Global Alginate Market Research Report: Forecast (2023-2028)

By Type (High Mannuronate, High Guluronate), By Product (Sodium Alginate, Calcium Alginate, Potassium Alginate, Propylene Glycol Alginate), By Application (Food &Beverages, Pharmac...euticals, Industrial, Others), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Company (Algaia, Marine Biopolymers Limited [MBL], DuPont de Nemours, Inc., Ingredients Solutions, Inc., KIMICA, IRO Alginate Industry Co., Ltd., Ceamsa, Hyzlin, SNAP Natural & Alginate Product Pvt. Ltd., Zibo Wangfei Seaweed Tech Co., Ltd., Marine Biopolymers Limited, Qingdao Gfuri Seaweed Industrial Co., Ltd., Meron Group, Others) Read more

- Chemicals

- Jul 2023

- Pages 192

- Report Format: PDF, Excel, PPT

Market Definition

A natural polymer derived from the seaweed, primarily from the brown algae is termed as Alginate or algin. Due its qualities like biocompatibility, gel-forming capabilities, and ease to use nature makes it popular among the food & beverage, pharmaceuticals, biomedical, etc.

Market Insights & Analysis: Global Alginate Market (2023-28):

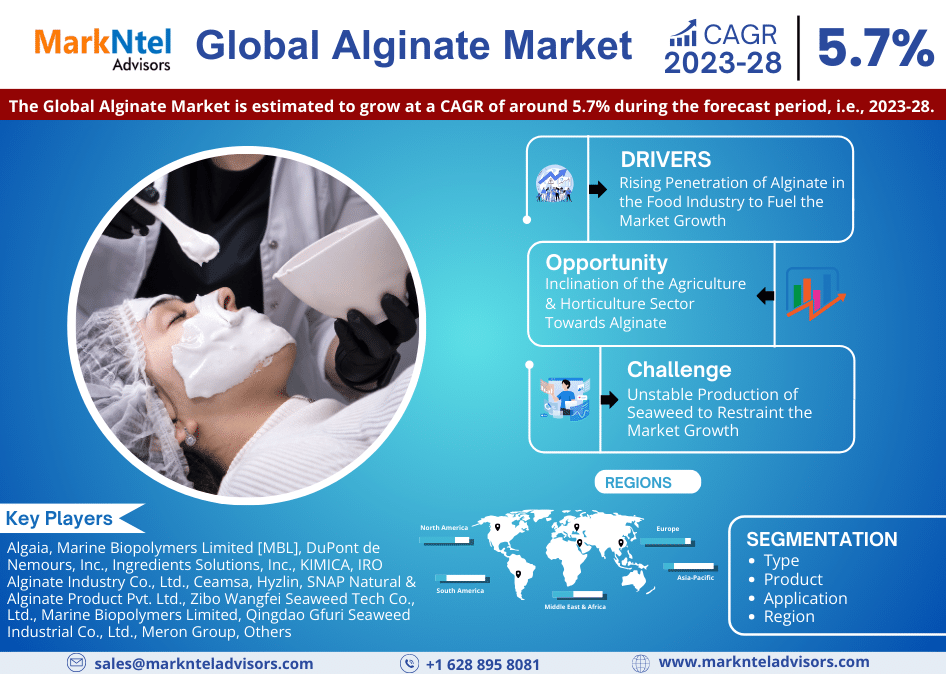

The Global Alginate Market is estimated to grow at a CAGR of around 5.7% during the forecast period, i.e., 2023-28. The market is presumed to grow owing to the rising demand from the food & beverage sectors as well surging adoption of natural ingredients among several industries. As it is generally available in granular & filamentous forms & can bind with water to form a sticky gum, therefore it is broadly utilized for thickening food products, casting dental molds, etc.

It is largely consumed by the food & beverage industry for the production of food items, such as jellies, ice creams, frozen desserts, jams, instant noodles, fruit fillings, and many more to give a nice gel-like texture to them. It is also used to produce condensed flavors & as a coating for several edible items for enhancing their appearance. Also, with the regulatory grants received from US Food & Drug Administration (FDA) & the European Commission as well as its wide acceptance in the food & beverage sector, it is projected that the demand for alginate would grow are a rapid pace.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 5.7% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | Algaia, Marine Biopolymers Limited [MBL], DuPont de Nemours, Inc., Ingredients Solutions, Inc., KIMICA, IRO Alginate Industry Co., Ltd., Ceamsa, Hyzlin, SNAP Natural & Alginate Product Pvt. Ltd., Zibo Wangfei Seaweed Tech Co., Ltd., Marine Biopolymers Limited, Qingdao Gfuri Seaweed Industrial Co., Ltd., Meron Group, Others |

| Unit Denominations | USD Million/Billion |

Furthermore, customer appetite for retail products such as clothing, food, and other products is supplementing across the world. With the rising need, the textile sector is anticipated to expand to meet the novel demand, eventually contributing in enhancing the Alginate Market size. In highly industrialized areas, such as North America, textile factories are more likely to produce technical products, such as technical textiles, than commodity goods, thus yielding demand for technical grade sodium alginate, further redirecting their focus from generic to specialized specialty textiles.Alginate also has a wide presence in the medical sector as they are used during the process of healing wounds & to cure infections. With its ability to form hydrogels, alginate is used in hospitals for drug delivery & tissue engineering applications, contributing to upscaling the market growth.

