US Battle Management System Market Research Report: Forecast (2023-2028)

By Platform (Armored Vehicles, Headquarters & Command Centers, Soldier Systems), By Solution (Hardware, Software), By System Component (Computing, Communication & Networking, Navig...ation, Imaging, And Mapping), By End User (Army, Air Force, Navy), By Company (General Dynamics Corporation, Harris Corporation, Leonardo DRS, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company, Rheinmetall AG, Rockwell Collins, Systematic Group, Thales Group) Read more

- Aerospace & Defense

- Mar 2023

- Pages 89

- Report Format: PDF, Excel, PPT

Market Definition

A battle management system is an integrated defense system among the tri-forces of the country. The system is used to share intelligence & information among the land, water, and air forces on a real-time basis in an integrated manner. In this way, the forces can counter the enemy's actions collectively.

Market Insights & Analysis: The US Battle Management System Market (2023-28)

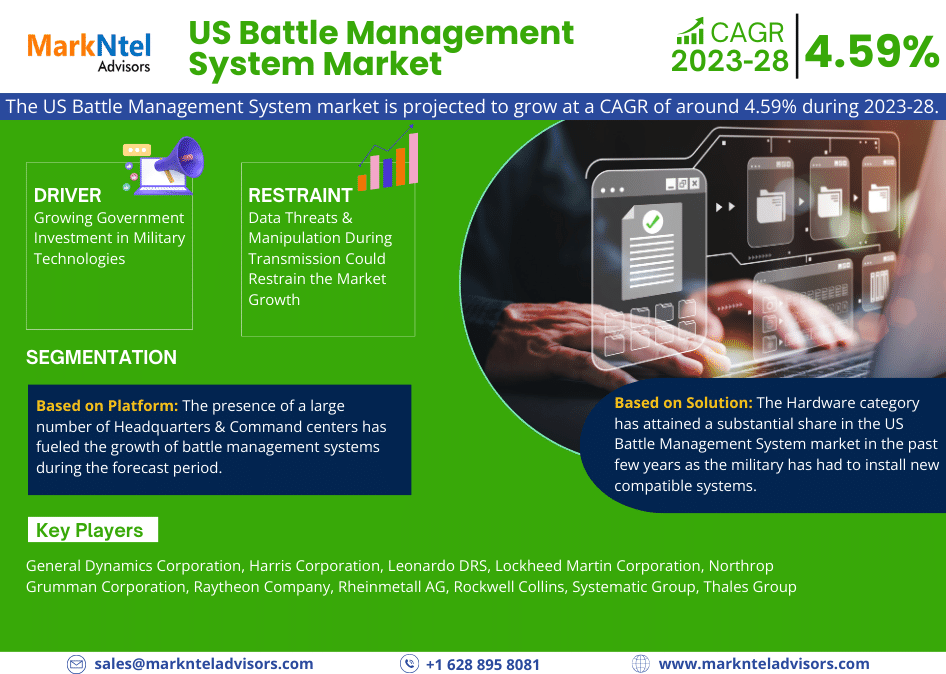

The US Battle Management System market is projected to grow at a CAGR of around 4.59% during the forecast period, i.e., 2023-28. The US is one of the largest military forces across the globe with the constant need for the deployment of troops, arms, machinery, and assets in different bases across the globe. The requirement of a unified command & control center for easier operations & maneuverability has accentuated the deployment of battle management systems.

Various new military challenges have also emerged, including cyber warfare, which led to the adoption of a robust framework of communication systems that can be relied on to communicate among the various commands of armed forces in the US. Due to the increasing inclination of forces towards multi-domain battlespaces to effectively counter & identify enemy targets, the demand for these weapons is on the rise. For instance:

- In 2022, the US Army launched Project Convergence, an experiment for multi-domain operations & that involves learning to operate an artificial intelligence (AI) & machine learning-enabled battle management system. This is a part of the US army’s new learning campaign, designed to aggressively advance & integrate the army’s contribution to aligning its efforts to increase its force multiplier capabilities.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 4.59% |

| Key Companies Profiled | General Dynamics Corporation, Harris Corporation, Leonardo DRS, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company, Rheinmetall AG, Rockwell Collins, Systematic Group, Thales Group |

| Unit Denominations | USD Million/Billion |

Additionally, the US operates a large number of overseas military bases in distant parts, including Japan, South Korea, Germany, Saudi Arabia, the UK, Poland, Turkey, etc. These bases are vastly distant from one another, leading to a structural issue of communication between the assets as well as the easier mobilization of the forces in any of the eventual situations. Further, with the growing geopolitical tension in Europe & the South China Sea, the government’s focus on integrating its forces with a proper command & control mechanism is expected to grow, which would be conducive to the deployment of battle management systems by the US forces.

Market Dynamics:

Key Driver: Growing Government Investment in Military Technologies

The US government has been heavily investing in developing advanced military equipment to enhance its technological superiority & strengthen the national defense system. This has led to the active engagement of the government in research & development (R&D) and the adoption of military technologies, including battle management systems, to handle hazardous battle circumstances. According to Govini, a Decision Science company, the US government boosted its military spending on essential technologies by roughly USD60.7 billion in 2017 to USD117.2 billion in 2021.

Furthermore, the expansion of overseas operations & the growing need for upgradation in the existing land, sea, and air-based infrastructure has enhanced the adoption of advanced technology systems like battle management systems & AI coupled with guns, drones, and other equipment for real-time battle surveillance. For instance:

- In 2023, US Main Battle Tank (MBT) M1 Abrams was tested with experimental Artificial Intelligence (AI)-driven target recognition system. This development was observed under the US Army’s Project Convergence 2022 event.

Hence, the growing investment in advanced technology by the US government has created a positive impact on the US Battle Management System market.

Possible Restraint: Data Threats & Manipulation During Transmission Could Restrain the Market Growth

During operations, the Battle Management System collects data from numerous sources, including handheld sensors, radars, electro-optic sensors, etc., which results in the generation of a massive amount of data. Consequently, sharing & transferring a large quantity of information affects the speed in real-time & could lead to data threats & manipulation, further impairing the functionality of the battle management system. Hence, this would result in a decrease in the effectiveness of missions during times of war. Additionally, as the technology is still in the development phase & many of the manufacturers are progressively integrating advanced battle management software, the threat to data protection is high in the present scenario, thus impeding market growth.

Growth Opportunity: Growing 5G Infrastructure Network to Push the Growth of the US Battle Management System

The US has witnessed various developments in its 5G network capability in recent years. Major telecom operators in the country, such as Mint Mobile, Nex-Tech Wireless, etc., have started providing 5G services to their users by the end of 2021. This offers a lucrative opportunity for the growth of battle management systems in the country as it would provide advancements in multiple capacities, including improved speed, connectivity, and reduced latency. The US forces have been constantly exploring ways to use the network to their advantage. In 2020, the US Air Force Warfare Center announced the award of a DoD contract to build the 5G network infrastructure & support services for its Nellis Air Force Base, Nevada, to determine how best to use the technology to provide improved connectivity between sensors & command and control nodes across the battlespace.

The Department of Defense’s concept of Joint All-Domain Command and Control (JADC2) includes efforts to connect sensors from all of the military services, including the Air Force, Army, Marine Corps, Navy, and Space Force to a single network. The Air Force's version of JADC2 is the Advanced Battle Management System (ABMS), which would run on 5G. According to the National Defense Industrial Association, 5G can improve something as simple as virtual reality training or as ambitious as system connectivity for JADC2. Thus, the establishment of a 5G network in the country would boost the capabilities of battle management systems & its market in the United States in the coming years.

Key Trend: Emergence of Electromagnetic Battle Management Systems:

The US has developed EMBMs (Electromagnetic Battle Management Systems) in recent years to improve situational awareness by making use of the electromagnetic spectrum. The country has been exploring its capabilities to develop a more holistic approach than just electronic warfare to counter the growing capabilities of its adversaries. Electromagnetic battle management would help in dealing with debilitating unintentional electromagnetic interference from allies & partners, as well as would improve situational awareness by identifying the activities inside the electromagnetic spectrum at any given area.

In 2021, the Defense Information Systems Agency (DISA) started working on these systems with its main customer, the US Strategic Command. DISA envisions building a Joint Electromagnetic Battle Management (EMBM) system to allow the US forces to operate in constrained, contested, and congested electromagnetic operations environments in a better way. Thus, the electromagnetic management system is expected to gain popularity in the US in the coming years owing to capacity & resiliency development efforts by the US joint forces.

Market Segmentation

Based on Platform:

- Armoured Vehicle & Platforms

- Headquarters & Command Centres

- Soldier System

The presence of a large number of Headquarters & Command centers has fueled the growth of battle management systems during the forecast period. The US Department of Defense has approximately 11 combatant commands like Africa Command, Central Command, European Command, Indo-Pacific Command, etc. The command centers assist commanders in planning & executing ground missions in real-time by providing real-time communications across air, land, and sea platforms.

