UAE Port Automation Market Research Report: Forecast (2023-2028)

By Platforms (Software, Services), By Throughput Capacity (Extensively Busy Port (More than 18 million TEU), Moderately Busy Port (5-10 million TEU), Scarcely Busy Ports (Less than... 5 million TEU)), By Solutions (Terminal Automation & Cargo Handling, Port Community System (PCS), Traffic Management System (Real Time Location System, Automated Information System, etc.), Smart Port Infrastructure (Automated Mooring system, Gate Automation, etc.), Smart Safety & Security, Others (Data Analytics and Optimization Solutions, Predictive Maintenance Systems, etc.)), By Connectivity (Bluetooth, Wireless LAN, Wi-Fi, IR, ZigBee, Others (RFID, LPWAN, etc.)), By Data Storage (Cloud, On Premise, Hybrid), By Region, (Dubai, Abu Dhabi & AI Ain, Sharjah & Northern Emirates), By Competitors (Microsoft, Accenture, Kaleris, Royal Haskoning, Wipro, IBM, Kalmar, TCS, Konecranes, DP World, and TMEIC GE) Read more

- ICT & Electronics

- Aug 2023

- Pages 132

- Report Format: PDF, Excel, PPT

Market Definition

Digital transformation is one of the solutions driving the ports to adopt advanced technologies in the maritime industry to reduce operational costs, reduce human errors, collect real-time data, & make data-driven decisions. Port automation improvises port infrastructure & techniques to handle large cargo amounts, ensure security & safety, manage container traffic, and reduce carbon emissions. This automated infrastructure provides highly reliable solutions & enhanced performance of port operations with a wide range of applications.

Market Insights & Projections: The UAE Port Automation Market (2023-28):