Moreover, it has a significant adoption from the cosmetic or skincare industry as a thickener & emulsifier in numerous products, like creams, shampoos, lotions, hand wash, etc. Therefore, owing to the rising adoption from several industries, the Global Alginate Market is predicted to flourish in the future years.

Global Alginate Market Driver:

Rising Penetration of Alginate in the Food Industry to Fuel the Market Growth – Owing to its amazing quality of giving a good texture & thickness to the food, alginate is widely used in the food industry, hence supporting in driving the market. It is highly popular in the food sector due to being a natural raw material & finds its application in the production of bakery products, sauces, confectionery items, deserts, etc., Also, with the booming demand for many of the convenience & ready-to-eat=food, there demand across the globe is poised to surge.

Ascending customer awareness of products with unique & traditional flavors is projected to compel the Alginate Market expansion. The demand for an emulsifying agent such as alginate, which is considered safe for human consumption, is foreseen to increase as the share of bakeries in Europe grows, as a result of changing consumer eating patterns. Furthermore, as the number of product-specific bakeries supplements, emulsifying businesses would be predicted to develop ingredients that produce the best results in the ultimate product, thereby creating a positive outlook of the Global Alginate Market in the upcoming years.

Global Alginate Market Opportunity:

Inclination of the Agriculture & Horticulture Sector Towards Alginate – As alginate has a property of hydrogel, which has zero to very least toxicity & biocompatibility, and are eco-friendly, thus its acceptance among agriculture & horticulture has been witnessed, creating an opportunistic arena for the Alginate Market in the future years. It is utilized as a super absorbent in the agriculture industry for coating fruits & vegetables, and seeds, as well as a carrier of fungi & bacteria, aiding in promoting the growth of plants.

Coating the seeds with alginate improves the germination rates & protects them against any harmful substance. Along with this, alginate-based hydrogels are used for water retention in soil & as carriers for the controlled release of fertilizers & agrochemicals, hence aiding in influencing the market growth. Further, with the rising focus on sustainable agriculture & the requirement for improved crops & productivity, the demand for alginate from this sector is presumed to uplift in the forthcoming years.

Global Alginate Market Challenge:

Unstable Production of Seaweed to Restraint the Market Growth – Harvesting or growing seaweed is not an easy process & as its production process is unsustainable, thus significantly impacting the environment & economies. Owing to its unsustainable production process, it was observed that the wildlife & conservation of several areas, like Northern Ireland, were majorly disturbed, leading to a surge in demand for producing seaweed, which is the primary source of getting alginate using sustainable techniques.

Thus, with the growing concern regarding the environment, the production of seaweed has been declining, further reducing the production & supply of alginate, therefore creating a challenge for the industry expansion. The downfall in the supply of raw material, which is seaweed to produce alginate could result in high prices, limited availability, and potential supply chain disruption for the manufacturers & end-users, therefore impeding the growth of the Global Alginate Market.

Global Alginate Market (2023-28): Segmentation Analysis

The Global Alginate Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–2028 at the global, regional, and national levels. Based on the analysis, the market has been further classified as:

Based on Product

- Sodium Alginate

- Calcium Alginate

- Potassium Alginate

- Propylene Glycol Alginate

Sodium Alginate is the most prominent product & holds the substantial share of the Global Alginate Market due to its high adoption in the industries such as pharmaceuticals, textile, and food & beverages. It is generally used as a thickening & gelling agent in the food sector to prepare whipped creams, jellies, and several other edible products. Moreover, due to its remarkable physicochemical & biodegradable properties, the application of sodium alginate in tissue engineering, pharmaceutical formulations, and therapeutic wound therapy is foreseen to upsurge. On top of that, the pharmaceutical industry's production of advanced salt alginate-based solutions for tailored absorption, such as solid gel dispersion, is anticipated to enhance the Alginate Market's revenue growth.

Based on Application:

- Food & Beverages

- Pharmaceuticals

- Industrial

- Others

Food & Beverages is projected to be one of the most prominent application assisting in enhancing the growth graph of the Global Alginate Market in the forecast years, owing to be the preferable alternative to synthetic ingredients. As alginate has the ability to reconstruct meat to resemble traditional meat cuts such as roasts, nuggets, loaves, etc., it is observed that the meat industry is extensively adopting it. Further, with the surge in disposable income in the countries, like China, Brazil, and India, the consumption of meat is widely increasing, further positively affecting the market growth. Also, as alginate is considered as the best natural ingredient, its adoption in the food & beverage industry is also inclined due to the high prevalence of the individuals to eat healthy diet.

Global Alginate Market Regional Projections:

Geographically, the Global Alginate Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Asia-Pacific captured the dominant share of the Global Alginate Market during the past period & is predicted to follow the same trend in the years ahead. The regional market’s growth is attributed to the elevating pharmaceutical industry & the ease in the availability of raw materials in China & India, which are the major supporter in influencing the alginate market in Asia-Pacific. Also, as countries such as China & Japan are the primary manufacturer of alginate, the region is accounted to be the primary landscape in influencing the global market.

Nevertheless, North America & Europe are also presumed to be the leading regions, followed by Asia-Pacific in the forecast years, due to the presence of the largest market for processed food, bakery, frozen food, etc. Also, owing to the soaring demand for natural & healthy products like low-fat & Low-calories food items, including curd, ice creams, whipped creams, the demand for alginate is foreseen to boom in the following years.

Global Alginate Industry Recent Development:

- 2023: Meron Group launched a new dessert premixes for HoReCA & several products, due to the rising demand for ready-to-make dessert mixes.

- October 2022: KIMICA declared the opening of "KIMICA HONKAN" a building constructed with advanced technologies for the R&D of the products.

Gain a Competitive Edge with Our Global Alginate Market Report

- Global Alginate Market report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Global Alginate Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

Frequently Asked Questions

Global Alginate Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Alginate Market Regulations & Policy

- Global Alginate Market Trends & Developments

- Global Alginate Market Dynamics

- Drivers

- Challenges

- Global Alginate Market Hotspot & Opportunities

- Global Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type

- High Mannuronate - Market Size & Forecast 2018-2028, (Tons)

- High Guluronate - Market Size & Forecast 2018-2028, (Tons)

- By Product

- Sodium Alginate - Market Size & Forecast 2018-2028, (Tons)

- Calcium Alginate- Market Size & Forecast 2018-2028, (Tons)

- Potassium Alginate - Market Size & Forecast 2018-2028, (Tons)

- Propylene Glycol Alginate- Market Size & Forecast 2018-2028, (Tons)

- By Application

- Food & Beverages - Market Size & Forecast 2018-2028, (Tons)

- Bakery- Market Size & Forecast 2018-2028, (Tons)

- Confectionery- Market Size & Forecast 2018-2028, (Tons)

- Meat Products- Market Size & Forecast 2018-2028, (Tons)

- Dairy Products- Market Size & Forecast 2018-2028, (Tons)

- Sauces & Dressings- Market Size & Forecast 2018-2028, (Tons)

- Beverages- Market Size & Forecast 2018-2028, (Tons)

- Others- Market Size & Forecast 2018-2028, (Tons)

- Pharmaceutical - Market Size & Forecast 2018-2028, (Tons)

- Industrial- Market Size & Forecast 2018-2028, (Tons)

- Others- Market Size & Forecast 2018-2028, (Tons)

- Food & Beverages - Market Size & Forecast 2018-2028, (Tons)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Market Share

- Competition Characteristics

- By Type

- Market Size & Analysis

- North America Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- By Country

- The US

- Canada

- Mexico

- The US Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Canada Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Mexico Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Market Size & Analysis

- South America Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Argentina Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Market Size & Analysis

- Europe Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- The UK Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- France Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Italy Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Spain Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- South Africa

- The UAE

- Saudi Arabia

- Rest of Middle East & Africa

- South Africa Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- The UAE Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Saudi Arabia Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- By Country

- China

- Japan

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- China Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Japan Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Australia Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- India Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- South Korea Alginate Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (Tons)

- By Product - Market Size & Forecast 2018-2028, (Tons)

- By Application - Market Size & Forecast 2018-2028, (Tons)

- Market Size & Analysis

- Market Size & Analysis

- Competitive Outlook

- Company Profiles

- Algaia

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Marine Biopolymers Limited (MBL)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DuPont de Nemours, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ingredients Solutions, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- KIMICA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- IRO Alginate Industry Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ceamsa

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hyzlin

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SNAP Natural & Alginate Product Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Shandong Jiejing Group Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Zibo Wangfei Seaweed Tech Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Marine Biopolymers Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Qingdao Gfuri Seaweed Industrial Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Meron Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Algaia

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making