Global Water and Wastewater Pumps Market Research Report: Forecast (2024-2030)

Water and Wastewater Pumps Market - By Pump Type (Centrifugal [End Suction, Split Case, Vertical], Submersible Pump, Positive Displacement [Progressing Cavity, Diaphragm, Gear Pump..., Others]), By End User (Industrial Water & Wastewater, Municipal Water & Wastewater) and others Read more

- FMCG

- Mar 2024

- Pages 198

- Report Format: PDF, Excel, PPT

Market Definition

Water & wastewater pumps play a critical role in ensuring the effective & efficient movement of fluids through various stages of water treatment & wastewater treatment processes. These pumps are specifically designed to handle the often complex & demanding requirements of treating water & wastewater, which could include the presence of solids, chemicals, varying viscosities, and other contaminants.

Market Insights & Analysis: Global Water & Wastewater Pumps Market (2024-30):

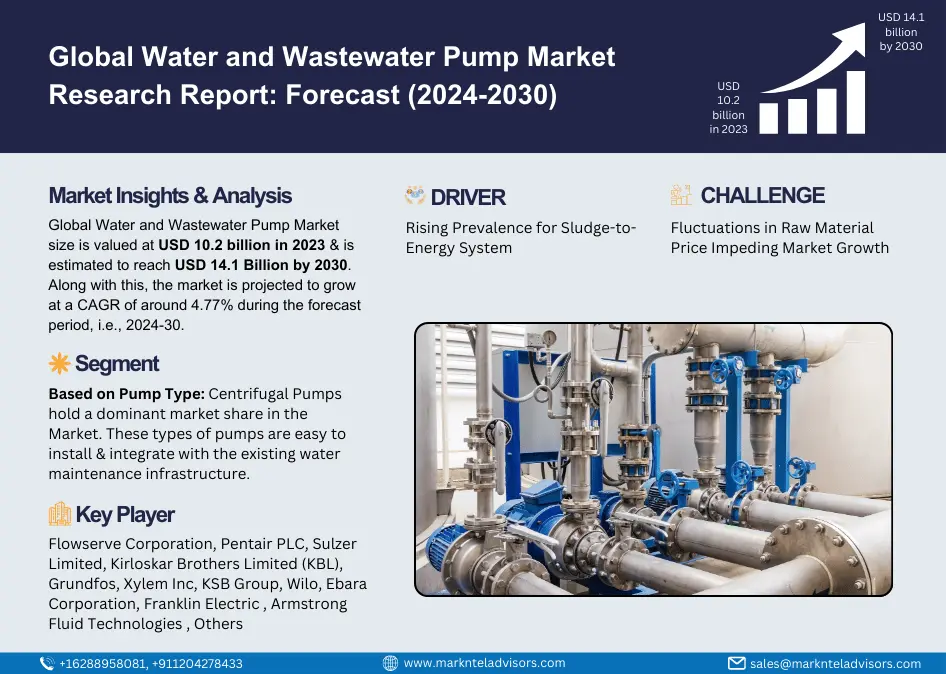

The Global Water & Wastewater Pumps Market size is valued at USD 10.2 billion in 2023 & is estimated to reach USD 14.1 billion by 2030. Along with this, the market is projected to grow at a CAGR of around 4.77% during the forecast period, i.e., 2024-30. The industry growth imputes to the growing clean water demand, technological advancement, widening oil & gas industry, and rapid urbanization globally. According to the United Nations Environment Program (UNEP) 2023, around 6 billion consumers would face water scarcity by 2050 due to climate change, pollution, and increasingly unsustainable consumption & production.

Degradation & loss of land fertility, and associated natural habitats & biodiversity are other such threats. To overcome these challenges government & private entities in India, the European Union, China, Japan, etc., are increasingly investing in the water & wastewater treatment infrastructures in recent years. As a result, there has been a noticeable surge in demand for a wide range of pumps designed to facilitate various treatment processes. This upswing in demand has fueled substantial growth within the water & wastewater pumps.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 4.77% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia & New Zealand, Southeast Asia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Chile, Peru, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Qatar, Rest of MEA | |

| Key Companies Profiled | Flowserve Corporation, Pentair PLC, Sulzer Limited, Kirloskar Brothers Limited (KBL), Grundfos, Xylem Inc, KSB Group, Wilo, Ebara Corporation, Franklin Electric , Armstrong Fluid Technologies , Others |

| Market Value (2023) | USD 10.2 Billion |

| Market Value (2030) | USD 14.1 Billion |

Additionally, almost 380 billion m3 of municipal wastewater is generated globally and wastewater production is expected to increase by 24% in 2030, as per UNICEF. Therefore, the administrative authorities of nations, such as the US, India, etc., are undertaking active measures to treat the generated wastewater, eventually increasing the requirement for water & wastewater pumps across the Globe.

