Global Blockchain-as-a-Service Market Research Report Forecast: (2025-2030)

Blockchain-as-a-Service Market - By Offering (Tools, Services), By Application (Supply Chain Management, Smart Contracts, Financial Payments, Others), By Organization Size (Small a...nd Medium Enterprise [SME], Large Enterprise), By End User (BFSI, IT & Telecom, Retail & Commerce, Transport & Logistics, Healthcare & Life Sciences, Automotive) and Others Read more

- ICT & Electronics

- Feb 2025

- Pages 187

- Report Format: PDF, Excel, PPT

Market Definition

A third-party cloud-based infrastructure and data management platform for businesses developing and running Blockchain applications is called Blockchain-as-a-Service. Creating their Blockchain technology rather than investing resources in building internal tools helps users save time and money while enabling high levels of transaction traceability.

Market Insights & Analysis: Global Blockchain-as-a-Service Market (2025-2030):

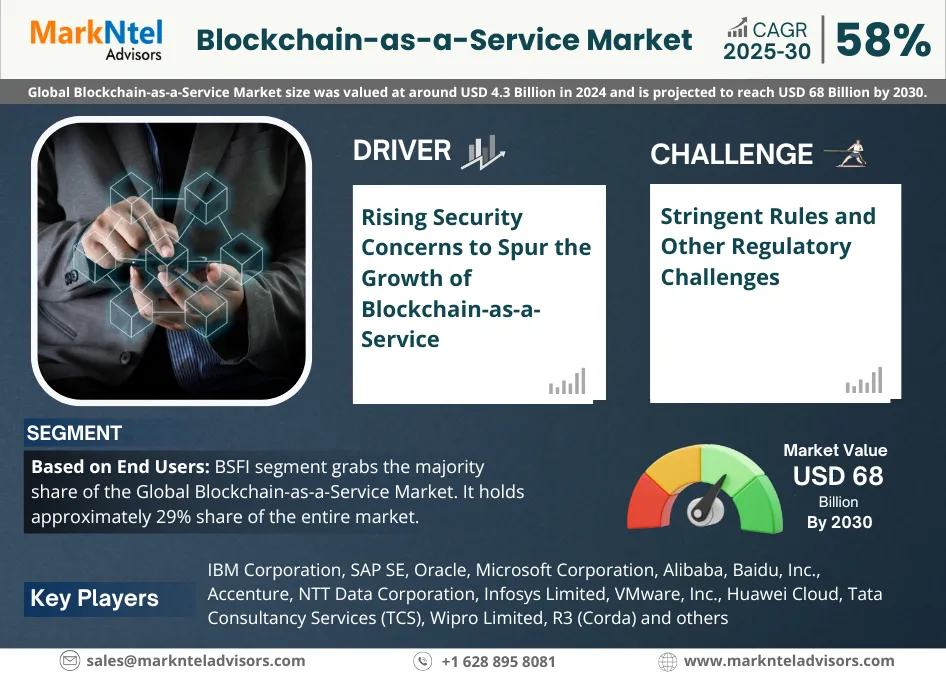

The Global Blockchain-as-a-Service Market size was valued at around USD 4.3 Billion in 2024 and is projected to reach USD 68 Billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 58% during the forecast period, i.e., 2025-30. Businesses can host, edit, and manage blockchain apps & smart contracts using cloud-based platforms with Blockchain-as-a-Service (BaaS) which provides a scalable and safe solution. Its ability to solve intricate business issues while preserving anonymity, immutability, transparency, and secure transactions is driving the market growth. Due to the growth of digital currencies like cryptocurrencies major industries like; BFSI, IT & telecom, and healthcare are increasingly utilizing blockchain’s advantages.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 4.3 Billion |

| Market Value in 2030 | USD 68 Billion |

| CAGR (2025-30) | 58% |

| Leading Region | North America |

| Top Key Players | IBM Corporation, SAP SE, Oracle, Microsoft Corporation, Alibaba, Baidu, Inc., Accenture, NTT Data Corporation, Infosys Limited, Stratis Group, VMware, Inc., Huawei Cloud, Tata Consultancy Services (TCS), Wipro Limited, R3 (Corda) and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

For instance; JP Morgan’s coin transactions were around USD 10 Billion daily as per its November 2023 reports. The BFSI industry has embraced BaaS extensively because of the demand for cost-effective digital ledgers safe banking transactions and effective cross-border payments. Blockchain is being integrated by financial institutions worldwide to improve operational efficiency, speed & transaction security. The consumer requirement for instant settlement of funds is creating an urgent requirement for BaaS. For example: The Quorum platform from JP Morgan and Ripple’s real-time cross-border payment solutions are two prominent examples of this trend. Globally, approximately 43.9% of users desire instant payments for better cash management.

Moreover, the adoption of blockchain has been significantly accelerated in the US, China, India, Canada, and Europe. The U.S. and China are at the forefront of blockchain innovation investments with applications in banking transportation systems and public services. For instance; a State-sponsored program encouraging blockchain adoption across industries is China's Blockchain-based Service Network which is used to deploy and operate all types of blockchain-distributed applications. Further propelling the BaaS market is the growing fintech ecosystem, especially in South Korea and India.

To satisfy business needs firms like; IBM and Microsoft Azure offer scalable blockchain services. Furthermore, the incorporation of blockchain technology into public utilities such as banking and vehicle management creates a plethora of opportunities for service providers and drives market expansion.

Global Blockchain-as-a-Service Market Driver:

Rising Security Concerns to Spur the Growth of Blockchain-as-a-Service – Blockchain offers safe business transactions by protecting records with cryptography. Numerous end-use industries such as healthcare, BFSI, media, entertainment, automotive, etc. depend on the accuracy timeliness, and reliability of data stored in blockchain. Furthermore, the BFSI sector benefits from the deployment of blockchain technology by establishing more secure networks for digital transactions and gaining the confidence of consumers to trade and invest in cryptocurrencies. For instance; JP Morgan’s Kinexys (formally Onyx) blockchain network processes an average of more than USD 2 billion daily in transaction volume providing accurate and timely cross-border payments and settlements with payment transactions grown by 10x year over year. Secure digital ledger technology has also become more popular among businesses as a result of the pandemic’s acceleration in the adoption of cloud-based digital platforms. This is driving the market towards growth as companies are using Blockchain-as-a-Service to achieve higher levels of operational security and transparency.

Global Blockchain-as-a-Service Market Opportunity:

Application of Blockchain Technology in the Automotive Sector – As blockchain-based solutions offer operational transparency, the end-use industry can benefit from several real advantages. Several factors including complex supply chains, multi-stage manufacturing processes, regulatory frameworks, car dealership networks, and aftersales services are creating numerous opportunities for the automotive industry to adopt blockchain technology. Furthermore, the automotive industry has seen a discernible rise in the use of Blockchain-as-a-Service. For example; to guarantee ethical and sustainable sourcing, BMW’s PartChain Project tracks raw materials across its supply chain using blockchain technology.

In addition, to giving consumers new options to track vehicle history, file insurance claims, share ownership, etc., this can help automakers improve their supply chain networks. While decreasing the amount of human control and intervention. Thus in the coming years, Blockchain-as-a-Service (BaaS) would have a great opportunity in the automotive sector.

Global Blockchain-as-a-Service Market Challenge:

Stringent Rules and Other Regulatory Challenges – Regulations like Know Your Customer and anti-money laundering are often very stringent for financial firms. These limitations vary from one nation to the next and are regularly modified. Using BaaS platforms to implement blockchain applications in this industry requires careful consideration of how to adhere to these regulations while still utilizing blockchain advantages. Blockchain technology is also used by healthcare organizations to securely manage and exchange patient health records. As healthcare data is sensitive, stringent data protection regulations must be followed even though blockchain provides an unchangeable and transparent record. Enforcing regulations such as the General Data Protection Regulation in Europe or the Health Insurance Portability and Accountability Act in the US is a barrier to the market growth & expansion. Additional regulatory barriers and non-compliance with these rules may limit market expansion.

Global Blockchain-as-a-Service Market Trend:

Blockchain-based NFTs Gaining Traction – Due to their numerous industry applications, blockchain-based non-fungible tokens (NFTs) are rapidly emerging as a significant trend in the global Blockchain-as-a-Service industry. Just as blockchain brought fungibility to the digital world and enabled value exchange in the form of cryptocurrencies, it is now bringing non-fungibility in the form of NFTs. For instance; NFT transactions reached up to USD 4.7 Billion in early 2023 showing exponential growth. Also, the expanding Metaverse running on the blockchain can support a variety of NFTs including digital passes, virtual property, cosmetics, and more. NFT is also widely used in play-to-earn games like Axie Infinity, and metaverse platforms like; The Sandbox enabling users to trade virtual assets and driving growth in decentralized ownership models. As a result, NFTs are emerging as a crucial component of Blockchain-as-a-Service.

Global Blockchain-as-a-Service Market (2025-2030): Segmentation Analysis

The Global Blockchain-as-a-Service Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the global level. Based on the analysis, the market has been further classified as:

Based on End Users:

- BFSI

- IT & Telecom

- Retail & Commerce

- Healthcare & Life Sciences

- Automotive

- Others (Energy & Utility, Media & Entertainment, etc.)

