UAE Smart Utility Meters Market Research Report: Forecast (2023-2028)

By Type (Electric Meter, Water Meter, Gas Meter) By Technology (Advanced Metering Infrastructure, Automatic Meter Reading, By Communication Radio Frequency, Power Line Communicatio...n, Cellular Network) By End User (Residential, Commercial, Industrial, Government and Transportation) By Region (Dubai, Abu Dhabi & Al Ain, Sharjah and Northern Emirates) By Company (Landis+Gyr, Honeywell International, Inc., Elster, Siemens, Iskraemeco, Kamstrup, Itron, Schneider Electric, Aclara Technologies LLC, Sensus) Read more

- Energy

- May 2023

- Pages 103

- Report Format: PDF, Excel, PPT

Market Definition

A smart utility meter is a device that has the ability to compile & transmit real-time factual information regarding energy consumption. While, at the same time, enabling a two-way communication link between the meter & the utility firm.

Market Insights

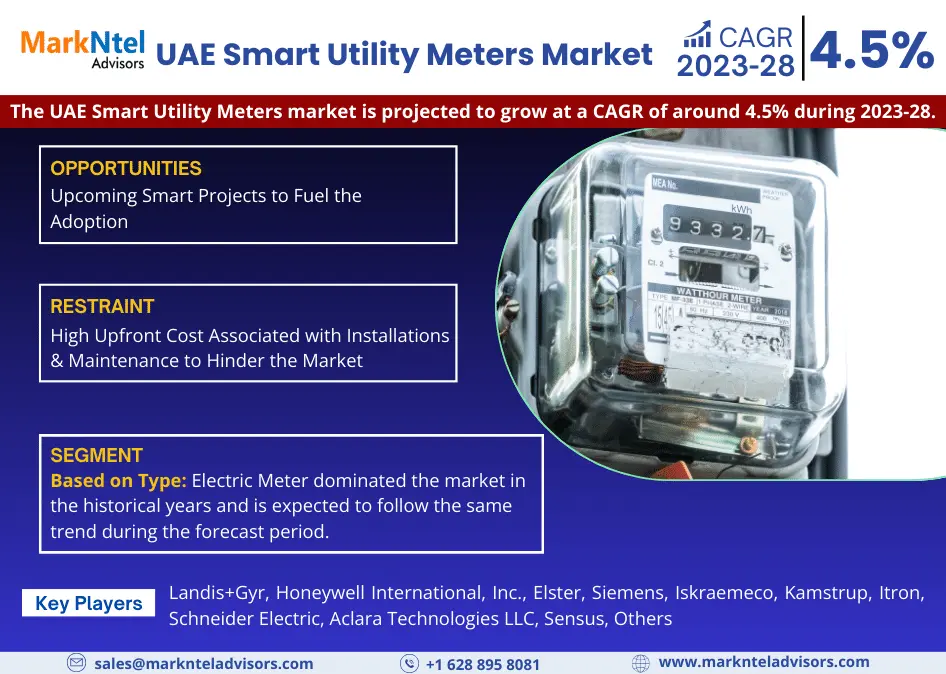

The UAE Smart Utility Meters market is projected to grow at a CAGR of around 4.5% during the forecast period, i.e., 2023-28. The main impetuses of this market are attributed to the UAE government's emphasis on energy efficacy & heightened demand for smart grid undertakings. Digital electricity infrastructure in the country has already garnered significant investments, complemented by rapid infrastructural progressions that reinforce these developments. Currently, the UAE is manifesting a rapid proliferation of infrastructure, conspicuous through an array of schemes that are either in progress or under contemplation. The construction & establishment of fresh edifices, manufacturing facilities, as well as residential enclaves has led to an amplified usage rate for energy resources. For instance,

- In 2022, Dubai Municipality approved plans to transform Al Quoz into one of the world's largest creative hubs, with the go-ahead given by Sheikha Latifa bint Mohammed. The project is set to attract around 33,000 people per day & provide housing for over 8,000 individuals. The zone's expansion is predicted to witness an upsurge in the number of creatives in the area from 900 to 20,000.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 4.5% |

| Region Covered | Dubai Abu, Dhabi & Al Ain Sharjah and Northern Emirates |

| Key Companies Profiled | Landis+Gyr, Honeywell International, Inc., Elster, Siemens, Iskraemeco, Kamstrup, Itron, Schneider Electric, Aclara Technologies LLC, Sensus, Others |

| Unit Denominations | USD Million/Billion |

The UAE has dedicated significant resources to enhancing its digital electricity infrastructure, focusing on smart grids & introducing additional renewable energy sources as well as enhancing capacity for storing green power. The country is making considerable investments in smart grid programs to boost the reliability & efficiency of its electrical infrastructure. Moreover, electricity generation, transmission, and distribution are all optimized by smart grids, which use cutting-edge technology in the form of sensing, communication, and control systems. The deployment of intelligent metering utilities is an indispensable component of smart grid infrastructure as it furnishes energy consumers with real-time data concerning their electricity consumption, facilitating the reduction of their energy expenditure. In the UAE, there is an increasing need for energy efficiency, particularly in the residential & commercial sectors.

