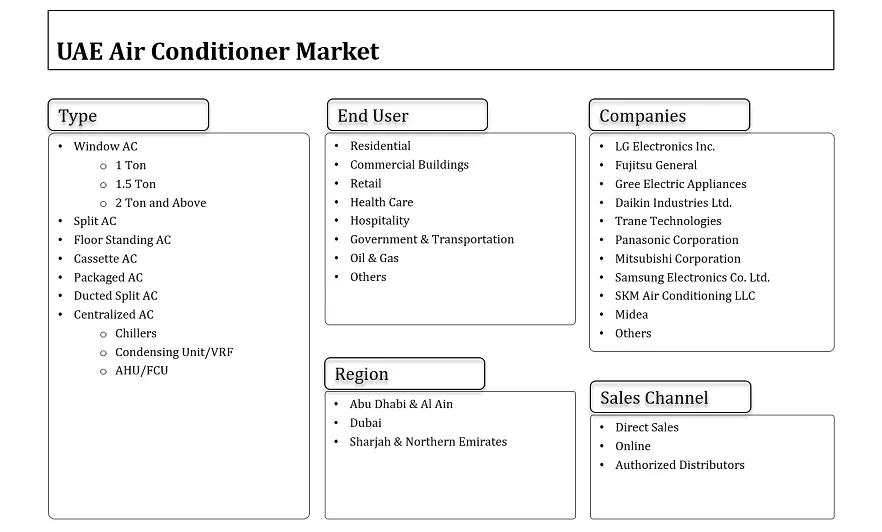

Air Conditioner Market Size in UAE - By Type (Window AC, Split AC, Floor Standing AC, Cassette AC, Packaged AC, Ducted Split AC, Centralized AC), By End User (Residential, Commerci......al Buildings, Retail, Health Care, Hospitality, Government & Transportation, Oil & Gas, Others), By Sales Channel (Direct Sales, Online, Authorized Distributors) and Others Read more

- Environment

- Mar 2025

- 106

- PDF, Excel, PPT

Market Definition

With the surging preference toward pure & disease-free indoor air quality, coupled with the improving buying power & changing living standards of people, the UAE is observing the rising adoption of air conditioners. Besides, the geographic location of the UAE presents hot climate conditions that also add up to the mounting need for air conditioners across the country. It is majorly to enhance comfort & cooling at different facilities and boost the air conditioner industry across the UAE.

Market Insights & Analysis: UAE Air Conditioner Market (2025-30):

The UAE Air Conditioners Market size was valued at around USD 190.11 Million in 2024 and is projected to reach USD 282.12 Million by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.8% during the forecast period, i.e., 2025-30. The growth of the market is likely to be driven primarily by the rapidly improving economic conditions and changing living standards of people & their growing purchasing power, i.e., boosting the sales of air conditioners to enhance the comfort at facilities. Additionally, escalating government focus on economic diversification away from oil is stimulating various infrastructural developments. Due to this, the UAE is experiencing numerous construction projects like hotels, resorts, corporate spaces, residential buildings, & shopping malls are surging rapidly. It, in turn, is instigating air conditioner manufacturers to accelerate their production capacities and meet the mounting end-user demand.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 190.11 Million |

| Market Value by 2030 | USD 282.12 Million |

| CAGR (2025-30) | 6.8% |

| Leading Region | Dubai |

| Top Key Players | LG Electronics Inc., Fujitsu General, Gree Electric Appliances, Daikin Industries Ltd., Trane Technologies, Panasonic Corporation, Mitsubishi Corporation, Samsung Electronics Co. Ltd., SKM Air Conditioning LLC, Midea, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Moreover, Prominent driver propelling this market is the UAE’s strategic pivot towards self-sufficiency in green building technologies. With the country striving to meet its net-zero goals by 2050, HVAC systems—major contributors to electricity usage—are now at the center of national energy policies. This is encouraging a new wave of innovation in inverter-based and VRF systems, especially as mandates around refrigerant usage and building retrofits tighten.

Besides, rapidly establishing multinational companies, growing migrant influx, and the expanding tourism sector in the country are other crucial aspects propelling the need for air conditioners and driving the market. Moreover, the mounting need to strengthen the hospitality & healthcare sectors is soaring the construction & infrastructural developments of these facilities, which, in turn, would boost the demand for air conditioners and fuel the overall market growth in the coming years.

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- UAE Air Conditioner Import & Export Analysis, 2020-2024

- UAE Air Conditioner Market Value Chain & Stakeholder Margin Analysis

- UAE Air Conditioner Market Trends & Developments

- UAE Air Conditioner Market Dynamics

- Growth Drivers

- Challenges

- UAE Air Conditioner Market Regulations, Norms, & Product Standards

- UAE Air Conditioner Market Hotspots & Opportunities

- UAE Air Conditioner Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units) [Window + Split + Cassette]

- Market Share & Analysis

- By Type

- Window AC- Market Size & Forecast 2020-2030, USD Million

- Split AC- Market Size & Forecast 2020-2030, USD Million

- Floor Standing AC- Market Size & Forecast 2020-2030, USD Million

- Cassette AC- Market Size & Forecast 2020-2030, USD Million

- Packaged AC- Market Size & Forecast 2020-2030, USD Million

- Ducted Split AC- Market Size & Forecast 2020-2030, USD Million

- Centralized AC- Market Size & Forecast 2020-2030, USD Million

- By End User

- Residential- Market Size & Forecast 2020-2030, USD Million

- Commercial Buildings- Market Size & Forecast 2020-2030, USD Million

- Retail- Market Size & Forecast 2020-2030, USD Million

- Health Care- Market Size & Forecast 2020-2030, USD Million

- Hospitality- Market Size & Forecast 2020-2030, USD Million

- Government & Transportation- Market Size & Forecast 2020-2030, USD Million

- Oil & Gas- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Sales Channel

- Direct Sales- Market Size & Forecast 2020-2030, USD Million

- Online- Market Size & Forecast 2020-2030, USD Million

- Authorized Distributors- Market Size & Forecast 2020-2030, USD Million

- By Region

- Abu Dhabi & Al Ain

- Dubai

- Sharjah & Northern Emirates

- By Company

- Market Shares

- Competition Characteristics

- By Type

- Market Size & Analysis

- UAE Window Air Conditioner Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- 1 ton

- 5 ton

- 2 tons & Above

- By End User- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- By Capacity- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- Market Size & Analysis

- UAE Split Air Conditioner Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- By End User- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- Market Size & Analysis

- UAE Floor Standing Air Conditioner Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Capacity- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- By End User- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- Market Size & Analysis

- UAE Cassette Air Conditioner Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, Thousand Units & USD Million

- Market Size & Analysis

- UAE Packaged Air Conditioner Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- UAE Ducted Split Air Conditioner Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- UAE Centralized Air Conditioner Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Chiller- Market Size & Forecast 2020-2030, USD Million

- Condensing Unit/VRF- Market Size & Forecast 2020-2030, USD Million

- AHU/FCU- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, USD Million

- By Type

- Market Size & Analysis

- UAE Air Conditioner Market Key Strategic Imperatives for Success & Growth

- Competitive Benchmarking

- Company Profiles

- LG Electronics Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Fujitsu General

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gree Electric Appliances

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Daikin Industries Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Trane Technologies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Panasonic Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mitsubishi Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Samsung Electronics Co. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SKM Air Conditioning LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Midea

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- LG Electronics Inc.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making