Vietnam Cloud Gaming Market Research Report: Forecast (2025-2030)

Vietnam Cloud Gaming Market Size - By Components (Cloud Gaming Platforms, Cloud Gaming Content Services), By Type (File Streaming, Video Streaming), By Operating Model B2B, B2C), B...y Device (Smartphones, Tablets, Gaming Consoles, PCs & Laptops, Smart TVs, Head Mounted Displays), By Gamer Type (Casual Gamers, Avid Gamers, Lifestyle Gamers) and others Read more

- ICT & Electronics

- May 2025

- Pages 130

- Report Format: PDF, Excel, PPT

Market Definition

Cloud games refer to games on demand that allow users to play games on various devices, including smartphones, tablets, personal computers, and laptops, and others, without needing powerful hardware. This type of game runs with the help of a server in data centers, and videos are streamed to the user’s device using the internet.

Market Insights & Analysis: Vietnam Cloud Gaming Market (2025-30):

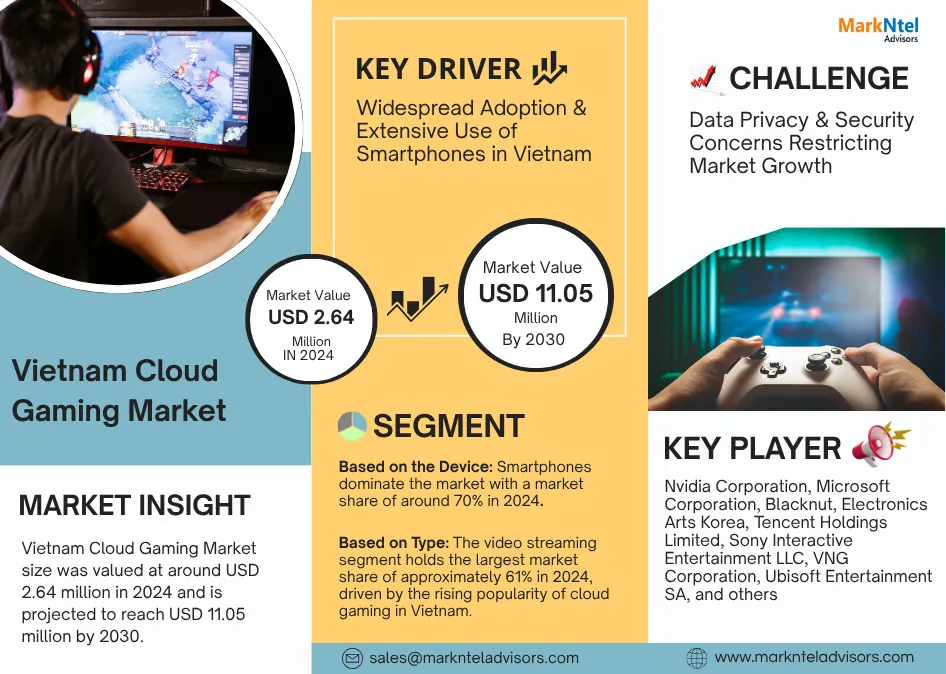

The Vietnam Cloud Gaming Market size was valued at around USD 2.64 million in 2024 and is projected to reach USD 11.05 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 22.60% during the forecast period, i.e., 2025-30. Vietnam is one of the fastest-growing markets for cloud gaming in Southeast Asia. The cloud gaming market in the country is mainly driven by factors including the expanding mobile gaming sector, government support to boost the gaming sector, increasing game developer interest, incorporation of 5G connectivity in the country, among others.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 2.64 million |

| Market Value by 2030 | USD 11.05 million |

| CAGR (2025–30) | 22.60% |

| Top Key Players | Nvidia Corporation, Microsoft Corporation, Blacknut, Electronics Arts Korea, Tencent Holdings Limited, Sony Interactive Entertainment LLC, VNG Corporation, Ubisoft Entertainment SA, and others |

| Segmentation | By Components (Cloud Gaming Platforms, Cloud Gaming Content Services), By Type (File Streaming, Video Streaming), By Operating Model B2B, B2C), By Device (Smartphones, Tablets, Gaming Consoles, PCs & Laptops, Smart TVs, Head Mounted Displays), By Gamer Type (Casual Gamers, Avid Gamers, Lifestyle Gamers) and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

In recent years, the country has observed the launch of 5G connectivity by several telecom companies like Viettel, VNPT, and MobiFone. For instance, the Viettel company launched commercial 5G connectivity, available to the general public. It currently has 6,500 BTS stations, covering all 63 provincial capitals. The company’s 5G network provides speeds between 700 Mbps and 1 Gbps, about ten times faster than 4G, which is enabling smooth cloud game access to users. Furthermore, approximately 80% of games played in Vietnam are developed by international companies, mostly from China and Korea. Vietnam has a huge young population highly involved in electronic gaming, which is encouraging international players to collaborate with local developers to form a robust presence in the country. Thus, the nation is recording higher foreign investment in the cloud gaming market.

The government of the country is also aiming to boost its gaming industry due to the increasing pool of gaming talent in the country. The government once decided to impose a luxury tax on gaming later decided not to impose any luxury taxes on games. They not only excluded games from the list of industries subject to the luxury tax, but have also requested the Ministry of Information and Communications (MIC) to design a strategy to develop the game industry with tax incentives.

Also in 2023, the Ministry of Information and Communications (MIC) collaborated with educational institutions like the Posts and Telecommunications Institute of Technology (PTIT) to offer training in the game industry. MIC is also cooperating with many organizations and units to run media campaigns to eliminate preconceptions about the gaming industry, that it is not addictive, but an industry that can create huge profits for the country. Additionally, they are also applying effective measures to restrict the side effects of games in the country, aiming to boost the gaming industry, including cloud games.

Vietnam Cloud Gaming Market Driver:

Widespread Adoption & Extensive Use of Smartphones in Vietnam – The country is observing widespread adoption of smartphones, which is the major factor driving the cloud gaming market in Vietnam. In 2025, 90% of Vietnamese people have a mobile broadband subscription, and most of them are smartphone users. Similarly, according to the Ministry of Information and Communications, in 2024, Vietnam's internet usage rate is projected to hit 78.1%, while subscriptions for both fixed and mobile broadband have seen a significant rise in the same year. This figure depicts that smartphone use as well as internet penetration is rising in the country in areas including both urban and rural.

As cloud gaming is completely dependent on internet speed and is played on devices like smartphones, this increase in smartphone usage is providing platforms to cloud gamers, enabling them to play cloud games, supporting the cloud gaming market growth in the country.

Vietnam Cloud Gaming Market Opportunity:

Deployment of AI Technology in Cloud Games – The deployment of AI technology into the cloud gaming market presents a significant opportunity for players to innovate and capitalize on emerging technologies. For example, at CES 2025, Dead Meat was shown running in real-time on a GeForce RTX 50 Series GPU, generating dialogue locally for the very first time. The addition of Artificial Intelligence into cloud gaming allows gameplay innovation, along with enhancing server performance and user experience. Companies are encouraged by the benefits of integrating AI in cloud gaming and, therefore, focus on developing AI-integrated products.

Moreover, the Vietnamese Government is also supporting the development of AI by offering collaboration opportunities to private players for funding and other expansion objectives. In 2024, NVIDIA signed an agreement with the Vietnamese government to establish its new Vietnam Research and Development Center focused on AI. The company is going to use the R&D center to focus on software development, capitalizing on the country’s strong talent pool of STEM engineers, and to engage industry leaders, startups, government agencies, universities, and students to accelerate the adoption of AI. This shift toward AI-enhanced gaming experiences creates a wealth of opportunities for businesses and developers looking to tap into the future of cloud gaming.

Vietnam Cloud Gaming Market Challenge:

Data Privacy & Security Concerns Restricting Market Growth – As cloud gaming platforms handle sensitive user data, concerns over data privacy and cybersecurity are heightened. The country is considered the most cyber-attacked nations in Southeast Asia. As per the Vietnam Cyber Security Summary Report, in 2023, the nation encountered more than 13,900 cyberattacks, with the data reaching a cumulative 83,000 in the past five years. Among them, the most vulnerable industries included the financial, energy, and tech sectors. Such threats are resulting in increased cybersecurity laws, which in turn, make it challenging for the market players to expand their products in the country.

The Cloud Gaming Market in Vietnam is completely captured by foreign entities. The local players are still unable to tap the market potential, due to which most of the foreign game developers are ruling the cloud gaming industry. However, ensuring compliance with local data protection laws and maintaining user trust are ongoing challenges. Ensuring compliance with relevant regulations that are being developed frequently, owing to data security concerns, keeps the market from growing to its full potential. For instance, Vietnam is going to bring into effect a new data security law, “Law on Data”, in July 2025. The law aims to govern digital content-related activities alongside the existing Personal Data Protection Decree (PDPD).

Additionally, addressing piracy concerns related to data privacy and protecting intellectual property rights is complex and time-consuming. Therefore, data security issues are causing difficulty in achieving consumers’ trust, and various regulations are hindering the expansion of foreign cloud gaming players. This will eventually restrict the market growth in the forecasted period.

Vietnam Cloud Gaming Market Trend:

Collaboration Between Global and Local Companies – International cloud gaming companies like Nvidia GeForce Now and Xbox Cloud Gaming are making partnerships with local developers and service providers in the country. This is enabling global players to enhance their presence and deliver localized content in cloud games. For instance, in 2023, NVIDIA Corporation introduced NVIDIA ACE, which is a suite of RTX-accelerated digital human technologies that bring game characters to life with AI generators. The company is partnering with leading game developers Wemade Next Co., Ltd., to incorporate its ACE autonomous game characters into their titles. Moreover, it is also providing local cloud games developers access to advanced gaming technology.

Owing to such collaborations, the country’s foreign investments are also increasing, contributing to the nation’s economy. This will also result in more government financial support for the local companies to enhance the domestic cloud gaming market.

Moreover, the telecom companies are also collaborating with other international cloud gaming service providers that are providing access to cloud gaming to the users in Vietnam. Thus, this partnership between the companies in Vietnam would support the market growth in the coming years.

Vietnam Cloud Gaming Market (2025-30): Segmentation Analysis

The Vietnam Cloud Gaming Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the country level. Based on the analysis, the market has been further classified as:

By Type:

- File Streaming

- Video Streaming

The video streaming segment dominates the market with a market share of around 61% in 2024 because this type of streaming in cloud gaming has been growing in popularity in Vietnam. Gamers are accessing a variety of cloud gaming platforms that allow them to stream high-quality games without needing powerful local hardware. Video streaming allows immediate visualization of games, without any need to download the file.

This factor associated with video games is also helping users in making their smartphones' internal space available for the storage of other important things, rather than storing the games in it. This is because a large population of cloud game users in the country are playing games through smartphones. As Video streaming bypasses these storage issues and provides seamless access to games, video streaming is expected to grow further in Vietnam with improving internet speeds in the country.

By Device:

- Smartphones

- Tablets

- Gaming Consoles

- PCs & Laptops

- Smart TVs

- Head Mounted Displays

Among all the segments under the device category, the Smartphones segment dominates the market with a market share of around 70% in 2024. The country has a majority of the lower and middle-income groups. As per IFAD, in 2023, more than 30 million people, or one-third of the population, were living close to the poverty line. Thus, buying high-performance gaming PCs or consoles is expensive for the majority of the Vietnamese population. Smartphones are more affordable, offering a cost-effective option for accessing high-quality cloud gaming content.

