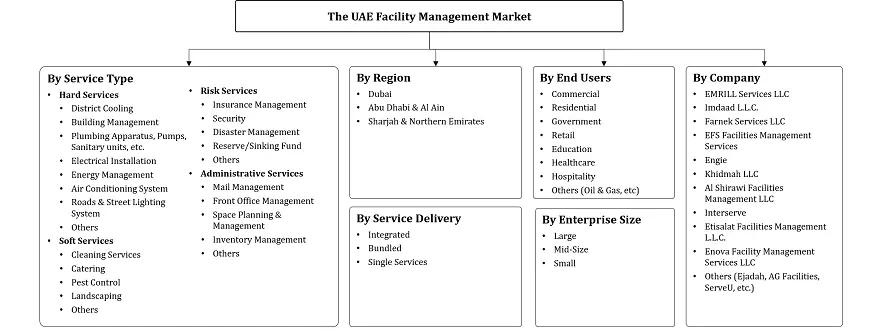

UAE Facility Management Market Report - By Type (Hard, Soft, Risk, Administrative), By Operating Model (In-House, Outsourced), By Service Delivery (Single Service, Bundled, Integrated), By Size (Small... ... ted), By Size (Small Enterprise, Mid-Size Enterprise, Large Enterprise), By End Users (Residential, Commercial, Government, Retail, Education, Healthcare, Hospitality, Others), By Enterprise Size (Small, Med-Size, Large), and Others Read more

- Buildings, Construction, Metals & Mining

- Jul 2025

- 137

- PDF, Excel, PPT

Market Definition

Facility or facilities management (FM) is a professional discipline that is dedicated to providing support to people by ensuring functionality, comfort, safety, sustainability, and efficiency within the built environment, while coordinating the use of space, infrastructure, and organization. The FM profession operates under global standards such as ISO 41001 and is guided by organizations like the International Facility Management Association (IFMA).

Market Insights & Analysis: UAE Facility Management Market (2025-30):

The UAE Facility Management Market size was valued at around USD 18.29 billion in 2024 and is expected to reach USD 33.64 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 10.69% during the forecast period, i.e., 2025-30. The growth of the market is mainly driven by rapid urbanization in the country, which drives the growth of residential, commercial, industrial, and overall infrastructure, all of which directly raise the demand for specialized facility (or facilities) management (FM) services and FM providers who deliver them.

Additionally, trends such as the increased adoption of Artificial Intelligence (AI) and Internet of Things (IoT) solutions drive the growth of this market by innovating operations through predictive maintenance, real-time asset monitoring, etc. For instance, Enova introduced Artificial Intelligence Enova Virtual Assistant, AIEVA, to enhance the user experience for customers, job seekers, and suppliers by responding to inquiries related to Enova.

Moreover, UAE’s commitment to environmental goals also play a part, for instance, with UAE Energy Strategy 2050, the country has planned to generate half of its electrical energy by 2050 from sources such as solar and nuclear energy and reduce its carbon footprint by 70%, targeting 44% renewables, 38% gas, 12% clean coal and 6% nuclear energy sources. This is also apparent by initiatives like DEWA’s Al-Shera’a, which is designed to be the world’s “tallest, largest and smartest” net positive government building. These initiatives help in driving growth opportunities for specialized FM providers that focus on green energy and smart technology.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Base Years | 2024 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 18.29 Billion |

| Market Value by 2030 | USD 33.64 Billion |

| CAGR (2025–30) | 10.69% |

| Top Key Players | Emrill Services LLC, Imdaad L.L.C., Farnek Services LLC, EFS Facilities Management Services, Engie, Khidmah LLC, Al Shirawi Facilities Management LLC, Interserve, Etisalat Facilities Management L.L.C., Enova Facility Management Services LLC, and others |

| Segmentation | By Type (Hard, Soft, Risk, Administrative), By Operating Model (In-House, Outsourced), By Service Delivery (Single Service, Bundled, Integrated), By Size (Small Enterprise, Mid-Size Enterprise, Large Enterprise), By End Users (Residential, Commercial, Government, Retail, Education, Healthcare, Hospitality, Others), By Enterprise Size (Small, Med-Size, Large), and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Furthermore, the UAE is also making an immense transformation in healthcare investment, as it is pushing towards advanced infrastructure, excellence in operations, and ensuring that it aligns with the regulations. For instance, Forte Healthcare is a key player that supports the establishment of world-class medical facilities across the country, and the facilities enhance the patient experience and clinical excellence. This increases the need for sophisticated FM services in the market.

UAE Facility Management Market Driver:

Increasing Adoption of Technological Advancements & Smart Building Solutions – There is an increase in the adoption of advanced technologies and smart building solutions, driven by the goal of achieving enhanced efficiency, reduction in costs, and improvement in the quality of life of occupants within the country. Additionally, key technologies such as the IoT and AI are integrated to collect real-time data on aspects like energy consumption and occupancy, which AI algorithms then analyze for optimizing performance and predictive maintenance. For instance, Enova's AIEVA automates service requests, freeing teams for high-value analytics. Moreover, the UAE’s strong focus on smart city initiatives such as Smart Dubai further calls for the advancement of FM services to manage interconnected, smart urban environments. This technological transformation also greatly drives the demand in the market.

Furthermore, the inclusion of smart building technologies in over 75% of new real estate projects is driving demand for advanced FM services as clients are increasingly seeking integrated facility management (IFM) solutions that offer data backed performance reporting and real time key performance indicators (KPI) dashboards, This demand for advanced, data driven services is also pushing FM providers to invest in and adopt these systems, transforming FM from a cost center into a strategic pillar that supports the UAEs diversification and sustainability goals.

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Expert Verbatim- What our Experts Say?

- Macroeconomic Outlook

- UAE Facility Management Market Outlook (2020-2030)

- Industry Potential & Outlook

- By Revenues

- Industry Segmentation & Outlook

- By Type

- Hard

- Soft

- Risk

- Administrative

- By Operating Model

- In-House

- Outsourced

- By Service Delivery

- Integrated

- Bundled

- Single Services

- By End Users

- Commercial

- Residential

- Government

- Retail

- Education

- Healthcare

- Hospitality

- Others

- By Enterprise Size

- Large

- Mid-Size

- Small

- By Region

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Type

- Industry Potential & Outlook

- UAE Hard Facility Management Market Outlook (2020-2030)

- Industry Potential & Outlook

- By Revenues

- Industry Segmentation & Outlook

- By Type

- District Cooling

- Building Management

- Plumbing Apparatus, Pumps, Sanitary units, etc.

- Electrical Installation

- Energy Management

- Air Conditioning System

- Roads & Street Lighting System

- Others

- By Operating Model

- By Service Delivery

- By End User

- By Enterprise Size

- By Region

- By Type

- Industry Potential & Outlook

- UAE Soft Facility Management Market Outlook (2020-2030)

- Industry Potential & Outlook

- By Revenues

- Industry Segmentation & Outlook

- By Type

- Cleaning Services

- Catering

- Pest Control

- Landscaping

- Others

- By Operating Model

- By Service Delivery

- By End User

- By Enterprise Size

- By Region

- By Type

- Industry Potential & Outlook

- UAE Risk Facility Management Market Outlook (2020-2030)

- Industry Potential & Outlook

- By Revenues

- Industry Segmentation & Outlook

- By Type

- Insurance Management

- Security

- Disaster Management

- Reserve/Sinking Fund

- Others

- By Operating Model

- By Service Delivery

- By End User

- By Enterprise Size

- By Region

- By Type

- Industry Potential & Outlook

- UAE Administrative Facility Management Market Outlook (2020-2030)

- Industry Potential & Outlook

- By Revenues

- Industry Segmentation & Outlook

- By Type

- Mail Management

- Front Office Management

- Space Planning & Management

- Inventory Management

- Others

- By Operating Model

- By Service Delivery

- By End User

- By Enterprise Size

- By Region

- By Type

- Industry Potential & Outlook

- UAE Facility Management Market Regulations

- UAE Facility Management Market Trends & Developments

- UAE Facility Management Market Dynamics

- Impact Analysis

- Drivers

- Challenges

- UAE Facility Management Services Market, Customer Buying Behaviour, 2023

- Factors Influencing Customer’s Decision

- Priority Matrix of Customer’s Need

- Customer and Service Provider Proximity Analysis

- UAE Facility Management Market Winning Strategies, 2023

- Investment Scenario

- Hotspots

- UAE Facility Management Market Attractiveness Index, (2025-2030)

- By Type

- By Operating Model

- By End Users

- By Service Delivery

- By Enterprise Size

- By Region

- UAE Facility Management Market Porter’s Five Forces Analysis

- UAE Facility Management Market Pricing Analysis, 2023

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- EMRILL Services LLC

- Imdaad L.L.C.

- Farnek Services LLC

- EFS Facilities Management Services

- Engie

- Khidmah LLC

- Al Shirawi Facilities Management LLC

- Interserve

- Etisalat Facilities Management L.L.C.

- Enova Facility Management Services LLC

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making