UAE Rent a Car Market Research Report: Forecast (2023-2028)

By Type of Car (Economy, SUV, Multi Utility Vehicle, Luxury), By Application (Leisure, Commercial), By Drive Type (Self-Driving, Chauffeur), By Booking Type (Offline, Online), By U...sage (Local, Airport, Outstation), By Rental Duration (Short Term, Long Term), By Region (Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates) , By company (Thrifty, Hertz, Emirates Transport, Massar Solutions, Sixt Rent a Car, Fast rent a car, Kayak, Europcar, Avis Rent a Car, Dollar Rent a Car, Others) Read more

- Automotive

- Jan 2023

- Pages 103

- Report Format: PDF, Excel, PPT

Market Definition

"Rent a car," or car rental services, are when a company offers vehicles to customers on temporary bases and charges them based on the type of vehicle chosen, miles/hours driven, and the number of days, among other parameters. These services are swiftly gaining popularity across the UAE, owing primarily to the mounting influx of tourists, pilgrims, & migrants using rental cars for local commute.

Market Insights

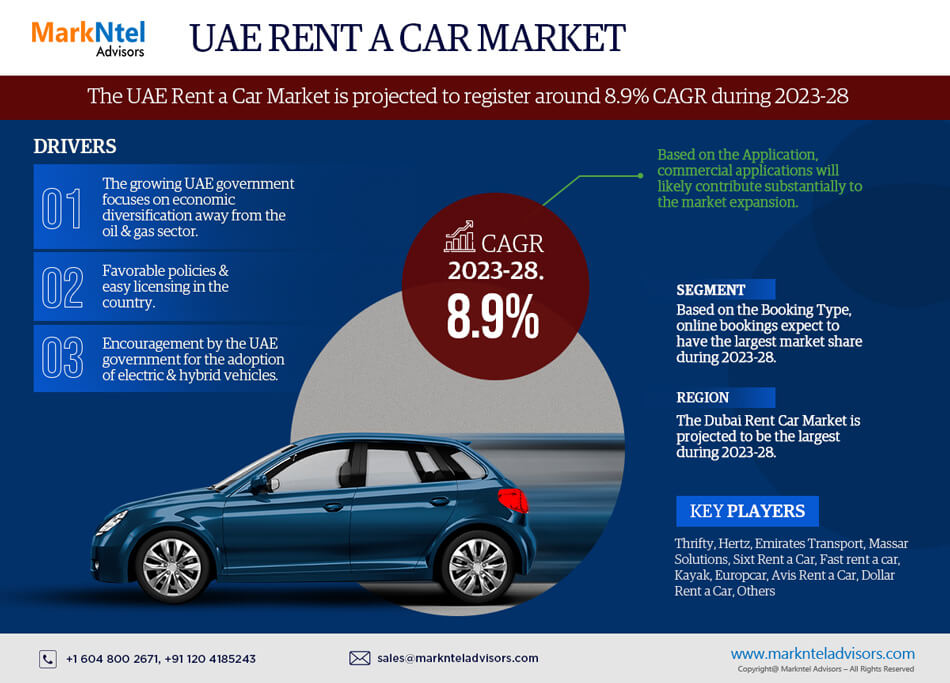

The UAE Rent a Car Market is projected to register around 8.9% CAGR during the forecast period, i.e., 2023-28. Most of the market expansion would be driven by the growing focus of the UAE government on the economic diversification away from the oil & gas sector, i.e., portraying massive expenditure on the tourism sector to attract tourists, pilgrims, and migrants to the country. As a result, the demand for car rental services for local commute is increasing swiftly across the country and driving the UAE Rent a Car Market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2021 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 8.9% |

| Region Covered | Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates |

| Key Companies Profiled | Thrifty, Hertz, Emirates Transport, Massar Solutions, Sixt Rent a Car, Fast rent a car, Kayak, Europcar, Avis Rent a Car, Dollar Rent a Car, Others |

| Unit Denominations | USD Million/Billion |

Besides, favorable policies & easy licensing in the country are leading to the consumer inclination toward using rental cars for commercial applications like cab & taxi services, etc. In addition, massive expenditure on hosting Auto Expos, where the event spans around 6 months & expects more than 3 million people, is another crucial aspect playing a prominent role in propelling the demand for car rental services in the UAE.

Moreover, growing encouragement by the UAE government for the adoption of electric & hybrid vehicles by laying out incentives is also likely to generate growth opportunities for the leading market players with an anticipated rise in the vehicle fleet over the coming years. Furthermore, easy licensing is showcasing a mounting competition between prominent car rental companies in the UAE for offering superior value-added services instead of just heading toward a price war.

Such strategies include services like a sliding scale termination policy, pooled mileage for corporates, and guaranteed replacement of vehicles during servicing, among others. Hence, these aspects indicate that the UAE Rent a Car Market is set to observe an upward trend through 2028.

Market Segmentation

Based on the Booking Type:

- Online

- Offline

Of both, online bookings are expecting the largest share in the UAE Rent a Car Market during 2023-28, mainly on the back of surging penetration of smartphones & the internet, coupled with the convenience of choosing the most appropriate cars for rent after comparing different websites.

Besides, car rental service providers are increasingly adopting online portals owing to their ease & convenience. The country is witnessing growing customer preferences toward online channels for car rental services, owing to various emerging car rental service applications, significant updates in existing platforms, and the advent of subscription-based services.

In addition, an increasing number of partnerships, collaborations, and mergers & acquisitions between the leading car rental service providers to offer exceptional customer services further project a significant boost to the UAE Rent a Car Market for online bookings through 2028.

Based on the Application:

- Leisure

- Commercial

Here, commercial applications are likely to contribute substantially to the market expansion through 2028, owing to massive government investments in developments across the tourism sector and improving road connectivity in the UAE to cater to the needs of tourists, pilgrims, & migrants for local commutation.

As a result of the surging demand for cab or taxi services, there's a mounting competition between the prominent players in offering new services & extra value benefits to attract more and more people toward opting for rent a car services. Besides, the paradigm shift of major rent-a-car service providers toward digital platforms to offer the convenience of online car rental services is also boosting the UAE Rent a Car Market for commercial applications.

Furthermore, favorable licensing policies leading to numerous drivers seeking commercial vehicles to cater to the growing consumer requirements for car rental services also project remunerative growth prospects for the UAE Rent a Car Market in the coming years.

Regional Landscape

Geographically, the UAE Rent a Car Market expands across:

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

In the UAE, the Dubai Rent a Car Market is projected to be the largest during 2023-28. It attributes principally to the city being a prominent area of attraction with a massive influx of tourists, pilgrims, migrants, and corporates, among others, i.e., making a positive influence on the demand for rental cars for local commute. Additionally, favorable policies & opportunities are attracting numerous car rental companies to establish their corporate offices in the city. Hence, these aspects are demonstrating a burgeoning demand for car rental services in Dubai while generating growth prospects for the UAE Rent a Car Market through 2028.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the UAE Rent a Car Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the UAE Rent a Car Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the UAE Rent a Car Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the UAE Rent a Car Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Market Segmentation

- Assumptions

- Preface

- Executive Summary

- Impact of COVID-19 on UAE Rent a Car Market

- UAE Rent a Car Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Total Cars Available for Rental

- Market Share & Analysis

- By Type of Car

- Economy

- SUV

- Multi Utility Vehicle

- Luxury

- By Application

- Leisure

- Commercial

- By Drive Type

- Self-Driving

- Chauffeur

- By Booking Type

- Offline

- Online

- By Usage

- Local

- Airport

- Outstation

- By Rental Duration

- Short Term

- Long Term

- By Region

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

- By Company

- Competition Characteristics

- Market Share & Analysis

- Competitive Matrix

- By Type of Car

- Market Size & Analysis

- UAE Rental Economy Car Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Application

- By Drive Type

- By Booking Type

- By Usage

- By Rental Duration

- By Region

- Market Size & Analysis

- UAE Rental SUV Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Application

- By Drive Type

- By Booking Type

- By Usage

- By Rental Duration

- By Region

- Market Size & Analysis

- UAE Rental Multi Utility Vehicle Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Application

- By Drive Type

- By Booking Type

- By Usage

- By Rental Duration

- By Region

- Market Size & Analysis

- UAE Rental Luxury Car Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Application

- By Drive Type

- By Booking Type

- By Usage

- By Rental Duration

- By Region

- Market Size & Analysis

- UAE Rent a Car Market Pricing Analysis

- UAE Rent a Car Market Policies, Regulations, Product Standards

- UAE Rent a Car Market Trends & Insights

- UAE Rent a Car Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- UAE Rent a Car Market Hotspot & Opportunities

- UAE Rent a Car Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product/ Solution Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles of Top Companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Thrifty

- Hertz

- Emirates Transport

- Massar Solutions

- Sixt Rent a Car

- Fast rent a car

- Kayak

- Europcar

- Avis Rent a Car

- Dollar Rent a Car

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making