The nation's energy supplies are being stressed by the country's expanding population, fast urbanization, and rising energy consumption. Smart utility meters assist customers & companies in understanding their energy usage trends & taking action to cut energy use. Hence, this would not only help customers save money on their energy costs but also lessen the nation's carbon imprint. The market is influenced by the growing concern over energy usage & high electricity bills, as UAE is one of the leading countries in the world to charge electricity bills. As a result, consumers are becoming conscious of energy consumption & are inclined toward the adoption of smart meters that help them manage their consumption effectively.

Additionally, the realm of the UAE Smart Meter Utility market is anticipated to flourish tremendously due to the expeditious evolution of infrastructure, governmental schemes, and substantial investments in digital electric infrastructure & smart grid initiatives. Furthermore, there is an escalating demand for proficient consumption of energy & a growing apprehension over energy conservation. The deployment of smart meter utilities is an integral part of the nation's energy policy & it would facilitate customers & businesses in decreasing their energy usage, thereby cutting down on electricity expenses. Hence, this market is envisaged to undergo remarkable progression in the imminent years.

Market Dynamics

Significant Driver: The UAE's Rapid Infrastructure Development is Driving the Market

The rapid development of infrastructure in the UAE is a significant driver of the Smart Utility Meter market. To satisfy the rising demand for electricity & boost the effectiveness of its energy use, the UAE has made significant investments in the upgradation of its infrastructure, particularly its power grid. The implementation of intelligent metering utilities has become a crucial part of the smart grid infrastructure as these meters give customers real-time information on their energy usage, which helps lower their energy costs. Furthermore, the UAE's progress in developing smart infrastructure has fostered a suitable atmosphere for market growth. For instance:

- In 2022, the ongoing construction of Jubail Island, which would have six residential village estates totaling more than 400 hectares, 10,000 people are expected to live there in four years.

Furthermore, the UAE has also started several energy efficiency programs to encourage sustainable consumption & minimize energy waste in addition to these projects. Therefore, the rapid development of infrastructure drives the market in the UAE in the following years.

Possible Restraint: High Upfront Cost Associated with Installations & Maintenance to Hinder the Market

The lofty upfront cost associated with the installation & maintenance of smart utility meters is the most prominent aspect to act as a barrier to the market. The requirement for specialized tools & knowledgeable labor during the installation procedure is one of the major causes of the high cost of these systems. Unlike conventional meters, these meters require a more involved installation procedure that includes the setup of networking & wiring devices as well as software & hardware parts.

Hence, this necessitates the knowledge of highly qualified staff, who frequently demand higher compensation, raising the installation's overall cost. Large amounts of data produced by smart meters require the deployment of complex hardware & software components to analyze the patterns & trends. Therefore, customers may choose to continue using their conventional meters, which might impede market growth.

Growth Opportunity: Upcoming Smart Projects to Fuel the Adoption

The growth of smart infrastructure in recent years has spread around the globe, thereby creating newer growth opportunities for the market. The requirement for precise & current data has grown substantially as the world is rapidly shifting toward digitization. Smart utility meters are an important part of this digitization system as they give customers exact real-time data on their electricity consumption, which is cost-effective.

Additionally, the growing smart projects in lieu of the expanding urbanization is one of the main reasons that has forced the market for smart utility meters to improve the energy effectiveness of cities & encourage sustainable growth in the UAE. These smart programs include the development of smart grids, advanced transportation networks, and intelligent buildings, all of which significantly rely on these meters to monitor & control energy use. Therefore, the UAE's eyes on sustainability, its government initiatives, the increasing prevalence of smart homes & buildings, and its investment in smart infrastructure contribute to the growing adoption of smart utility meters in the country.

Key Trend: Technological Advancements, Like the Integration of AI & Machine Learning in the System

Technological advancement is the key trend influencing the popularity of smart utility meters in the UAE. Major companies operating in the market are focusing on developing new products with advanced technology, such as the integration of AI (artificial intelligence) & machine learning in these meters. The implications of machine learning algorithms include the analysis of data collected from smart meters to identify the usage consumption patterns & trends in managing their energy resources more effectively.

Moreover, with the integration of these technologies, the meters could read real-time data & inspect the occurrence of potential issues, enabling proactive maintenance & rectification measures. Additionally, leveraging these technologies reduces the potential for downtime & power outages that have a significant impact on both users & utilities. Therefore, with the advancement in technology, companies would expand their operations, reduce costs, and come up with more personalized devices in the near future to enhance the UAE Smart Utility Meters Market size.

Market Segmentation

Based on Type:

- Electric Meter

- Water Meter

- Gas Meter

Of them all, Electric Meter dominated the market in the historical years & is expected to follow the same trend during the forecast period, as well, owing to their ability to accurately measure & monitor energy consumption while offering a host of other benefits. Smart meters' broad acceptance is also a result of their capacity to identify & report energy waste and can spot irregularities & inefficiencies in energy use patterns, enabling consumers to take corrective action before the problem gets worse.

For enterprises where energy waste lead to huge financial losses, this function is crucial to promoting sustainable growth & lower carbon emissions. Additionally, smart meters give users flexibility & convenience by enabling them to view & manage their energy use anytime, anywhere, and change their settings remotely with the help of mobile apps & web-based interfaces, making it simple to control energy consumption.

Based on the End User:

- Residential

- Commercial

- Industrial

- Government & Transportation

The Residential sector captured a significant market share in the past years & is predicted to be the most prominent sector during the forthcoming period as well. The UAE government has been aggressively encouraging the installation of smart meters in residential buildings as a part of its bigger smart city plan to raise energy efficiency, lower carbon emissions, and optimize resource. The country's large expatriate population is another element supporting the sector's dominance in the industry.

The country has numerous expatriates residing in flats & other multiunit structures that frequently include central air conditioning & other energy-intensive appliances supported by these meters. Henceforth, with more residential consumers choosing to install smart meters in their homes, it is anticipated that the residential sector would continue to rise as the most advantageous sector to contribute to the revenue growth of the market in the following years.

Regional Projection

Geographically, the market expands across:

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

Of all the regions across the country, Abu Dhabi & Al Ain have been the leading regions in the UAE Smart Utility Meters market owing to government initiatives to promote energy efficiency. The huge populace of UAE citizens lives in Abu Dhabi & Al Ain, which has brought about a sturdy call for electricity & supported market growth.

The government's emphasis on sustainability has been a major factor in the country's adoption of these meters, followed by the implementation of various programs to encourage energy conservation & reduce carbon emissions in the country. In 2022, Abu Dhabi National Energy Company and Etisalat Digital partnered to drive digital transformation in the country & enhance utility metering in the Emirates of Abu Dhabi for a better customer experience, hence supporting the market's revenue growth in the following years.

Gain a Competitive Edge with the UAE Smart Utility Meters Market Report

- The UAE Smart Utility Meters Market Report by Markntel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The UAE Smart Utility Meters Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The UAE Power Industry Outlook, 2023

- Current Scenario

- Recent Development

- Others

- The UAE Water Industry Outlook, 2023

- Current Scenario

- Government Initiatives

- Others

- The UAE Smart Utility Meters Market Trends & Insights

- The UAE Smart Utility Meters Market Dynamics

- Drivers

- Challenges

- The UAE Smart Utility Meters Market Policy & Regulations

- The UAE Smart Utility Meters Market Growth Opportunities & Hotspots

- The UAE Smart Utility Meters Market Analysis, 2018-2028F

- Market Size & Outlook

- Revenues (USD Million)

- Market Share & Outlook

- By Type

- Electric Meter

- Water Meter

- Gas Meter

- By Technology

- Advanced Metering Infrastructure

- Automatic Meter Reading

- By Communication

- Radio Frequency

- Power Line Communication

- Cellular Network

- By End User

- Residential

- Commercial

- Industrial

- Government and Transportation

- By Region

- Dubai

- Abu Dhabi & Al Ain

- Sharjah and Northern Emirates

- By Company

- Competition Characteristics

- Revenue Shares

- By Type

- Market Size & Outlook

- The UAE Smart Electric Meters Market Analysis, 2018-2028F

- Market Size & Outlook

- Revenues (USD Million)

- Market Share & Outlook

- By Technology

- By Communication

- By End User

- Market Size & Outlook

- The UAE Smart Water Meters Market Analysis, 2018-2028F

- Market Size & Outlook

- Revenues (USD Million)

- Market Share & Outlook

- By Technology

- By Communication

- By End User

- Market Size & Outlook

- The UAE Smart Gas Meters Market Analysis, 2018-2028F

- Market Size & Outlook

- Revenues (USD Million)

- Market Share & Outlook

- By Technology

- By Communication

- By End User

- Market Size & Outlook

- The UAE Smart Utility Meters Market Key Strategic Imperatives for Success & Growth

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target Applications

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Landis+Gyr

- Honeywell International, Inc.

- Elster

- Siemens

- Iskraemeco

- Kamstrup

- Itron

- Schneider Electric

- Aclara Technologies LLC

- Sensus

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making