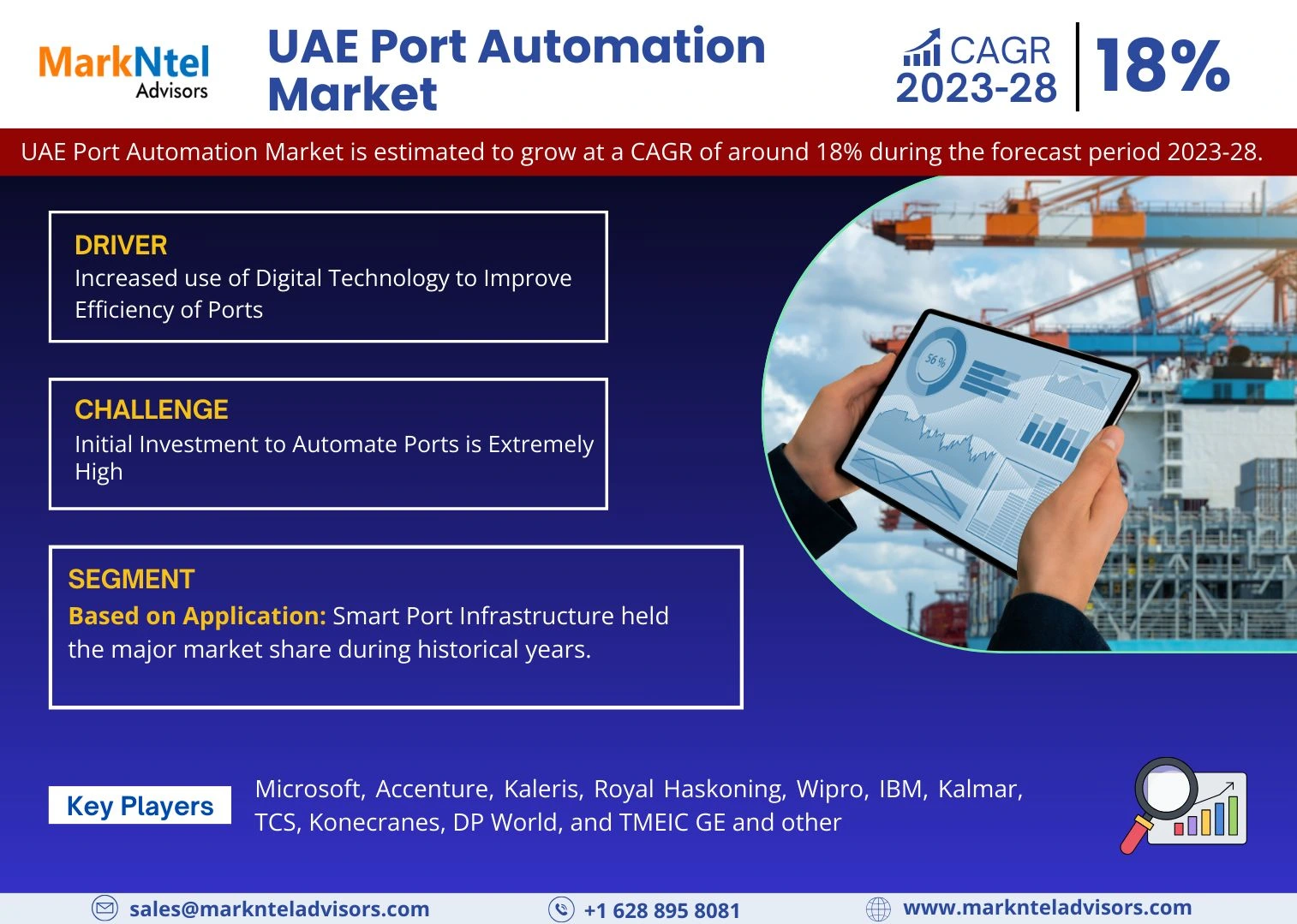

The UAE Port Automation Market is estimated to grow at a CAGR of around 18% during the forecast period, i.e., 2023-28. The growing complexity of port operations in the UAE has caused extensive diversification & intensification in the infrastructure & technology of ports. Accordingly, ports in the UAE have been integrating more technological & automated solutions like robotics, artificial intelligence, IoT, etc., to boost productivity. The adoption of digital technology has made ports more automated, with a connected supply chain & limited workforce to carry out operations. As a result, various investments are taking place in port automation to enhance the efficiency of seaports. For instance:

- In 2021, Abu Dhabi Ports Group & France-based CMA CGM Group signed a 35-year concession agreement with around USD153.9 million investments in the new terminal Khalifa Port, aiming to establish a semi-automated container port across the GCC region.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 18% |

| Region Covered | Dubai, Abu Dhabi, & AI Ain, Sharjah & Northern Emirates |

| Key Companies Profiled | Microsoft, Accenture, Kaleris, Royal Haskoning, Wipro, IBM, Kalmar, TCS, Konecranes, DP World, and TMEIC GE |

| Unit Denominations | USD Million/Billion |

In addition, the government-owned & privately-owned port companies have been collaborating with IT solutions providers to boost operational efficiency & provide solutions for continuous & smooth operations of cranes, vehicles, containers, Closed-Circuit Televisions (CCTVs), etc. These port automation systems transfer large amounts of data to the port control center & help personnel proactively report & resolve operational concerns in real-time. Due to this, port authorities have been actively integrating this technology & updating their systems to enhance efficiency, driving the demand for port automation in the country.

Further, as the UAE ports would also require continuous software upgrades, along with the continuously incoming new technologies, the demand for port automation across the nation would uplift in the coming years as well.

The UAE Port Automation Market Drivers:

Increased use of Digital Technology to Improve Efficiency of Ports – To create a competitive advantage ports have been looking for solutions to improve their productivity. In this, digital transformation is one of the solutions driving the ports to adopt digital technologies to reduce operational costs, minimize human error, collect real-time data, and make data-driven decisions. These benefits enhance the efficiency of port operations, thereby driving the market of port automation in the UAE.

Ports across the UAE have been strategically moving towards becoming the world’s foremost digitalized smart ports where the ports, such as DP World, Khalifa, Jebel Ali, etc., are gradually adopting security-enabling technologies like blockchain, IoT, and other automation platforms, which provide unique connectivity & efficiency. This integration of the technology in the port of the UAE has driven the demand for port automation software in the country.

Additionally, growing investment for the development of new ports & rising trade in the country associated with continuous updates required in the technology would present opportunities for the further adoption of digital port automation technologies & assist in the market growth in the coming years.

The UAE Port Automation Market Opportunities:

New Port Developments Propel Growth in Port Automation Services – The development of new ports in the UAE presents a substantial opportunity for companies providing port automation services. The construction & operational processes of these ports would require advanced automation systems, creating a favorable environment for service providers to offer their expertise. These new ports are being developed to boost business activities & enhance trade within the country. For instance:

- In 2021, ADNOC Logistics & Services (ADNOC L&S) & AD Ports Group signed an agreement to develop a new port & logistics facility at TA’ZIZ, an upcoming chemicals production & industrial hub in Ruwais, UAE. This collaboration highlights the efforts to establish state-of-the-art port facilities to support the growing needs of industries in the region.

As a result, the development of these new ports not only creates opportunities for automation service & software providers but also accelerates the overall market growth of port automation from 2023 to 2028. Service providers in this sector can leverage these opportunities to offer their solutions & contribute to the efficient functioning of the newly established port facilities.

