Press Release Description

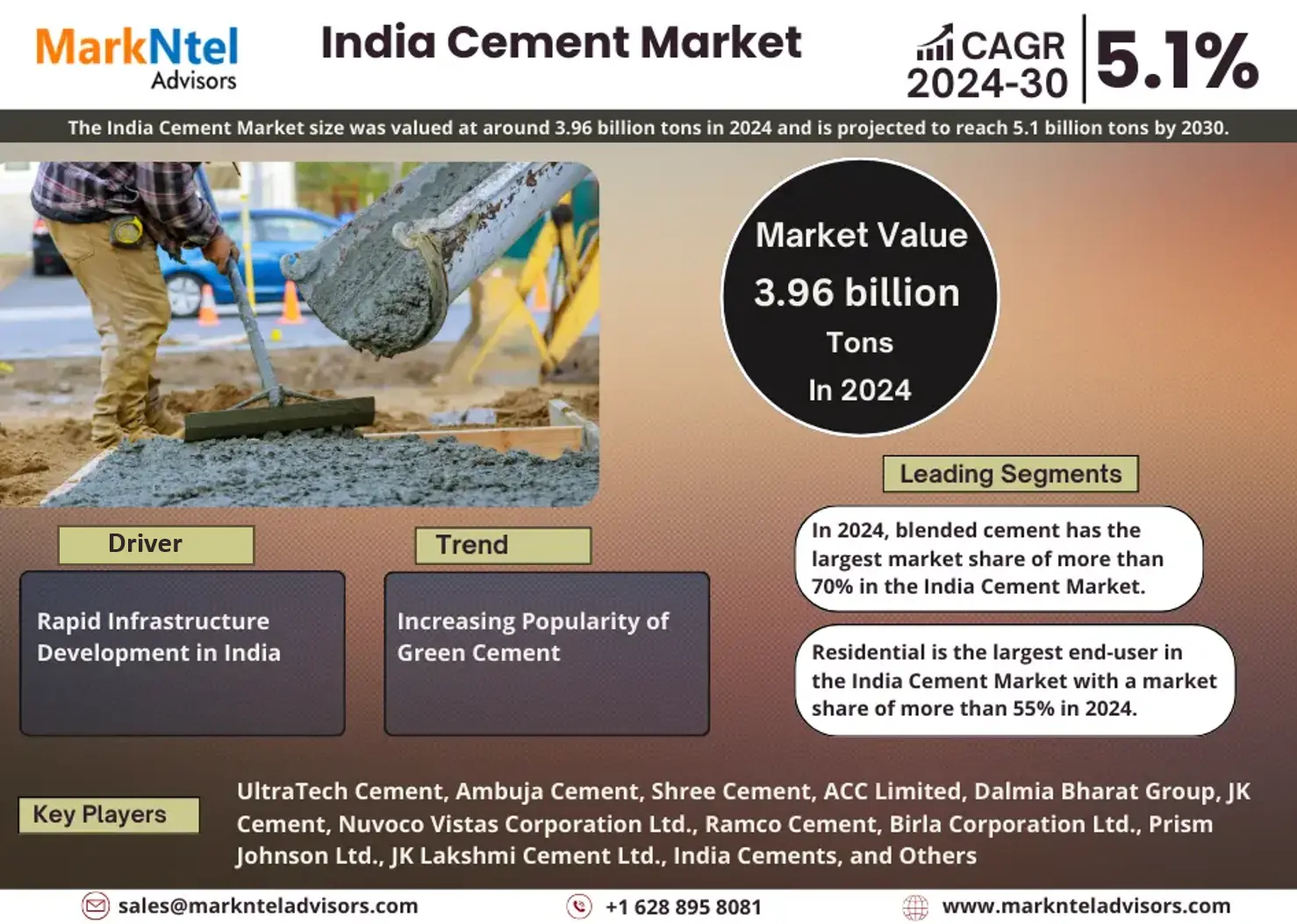

3.96 Billion Tons Indian Cement Industry to Witness a CAGR of Around 5.1% During 2025-30

The India Cement Market size was valued at around 3.96 billion tons in 2024 and is projected to reach 5.1 billion tons by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.1% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in the recent research report. This growth of the market is mainly supported by the expansion of end users of the cement industry in India. The increased expenditure of the Indian government for the expansion of the country's infrastructure gave a solid push to the growth in the market. The government plans to turn India into a developed country by 2047. This has resulted in programs like National Infrastructure Pipelines (NIP) and PM Gatishakti National Master Plan (NMP). The NIP has targeted investments of about USD1.3 trillion between the period 2020 to 2025, and NMP encompasses 15,928 projects under it as of 2024, with an approximate cost of USD2.4 trillion. Indian Government has allocated around USD132 billion for capital expenditure in the budget of FY25, which will further drive the cement market of India. Moreover, the expansion of the road network, in India is also going to open up a strong opportunity for the India Cement Market.

Since 2014, the network of national highways in the country has grown by 60% from 91,287 km to 1,46,145 km in 2024, as per the Road Transportation and Highways Ministry (MoRTH) of India. Roads which are the primary means of logistics and transportation in India have witnessed rapid expansion under the government program referred to as Project Bharatmala to fill the gaps in the national highways network and connect more regions to it to ensure seamless freight and passenger movement. The project's Phase-I involved the construction of 15,549 km of road till FY24, while the remaining 19,251 km of roads is expected to be completed by 2028. Development of such scenarios drives and provides a huge growth opportunity to the India Cement Market over the foreseeable future, further states the research report, "India Cement Market Analysis, 2025."

Segmentation Analysis

Residential Sector Holds the Largest Market Share

Based on the end users, the market is further bifurcated into, residential, infrastructure, commercial, and industrial. The residential segment holds more than 55% share in the market making it the biggest end-user segment in the market. This is mainly due to the housing is considered an essential requirement in India which leads to a healthy demand for cement in the country throughout the year. PM Awas Yojna (Gramin) was launched by the Indian government leading to 25.5 million houses being constructed by January 2024.

Moreover, the RBI’s data regarding credit outstanding for housing has surged substantially to around USD323.7 billion in March 2024 from USD 205.2 billion in March 2022. This highlights the strong demand for cement from the residential & housing sectors of India. Furthermore, as per GoI, under PM Awas Yojna (Gramin), 20 million affordable housing will be added in the next five years. This will provide a significant opportunity for growth in the cement market of India over the foreseeable future.

South India Leads the Industry

South India holds around 27% of the share in the India Cement Market. As per, the Cement Manufacturers Association, the region has an installed production capacity of cement of around 187.96 million tons in FY23. This is due to the presence of a large number of cement companies in the region which is different from Northern India. For example, as per ICRA report, in 2024, the top-5 players in the south have around 47% of the market share in the south’s total capacity in contrast to the top-5 players in the North holding 83% of the market share in the total capacity of the North, thus with a large number of players, opportunity for expansion and M&A is wide in South India.

Competitive Landscape

With strategic initiatives such as mergers, collaborations, and acquisitions, the leading market companies, including UltraTech Cement, Ambuja Cement, Shree Cement, ACC Limited, Dalmia Bharat Group, JK Cement, Nuvoco Vistas Corporation Ltd., Ramco Cement, Birla Corporation Ltd., Prism Johnson Ltd., JK Lakshmi Cement Ltd., India Cements, and Others are looking forward to strengthening their market positions.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the country?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping up across the country?

- How have buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2020-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure