US Online Exam Proctoring Market Research Report: Forecast (2025-2030)

US Online Exam Proctoring Market - By Solution (Live-Online Proctoring, Automated Proctoring, Hybrid Proctoring), By End User (Academic Institutions [Schools, Collages/Universities...], Certification & Licensure Programs [Professional Certifications, IT Certifications, Licensing Exams], Corporates [Recruitment, Training & Upskilling], Government) and others Read more

- ICT & Electronics

- Nov 2024

- Pages 131

- Report Format: PDF, Excel, PPT

Market Definition

Online exam proctoring also called remote exam proctoring is a technological solution for conducting exams online. The online exams will either use the software installed into the assessment taker's system or provide an API or cloud-based integration to the assessment owners who can integrate it into its system and applications. These exams are monitored by a proctor who observes the whole process to ensure no malpractice is involved during the online exam. This proctor would either be a human who will do the live monitoring an advanced AI that looks for patterns or a hybrid which is a combination of both.

Market Insights & Analysis: US Online Exam Proctoring Market (2025-30):

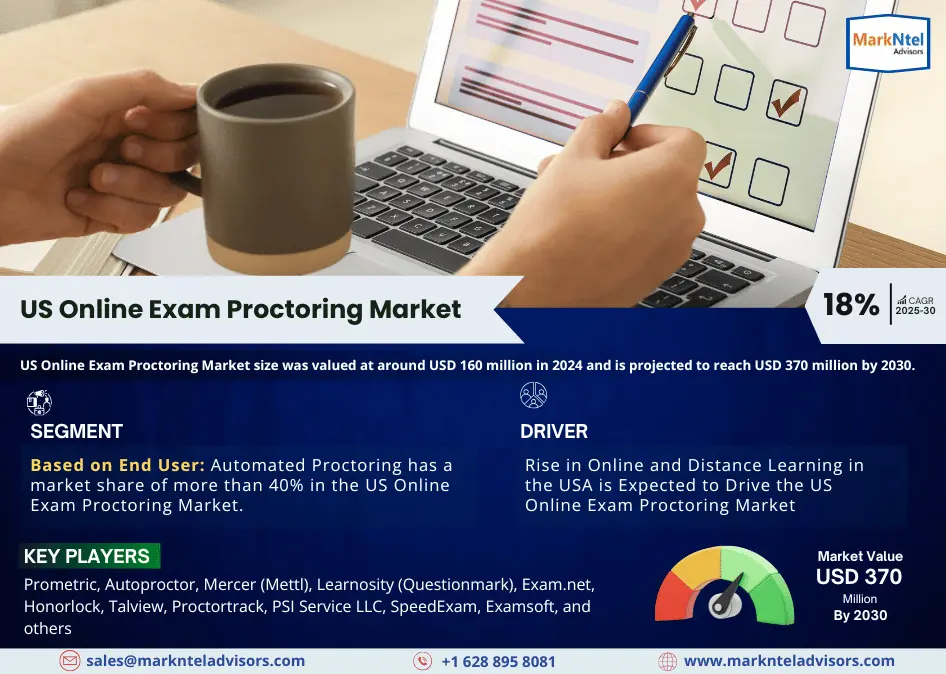

The US Online Exam Proctoring Market size was valued at around USD 160 million in 2024 and is projected to reach USD 370 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 18% during the forecast period, i.e., 2025-30. This growth in the market is attributed to the increasing adoption of online and distance learning in the United States (US). The growth in online and distance learning is driven by convenience and is relatively less expensive than pursuing a degree through traditional means. This trend has led universities in the US to offer online programs for various courses. These developments resulted in more than half of the 18.9 million enrolled students studying in a distance format in 2022-23 according to the National Center for Education Statistics (NCES).

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 160 Million |

| Market Value in 2030 | USD 370 Million |

| CAGR (2025-30) | 18% |

| Top Key Players | Prometric, Autoproctor, Mercer (Mettl), Learnosity (Questionmark), Exam.net, Honorlock, Talview, Proctortrack, PSI Service LLC, SpeedExam, Examsoft, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Additionally, in the US there is rapid deployment and adoption of new technologies leading to the evolution of industry dynamics in the country. The employees and new graduates are expected to have an adequate understanding of the latest technologies like artificial intelligence, data analytics, etc. This has driven the growth, particularly in IT certification. Majorly, these examinations are proctored which is a necessity for certification requirements. Furthermore, various licensing exams in the US such as CFA, Bar, US Medical Licensing Examination, etc. involve various stages of online proctored examination.