The UAE Port Automation Market Challenges:

Initial Investment to Automate Ports is Extremely High – The high initial investment to automate port terminals is hampering the market growth of port automation in the UAE. The advanced technology necessitates substantial capital investment & time for integrating software services across the port. Activities such as tracking, security, and other operations, need to be seamlessly integrated, adding to the overall cost.

As a result, smaller ports often opt for semi-automated solutions as secondary support to manual labor, as they find it challenging to afford the expenses of full automation. This slower adoption of automated solutions in the UAE ports, compared to other sectors like mining & warehousing has been impeding the overall market growth of port automation in the UAE.

The UAE Port Automation Market Trends:

Integration of AI-based Tracking System – AI-based container tracking has been a growing trend in the field of port automation, and the ports of the UAE have embraced this technology to optimize their processes and gain a competitive edge in the market. Given that, a significant portion of the country's trade was conducted through maritime channels, a large volume of containers has been entering & leaving the ports daily. To effectively monitor & locate these containers, port authorities are increasingly integrating AI-based tracking systems. For instance:

- In 2021, Microsoft partnered with the Port Authority of UAE to deploy Microsoft Azure Cloud-based solutions, bolstering their artificial intelligence services at Khalifa Port. This collaboration facilitated the implementation of container smart tracking solutions driven by AI, enabling comprehensive container tracing & enhancing autonomous shuttle capabilities.

Therefore, as the integration of AI-based tracking systems has been rapidly gaining traction in the country, it has been fueling the demand for port automation software. By leveraging advanced technologies, the port authorities aim to streamline operations, improve efficiency, and provide seamless container tracking services. Also, to streamline operations, improve efficiency, and provide seamless container tracking services, the adoption of an AI-based tracking system is projected to increase in the coming years, which would drive the demand for port automation in the forecast years.

The UAE Port Automation Market (2023-28): Segmentation Analysis

The UAE Port Automation Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023-2028 at the UAE, regional, and national levels. Based on the analysis, the market has been further classified as:

Based on Application:

- Terminal Automation & Cargo Handling

- Port Community System (PCS)

- Traffic Management System

- Smart Port Infrastructure

- Smart Safety & Security

Smart Port Infrastructure held the major market share during historical years. This was primarily due to the upsurge in trade, in which management of seaport operations was required since cargo volumes & the sizes of vessels have been increasing significantly. In line with this, ports are implementing smart infrastructure facilities to deal with various concerns associated with handling large volumes of cargo, managing the rail & inland container depot, fleet management, etc.

Additionally, port authorities, in partnership with automation service provider companies like Accenture, Wipro, Oracle, Microsoft, IBM, etc., are furnishing their ports with smart automated solutions to deal with operational & managerial challenges.

Thus, the implementation of the technology in ports has enhanced operational efficiency & streamlined all the processes, which increased the automation of port infrastructure. Moreover, the benefits of smart port infrastructure by reducing the operational cost, and minimizing the error, are further estimated to enhance its demand across the UAE ports during 2023-28.

Based on Platform

- Software

- Asset Management

- Utility & Maintenance Management

- Infrastructure Management

- Property (Capital) Management

- Fleet Management System

- Terminal Operating System (Yard Management, Container Handling Equipment Management, Gate Management, Bookings, etc.)

- Services

- Managed

- Professional

In 2022, the Software segment emerged as the dominant force in the UAE Port Automation Market. The port authorities in the UAE have been actively seeking efficient port terminal solutions to optimize asset utilization & control terminal automation operations effectively. Ports regularly encounter various challenges, such as shipment handling, unreliable scheduling, inadequate cargo storage space, equipment shortages, climate changes, and limited storage areas.

To address these concerns, ports needed advanced automation systems for asset management, maintenance, secure data handling, and streamlined cargo movement. Therefore, the adoption of automated software solutions to enhance the overall functioning & productivity of port activities has amplified in the historical years. Also, the expansion of ports across the country coupled with the enhanced need for optimizing port functioning is expected to bolster the growth of the software segment in the UAE Port Automation Market in the coming years as well.

The UAE Port Automation Market (2023-28): Regional Analysis

Geographically, the UAE Port Automation Market expands across:

- Dubai

- Abu Dhabi & AI Ain

- Sharjah & Northern Emirates

Abu Dhabi & Dubai seized a substantial share of the UAE Port Automation Market during 2018-22. This was primarily due to the large number of container ports in Dubai & the high container traffic in both Dubai & Abu Dhabi seaports. With the majority of cargo transportation occurring through sea routes, both Abu Dhabi & Dubai had to expand & develop their seaports to manage the increasing trade-related activities efficiently.