Additionally, various smartphone companies like Samsung, Oppo, Apple, Xiaomi, and others are offering phones with EMI options, making it easier for gaming enthusiasts to purchase their desired devices. The smartphone penetration has reached to level where over 85% of the population has a smartphone in 2024. Moreover, the transition of internet connection to 4G and 5G has smoothed the cloud gaming experience on smartphones, owing to reduced latency and faster operations. These qualities associated with smartphones are projected to support the market growth.

Vietnam Cloud Gaming Industry Recent Development:

- 2023: MobiFone, a telecommunication company, partnered with Radian ARC and Blacknut company to launch a cloud gaming platform for tablets, smartphones, and PCs. The games were accessible via Radian Arc’s AMD-based GPU Edge technology and Blacknut’s streaming technology, which utilizes MobiFone’s 4G and 5G network coverage.

- 2023: Google Cloud and VNG Games collaborated in the year 2023. The VNG Games harness Google Cloud's infrastructure to revolutionize the real-time player's experience, which would help in the growth of cloud games in the country.

Gain a Competitive Edge with Our Vietnam Cloud Gaming Market Report

- Vietnam Cloud Gaming Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Vietnam Cloud Gaming Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumptions

- Executive Summary

- Vietnam Cloud Gaming Market Trends & Developments

- Vietnam Cloud Gaming Market Dynamics

- Growth Drivers

- Challenges

- Vietnam Cloud Gaming Market Hotspots & Opportunities

- Vietnam Cloud Gaming Market Policies & Regulations

- Vietnam Cloud Gaming Market Outlook, 2020-2030F

- Market Size & Analysis

- Revenues (USD Million)

- Market Share & Analysis

- By Components

- Cloud Gaming Platforms- Market Size & Forecast 2020-2030F, (USD Million)

- Cloud Gaming Content Services- Market Size & Forecast 2020-2030F, (USD Million)

- By Type

- File Streaming- Market Size & Forecast 2020-2030F, (USD Million)

- Video Streaming- Market Size & Forecast 2020-2030F, (USD Million)

- By Operating Model

- B2B- Market Size & Forecast 2020-2030F, (USD Million)

- B2C- Market Size & Forecast 2020-2030F, (USD Million)

- By Device

- Smartphones- Market Size & Forecast 2020-2030F, (USD Million)

- Tablets- Market Size & Forecast 2020-2030F, (USD Million)

- Gaming Consoles- Market Size & Forecast 2020-2030F, (USD Million)

- PCs & Laptops- Market Size & Forecast 2020-2030F, (USD Million)

- Smart TVs- Market Size & Forecast 2020-2030F, (USD Million)

- Head Mounted Displays- Market Size & Forecast 2020-2030F, (USD Million)

- By Gamer Type

- Casual Gamers- Market Size & Forecast 2020-2030F, (USD Million)

- Avid Gamers- Market Size & Forecast 2020-2030F, (USD Million)

- Lifestyle Gamers- Market Size & Forecast 2020-2030F, (USD Million)

- By Company

- Market Share

- Competition Characteristics

- By Components

- Market Size & Analysis

- Vietnam Cloud Gaming Platforms Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030F, (USD Million)

- By Operating Model- Market Size & Forecast 2020-2030F, (USD Million)

- By Device- Market Size & Forecast 2020-2030F, (USD Million)

- By Gamer Type- Market Size & Forecast 2020-2030F, (USD Million)

- Market Size & Analysis

- Vietnam Cloud Gaming Content Service Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030F, (USD Million)

- By Operating Model- Market Size & Forecast 2020-2030F, (USD Million)

- By Device- Market Size & Forecast 2020-2030F, (USD Million)

- By Gamer Type- Market Size & Forecast 2020-2030F, (USD Million)

- Market Size & Analysis

- Vietnam Cloud Gaming Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Nvidia Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Microsoft Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Blacknut

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Electronics Art Korea

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tencent Holdings Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sony Interactive Entertainment LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- VNG Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ubisoft Entertainment SA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Nvidia Corporation

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making