Asia-Pacific Digital Respiratory Device Market Research Report: Forecast (2025-2030)

Asia-Pacific Digital Respiratory Device Market - By Device Type (Therapeutic Devices (CPAP Devices, BI-PAP Devices, Humidifiers, Nebulizers, Ventilators, Inhalers, Oxygen Concentra...tes, Resuscitators), Diagnostics Monitoring Devices (Spirometers, Pulse Oximeters), Consumables and Accessories, Respiratory Therapy Wearable Medical Device (Watch and Wristband), Disposables (Nasal Cannulas, Filters, Breathing Circuits)), By End-User (Homecare, Hospitals and Clinics, Ambulatory Care Centers), By Application (Chronic Obstructive Pulmonary Disease, Sleep Apnea, Asthma, Infectious Disease), By Country (China, India, Japan, Australia, New Zealand, South Korea, Rest of Asia-Pacific), By Company (Philips, 3M Healthcare, Astra Zenca Plc., Novartis AG, GE Healthcare, Masimo Corporation, Cipla Ltd., Resmed Ltd., Teva Pharmaceuticals Industries Ltd., Acorda Therapeutics),and others. Read more

- Healthcare

- Jun 2025

- Pages 232

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Asia-Pacific Digital Respiratory Device Market (2025-30):

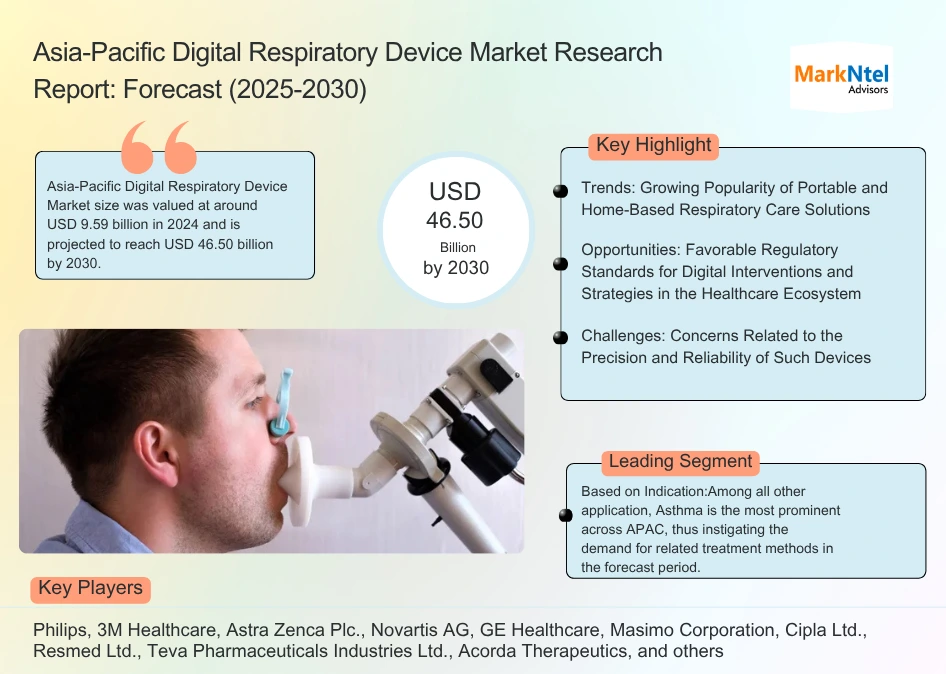

The Asia-Pacific Digital Respiratory Device Market size was valued at around USD 9.59 billion in 2024 and is projected to reach USD 46.50 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 30.10% during the forecast period, i.e., 2025-30.

Most of the market expansion is attributed to the mounting instances of respiratory diseases, including asthma, chronic obstructive pulmonary disease, and sleep apnea, resulting in the frequent adoption of the digital technology-enabled medical device. Besides, the region’s widespread presence of other respiratory diseases, such as chronic bronchitis, emphysema, and wheezing, has swiftly augmented the demand for digital respiratory devices.

However, by means of new technological advancements in emerging economies coupled with bolstering public awareness and increased healthcare expenditure, several governments seek to mitigate respiratory ailments while improving medical facilities in their respective countries. Given the aftermath of Covid-19, China is pacing up with the inclusion of Artificial intelligence in the medicine and healthcare ecosystem. The goal is to optimize resource allocation, enhance service efficiency, and bring innovation in service and management modes.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Base Years | 2024 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 9.59 Billion |

| Market Value by 2030 | USD 46.50 Billion |

| CAGR (2025–30) | 30.10% |

| Top Key Players | Philips, 3M Healthcare, Astra Zenca Plc., Novartis AG, GE Healthcare, Masimo Corporation, Cipla Ltd., Resmed Ltd., Teva Pharmaceuticals Industries Ltd., Acorda Therapeutics, and others |

| Segmentation | By Device Type (Therapeutic Devices (CPAP Devices, BI-PAP Devices, Humidifiers, Nebulizers, Ventilators, Inhalers, Oxygen Concentrates, Resuscitators), Diagnostics Monitoring Devices (Spirometers, Pulse Oximeters), Consumables and Accessories, Respiratory Therapy Wearable Medical Device (Watch and Wristband), Disposables (Nasal Cannulas, Filters, Breathing Circuits)), By End-User (Homecare, Hospitals and Clinics, Ambulatory Care Centers), By Application (Chronic Obstructive Pulmonary Disease, Sleep Apnea, Asthma, Infectious Disease), By Country (China, India, Japan, Australia, New Zealand, South Korea, Rest of Asia-Pacific), By Company (Philips, 3M Healthcare, Astra Zenca Plc., Novartis AG, GE Healthcare, Masimo Corporation, Cipla Ltd., Resmed Ltd., Teva Pharmaceuticals Industries Ltd., Acorda Therapeutics),and others. |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Moreover, new regulatory opportunities and difficulties arise as machine learning and artificial intelligence (AI) become more frequent in digital health products and solutions. Thus, numerous regulatory agencies are actively developing regulatory frameworks that handle products utilizing AI/ML, such as Singapore’s HSA and Japan’s MHLW/PMDA. Furthermore, the rapid increase in the population of seniors and obese people will also likely present chances for the market for respiratory care devices to expand in the years to come. Nonetheless, the demand for respiratory care equipment may face additional challenges due to the numerous adverse effects on infants’ respiratory systems in the coming years.

Asia-Pacific Digital Respiratory Device Market Driver:

Increasing Prevalence of Chronic Respiratory Diseases Across APAC – COVID-19 came as a shock to the economies in the APAC region, as the healthcare infrastructure was not comparable to the global benchmarks. This outbreak ultimately resulted in an increased number of patients suffering from respiratory ailments. China has the most significant number of chronic obstructive pulmonary disease incidences due to the rising aging population. Owing to alarming levels of air pollution, exposure to chemicals, an aging population, and rising smoking habits among inhabitants, the rate of frequency of diseases such as chronic pulmonary diseases (COPD) and asthma is growing among the people in the region. Such an increasing prevalence of diseases would positively influence the supplies of respiratory devices in the forecast period.

Asia-Pacific Digital Respiratory Device Market Opportunity:

Favorable Regulatory Standards for Digital Interventions and Strategies in the Healthcare Ecosystem – In order to handle the large amount of data generated during diagnosis and treatment procedure paired with health status, efficient regulations by the government have been realizing in the past few years. The APAC region's regulatory review procedures are expected to be more consistent and predictable because of the convergence of digital health regulations, which will elevate the delivery of new, safe, and effective digital health solutions to patients and medical professionals. Furthermore, the establishment of regulatory pathways designed specifically to meet the requirements of digitalized medical products would encourage innovation, which will be advantageous to both developers and patients.

Asia-Pacific Digital Respiratory Device Market Challenge:

Concerns Related to the Precision and Reliability of Such Devices – Although the benefits of such smart devices are immense, there are some restrictions that may impede industry growth in the years to come. The prominent one would be the concerns related to the precision and dependability of the device. Also, these devices' availability and high cost hinder market expansion. Besides, given the multiple adverse impacts on newborns' respiratory systems in the coming years, the demand for respiratory care equipment may encounter new difficulties.

Asia-Pacific Digital Respiratory Device Market Trend:

Growing Popularity of Portable and Home-Based Respiratory Care Solutions – The most significant trend reshaping the growth of the Asia-Pacific respiratory device market is the rapid shift toward portable and home-based respiratory care solutions. This transition is driven by several converging factors, rising rates of chronic respiratory diseases such as COPD and asthma, an aging population, and heightened air pollution in urban centers. As healthcare costs climb and patients increasingly prefer outpatient and at-home care, demand for compact, easy-to-use devices like portable oxygen concentrators, CPAP machines, and handheld nebulizers has surged. Additionally, manufacturers are responding by developing lightweight, battery-operated models that offer mobility and convenience for both daily living and travel. This trend is further supported by government initiatives and expanding insurance coverage, particularly in emerging economies, making home respiratory therapies more accessible and appealing to a broader patient base.

Asia-Pacific Digital Respiratory Device Market (2025-30): Segmentation Analysis

The Asia-Pacific Digital Respiratory Device Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025–2030 at the regional level. Based on the analysis, the market has been further classified as:

Based on Indication:

- Chronic Obstructive Pulmonary Disease,

- Sleep Apnea,

- Asthma,

- Infectious Disease

Among all other application, Asthma is the most prominent across APAC, thus instigating the demand for related treatment methods in the forecast period. Concomitant allergic diseases, personal history of allergy, and cesarean birth are the prominent risk factors for developing asthma across the continent. Even with the presence of novel therapies, healthcare professionals face continuous blocks in managing respiratory diseases here. As a result, Smart inhalers are gaining traction as they have the potential to address those challenges. These inhalers are equipped with advanced features that aid the connection with mobile apps, enabling the supervision of medication schedules and subsequent doses. Besides, these devices can deliver dosage reminders, track adherence, correctly record the time, date, and location of each dose administered, and enable access to readily shareable data via Bluetooth. Furthermore, many smart devices either have sensors built into the inhaler's body or have external sensors that can be added to conventional inhalers. Backed by these aspects, the Industry for digital respiratory devices will likely gain momentum in the coming years.

Based on End User:

- Homecare

- Hospitals and Clinics

- Ambulatory Care Centers

All things considered, Hospitals & Clinics acquired a sizeable portion of the Asia-Pacific Digital Respiratory Device Market and are projected to continue to lead in the same direction over the coming years. This growth ascribes to a rapid increase in the elderly population, which has subsequently elevated the demand for emergency and long-term hospitalizations. Consequently, increasing demand for smart respiratory machines such as BI-PAP Devices, smart inhalers, oxygen concentrates, and diagnostics monitoring devices, including spirometers and pulse oximeters. On the other hand, the swift surge in the number of premature or newborn infants with underdeveloped lungs or showing respiratory difficulties is resulting in high childhood asthma, thus, prompting medical facilities like hospitals & clinics to stock such devices for timely and proper treatment. As a result, the hospitals and clinics indicate lucrative prospects for the sector's top players, propelling the overall market trajectory through 2030.

Asia-Pacific Digital Respiratory Device Market (2025-30): Regional Projection

Geographically, the Asia-Pacific Digital Respiratory Device Market expands across:

- China

- India

- Japan

- Australia

- New Zealand

- South Korea

- Rest of Asia-Pacific

Country-wise, China garnered the lion’s share of the Digital Respiratory Device Market across Asia Pacific in the historical period. The ever-increasing aging population has been a prominent factor backing the steady adoption of such devices here. It also owes to the growing prevalence of asthma, which has been an economic and social burden for children and guardians for the past three decades. As such, China announced its first health initiative, Healthy China 2030, which seeks to improve the national health system. Such initiatives would further propel the demand for smart and effective medical devices in the long run. Moreover, Medical informatics research in China has AI as a competing arena, focusing on diagnostic deep-learning algorithms for medical imaging. Moreover, due to rapid urbanization and continuously increasing population awareness, the usage and advancement of digital medical devices have grown over the years. For instance,

On the other hand, Australia acquired the leading position among Pacific countries in the market, with COPD being the 5th major cause of death across the country. With one-fifth of the population already demonstrating asthma-COPD overlap syndromes (ACOS), Australia emerges as an opportunistic area for the stakeholders.