Apart from this, the NCES is deploying the National Assessment of Educational Progress (NAEP) which will change the way, assessments are held in K-12 classrooms, transitioning from pen and paper to digital assessments. Such development is mandatory for today’s generation “Alpha” which is a digital native. In 2024, most of the classrooms in the US are equipped with computers, tablets, and digital learning tools. These developments will augment the size & volume of the US Online Exam Proctoring Market over the forecasted period.

US Online Exam Proctoring Market Driver:

Rise in Online and Distance Learning in the USA – The online exam proctoring industry in the United States (US) is rapidly growing. This growth is driven by the massive boom in online and distance learning education in the USA. As per National Center for Education Statistics (NCES) data, enrolment numbers in higher education in classroom mode have declined by around five percent between 2019-20 to 2022-23. During the same period, enrolment of students in higher education in distance learning formats has risen by more than 30%. The majority of them are from the four-year undergraduate program. One crucial factor that also boosted the growth in digital enrolments is expensive learning cost of colleges and universities.

This is to the point that in the USA as of 2024 the student debt stands at over USD 1.7 trillion according to the US government's estimates. Therefore, online and distance learning provides an attractive model for education that is affordable and flexible. Furthermore, the increasing online and distance education would require the students to complete their fair assessment, free from any malpractices that secure the integrity of the examination. This is driving the demand for online proctoring solutions in the US. Apart from this, there is a significant increase in the enrolled college students, studying in any form of distance format to the overall enrolment in colleges. According to the NCES, the students studying in distance format made up around 36% in 2019-20 have risen to more than 50% in 2022-23. This highlights a growing momentum of online and distance learning in the USA thereby leading to a healthy demand for online exam proctoring over the foreseeable future.

US Online Exam Proctoring Market Opportunity:

Rising Demand for IT Certifications Presents Growth Opportunities – The rapid technological advancements and fast adoptions of technologies such as artificial intelligence (AI), data analytics, machine learning, etc., present growth prospects to the US Online Exam Proctoring Market. The primary reason attributed to this is the increasing requirement for IT professionals in the US. This job profile involves Data Scientists, Information & Security Analysts, and computer & information research scientists according to the US Bureau of Labor & Statistics (US BLS). These profiles are estimated to surge by more than 26% from 2023 to 2033. The individuals and professionals looking to make their careers in these fields will need to upskill themselves and acquire relevant certifications in the technologies used in these domains. These scenarios will lead to a surge in the demand for online exam-proctoring solutions that ensure the integrity of the examination necessary to provide IT certifications.

US Online Exam Proctoring Market Challenge:

Rising Cyber-Attacks and Data Breaches – Data breach is a major challenge for the online exam proctoring market in the US. The remote proctoring exams require individuals to keep their microphones and webcam of their system to remain open during the time of the examinations. During this, a lot of information about the test takers such as their identities, biometrics, images, videos, and recordings gets collected. These data are vulnerable to the rising cyber-attacks in the US particularly in the Education sector of the country. In 2024, Microsoft stated that schools and universities are facing soaring malware and phishing attacks with around 43% of higher education institutes facing these cyber threats weekly. For instance,

- In June 2024, Learnosity (Questionmark) an e-learning platform that also provides online exam proctoring solutions issued a notification about the phishing cybersecurity threat it faced.

US Online Exam Proctoring Market Trend:

Introduction of Virtual Reality in Online Assessment – It is observed that companies in the online exam proctoring market of the US are looking at numerous ways to differentiate their products and services. The integration of simulation with remote proctored examination and assessment is one such developing trend. For instance,

- In April 2024, Prometric announced its partnership with Mursion a leading simulation provider for evaluating workplace skills, to introduce virtual reality into online assessments.

Bringing in virtual reality in the assessment process will allow candidates to test their skills in a more immersive and realistic environment. These assessment solutions are important in corporates for workforce assessment for training and recruitment purposes, particularly for examining sales, communication, and leadership skills.