Out of them, the BSFI segment grabs the majority share of the Global Blockchain-as-a-Service Market. It holds approximately 29% share of the entire market. This expansion is being driven by the creation of digital ledgers, the growing need for sophisticated and secure transaction models, the integration of smart banking operations, and the rising demand for high transaction speeds. To enhance banking operations and ensure the highest level of security for their customer's transactions, the BFSI industry has responded by implementing Blockchain-as-a-Service within their organizations in several regions including Asia-Pacific, Europe, and North America. For recording, tracking, and managing transactions, worldwide banks are embracing cutting-edge technology platforms like Blockchain-as-a-Service in response to the growing demand for smart banking and quick easy transactions. It is anticipated that this will accelerate the development of Blockchain-as-a-Service during the forecast period as well.

Based on Organization Size:

- Small and Medium Enterprise (SME)

- Large Enterprise

Out of them, the Large Enterprises segment leads the Global Blockchain-as-a-Service Market with a market share of around 65%. The demand for BaaS in large organizations is primarily driven by the decentralization of business processes, transparency of data security, and reduced operating costs. The use of BaaS is growing among major players with substantial managerial and operational resources such as; automakers, healthcare platforms, banking, and financial institutions. These companies now use BaaS primarily to streamline supply chain and transactional operations. Additionally, Blockchain-as-a-Service made it easier for large corporations to expedite transactions and promote mutual trust.

Global Blockchain-as-a-Service Market (2025-30): Regional Projections

Geographically, the Global Blockchain-as-a-Service Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Out of them, North America leads the Global Blockchain-as-a-Service Market with a substantial market share of around 40%. In the region, most of the companies in various sectors like; BSFI, Defense, Retail, Healthcare, and Manufacturing have started implementing blockchain technology in their businesses. The presence of major technology firms like Microsoft, IBM, and Amazon providing robust BaaS platforms, further boosts the regional market growth. Multiple blockchain projects are on the rise in countries like the US & Canada providing growth opportunities to the regional market. Thriving e-commerce and online retail activities would contribute significantly to the market growth in North America, during the forecast period.

Global Blockchain-as-a-Service Industry Recent Development:

- January 2024: IBM & Caper Labs plan to develop a new Casper Labs solution, designed with blockchain and built leveraging IBM Watson. Governance. This will help clients to leverage blockchain to gain greater transparency and audibility in their AI systems.

- May 2024: Infosys was named as the newest Hyperledger Certified Service Provider allowing businesses the flexibility and modularity to create custom blockchain solutions tailored to their specific needs by leveraging Infosys’ comprehensive services.

Gain a Competitive Edge with Our Global Blockchain-as-a-Service Market Report

- Global Blockchain-as-a-Service Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Blockchain-as-a-Service Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Blockchain-as-a-Service Market Trends & Deployments

- Global Blockchain-as-a-Service Market Dynamics

- Growth Drivers

- Challenges

- Global Blockchain-as-a-Service Market Opportunities & Hotspots

- Global Blockchain-as-a-Service Market Value Chain Analysis

- Global Blockchain-as-a-Service Market Regulations and Policy

- Global Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering

- Tools- Market Size & Forecast 2020-2030, USD Million

- Services- Market Size & Forecast 2020-2030, USD Million

- By Application

- Supply Chain Management- Market Size & Forecast 2020-2030, USD Million

- Smart Contracts- Market Size & Forecast 2020-2030, USD Million

- Financial Payments- Market Size & Forecast 2020-2030, USD Million

- Others (Identity Management, Governance, Risk & Compliance (GRC) management)

- By Organization Size

- Small and Medium Enterprise (SME)- Market Size & Forecast 2020-2030, USD Million

- Large Enterprise- Market Size & Forecast 2020-2030, USD Million

- By End User

- BFSI- Market Size & Forecast 2020-2030, USD Million

- IT & Telecom- Market Size & Forecast 2020-2030, USD Million

- Retail & Commerce- Market Size & Forecast 2020-2030, USD Million

- Transport & Logistics- Market Size & Forecast 2020-2030, USD Million

- Healthcare & Life Sciences- Market Size & Forecast 2020-2030, USD Million

- Automotive- Market Size & Forecast 2020-2030, USD Million

- Others (Energy & Utility, Media & Entertainment, etc.)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share and Analysis

- By Offering

- Market Size & Analysis

- North America Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Mexico Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Market Size & Analysis

- Brazil Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Argentina Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Europe Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- The Netherlands

- Scandinavia

- Rest of Europe

- Germany Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The UK Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- France Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Spain Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The Netherlands Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Scandinavia Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- Saudi Arabia

- The UAE

- South Africa

- Turkey

- Israel

- Rest of the Middle East & Africa

- Saudi Arabia Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The UAE Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Africa Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Turkey Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Israel Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- China Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Japan Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Korea Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Australia Blockchain-as-a-Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2020-2030, USD Million

- By Application-Market Size & Forecast 2020-2030, USD Million

- By Organization Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Blockchain-as-a-Service Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- IBM Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- SAP SE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Oracle

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Microsoft Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Alibaba

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Baidu, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Accenture

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- NTT Data Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Infosys Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Stratis Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- VMware, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Huawei Cloud

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Tata Consultancy Services (TCS)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Wipro Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- R3 (Corda)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Others

- IBM Corporation

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making