Saudi Arabia Data Center Market Research Report: Forecast (2025-2030)

Saudi Arabia Data Center Market Report - By Data Centre Size (Large, Massive, Medium, Mega, Small), By Tier Type (Tier I and II, Tier III, Tier IV), By Absorption (Non-Utilized, Ut...ilized, By Colocation Type By End User) and Others Read more

- ICT & Electronics

- Dec 2024

- Pages 97

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Saudi Arabia Data Center Market (2025-2030):

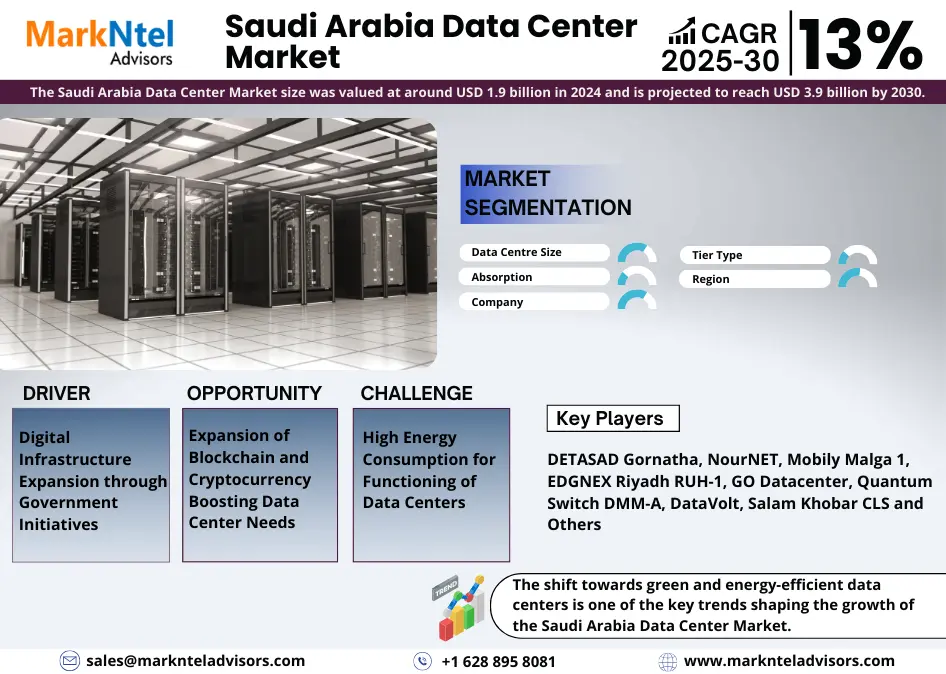

The Saudi Arabia Data Center Market size was valued at around USD 1.9 billion in 2024 and is projected to reach USD 3.9 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 13% during the forecast period, i.e., 2025-30. Numerous factors are playing a major role in enhancing Saudi Arabia's Data Center Market, presenting abundant prospects, and influencing new trends. The growing need for cloud services is being fueled by the transition to digital enterprise models throughout diverse sectors. Companies are relying more on cloud services because they are cost-effective, effortlessly scalable, and provide accessibility, driving the need for data facilities. Furthermore, the rapid growth of e-commerce has played a crucial role, as online purchasing and digital transactions have become more and more popular, leading to a need for robust data storage and processing capacities. The elevated adoption of 5G networks has heightened the necessity for close-by facts facilities due to the demands of low-latency applications, leading to the emergence of regional data centers.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 1.9 Billion |

| Market Value (2030) | USD 3.9 Billion |

| CAGR (2024-30) | 13% |

| Top Key Players | DETASAD Gornatha, NourNET, Mobily Malga 1, EDGNEX Riyadh RUH-1, GO Datacenter, Quantum Switch DMM-A, Center3 Jeddah203, Gulf Data Hub KAUST 1, DataVolt, Salam Khobar CLS, Gateway Gulf DC Dammam, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Moreover, there is considerable potential in the market for wholesale colocation services, with major global cloud providers such as; Amazon Web Services and Microsoft Azure actively growing their presence in the area. These businesses need extensive, secure, and adaptable infrastructure that can be provided by local companies through wholesale colocation. Additionally, Saudi Arabia's important location as a gateway to the Middle East and North Africa (MENA) region makes it a desirable center for global companies looking for data hosting options. Another opportunity exists in edge computing, with data centers predicted to spread out in more distant locations to cater to 5G networks, IoT, and local processing requirements. Edge data centers will play a vital role in reducing latency as businesses and consumers continue to depend more on real-time data.

Furthermore, the focus on reducing the country's carbon footprint provides data center operators with the chance to embrace more sustainable practices through renewable energy. Incorporating solar and wind power into data center activities supports Saudi Arabia's environmental objectives and enhances energy efficiency and cost-effectiveness. In addition, the shift towards hyper-scale and mega data centers is becoming more noticeable, especially in urban areas such as Riyadh and Jeddah. These extensive facilities are created to meet the increasing need for cloud services and big data analytics. Another emerging pattern is the move towards using multi-cloud and hybrid cloud setups, pushing companies to look for adaptable and expandable infrastructure options in various data centers.

Saudi Arabia Data Center Market Driver:

Digital Infrastructure Expansion through Government Initiatives – The growth of Saudi Arabia's data center industry is pushed by government initiatives and Vision 2030's attention on increasing digital infrastructure. The goal of Vision 2030 is to transform Saudi Arabia into a top global digital economy by enhancing its infrastructure and implementing current technologies. As an element of this, the Saudi government has pledged to invest in smart cities, cloud computing, and digital services, all of which rely greatly on strong data center infrastructure. It is predicted that the NEOM project, a modern smart city, will generate a large need for data centers with a high ability to fulfill its requirements for AI, IoT, and big data. Further to Vision 2030, the MCIT in Saudi Arabia is focusing on improving the nation's digital environment by encouraging digital transformation in sectors like finance, healthcare, and education. These kinds of initiatives are driving the demand for secure and reliable data centers.

Saudi Arabia Data Center Market Opportunity:

Expansion of Blockchain and Cryptocurrency Boosting Data Center Needs – The growth of blockchain and cryptocurrency offers a great opportunity for the Saudi Arabia Data Center Market. With the growing popularity of cryptocurrencies which include Bitcoin and Ethereum, there is a growing need for data storage, data processing, and secure transaction validation. Cryptocurrency mining requires a huge amount of computing energy, typically provided using data centers that have the most effective hardware. Bitcoin mining uses around 176.62 TWH of energy each year, with a huge part of this electricity utilization related to data centers that house mining operations.

Furthermore, blockchain technology is being more and more included in extraordinary industries including finance, healthcare, and logistics. This necessitates dependable, flexible, and safe infrastructure, resulting in a higher need for blockchain infrastructure. As the use of cryptocurrency trading and blockchain technology increases, there will be a rising need for data centers to accommodate these activities, leading to new prospects for providers in the nation.

Saudi Arabia Data Center Market Challenge:

High Energy Consumption for Functioning of Data Centers – One main obstacle in Saudi Arabia's data center industry is the large electricity usage and issues about sustainability. Data centers are acknowledged for their excessive electricity needs, particularly in places with harsh climates like Saudi Arabia, wherein cooling systems are necessary for ensuring perfect operational conditions. Data centers are using 20 MW to more than 100 MW of electricity per day as a large variety of systems and equipment runs relentlessly around the clock. Data centers can represent as much as 30% of the overall electricity usage in a country's ICT industry, with nearly 1/2 of this electricity being consumed by the cooling systems in these centers. Although renewable electricity assets like; solar electricity are accessible, Saudi data centers still rely heavily on traditional resources for their electricity blend, causing issues about the sustainability and environmental consequences of these centers.

Saudi Arabia Data Center Market Trend:

Shift Towards Green and Energy-Efficient Data Centers – A prime improvement in the data center industry in Saudi Arabia is the shift toward eco-friendly and electricity-saving data centers. Because the need for digital services grows, the significance of electricity-efficient operations will also increase, specifically due to the excessive electricity usage of traditional data centers. The Saudi Arabian government is prioritizing sustainability as a prime goal in Vision 2030, with a focus on growing electricity resources and decreasing carbon emissions. Furthermore, the usage of cutting-edge cooling methods like; liquid cooling and loose-air cooling systems is becoming more popular to lessen electricity consumption. This emphasis on sustainability is not just critical for environmental targets but also presents financial savings and enhanced efficiency. For instance,

- In April 2024, Swiss-developed data center technologies in Saudi Arabia are establishing higher levels of energy efficiency and security, enhancing the country's digital infrastructure. This partnership highlights the high quality of Swiss engineering and Saudi Arabia's dedication to innovative, environmentally friendly technology.

Saudi Arabia Data Center Market (2025-2030): Segmentation Analysis

The Saudi Arabia Data Center Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on the Data Center Size:

- Large

- Massive

- Medium

- Mega

- Small

Several key factors are leading to the dominance of mega data centers by capturing almost 40% of the entire market in Saudi Arabia. Cloud companies and agencies engaged in large infrastructure for cloud computing, big data analysis, and different digital services, need an optimum-sized data center to store & manage vital data, thus creating a demand for mega data centers as these can be much more useful compared to other forms of data centers. The increase in cloud utilization, mainly by major agencies including Amazon Web Services (AWS) And Microsoft Azure, has led to a greater need for hyper-scale data centers. These mega facilities can house tens of hundreds of servers, offering wonderful scalability and versatility. Saudi Arabia’s vision for 2030 and the emergence of smart cities like NEOM require large virtual infrastructure, which includes massive-scale data centers that cater to IOT, AI, and different modern technologies. Furthermore, the authorities’ emphasis on 5G networks and the digital advancement in areas together with finance, healthcare, and e-commerce are also contributing to the need for bigger, extra-efficient facilities.