Furthermore, governments across the globe are increasingly implementing stringent regulations to control the quality of pre-treated wastewater to fight the growing water pollution. Around 2 billion individuals (26% of the population) do not have safe drinking water, and around 3.6 billion (46%) lack access to safely managed sanitation, as per UNESCO. These indicators raised concerns among the national governments to compact water pollution in various ways, including stringent water quality rules. As a result, there are growing regulations and policies introduced by countries such as India, China, the UK, Germany, etc.

Consequently, these stringent standards are expected to create a heightened demand for cutting-edge, high-efficiency, and regulation-compliant pumping solutions, thus contributing to enhancing the Water and Wastewater Pump Market share in the coming years.

Global Water & Wastewater Pumps Market Opportunity:

Rising Prevalence for Sludge-to-Energy System – The rapid shift towards sustainable energy solutions and efficient wastewater management, owing to climate change mitigation, energy security, urban development & liability, etc., presents a promising opportunity for the Water and Wastewater Pump Market in the forecast period. The growing focus on sustainable energy solutions and wastewater management is resulting in the development of new technologies like the Sludge-to-Energy system, which converts sewage sludge into biogas by pre-treating sewage sludge with thermal hydrolysis.

This technology is expected to play a crucial role in addressing environmental concerns, such as energy demand, emissions, and waste management. As a result, it is gaining traction in developed and developing nations like the US, China, Brazil, and Norway, thus driving the Water & Wastewater Pumps Market.

Global Water & Wastewater Pumps Market Challenge:

Fluctuations in Raw Material Price – In recent years, there have been instabilities in the prices of raw materials, such as metals, plastics, and electronic components used in pump manufacturing. The alteration in prices directly, negatively impacts the overall cost of pumps, making them inaccessible to the end-users with financial constraints. Additionally, the spike in prices of steel due to the destruction of steel production facilities in Ukraine and soaring energy costs have led to widespread plant idling and production stoppages, especially in Europe. This collapse in steel production makes it challenging for pump manufacturers to maintain stable pricing & profitability.

According to the president of Kovai Power Driven Pumps and Spares' Manufacturers (KOPMA), around 3000 small-scale pump manufacturing units are functioning in Coimbatore, out of which approximately 50% of small manufacturing units are under heavy financial crisis since they are unable to compete with big players on pricing. Therefore, several water pump manufacturers in countries, like India, and others, are either closing down their manufacturing units or increasing the cost of the water pumps to sustain in the market, hence negatively impacting the Water and Wastewater Pump Market growth.

Global Water & Wastewater Pumps Market Trend:

Increasing Adoption of Technology-based Water Pumps – In recent years, end-user industries have been shifting towards sustainability and seeking ways to optimize water and energy usage in their operations. Along with this, the industries are signing Corporate Social Responsibility (CSR) agreements to reduce energy & resource wastage. As a result, various industry verticals are actively integrating pumps, based on techniques like Zero Liquid Discharge (ZLD) to enable adequate water management. Hence, this inclination has led water & wastewater pump manufacturers to integrate sustainable technologies like anaerobic digestion, variable frequency drive, anti-clog impeller, etc., into their pumps in recent years.

Moreover, top companies like Xylem, Grundfos, Sulzer, etc., are increasingly amalgamating digital technologies, industrial analytics, and IoTs into pump systems, which are transforming water & wastewater treatment processes across the globe. Furthermore, smart pumps equipped with sensors provide real-time data, enabling predictive maintenance, optimizing pump performance, and enhancing overall operational efficiency. Also, digital integration aligns with efficiency & sustainability trends and would drive the adoption of advanced pump systems, further fueling the Water & Wastewater Pump Market growth in forthcoming periods.

Global Water & Wastewater Pumps Market (2024-30): Segmentation Analysis

The Global Water & Wastewater Pumps Market study by MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2030 at the global level. As per the analysis, the market has been further classified as:

Based on Pump Type:

- Centrifugal

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Centrifugal Pumps holds a dominant share in the Global Water Pump Market. These types of pumps are easy to install & integrate with the existing water maintenance infrastructure. Along with this, they are designed using fewer components. As a result, the centrifugal pumps are relatively easier to maintain rather than the positive displacement pumps, thus supporting their market growth.

This water pump operates efficiently, even at a wide range of flow rates and pressures. This, in turn, often results in lower energy consumption, consequently, attracting both large-scale as well as small-scale industries to count on this type of pump. Furthermore, their physical properties help in providing a consistent and reliable flow, which is crucial for many industrial processes.

Based on End Users:

- Industrial Water & Wastewater

- Municipal Water & Wastewater

The Municipal Water & Wastewater segment accounts for the potential share in the Global Water & Wastewater Pumps Market. Municipalities typically operate large-scale wastewater treatment plants and networks of sewer systems to treat the wastewater collected and disposed of by residential, commercial, and industrial. These treatment plants require robust pumping systems for efficiently conveying wastewater from households and businesses to treatment facilities, ensuring public health and environmental protection. This, in turn, is enhancing the market share of the municipalities in the Global Water & Wastewater Pumps Industry.

