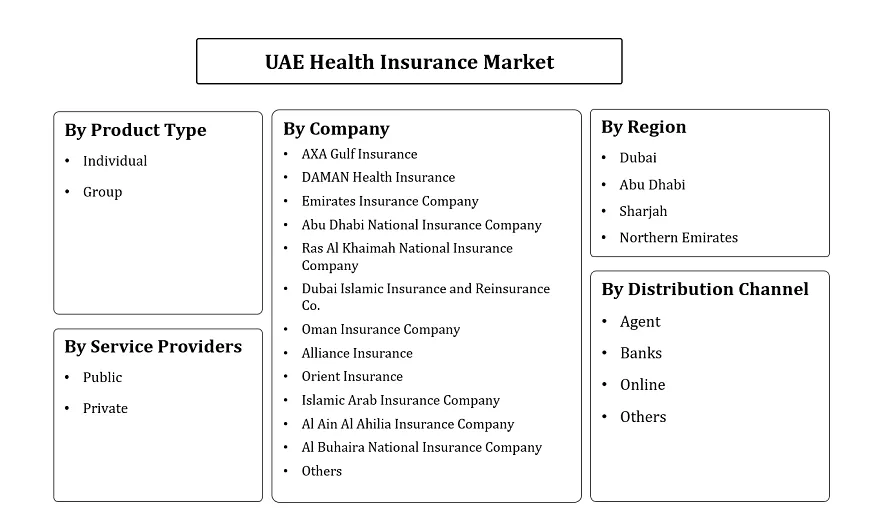

UAE Health Insurance Market Report - By Product Type (Individual, Group), By Service Providers (Public, Private), By Distribution Channel (Agent, Banks, Online) and Others ... Read more

- Healthcare

- Jan 2025

- 121

- PDF, Excel, PPT

Market Insights & Analysis: UAE Health Insurance Market (2025-30):

The UAE Health Insurance Market size was valued at around USD 8.7 billion in 2024 and is projected to reach USD 12.7 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.5% during the forecast period, i.e., 2025-30. Rapid expansion afflicts the market for health insurance in the UAE mostly due to shifting consumer demands, new technology adoption, and government regulations. The increasing demand for private health insurance is fueled by the country's growing population of expatriates who account for close to 88% of its total population.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 8.7 Billion |

| Market Value in 2030 | USD 12.7 Billion |

| CAGR (2025-30) | 6.5% |

| Top Key Players | AXA Gulf Insurance, DAMAN Health Insurance, Emirates Insurance Company, Abu Dhabi National Insurance Company, Ras Al Khaimah National Insurance Company, Dubai Islamic Insurance and Reinsurance Co, Oman Insurance Company, Alliance Insurance, Orient Insurance, Islamic Arab Insurance Company, Al Ain Al Ahilia Insurance Company, Al Buhaira National Insurance Company, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Residents are compelled to choose comprehensive insurance plans that offer extensive coverage due to rising healthcare costs exceeding USD 22 billion in 2024 in the UAE. Additionally, insurers are creating policies specifically designed for senior citizens and families in response to shifting demographics meeting the healthcare requirements of an aging population and dependents. In places like; Abu Dhabi and Dubai, the government requires coverage for foreigners and their dependents so employer-sponsored health insurance continues to dominate. As technology advances, the industry changes, and Artificial Intelligence (AI) is increasingly being utilized for transactions like; claims processing and fraud detection to achieve efficiency in the overall processing and increase transparency. AI adoption in health insurance can greatly increase customer satisfaction reducing processing time by 70% and cutting claim handling costs by almost 30%.

Moreover, value-added services' increasing popularity helps the market as well. Insurance plans are increasingly including wellness initiatives, fitness memberships, and mental health coverage as standard features reflecting a greater emphasis on overall health. To meet the needs of multicultural families in the United Arab Emirates, the trend toward family-centric and group health insurance packages is gaining traction. Furthermore, health insurance plans that are in line with medical tourism initiatives benefit both insured residents and visiting patients as the UAE's healthcare system draws in patients from abroad. All these elements make the UAE Health Insurance Market a flexible and dynamic sector with room to grow.

- Market Segmentation

- Research Methodology

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- UAE Health Insurance Market Trends & Development

- UAE Health Insurance Market Industry Dynamics

- Drivers

- Challenges

- UAE Health Insurance Market Hotspot & Opportunities

- UAE Health Insurance Market Policies, Regulations, Product Standards

- UAE Health Insurance Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Market Share & Analysis

- By Product Type

- Individual- Market Size & Forecast 2020-2030, USD Million

- Group - Market Size & Forecast 2020-2030, USD Million

- By Service Providers

- Public- Market Size & Forecast 2020-2030, USD Million

- Private- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel

- Agent - Market Size & Forecast 2020-2030, USD Million

- Banks - Market Size & Forecast 2020-2030, USD Million

- Online - Market Size & Forecast 2020-2030, USD Million

- Others - Market Size & Forecast 2020-2030, USD Million

- By Region

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates

- By Company

- Competition Characteristics

- Company Share & Analysis

- By Product Type

- Market Size & Analysis

- UAE Individual Health Insurance Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Providers - Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- UAE Group Health Insurance Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Providers - Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- UAE Health Insurance Market Key Strategic Imperatives for Growth & Success

- Competitive Outlook

- Company Profiles

- AXA Gulf Insurance

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DAMAN Health Insurance

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Emirates Insurance Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Abu Dhabi National Insurance Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ras Al Khaimah National Insurance Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dubai Islamic Insurance and Reinsurance Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oman Insurance Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Alliance Insurance

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Orient Insurance

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Islamic Arab Insurance Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Ain Al Ahilia Insurance Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Buhaira National Insurance Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- AXA Gulf Insurance

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making