Gain a Competitive Edge with Our Asia-Pacific Digital Respiratory Device Market Report

- Asia-Pacific Digital Respiratory Device Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Asia-Pacific Digital Respiratory Device Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

Introduction

- Product Definition

- Research Process

- Glossary

- Market Segmentation

- Executive Summary

- Expert Verbatim- Interview Excerpts of Industry Experts

- Asia-Pacific Digital Respiratory Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenues

- Market Share & Analysis

- By Device Type

- Therapeutic Devices

- CPAP Devices

- BI-PAP Devices

- Humidifiers

- Nebulizers

- Ventilators

- Inhalers

- Oxygen Concentrates

- Resuscitators

- Diagnostics Monitoring Devices

- Spirometers

- Pulse Oximeters

- Consumables and Accessories

- Respiratory Therapy Wearable Medical Device

- Watch and Wristband

- Disposables

- Nasal Cannulas

- Filters

- Breathing Circuits

- Therapeutic Devices

- By End-User

- Homecare

- Hospitals and Clinics

- Ambulatory Care Centers

- By Application

- Chronic Obstructive Pulmonary Disease

- Sleep Apnea

- Asthma

- Infectious Disease

- By Country

- China

- India

- Japan

- Australia

- New Zealand

- South Korea

- Rest of Asia-Pacific

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Device Type

- Market Size & Analysis

- Asia Pacific Digital Respiratory Medical Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenue

- Market Share & Analysis

- By Product Type

- By End-User

- By Application

- China Digital Respiratory Medical Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenues

- Market Share & Analysis

- By Product

- By End-User

- By Application

- Market Size & Analysis

- India Digital Respiratory Medical Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenues

- Market Share & Analysis

- By Product

- By End-User

- By Application

- Market Size & Analysis

- Japan Digital Respiratory Medical Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenues

- Market Share & Analysis

- By Product

- By End-User

- By Application

- Market Size & Analysis

- Australia Digital Respiratory Medical Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenues

- Market Share & Analysis

- By Product

- By End-User

- By Application

- Market Size & Analysis

- New Zealand Digital Respiratory Medical Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenues

- Market Share & Analysis

- By Product

- By End-User

- By Application

- Market Size & Analysis

- South Korea Digital Respiratory Medical Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenue

- Market Share & Analysis

- By Product

- By End-User

- By Application

- Market Size & Analysis

- Rest of Asia-Pacific Digital Respiratory Medical Device Market Outlook, 2020-2030F

- Market Size & Analysis

- By Units Sold

- By Revenues

- Market Share & Analysis

- By Product

- By End-User

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Digital Respiratory Device Dynamics

- Drivers

- Challenges

- Impact Analysis

- Asia-Pacific Digital Respiratory Device Regulations, Product Standards

- Asia-Pacific Digital Respiratory Device Value Chain Analysis

- Asia-Pacific Digital Respiratory Device Intellectual Property Rights Analysis

- Asia-Pacific Digital Respiratory Device Hotspots & Opportunities

- Competition Outlook

- Competitor Wise Growth Strategies

- Product Portfolio

- Brand Specialization

- Target Markets

- Research & Development

- Strategic Alliances & Initiatives

- Company Profiles

- Philips

- 3M Healthcare

- Astra Zenca Plc.

- Novartis AG

- GE Healthcare

- Masimo Corporation

- Cipla Ltd.

- Resmed Ltd.

- Teva Pharmaceuticals Industries Ltd.

- Acorda Therapeutics

- Competitor Wise Growth Strategies

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making