Global Water & Wastewater Pumps Market (2024-30): Regional Projection

Geographically, the Global Water & Wastewater Pumps Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Asia-Pacific region would capture the largest share of the Water and Wastewater Pump Market in the upcoming years. This is attributed to the growing adoption of decentralized wastewater treatment systems, rising public-private partnerships (PPS), and increasing industrialization within the region. The countries within the region have been witnessing growth in the funds' allocation for upgrading the water waste management infrastructure. Along with this, the market players across the region are partnering with the official authorities to install the pumps at the municipal wastewater treatment plants. Also, the companies are providing technical expertise & innovative product ranges to increase the adoption of these pumps.

Furthermore, these collaborative efforts by both private & public entities have led to the construction & expansion of new localized water treatment plants, which would continue to support the Asia-Pacific Water & Wastewater Pumps Market growth.

Global Water & Wastewater Pump Industry Recent Development:

- 2023: Sulzer Pump Solutions Inc., announced its plans to expand operation in Pickens County, the US, with a total investment of around USD 5.3 million.

- 2023: Grundfos acquired Metasphere, a smart sewer solution provider, to strengthen its product portfolio and to provide its global municipal customers with even more product offerings.

Gain a Competitive Edge with Our Global Water & Wastewater Pumps Market Report

- Global Water & Wastewater Pumps Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Water & Wastewater Pumps Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Water & Wastewater Pumps Market Trends & Developments

- Global Water & Wastewater Pumps Market Dynamics

- Growth Drivers

- Challenges

- Global Water & Wastewater Pumps Market Hotspot & Opportunities

- Global Water & Wastewater Pumps Market Regulations and Policies

- Global Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type

- Centrifugal – Market Size & Analysis 2019-2030F, (USD Million)

- End Suction – Market Size & Analysis 2019-2030F, (USD Million)

- Split Case – Market Size & Analysis 2019-2030F, (USD Million)

- Vertical – Market Size & Analysis 2019-2030F, (USD Million)

- Turbine – Market Size & Analysis 2019-2030F, (USD Million)

- Axial Pump – Market Size & Analysis 2019-2030F, (USD Million)

- Mixed Flow Pump – Market Size & Analysis 2019-2030F, (USD Million)

- Submersible Pump – Market Size & Analysis 2019-2030F, (USD Million)

- Positive Displacement – Market Size & Analysis 2019-2030F, (USD Million)

- Progressing Cavity – Market Size & Analysis 2019-2030F, (USD Million)

- Diaphragm – Market Size & Analysis 2019-2030F, (USD Million)

- Gear Pump – Market Size & Analysis 2019-2030F, (USD Million)

- Others – Market Size & Analysis 2019-2030F, (USD Million)

- Centrifugal – Market Size & Analysis 2019-2030F, (USD Million)

- By End User

- Industrial Water & Wastewater – Market Size & Analysis 2019-2030F, (USD Million)

- Municipal Water & Wastewater – Market Size & Analysis 2019-2030F, (USD Million)

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Pump Type

- Market Size & Analysis

- Global Municipal Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type

- By Region

- By Application

- Water

- Wastewater

- Market Size & Analysis

- Global Industrial Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type

- By Region

- By Application

- Water

- Wastewater

- Market Size & Analysis

- North America Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- By Application – Market Size & Analysis 2019-2030F, (USD Million)

- By Country

- The US

- Canada

- Mexico

- The US Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Canada Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Mexico Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- South America Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- By Application – Market Size & Analysis 2019-2030F, (USD Million)

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Argentina Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Europe Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- By Application – Market Size & Analysis 2019-2030F, (USD Million)

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Poland

- Rest of Europe

- Germany Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- The UK Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- France Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Spain Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Italy Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Poland Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- By Application – Market Size & Analysis 2019-2030F, (USD Million)

- By Country

- Saudi Arabia

- The UAE

- Egypt

- Nigeria

- South Africa

- Rest of The Middle East & Africa

- By Competition

- Saudi Arabia Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- The UAE Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Egypt Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Nigeria Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- South Africa Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type– Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- By Application – Market Size & Analysis 2019-2030F, (USD Million)

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia-Pacific

- China Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- India Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Japan Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- South Korea Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Australia Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Indonesia Water & Wastewater Pumps Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Pump Type – Market Size & Analysis 2019-2030F, (USD Million)

- By End User – Market Size & Analysis 2019-2030F, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Global Water & Wastewater Pumps Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Flowserve Corporation

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Pentair PLC

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Sulzer Limited

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Kirloskar Brothers Limited (KBL)

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Grundfos

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Xylem Inc

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- KSB Group

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Wilo

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Ebara Corporation

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Franklin Electric

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Armstrong Fluid Technologies

- Business Description

- Product Segment

- Financials

- Strategic Alliances/Partnerships

- Future Plans

- Others

- Others

- Flowserve Corporation

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making