US Online Exam Proctoring Market (2025-30): Segmentation Analysis

The US Online Exam Proctoring Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on End User:

- Academic Institutions

- Schools

- Colleges & Universities

- Certifications & Licensure Programs

- Profession Certifications

- IT Certifications

- Licensing Exams

- Corporates

- Recruitment

- Training & upskilling

- Government

Academic institutions have the largest market share of more than 50%. This is largely due to the academic institutions in the USA being the first to adopt online education and assessment during the lockdown phase. Furthermore, the number of students enrolling in some or other form of distance learning is rapidly rising. According to the National Center for Education Statistics (NCES), the number of students enrolling exclusively in distance education institutions stood at around 432,954 in 2019-20. These enrolments have seen a rise of around 20% by 2022-23, increasing the number of students pursuing their education exclusively from distance learning institutions to 520,525.

Furthermore, NCES reports that the number of students enrolling exclusively in distance learning courses was 3,009,246 in 2019-20. These numbers have seen a jump of 46%, raising the number of enrolments to 4,397,534 in 2022-23. This highlights the escalating allure of distance learning in the USA. As these trends continue, they will fuel the demand for online exam-proctoring solutions over the foreseeable future.

Based on Solution:

- Live-Online Proctoring

- Automated Proctoring

- Hybrid Proctoring

In 2024, Automated Proctoring has a market share of more than 40% in the US Online Exam Proctoring Market. This is mainly due to the increasing penetration of online exam proctoring in the United States and the exam takers having the option to opt for an assessment at their preferred time schedule. This makes automated proctoring a convenient solution that can easily deployed. It uses artificial intelligence to assess the examinee in real time and record and flag any malpractices to ensure the integrity of the examinations. AI can increase the efficiency of flag detection by raising its accuracy to more than 95%.

Apart from this, the growing shortage of teachers in the US is also a key driver. For instance, in 2022, the Annenberg Institute at Brown University in the USA found that an estimated 55,000 full-time teaching positions in the USA were vacant, which has been a growing problem. Additionally, during the 2023-24, 45% of public schools reported that they were understaffed according to the NCES. This is because only 18% of US citizens want young people to become K-12 teachers, according to the survey conducted by the University of Chicago in 2022. These scenarios make automated proctoring a preferred choice for conducting online exam proctoring in the US.

US Online Exam Proctoring Industry Recent Development:

- September 2024: Honorlock has deployed its online exam-proctored solution on the learning management platform (LMS) of one of the leading training & learning programs providers, Docebo.

- July 2024: Prometric has announced that it has acquired EdPower, a cloud-based solution provider for the K-12 market.

Gain a Competitive Edge with Our US Online Exam Proctoring Market Report

- US Online Exam Proctoring Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- US Online Exam Proctoring Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- US Online Exam Proctoring Market Start-up Ecosystem

- Year of Establishment

- Amount Raised (USD Million)

- Series of Fund Raise

- Purpose of Fund Raise

- Investors Involved

- US Online Exam Proctoring Market Trends & Development

- US Online Exam Proctoring Market Dynamics

- Drivers

- Challenges

- US Online Exam Proctoring Market Policies & Regulations

- US Online Exam Proctoring Market Hotspot & Opportunities

- US Online Exam Proctoring Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Solution

- Live-Online Proctoring- Market Size & Forecast 2020-2030, USD Million

- Automated Proctoring- Market Size & Forecast 2020-2030, USD Million

- Hybrid Proctoring- Market Size & Forecast 2020-2030, USD Million

- By End User

- Academic Institutions

- Schools- Market Size & Forecast 2020-2030, USD Million

- Collages/Universities- Market Size & Forecast 2020-2030, USD Million

- Certification & Licensure Programs

- Professional Certifications- Market Size & Forecast 2020-2030, USD Million

- IT Certifications- Market Size & Forecast 2020-2030, USD Million

- Licensing Exams- Market Size & Forecast 2020-2030, USD Million

- Corporates

- Recruitment- Market Size & Forecast 2020-2030, USD Million

- Training & Upskilling- Market Size & Forecast 2020-2030, USD Million

- Government- Market Size & Forecast 2020-2030, USD Million

- Academic Institutions

- By Region

- North-East

- Mid-West

- West

- South

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Solution

- Market Size & Analysis

- US Online Exam Proctoring Market Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- Prometric

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Autoproctor

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mercer (Mettl)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Learnosity (Questionmark)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Exam.net

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Honorlock

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Talview

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Proctortrack

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PSI Service LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SpeedExam

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ExamSoft

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Prometric

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making