Press Release Description

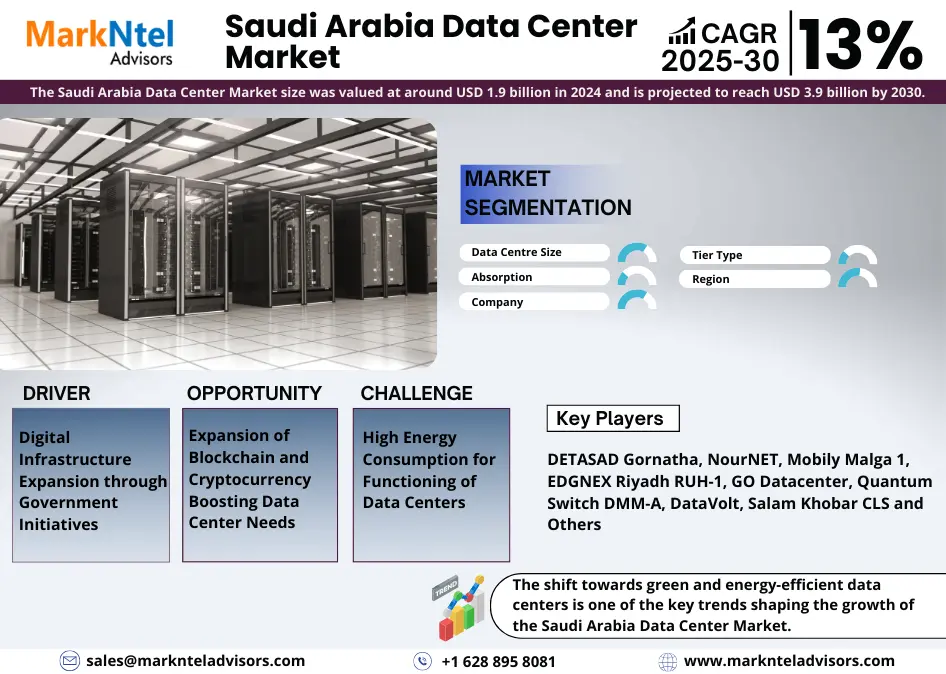

A USD 1.9 Billion Saudi Arabia Data Center Market to Surge at a CAGR of Around 13% During 2025-30

The Saudi Arabia Data Center Market size was valued at around USD 1.9 billion in 2024 and is projected to reach USD 3.9 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 13% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in the recent research report. Many factors are contributing significantly to the growth of the Data Center Market in Saudi Arabia, creating numerous opportunities and shaping emerging trends. The demand for cloud services is pushed by the shift to digital business models in specific industries. The increased use of cloud services by companies, because of their affordability, scalability, and accessibility, is fueling the demand for data centers. Moreover, the fast expansion of online enterprise has been important, with the rise in Online shopping and digital transactions necessitating strong data storage and processing competencies. The growing recognition of 5G networks has made it more essential to have data centers nearby because of the requirements of low-latency apps, ensuing within the advent of edge data centers.

Furthermore, the market for wholesale colocation services has significant potential, as major global cloud providers like; Amazon Web Services and Microsoft Azure are expanding their presence in this sector. Local companies can offer wholesale colocation to provide businesses with the extensive, secure, and adaptable infrastructure they require. Moreover, the strategic position of Saudi Arabia as a key entryway to the MENA region makes it an attractive choice for international businesses seeking data storage solutions. Another chance in edge computing is anticipated, where data centers are expected to be located farther away to accommodate 5G networks, IoT, and the need for local processing. Data centers will be vital in reducing latency as companies and consumers increasingly depend upon real-time data.

Additionally, the emphasis on reducing the country's carbon footprint offers data center operators the opportunity to adopt eco-friendly practices by using renewable energy. Integrating solar and wind energy into data center operations assists Saudi Arabia in reaching environmental goals and also improving energy efficiency and cost savings. Furthermore, there is a growing trend towards hyper-scale and mega data centers, particularly in urban locations like; Riyadh and Jeddah. These vast facilities are designed to address the growing demand for cloud services and big data analytics. Another growing trend is the shift towards utilizing both multi-cloud and hybrid cloud configurations, prompting businesses to seek flexible and scalable infrastructure solutions across different data centers, further states the research report, “Saudi Arabia Data Center Market Analysis, 2025”.

Segmentation Analysis:

Mega Segment Holds the Largest Market Share

Based on data center size, the market is further bifurcated into large, massive, medium, mega, and small. Several important factors are driving the prevalence of mega data centers, as they currently account for around 40% share of the total market. At first, their goal is to cater to the needs of huge cloud companies and agencies that require extensive infrastructure for cloud computing, big data analysis, and various digital services. The rise in cloud usage, particularly by leading firms like; Amazon Web Services (AWS) and Microsoft Azure, has resulted in a higher demand for hyper-scale data centers. These large-scale facilities can accommodate thousands of servers, providing exceptional scalability and flexibility.

Saudi Arabia's vision for 2030 and the rise of smart cities like NEOM demand extensive virtual infrastructure, such as large-scale data centers for serving IOT, AI, and other contemporary technologies. Moreover, the focus of the authorities on 5G networks and digital progress in sectors such as; finance, healthcare, and e-commerce is also adding to the demand for larger, more effective facilities.

Tier III is the Most Preferred Data Center Type

Tier III data centers dominate the Saudi Arabia Data Center Market with around 60% share due to their strong mix of reliability, scalability, and cost-efficiency. These amenities are created for excellent uptime using an N+1 duplicate setup, allowing for maintenance to occur seamlessly for crucial functions without downtime. Tier III data centers provide a strong choice for businesses in Saudi Arabia looking for reliable infrastructure for cloud services, e-commerce, and digital transformation. Tier III data centers cater to the increasing need for colocation services, meeting the requirements of businesses and cloud providers seeking secure, scalable, and environmentally friendly facilities. The increasing use of hybrid cloud and multi-cloud setups in Saudi Arabia is causing a rise in the need for Tier III, as they offer the perfect mix of performance, security, and cost-effectiveness in different sectors.

Competitive Landscape

With strategic initiatives such as mergers, collaborations, and acquisitions, the leading market companies, including DETASAD Gornatha, NourNET, Mobily Malga 1, EDGNEX Riyadh RUH-1, GO Datacenter, Quantum Switch DMM-A, Center3 Jeddah203, Gulf Data Hub KAUST 1, DataVolt, Salam Khobar CLS, Gateway Gulf DC Dammam, and others are looking forward to strengthening their market positions.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the country?

- How has the industry been evolving in terms of geography & solution adoption?

- What key factors would propel and impede the industry across the country?

- How have buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2020-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure