The US Contact Lenses Market Research Report: Forecast (2023-2028)

By Material Type (Soft Contact Lenses (Silicone Hydrogel, Hydrogel), Hard Contact Lenses (Rigid Gas-Permeable Lenses (RGP), Polymethyl Methacrylate (PMMA), Hybrid Contact Lenses)),... By Design (Spherical, Toric, Multifocal, Others (Monovision, Color lenses, etc.)), By Usability (Reusable, Disposable), By Application (Cosmetics, Corrective, Others (Prosthetic, Orthokeratology, etc.)) By Sales Channel (Offline (Optical Stores, Hospital & Clinics, Others (Pharmacies, Beauty Centres, etc.)), Online (Company-owned Portals, E-commerce Platforms), By Region (North-East, Mid-West, West, South), By Company (Alcon Laboratories Inc., Bausch + Lomb, Carl Zeiss AG, CIBA Vision, Contamac US Inc., CooperVision, Essilor of America, Inc., Hydrogel Vision Corp., Johnson & Johnson, Microport Scientific Corporation, Others) Read more

- FMCG

- May 2023

- Pages 89

- Report Format: PDF, Excel, PPT

Market Definition

Contact lenses are small, curved lenses that are worn over the eye. These are generally made to correct refractive flaws and keep eyes healthy, but they are also used in prosthetics, cosmetics, and other fields. Additionally, despite being inherently clear, these are frequently given a tiny bit of color to make them easier for users to handle. These are made of materials that are easily fixed with water in the eye, such as silicone hydrogel and hydrogel.

Market Insights & Analysis: The US Contact Lenses Market (2023-28)

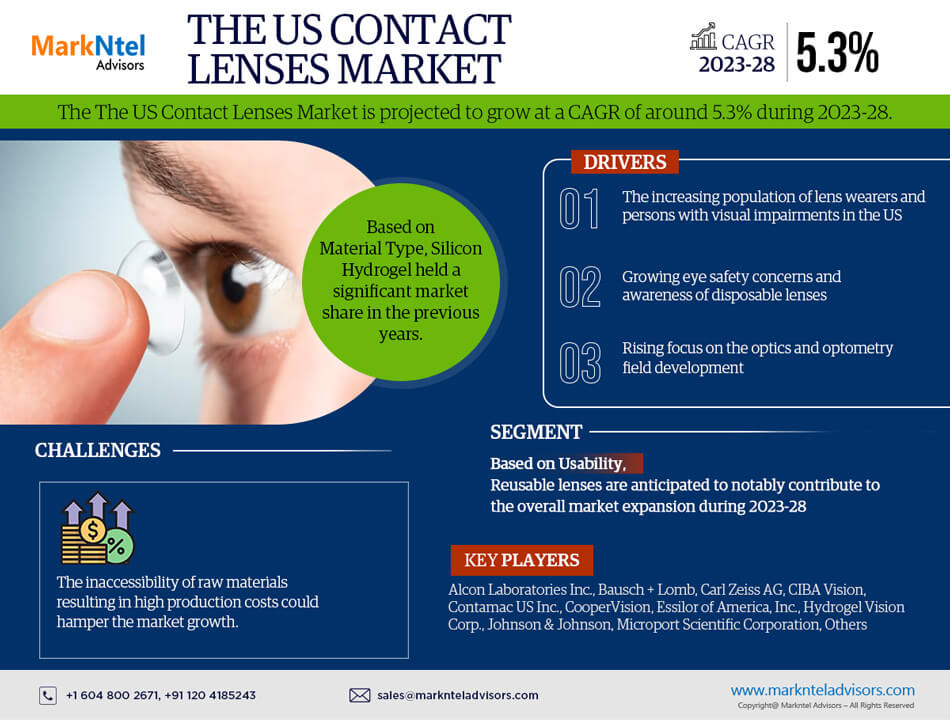

The US Contact Lenses Market is projected to grow at a CAGR of around 5.3% during the forecast period, i.e., 2023-28. Most of the market expansion attributes to the rapidly growing focus on the optics and optometry field development in the historical period. The demand for contact lenses in USA is increasing as the number of persons with visual impairments rises. For those with visual impairments, contact lenses ensure accurate visualization. The market for contact lenses in United States of America is expanding as a result of factors including the rising demand for these precise and practical lenses, individual's interest in sports, and lenses that provide excellent visual clarity for wearers.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 5.3% |

| Region Covered | North East, Mid-West, West, South |

| Key Companies Profiled | Alcon Laboratories Inc., Bausch + Lomb, Carl Zeiss AG, CIBA Vision, Contamac US Inc., CooperVision, Essilor of America, Inc., Hydrogel Vision Corp., Johnson & Johnson, Microport Scientific Corporation, Others |

| Unit Denominations | USD Million/Billion |

Moreover, numerous businesses in the US draw customers to the contact lens market. The US government supports R&D facilities to increase innovation in the contact lens market. Besides, with notable young and middle-aged US consumers alongside more than 30000 optometrists in active practice, the market is likely to accelerate in the coming years. Further, the United States market is booming due to rising consumer awareness of various contact lenses, alongside the rising adoption of contact lens technology advancements.

Key Trend: Growing Eye Safety Concerns to Drive Up Demand for Daily Disposables Lens

Rising awareness of the advantages of disposable lenses over reusable ones, such as protection from side effects of cleaning solutions such as eye staining, has furthered market growth in the past few years. Ophthalmologists recommend disposable lens adoption owing to safety reasons despite the fact that there is no appreciable cost difference between the costs of disposable and reusable lenses. In addition, the key players in the market are conducting awareness campaigns and releasing cutting-edge products, which are expected to boost the expansion of daily disposables. In the United States, for instance, Alcon launched PRECISION1 for Astigmatism in January 2021, a daily disposable silicone hydrogel (SiHy) lens.

