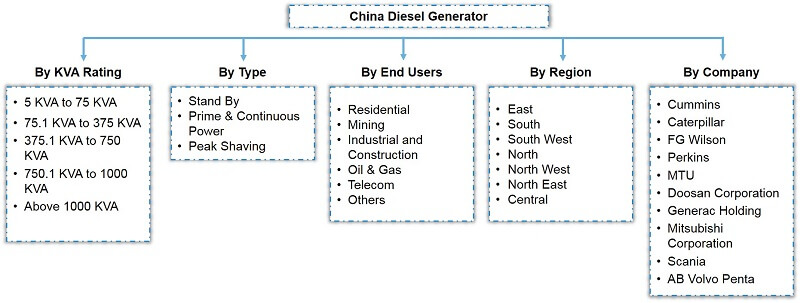

By KVA Rating (5 KVA to 75 KVA, 75.1 KVA to 375 KVA, 375.1 KVA to 750 KVA, 750.1 KVA to 1000 KVA, Above 1000 KVA), By Type (Stand-By, Prime & Continuous Power, Peak Shaving), By En......d Users (Residential, Mining, Oil & Gas, Industrial & Construction, Telecom), By Region (North, North West, North East, South, South West, East, Central), By Companies (Caterpillar Inc., Cummins, AB Volvo Penta, Perkins, MTU Aero Engines, Doosan Corporation, Generac Holding Inc., Mitsubishi Corporation, Scania, FG Wilson) Read more

- Energy

- Mar 2022

- 124

- PDF, Excel, PPT

Market Definition

Diesel generators are the primary sources of energy for many end-user sectors like Residential, Mining, Oil & Gas, Industrial & Construction, Telecom, etc., at times of power outages, grid failures, or emergency power supply requirements. These generators are gaining swift traction across China and are witnessing increasing deployment in multiple applications.

Market Insights

The China Diesel Generator Market is projected to grow at a CAGR of around 9% during the forecast period, i.e., 2022-27. The growth of the market is likely to be driven primarily by the burgeoning requirements of the swiftly expanding industrial sector of China for an uninterrupted power supply. In addition, the increasing construction projects for infrastructural developments is another prominent aspect surging the demand for a stable electricity flow and augmenting the demand for diesel generators in the country.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 9% |

| Region Covered | North, North West, North East, South, South West, East, Central |

| Key Companies Profiled | Caterpillar Inc., Cummins, AB Volvo Penta, Perkins, MTU Aero Engines, Doosan Corporation, Generac Holding Inc., Mitsubishi Corporation, Scania, FG Wilson, Others |

| Unit Denominations | USD Million |

Besides, favorable policies by the government are instigating the leading players to bring technological innovations in diesel generators and expand their scalability both locally & internationally, which, in turn, would propel the overall market growth through 2027.

Moreover, since the ownership of diesel generators can be expensive for contractors, several leading players in the market are offering rental services for these gensets and gaining swift momentum across the country. It, in turn, is displaying significant cost-effectiveness for the consumers, along with profitable prospects for the rental service providers. As these services are becoming an emerging trend in China, the overall market is likely to witness substantial growth over the forecast years.

Impact of Covid-19 on the China Diesel Generator Market

China, the epicenter of the Covid-19 pandemic that emerged in 2020, catastrophically impacted most industries, and the Diesel Generator Market was no exception. Owing to the severity of the pandemic, the government imposed stringent movement restrictions & lockdowns to curb the spread of this dreadful disease. As a result, the market witnessed several unprecedented challenges associated with the production & distribution of gensets across the country amidst the crisis.

The leading players in the market faced massive financial losses due to supply chain disruptions, unavailability of raw materials & labor, and reduced demand due to the shutdown of industries, construction projects, & commercial sectors, among others. However, on the other hand, the demand for gensets witnessed a temporary hike due to the continued requirement across the healthcare sector, which enabled Diesel Genset manufacturers to sustain the market.

Since the healthcare sector was under immense pressure owing to the exponentially rising number of Covid patients, the need to run several machines and equipment surged the demand for an uninterrupted energy flow and, in turn, fueled the demand for diesel generators. In addition to this, as people adopted work from home policies, the need for diesel generators escalated across the residential sectors as a primary source of power backup during grid failures & power outages to run home appliances.

Consequently, the market displayed an upswing and generated growth opportunities for the leading players to enhance their production & distribution capacities to meet the burgeoning consumer demand. Hence, with the gradual improvement in the pandemic, the government of China uplifted the restrictions & allowed the recommencement of business operations, which, in turn, stimulated the overall market growth and projected its usual growth pace in the coming years.

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Expert Verbatim- What our Experts Say?

- Macroeconomic Outlook

- China Diesel Generator Industry Outlook, 2017-2027

- Market Size & Analysis

- Revenues

- Units Sold

- Market Share & Analysis

- By KVA Rating

- 5 KVA to 75 KVA

- 75.1 KVA to 375 KVA

- 375.1 KVA to 750 KVA

- 750.1 KVA to 1000 KVA

- Above 1000 KVA

- By Type

- Stand By

- Prime & Continuous Power

- Peak Shaving

- By End Users

- Residential

- Mining

- Oil & Gas

- Industrial & Construction

- Telecom

- Others

- By Region

- North

- North West

- North East

- South

- South West

- East

- Central

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By KVA Rating

- Market Size & Analysis

- Upto 30 kW Diesel Generator Industry Outlook, 2017-2027

- Market Size & Analysis

- Revenues

- Units Sold

- Market Share & Analysis

- By Type

- By End Users

- By Region

- Market Size & Analysis

- 30.1 to 60 kW Diesel Generator Industry Outlook, 2017-2027

- Market Size & Analysis

- Revenues

- Units Sold

- Market Share & Analysis

- By Type

- By End Users

- By Region

- Market Size & Analysis

- 60.1 to 150 kW Diesel Generator Industry Outlook, 2017-2027

- Market Size & Analysis

- Revenues

- Units Sold

- Market Share & Analysis

- By Type

- By End Users

- By Region

- Market Size & Analysis

- 150.1 to 300 kW Diesel Generator Industry Outlook, 2017-2027

- Market Size & Analysis

- Revenues

- Units Sold

- Market Share & Analysis

- By Type

- By End Users

- By Region

- Market Size & Analysis

- 300.1 kW to 500 kW Diesel Generator Industry Outlook, 2017-2027

- Market Size & Analysis

- Revenues

- Units Sold

- Market Share & Analysis

- By Type

- By End Users

- By Region

- Market Size & Analysis

- 500 kW to 1,000 kW Diesel Generator Industry Outlook, 2017-2027

- Market Size & Analysis

- Revenues

- Units Sold

- Market Share & Analysis

- By Type

- By End Users

- By Region

- Market Size & Analysis

- Above 1,000 kW Diesel Generator Industry Outlook, 2017-2027

- Market Size & Analysis

- Revenues

- Units Sold

- Market Share & Analysis

- By Type

- By End Users

- By Region

- Market Size & Analysis

- China Diesel Generator Industry Policy & Regulations

- China Diesel Generator Industry Trends & Development

- China Diesel Generator Industry Dynamics

- Drivers

- Challenges

- Impact Analysis

- China Diesel Generator Industry Sales & Distribution Channel Analysis

- China Diesel Generator Industry, Customer Survey

- Customer Priorities

- Expectations from Vendors

- Brand Awareness

- Price Neutrality

- Current Brand Satisfaction Level

- China Diesel Generator Industry Vendor Selection Criteria

- China Diesel Generator Industry Porters Five Forces Analysis

- China Diesel Generator Industry Growth Opportunities & Hotspots

- China Diesel Generator Industry Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Caterpillar Inc.

- Cummins

- AB Volvo Penta

- Perkins

- MTU Aero Engines

- Doosan Corporation

- Generac Holding Inc.

- Mitsubishi Corporation

- Scania

- FG Wilson

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making