Algeria Drinking Milk Products Market Research Report: Forecast (2023-2028)

By Type (Fresh Milk, Flavored Milk, Powdered Milk), By Distribution Channel (Offline Stores [Hypermarket/Supermarket, Retail Stores, Convenience Stores], Online Stores), By End Use...r (Household, Commercial), By Company (Complexe Laitier d'Alger [COLAITAL], Tchin-Lait Sarl, Hodna Lait, Laiterie Sidi Saada SpA, Promasidor Djazair, Laiterie Betouche Sarl, Lactalis, Groupe, Laiterie Soummam Sarl, Nestlé SA, Giplait SpA, Others) Read more

- Food & Beverages

- May 2023

- Pages 112

- Report Format: PDF, Excel, PPT

Market Definition

Drinking Milk Products include a huge variety of ready-to-drink products like flavored milk, cold coffee, etc., prepared primarily from milk.

Market Insights

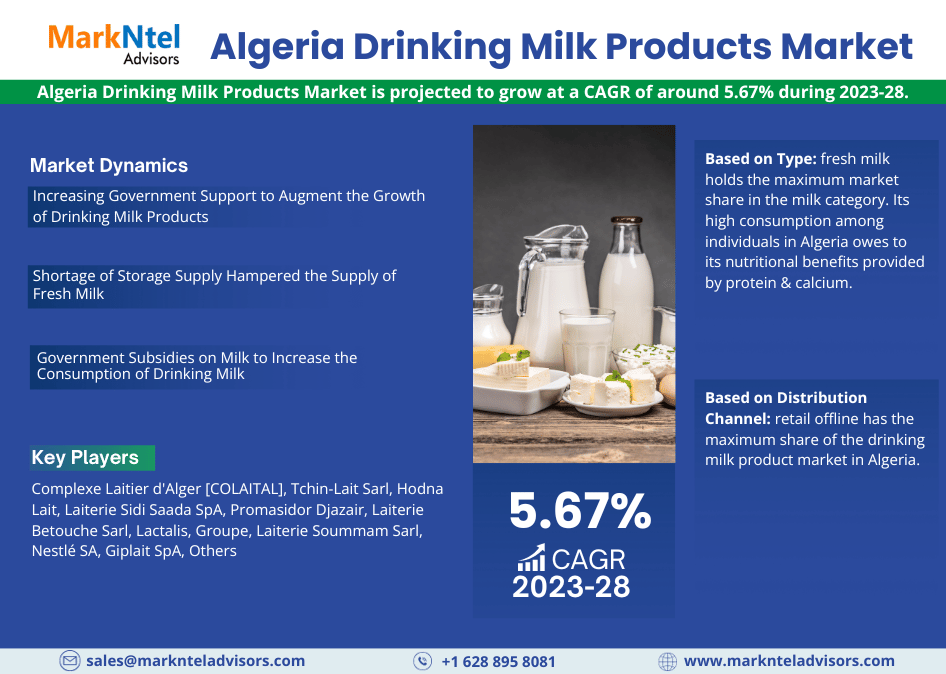

The Algeria Drinking Milk Products Market is projected to grow at a CAGR of around 5.67% during the forecast period, i.e., 2023-28. The major factor attributing to the growth is the increased consumption of milk & milk products in the country. In Algeria, dairy products remain the most widely consumed staple food after cereals. The government of Algeria has estimated that it requires close to 5 million metric tons (MMT) of milk annually for dairy consumption out of which 70% is procured from the domestic market itself and the rest is imported.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 5.67% |

| Key Companies Profiled | Complexe Laitier d'Alger [COLAITAL], Tchin-Lait Sarl, Hodna Lait, Laiterie Sidi Saada SpA, Promasidor Djazair, Laiterie Betouche Sarl, Lactalis, Groupe, Laiterie Soummam Sarl, Nestlé SA, Giplait SpA, Others |

| Unit Denominations | USD Million/Billion |

Apart from the consumption point of view, the dairy segment remains the second most consumed imported product after cereals. As per the Algerian Customs Statistics, during 2019, the value of total dairy imports was close to USD 1.24 billion, which represents 15.43 percent of the total food import of the country. Further, during the first quarter of 2020, the value of total dairy imports was USD 363.96 million, which is equal to 18.80% of the total food imports of the country. Thus indicating a growth in the consumption of milk products, which is further creating a conducive market environment for the growth of the Drinking Milk Products market in Algeria in coming years.

Market Dynamics

Increasing Government Support to Augment the Growth of Drinking Milk Products

The government in Algeria is promoting the expansion of the country’s agriculture and dairy production capacities to reduce its dependence upon imports. In 2020, the government initiated a 5-year strategic plan, under which the government encouraged the upgradation & modernization of the agriculture and dairy sector of the country and further increased the production levels. The government is also providing grants of land that can be used for the production of dairy products and pastures for cattle.

It is also encouraging the establishment of small dairy units and camel & goat breeding in the Sub-Saharan region. These developments are creating a conducive ecosystem for the growth of drinking milk product manufacturers, as they can easily establish their production units in the country with government support. Moreover, as the policy in Algeria currently focuses on the import substitution of milk products, it would increase the sales of domestically produced milk drinks and boost the Drinking Milk Products Market in the coming years.

Shortage of Storage Supply Hampered the Supply of Fresh Milk

In the year 2022, there was a shortage of storage facilities to store fresh milk, which disrupted its overall supply in the country during the holy month of Ramadan. Considering the festival month in the country, the demand for milk was at its peak but due to limited storage facilities, the supply chain got hampered, could not meet the consumer demand, and thus restricted the growth of the drinking milk products market in the country.

Government Subsidies on Milk to Increase the Consumption of Drinking Milk

The government of Algeria provides subsidies for the sales of fresh milk, as it is considered the cheapest source of protein and is consumed by almost the entire population of the country. Besides, the population of the country is also consistently rising, where it grew from nearly 42.70 million in 2019 to 44.18 million in 2021. Hence, the rising population levels, coupled with the availability of milk at a subsidized rate, cite the mounting consumption of drinking milk products across the country. These developments are likely to propel the growth of the Algeria Drinking Milk Products Market in the forecast years.

Market Segmentation

Based on Type:

- Fresh Milk

- Shelf Stable Milk

Of both, fresh milk holds the maximum market share in the milk category. Its high consumption among individuals in Algeria owes to its nutritional benefits provided by protein & calcium. Besides, fresh milk is one such category of milk that is consumed by all the sections of the society irrespective of their incomes. Along with it, the government also provides subsidies for the sale of fresh milk, thereby making its consumption less costly than shelf-stable milk.

In the coming years as well, the demand for fresh milk is expected to rise owing to the growing population levels in the country. The infants & kids require fresh milk to fulfill their nutritional needs, which would continue to augment the sales of fresh milk and positively impact the drinking milk product market in Algeria over the coming years.

Based on Distribution Channel:

- Retail Offline

- Retail E-Commerce

Here, retail offline has the maximum share of the drinking milk product market in Algeria. It owes primarily to the extensive presence of local retail stores in the country, as the sales of drinking milk products from conventional retail stores are convenient and easy. In the coming years as well the retail offline segment is expected to dominate the distribution of drink milk products due to its well distributed network.

Do You Require Further Assistance?

- The sample report seeks to acquaint you with the layout and the overall research content.

- The deliberate utilization of the report may further streamline operations while maximizing your revenue.

- To gain an unmatched competitive advantage in your industry, you can customize the report by adding more segments and specific countries suiting your needs.

- For a better understanding of the contemporary market scenario, feel free to connect to our knowledgeable analysts.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Assumption

- Market Definition

- Executive Summary

- Algeria Drinking Milk Product Market Trends & Insights

- Algeria Drinking Milk Product Market Regulations & Policy

- Algeria Drinking Milk Product Market Dynamics

- Growth Drivers

- Challenges

- Algeria Drinking Milk Product Market Hotspot and Opportunities

- Algeria Drinking Milk Product Market Outlook, 2018- 2028F

- Market Size and Analysis

- By Revenues (USD Million)

- By Volume (Million Liters)

- Market Share and Analysis

- By Type

- Fresh Milk

- Flavored Milk

- Powdered Milk

- By Distribution Channel

- Offline Stores

- Hypermarket/Supermarket

- Retail Stores

- Convenience Stores

- Online Stores

- Offline Stores

- By End User

- Household

- Commercial (Hotels, Restaurants, etc.)

- By Company

- Competition Characteristics

- Revenue Shares

- By Type

- Market Size and Analysis

- Algeria Drinking Milk Product Market Key Strategic Imperatives for Success and Growth

- Competitive Outlook

- Competition Matrix

- Product Portfolio

- Brand Specialization

- Target Markets

- Strategic Alliances & Collaborations

- Strategic Initiatives

- Company Profiles (Business Description, By Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Complexe Laitier d'Alger (COLAITAL)

- Tchin-Lait Sarl

- Hodna Lait

- Laiterie Sidi Saada SpA

- Promasidor Djazair

- Laiterie Betouche Sarl

- Lactalis, Groupe

- Laiterie Soummam Sarl

- Nestlé SA

- Giplait SpA

- Others (Celia Algerie SpA, ONALAIT)

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making