Press Release Description

The UAE Port Automation Market to Outperform with the Expansion in Maritime Trade & Government Economic Growth Focus

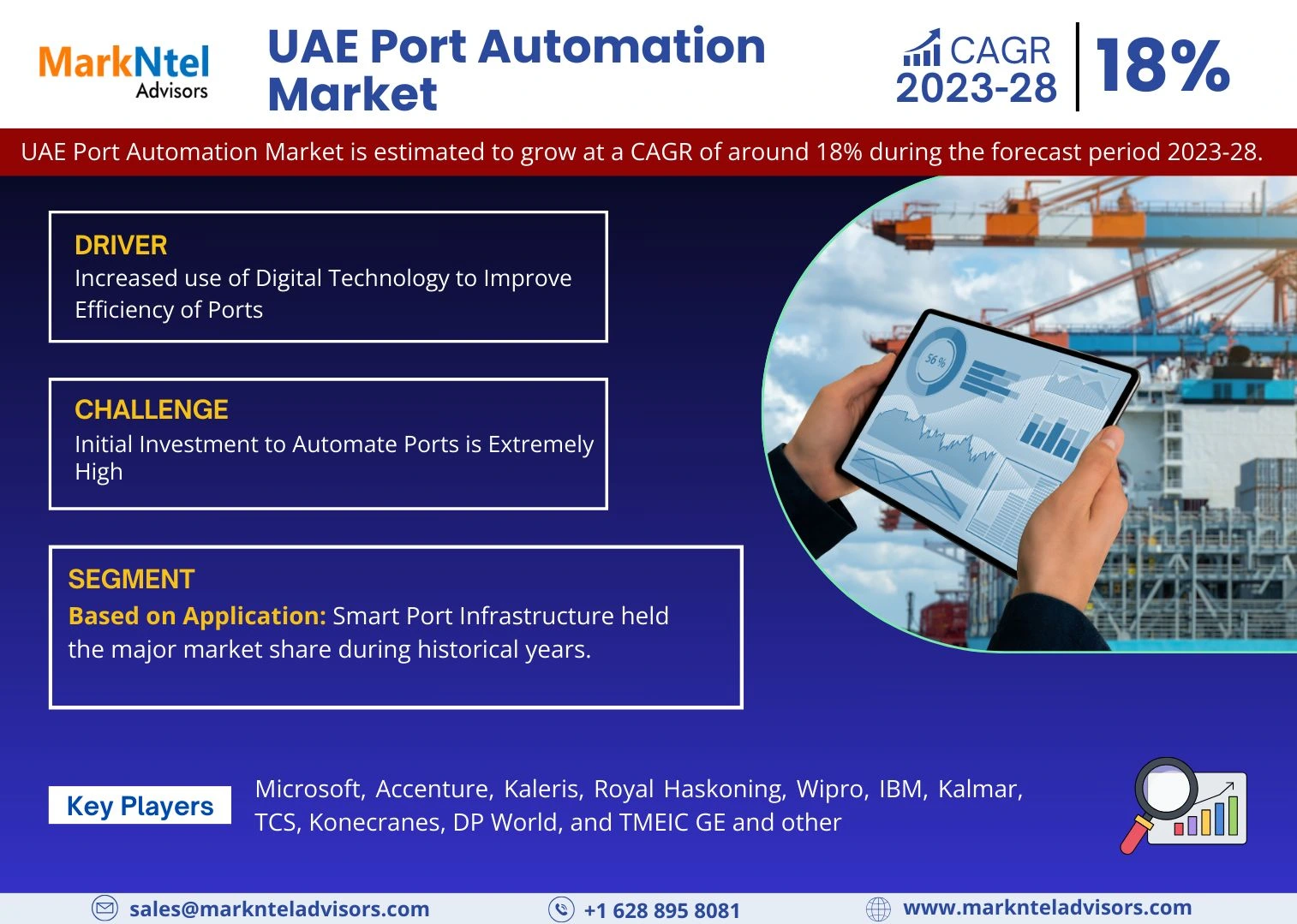

The UAE Port Automation Market is projected to grow at a CAGR of around 18% during the forecast period of 2023-28, cites MarkNtel Advisors in the recent research report. Some factors that have attributed to the growth were supplemented shipping & maritime traffic in the ports of the UAE, resulting in the enhanced need for capacity expansion as well as decreasing turnaround time. This increased traffic led to the stressed need for digitization of various activities such as security checks, verification, custom, immigration, handling, and movement of cargo in a timely manner for which the automatic entry/exit logs, verification, and docking payments automation has been implemented in multiple ports across the UAE.