Moreover, the operation of economic zones & logistics businesses in the GCC region occurs, mostly in Abu Dhabi, owing to its geographical advantage, which also contributed to the surge in container size & cargo volumes, leading to a significant impact on sea route operations. Thereby the adoption of smart technological solutions helped the port authorities to improve their supply chain operations, enhanced productivity, reduced labor costs, minimized errors, etc., thereby supporting the growth of port automation in Dubai & Abu Dhabi in recent years.

In addition, as per the UAE Vision 2021, the government is more devoted to developing a digital economy based on automated technologies & has been supporting the adoption of automation across various industries. Hence, the support of the government for the automation of countries' operations would assist the market growth of port automation systems in the country in 2023-2028.

The UAE Port Automation Industry Recent Development:

- 2023: DP World launched the first direct freight service between the UAE & Iraq to make the flow of goods between the two countries faster, safer, and more efficient.

- 2022: TMEIC acquired the ports & Terminals Division of Orbita Ingeniería, S.L. (Orbita) through its wholly owned subsidiary, TMEIC Port Technologies, S.L., to expand offerings to ports & terminals customers worldwide

Gain a Competitive Edge with Our UAE Port Automation Market Report

- The UAE Port Automation Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The UAE Port Automation Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

UAE Port Automation Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The UAE Port Automation Market Trends & Insights

- The UAE Port Automation Market Dynamics

- Drivers

- Challenges

- The UAE Port Automation Market Regulations, Policies, Product Benchmarks

- The UAE Port Automation Market Hotspot & Opportunities

- The UAE List of Ports with Planned Infrastructure Automation

- The UAE Port Automation Market Case Studies

- The UAE Port Automation Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Platforms

- Software- Market Size & Forecast 2018-2028F, USD Million

- Asset Management- Market Size & Forecast 2018-2028F, USD Million

- Utility & Maintenance Management- Market Size & Forecast 2018-2028F, USD Million

- Infrastructure Management- Market Size & Forecast 2018-2028F, USD Million

- Property (Capital) Management- Market Size & Forecast 2018-2028F, USD Million

- Fleet Management System- Market Size & Forecast 2018-2028F, USD Million

- Terminal Operating System (Yard Management, Container Handling Equipment Management, Gate Management, Bookings, etc.) - Market Size & Forecast 2018-2028F, USD Million

- Asset Management- Market Size & Forecast 2018-2028F, USD Million

- Services- Market Size & Forecast 2018-2028F, USD Million

- Managed- Market Size & Forecast 2018-2028F, USD Million

- Professional- Market Size & Forecast 2018-2028F, USD Million

- Software- Market Size & Forecast 2018-2028F, USD Million

- By Throughput Capacity

- Extensively Busy Port (More than 18 million TEU) - Market Size & Forecast 2018-2028F, USD Million

- Moderately Busy Port (5-10 million TEU) - Market Size & Forecast 2018-2028F, USD Million

- Scarcely Busy Ports (Less than 5 million TEU) - Market Size & Forecast 2018-2028F, USD Million

- By Solutions

- Terminal Automation & Cargo Handling- Market Size & Forecast 2018-2028F, USD Million

- Port Community System (PCS) - Market Size & Forecast 2018-2028F, USD Million

- Traffic Management System (Real Time Location System, Automated Information System, etc.) - Market Size & Forecast 2018-2028F, USD Million

- Smart Port Infrastructure (Automated Mooring system, Gate Automation, etc.)

- Smart Safety & Security- Market Size & Forecast 2018-2028F, USD Million

- Others (Data Analytics and Optimization Solutions, Predictive Maintenance Systems, etc.) - Market Size & Forecast 2018-2028F, USD Million

- By Connectivity

- Bluetooth - Market Size & Forecast 2018-2028F, USD Million

- Wireless LAN- Market Size & Forecast 2018-2028F, USD Million

- Wi-Fi- Market Size & Forecast 2018-2028F, USD Million

- IR- Market Size & Forecast 2018-2028F, USD Million

- ZigBee- Market Size & Forecast 2018-2028F, USD Million

- Others (RFID, LPWAN, etc.) - Market Size & Forecast 2018-2028F, USD Million

- By Data Storage

- Cloud- Market Size & Forecast 2018-2028F, USD Million

- On Premise- Market Size & Forecast 2018-2028F, USD Million

- Hybrid- Market Size & Forecast 2018-2028F, USD Million

- By Region

- Dubai

- Abu Dhabi & AI Ain

- Sharjah & Northern Emirates

- By Company

- Competition Characteristics

- Revenue Shares & Analysis

- By Platforms

- Market Size & Analysis

- The UAE Port Automation Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Microsoft

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Accenture

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kaleris

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Royal Haskoning

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Wipro

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- IBM

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kalmar

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TCS

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Konecranes

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DP World

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TMEIC GE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Microsoft

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making