Based on Tier Type:

- Tier I and II

- Tier III

- Tier IV

Tier III data centers account for around 60% share of the Saudi Arabia Data Center Market because they provide an excellent combination of reliability, scalability, and cost-efficiency. These centers are planned to ensure excessive availability through an N+1 redundancy setup, allowing for maintenance without any interruptions, which makes them appropriate for important applications. Tier III centers provide a strong solution for businesses in Saudi Arabia looking for reliable infrastructure for cloud services, e-commerce, and digital transformation. Tier III data centers also meet the increasing need for colocation services, serving enterprise clients and cloud providers seeking secure, scalable, and environmentally friendly facilities. The increased use of hybrid cloud and multi-cloud setups drives up the need for Tier III, as they offer the right mix of performance, security, and cost-effectiveness for many sectors in Saudi Arabia.

Saudi Arabia Data Center Industry Recent Development:

- October 2024: DataVolt, a data center developer located in Saudi Arabia, and Center3 have agreed to collaborate in providing data center maintenance and operations services throughout the country. United, the companies will use their resources and knowledge to strengthen trust, effectiveness, and creativity in data center management.

- July 2024: The Saudi Data and Artificial Intelligence Authority (SDAIA) announced a new data centers initiative in Riyadh. These projects aim to increase the efficiency and capacity of data centers in the area.

Gain a Competitive Edge with Our Saudi Arabia Data Center Market Report

- Saudi Arabia Data Center Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The Saudi Arabia Data Center Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Research Methodology

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Data Center Market Trends & Development

- Saudi Arabia Data Center Market Industry Dynamics

- Drivers

- Challenges

- Saudi Arabia Data Center Market Hotspot & Opportunities

- Saudi Arabia Data Center Market Policies, Regulations, Product Standards

- Saudi Arabia Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Data Centre Size

- Large - Market Size & Forecast 2020-2030F, USD Million

- Massive - Market Size & Forecast 2020-2030F, USD Million

- Medium - Market Size & Forecast 2020-2030F, USD Million

- Mega - Market Size & Forecast 2020-2030F, USD Million

- Small - Market Size & Forecast 2020-2030F, USD Million

- By Tier Type

- Tier I and II - Market Size & Forecast 2020-2030F, USD Million

- Tier III - Market Size & Forecast 2020-2030F, USD Million

- Tier IV - Market Size & Forecast 2020-2030F, USD Million

- By Absorption

- Non-Utilized - Market Size & Forecast 2020-2030F, USD Million

- Utilized - Market Size & Forecast 2020-2030F, USD Million

- By Colocation Type - Market Size & Forecast 2020-2030F, USD Million

- By End User - Market Size & Forecast 2020-2030F, USD Million

- By Region

- North

- South

- East

- West

- By Company

- Competition Characteristics

- Company Share & Analysis

- By Data Centre Size

- Market Size & Analysis

- Saudi Arabia Large Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Tier Type - Market Size & Forecast 2020-2030F, USD Million

- By Absorption - Market Size & Forecast 2020-2030F, USD Million

- Market Size & Analysis

- Saudi Arabia Massive Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Tier Type - Market Size & Forecast 2020-2030F, USD Million

- By Absorption - Market Size & Forecast 2020-2030F, USD Million

- Market Size & Analysis

- Saudi Arabia Medium Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Tier Type - Market Size & Forecast 2020-2030F, USD Million

- By Absorption - Market Size & Forecast 2020-2030F, USD Million

- Market Size & Analysis

- Saudi Arabia Mega Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Tier Type - Market Size & Forecast 2020-2030F, USD Million

- By Absorption - Market Size & Forecast 2020-2030F, USD Million

- Market Size & Analysis

- Saudi Arabia Small Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Tier Type - Market Size & Forecast 2020-2030F, USD Million

- By Absorption - Market Size & Forecast 2020-2030F, USD Million

- Market Size & Analysis

- Saudi Arabia Data Center Market Key Strategic Imperatives for Growth & Success

- Competitive Outlook

- Company Profiles

- DETASAD Gornatha

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- NourNET

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mobily Malga 1

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- EDGNEX Riyadh RUH-1

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- GO Datacenter

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Quantum Switch DMM-A

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Center3 Jeddah203

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gulf Data Hub KAUST 1

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DataVolt

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Salam Khobar CLS

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gateway Gulf DC Dammam

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- DETASAD Gornatha

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making