Khalifa Port is one of the prime examples of the integration of port automation systems with offering such as port gate automation, remote control program, automated stacking cranes, terminal operating systems, auto rostering systems, etc. Numerous expansion plans are also being announced by the government, which would be crucial to the growing demand for port automation systems in the UAE during the forthcoming period. For instance:

- In 2022, the government of the UAE initiated the expansion of Port Khalifa with a total cost of around USD1.1 billion. The expansion plans are aimed at increasing the container handling capacity of the port from the existing 15 million TEUs to 25 million TEUs.

With the expansionary measures being taken by the government, the deployment of port automation systems is expected to grow in the coming years, subsequently improving the market growth in the forecast years, further states the research report, “The UAE Port Automation Market Analysis, 2023.”

Smart Port Infrastructure to Exhibit a Considerable Growth in the UAE Port Automation

Based on the application, the market is further bifurcated into Terminal Automation, Port Community Systems (PCS), Traffic Management Systems, Smart Port Infrastructure, Smart Safety & Security, and Others (Data Analytics & Optimization Solutions, Predictive Maintenance Systems, etc.). Amon, due to an increase in trade, which necessitates the management of seaport operations, as cargo volumes & vessel sizes have grown dramatically. As a result, ports have been developing smart infrastructure facilities to address different issues connected with processing huge volumes of cargo, managing rail & inland container depots, fleet management, and so on.

Furthermore, port authorities in collaboration with automation service providers such as Accenture, Wipro, Oracle, Microsoft, IBM, and others, have been equipping their ports with smart automated infrastructure solutions to address operational & managerial difficulties in recent years. This technology implementation in ports has augmented operational efficiency & streamlined all processes, which increased automation in port infrastructure & has driven demand for automation software in the past.

Additionally, the implementation of smart port infrastructure is expected to bring about several advantages, including the reduction of operational costs and the mitigation of errors. These benefits are anticipated to drive a substantial increase in demand for such advanced port solutions across various ports in the UAE from 2023 to 2028.

Dubai & Abu Dhabi Held the Major Position

Abu Dhabi & Dubai captured a sizable portion of the UAE Port Automation Market. This was primarily due to Dubai's huge number of container ports & the significant volume of container traffic at both Dubai & Abu Dhabi seaports. Because sea routes carry the majority of freight, Abu Dhabi & Dubai expanded & enhanced their seaports to manage the rising trade-related operations efficiently.

Furthermore, the operation of economic zones & logistics enterprises in the GCC region takes place primarily in Abu Dhabi due to its geographic advantage, which has also contributed to an increase in container size & cargo quantities, having a substantial impact on sea route operations. Also, the use of smart technological solutions assisted port authorities in improving their supply chain operations, improving productivity, lowering labor costs, reducing errors, etc., which has, in turn, supported the growth of the market in Abu Dhabi & Dubai in the historical years.

Furthermore, aligned with the UAE Vision 2021, the government is actively dedicated to fostering a digital economy powered by automated technologies & has been supporting their adoption across industries. This commitment is expected to drive the market growth of port automation systems in the country from 2023 to 2028.

Competitive Landscape

With strategic initiatives, such as mergers, collaborations, and acquisitions, the leading market players, including Microsoft, Accenture, Kaleris, Royal Haskoning, Wipro, IBM, Kalmar, TCS, Konecranes, DP World, and TMEIC GE, are looking forward to strengthening their market position.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the country?

- How has the industry been evolving in terms of geography & software adoption?

- How has the competition been shaping across the country?

- How has the buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2018-28?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

Place an order

USD 2,200

USD 2,950

USD 3,850

USD 4,950

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure