, thereby exposing players to price volatility, geopolitical risks, shipping delays, and foreign exchange fluctuations. Also, there are additional compliance costs and uncertainty due to recent policy changes, which include restrictions or revised duties on precious metal alloys such as palladium, rhodium, and complex gold-rich alloys.

Moreover, this is a challenge, particularly for small and new players in securing stable and cost-effective raw inputs, thereby facing a reduction in margins or instability in prices, and making market entrance or scaling up harder. Additionally, global risks can lead to domestic projects getting delayed or even redesigned if desired materials cannot be sourced or imported. Therefore, this is a barrier for the market players in cementing their market position.

India Catalysts Market Trend:

Increasing Deployment of Carbon Capture Utilization & Storage (CCUS) Technology – The market landscape is changing quickly due to the favorable policies and infrastructure for CCUS. This is due to coal being a large part of the country’s energy mix, for which the government is now offering incentives for CCUS technology deployment, in many cases covering up to 50-100% of project costs. This is making CCUS a financially viable route for emission-intensive industries. For instance, this government commitment to scaling up these technologies is exhibited by the country approving several testbeds, such as in the cement sector, to demonstrate CCU/CCUS pathways.

Moreover, carbon capture processes require specialized catalysts for the absorption, conversion, and reduction of carbon dioxide (CO₂), thereby driving the demand for advanced catalyst materials such as adsorbents, non-amine solvents, and metal oxide catalysts. Additionally, this is making way for manufacturers who align with CCUS-compatible catalyst R&D, thereby gaining access to policy incentives and emerging as suppliers in the market. Therefore, CCUS is helping the market gain traction in the country over the forecast period.

India Catalysts Market (2025-30): Segmentation Analysis

The India Catalysts Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Type:

- Heterogeneous

- Homogeneous

Out of these, the heterogeneous catalyst type holds the largest market share, and its lead is driven by the country’s expanding heavy industrial base, particularly in sectors such as petroleum & refining, petrochemicals, and fertilizer production. This lead is also attributed to heterogeneous catalysts’ ease of separation and recovery after reaction due to them being in a different phase from the reactants, thereby lowering operational costs in large-scale and continuous manufacturing processes and driving the country’s industrial output. For instance, solid zeolite catalysts in Fluid Catalytic Cracking (FCC) units are essential for Indian oil refineries to produce high-value fuels such as gasoline, which is a process overseen by bodies such as the Ministry of Petroleum & Natural Gas's Centre for High Technology. Similarly, the use of iron-based heterogeneous catalysts in the Haber-Bosch process is important for the synthesis of ammonia in the fertilizer industry and agricultural self-sufficiency. Therefore, these factors are cementing the leading position of heterogeneous catalysts in the market.

Based on End-User:

- Petrochemicals & Refining

- Chemicals

- Automotive

- Pharmaceuticals

- Others

Among these, the petrochemicals and refining sector holds the largest market share as an end-user. The dominance is due to the sector’s scale in the country and its role in boosting the national economy. For instance, India is ranked among the top five global importers and consumers of crude oil and has refineries that process over 250 million metric tonnes annually, thereby increasing the demand for catalysts such as zeolites, platinum-group metals, and hydrotreating formulations, in cracking, reforming, desulfurization, and emission-control processes to maximize the output.

Moreover, there is a high demand for plastics, textiles, and packaging, which is driving the growth of this sector and sustained investments in refining and downstream integration. For instance, the demand for catalysts is driven by the Government policies promoting petrochemical hubs such as Petroleum, Chemicals, and Petrochemicals Investment Regions (PCPIRs). Therefore, these factors are driving massive demand for Catalysts from the petrochemicals & refining sector and ultimately augmenting the size & volume of the industry.

India Catalysts Industry Recent Development:

- 2024: Johnson Matthey (JM), a global leader in sustainable technologies, announced the opening of its new Engineering Center in Mumbai. This new site confirms JM’s commitment to India as a partner for manufacturing and engineering. The center will tap into India’s engineering talent, increasing JM’s capacity to deliver projects for its customers across its core licensing business and new growth areas in hydrogen, sustainable fuels, and chemicals.

- 2024: BASF India Limited increased the production capacity of its Ultramid® polyamide (PA) and Ultradur® polybutylene terephthalate (PBT) compounding plant in Panoli, Gujarat, and Thane, Maharashtra. Its Polyurethane Technical Development Center India was inaugurated in Mumbai to support the market development of polyurethane applications in industries such as transportation, construction, footwear, appliances, and furniture.

Gain a Competitive Edge with Our India Catalysts Market Report

- India Catalysts Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Catalysts Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Catalysts Market Policies, Regulations, and Product Standards

- India Catalysts Market Supply Chain Analysis

- India Catalysts Market Trends & Developments

- India Catalysts Market Dynamics

- Growth Drivers

- Challenges

- India Catalysts Market Hotspot & Opportunities

- India Catalysts Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Type

- Heterogeneous – Market Size & Forecast 2020–2030, USD Million

- Homogeneous – Market Size & Forecast 2020–2030, USD Million

- By Process

- Recycling – Market Size & Forecast 2020–2030, USD Million

- Regeneration – Market Size & Forecast 2020–2030, USD Million

- Rejuvenation – Market Size & Forecast 2020–2030, USD Million

- By End-User

- Petrochemicals & Refining – Market Size & Forecast 2020–2030, USD Million

- Chemicals – Market Size & Forecast 2020–2030, USD Million

- Automotive – Market Size & Forecast 2020–2030, USD Million

- Pharmaceuticals – Market Size & Forecast 2020–2030, USD Million

- Others – Market Size & Forecast 2020–2030, USD Million

- By Region

- North

- East

- South

- West

- Central

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Type

- By Revenues (USD Million)

- Market Size & Outlook

- India Heterogeneous Catalysts Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Process – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- India Homogeneous Catalysts Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Process – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- India Catalysts Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Albemarle

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Axens

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BASF Catalysts India

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Clariant

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Deepak Nitrite

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ecovyst/Zeolyst International

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Evonik

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gulbrandsen

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Haldor Topsoe

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Honeywell (UOP/Honeywell Process)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Indian Oil Corporation (IOC)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Johnson Matthey

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- LANXESS

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Shell

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- W. R. Grace & Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Albemarle

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making