Furthermore, the new strategic plans by the US, such as indulging in a permanent garrison in Poland, deployment of troops to Romania & the Baltic region, deployment of two destroyers at its naval base in Spain, etc., are seen as the renewed focus of the country on European security. These strategic plans are expanding the number of out-stationed troops & vehicles in the European region. For integrating information & improving the command & control mechanism, these troops require battle management system components such as soldier systems, mounted screens, and sensors. Thus, the growing out-stationed US troops would support the growth of battle management systems during the forecast period.

Besides, other systems, such as Soldier Systems and Armored Vehicles & platforms, also play an important role in properly integrating the entire communication system within the armed forces. To deal with the evolving cyber warfare capabilities, the US has undergone massive modernization in terms of upgrading its old fleet of aircraft, combatant surface ships, submarines, aircraft carriers, and others. As a result of all of the government's modernization plans, the armored vehicle & platform and soldier systems industries are also expected to grow rapidly in the coming years.

Based on Solution:

- Hardware

- Software

Of both, the Hardware category has attained a substantial share in the US Battle Management System market in the past few years as the military has had to install new compatible systems, which require integration of sensors, displays, communication devices, etc., for various military platforms. The hardware also had to be upgraded for the accuracy of the sensors, such as GPS systems on armored vehicles, cameras in aircraft, night vision goggles for the soldiers, and monitors in the command & control center. With the growing efforts of modernization in 2022, Northrop Grumman was given a contract of nearly USD24.1 million for the procurement of hardware & software for sensors & situational awareness to reduce the risk of probable air attacks.

However, with technological advancements, such as machine learning & artificial intelligence, there has been an inclination toward software upgrades. Therefore, these developments are expected to boost the demand for battle management systems equipped with the latest technology & upgraded software in the forecast years.

Based on End User:

- Army

- Air Force

- Navy

The Air Force is one of the leading end-users of battle management systems trying to create a next-generation command & control (C2) system by adopting the ABMS (Advanced Battle Management Systems) Program. It is an acquisition program that would both procure components & implement new command & control techniques. The acquisition program has been conducted in line with the US Department of Defense’s s Joint All Domain Command and Control (JADC2) effort focused on modernizing the Department of Defense’s decision-making processes for combat operations. The Government Accountability Office has recommended developing a plan to attain mature technologies when needed for ABMS development areas which are projected to be instrumental in the demand for these systems, thus infusing the US Battle Management System Market size.

Recent Developments by Leading Companies

- 2022: L3 Harris Technologies received an order worth USD235 million to construct a man-pack radio system for the US Army. These systems would help the army personnel to have vehicular on-the-move communication

- 2022: The USAF received USD231 million to deploy its Advanced Battle Management System (ABMS). The deployment of ABMS would help the Air force in Joint All-Domain Command & Control (JADC2) within the Air platforms and infrastructure.

Gain a Competitive Edge with Our US Battle Management System Market Report

- The US Battle Management System Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The US Battle Management System Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Preface

- Executive Summary

- Impact of COVID-19 on the US Battle Management System Market

- The US Battle Management System Market Trends & Insights

- The US Battle Management System Market Dynamics

- Growth Drivers

- Challenges

- The US Battle Management System Market Hotspot & Opportunities

- The US Battle Management System Market Policies and Regulations

- The US Battle Management System Market Supply Chain Analysis

- The US Battle Management System Market Outlook 2018- 2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Platform

- Armored Vehicles

- Headquarters & Command Centers

- Soldier Systems

- By Solution

- Hardware

- Software

- By System Component

- Computing

- Computer Hardware Devices

- Data Distribution Units

- Communication & Networking

- Route

- Wired

- Wireless

- Software

- Command & Control Software

- Military Situational Awareness

- Security Management

- Others

- Route

- Navigation, Imaging, And Mapping

- Imaging Devices

- Display Devices

- Tracking Devices

- Night Vision Devices

- Computing

- By End User

- Army

- Air Force

- Navy

- By Company

- Competition Characteristics

- Revenue Shares

- By Platform

- Market Size & Analysis

- The US Battle Management System Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product and Services Portfolio

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product and Services Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- General Dynamics Corporation

- Harris Corporation

- Leonardo DRS

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Company

- Rheinmetall AG

- Rockwell Collins

- Systematic Group

- Thales Group

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making