Market Segmentation

Based on Usability,

- Reusable

- Disposable

Here, Reusable lenses are gaining immense popularity across the country and are anticipated to notably contribute to the overall market expansion during 2023-28. It owes primarily to the growing pool of patients with refractive errors, paired with the massive wearers. For instance, the Vision Council's 2020 study report estimates that around 125 million people worldwide wear contact lenses, with 42.2 million residing in the United States. The category is likely to ascend owing to the steady adoption of reusable lenses and the rising prevalence of contact lens wearers worldwide. Additionally, the benefits associated with reusable lenses, such as durability and comfort, are expected to augment the market growth during the forecast period.

Based on Material Type,

- Soft Contact Lenses

- Silicone Hydrogel

- Hydrogel

The Silicone Hydrogel lens category led the contact lens market in 2022, holding a significant market share. In comparison to gas-permeable lenses, silicone hydrogel lenses have several advantages, including increased comfort and flexibility. As a result, users favor it over other lenses more.

Gas-permeable and silicone hydrogel lenses are combined to create hybrid lenses. It comprises a soft peripheral skirt made of silicone or soft hydrogel material surrounding an RGP center zone. It offers both the soft lens wearing comfort and the RGP lens visual clarity. The increased adoption of hybrid lenses by those with keratoconus and astigmatism is likely to observe a positive influence on market growth. For instance,

- In 2023, Bausch + Lomb launched disposable Bausch + Lomb INFUSE® Multifocal Silicone Hydrogel Contact Lenses in the United States, that offer minimized contactness dryness with all-day comfort and clear vision.

- In 2020, Bausch + Lomb launched a new silicone hydrogel daily disposable contact lens. The Bausch + Lomb Ultra One Day contact lenses feature a new technology that releases ingredients to promote eye health and comfort.

Recent Developments in the US Contact Lenses Market

- In June 2023, Bausch + Lomb launched Biotrue® Rehydrating drops to boost the hydration of Contact Lens in the United States.

- In October 2022, Johnson & Johnson launched a daily disposable contact lens, namely Acuvue Oasys Max 1-Day, designed to provide all-day comfort and visual clarity for patients with digital device use. This lens is expected to arrive in the market by fall 2022 in both spherical and multifocal parameters.

- In January 2022, Alcon proclaimed the launch of Dailies TOTAL1 in the U.S. for patients with astigmatism. Being the first water gradient lens, the product seeks to provide a comfortable fit for patients.

- In April 2021, Johnson & Johnson Vision affirmed a global strategic collaboration with Menicon, a leading manufacturer of innovative lenses. The partnership seeks to bring forth therapeutic lenses in order to address the growing prevalence and progression of myopia in children.

- April 2021 - Cooper Companies Inc. announced the acquisition of No7 Lenses, which designs and manufactures specialty lenses distributed primarily in the U.K.

Market Dynamics

Key Driver: Increasing Population of Lens Wearers in The United States

Gradually more Americans will probably start wearing lenses. In the United States, 31 million people used contact lenses in 2021, according to research from the US Environmental Protection Agency. The expansion of the US market is predicted to be supported by the rising number of consumers, owing to the shift in consumer preference toward eyeglasses.

Possible Restraint: Inaccessibility of Raw Material Resulting in Higher Production Cost

Fluctuations in productivity brought on by variations in raw material availability, as well as the growing accessibility of alternatives like laser treatment, are some of the key market challenges. Additionally, the development in the USA contact lens industry is being hindered by a lack of qualified workers who are capable of producing sophisticated technology contact lenses at high costs due to their advanced features and production costs.

Gain a Competitive Edge with Our The US Contact Lenses Market Report

- The US Contact Lenses Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The US Contact Lenses Market aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Assumption

- Market Definition

- Executive Summary

- Impact of COVID-19 on the US Contact Lenses Market

- The US Contact Lenses Market Trends & Insights

- The US Contact Lenses Market Dynamics

- Growth Drivers

- Challenges

- The US Contact Lenses Market Policies, Regulations & Product Standards

- The US Contact Lenses Market Hotspot & Opportunities

- The US Contact Lenses Market Import-Export Statistics, 2018-22

- The US Contact Lenses Market Value Chain Analysis

- The US Contact Lenses Market Consumer Behavior Analysis

- By Age Group

- By Income Group

- By Usability Preference

- By Buying Channel

- The US Contact Lenses Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Material Type

- Soft Contact Lenses

- Silicone Hydrogel

- Hydrogel

- Hard Contact Lenses

- Rigid Gas-Permeable Lenses (RGP)

- Polymethyl Methacrylate (PMMA)

- Hybrid Contact Lenses

- Soft Contact Lenses

- By Design

- Spherical

- Toric

- Multifocal

- Others (Monovision, Color lenses, etc.)

- By Usability

- Reusable

- Disposable

- By Application

- Cosmetics

- Corrective

- Others (Prosthetic, Orthokeratology, etc.)

- By Sales Channel

- Offline

- Optical Stores

- Hospital & Clinics

- Others (Pharmacies, Beauty Centers, etc.)

- Online

- Company-owned Portals

- E-commerce Platforms

- Offline

- By Region

- North East

- Mid-West

- West

- South

- By Company

- Competition Characteristics

- Revenue Shares

- By Material Type

- Market Size & Analysis

- The US Contact Lenses Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles of top companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Alcon Laboratories Inc.

- Bausch + Lomb

- Carl Zeiss AG

- CIBA Vision

- Contamac US Inc.

- CooperVision

- Essilor of America, Inc.

- Hydrogel Vision Corp.

- Johnson & Johnson

- Microport Scientific Corporation

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making