UAE Elevator and Escalator Market Research Report: Forecast (2021-2026)

By Type (Elevator, Escalator), By Service (New Installation, Modernization, Maintenance), By End Users (Residential, Healthcare, Commercial, Retail, Govt. & Transportation, Hospita...lity, Others), By Geographic Region (Abu Dhabi & Al Ain, Dubai, Sharjah & Northern Emirates), By Competitors (Thyssenkrupp Elevator, Otis Elevator, AG Melco Elevator, Hyundai Elevator, Toshiba Elevator, Others) Read more

- Buildings, Construction, Metals & Mining

- Jan 2022

- Pages 142

- Report Format: PDF, Excel, PPT

Market Definition

As high-rise buildings are becoming more common and technology is becoming more affordable in the UAE, elevators & escalators installed within buildings are increasing dramatically. In earlier times, elevators and escalators were just a symbol of luxury, but now they have become an important system for enhancing accessibility.

Market Insights

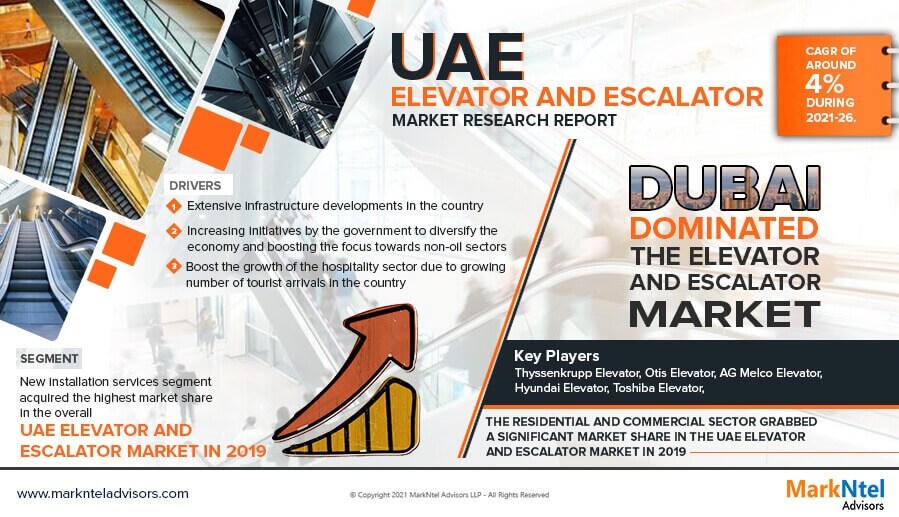

The UAE Elevator and Escalator Market is anticipated to grow at a CAGR of around 4% during the forecast period, i.e., 2021-26. Stabilizing economic conditions and rapid expansion of social infrastructures are the key factors driving the growth of the Elevator and Escalator Market in the UAE. Besides, the introduction of new transportation & construction projects in the country is also driving the market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 4% |

| Key Companies Profiled | Thyssenkrupp Elevator, Otis Elevator, AG Melco Elevator, Hyundai Elevator, Toshiba Elevator, Others |

| Unit Denominations | USD Million/Billion |

Additionally, in line with the UAE Vision 2021, significant investments in Dubai Expo 2020 & approval of other such large-scale projects, including the extension of red & green lines of Dubai metro, expansion of Al Maktoum International Airport, Abu Dhabi Metro, and other residential & commercial projects, shall further boost the installation of new escalators & elevators in the coming years.

Moreover, the flourishing tourism sector of the country is also resulting in an increasing number of constructions like hotels, malls, community centers, etc. This surge in the construction of new infrastructures, coupled with the growing trend of high-rise buildings in the UAE, is expected to boost the demand for elevators and escalators in the coming years.

Impact of Covid-19 on the UAE Elevator and Escalator Market

- With the government imposing movement restrictions & the shutdown of public gathering places to contain the spread of the disease owing to the Covid-19 pandemic, the UAE Elevator and Escalator Market in 2020 witnessed several adverse effects.

- These restrictions led to a halt in construction projects and the closure of manufacturing units, especially during the first half of the year, which, in turn, significantly declined the sales of elevators & escalators.

- Along with this, supply chain disruptions have been another major operational challenge for the elevator & escalator market, which, however, was reduced gradually from the beginning of May last year.

- Moreover, the partially restricted access to malls & restaurants also negatively influenced the overall market growth amidst the crisis.

- Nevertheless, the resumption of construction activities and the increasing inflow of tourists in the UAE has augmented new installations of elevators & escalators, coupled with the need for the maintenance of existing ones.

Market Segmentation

By Service:

- New Installation

- Modernization

- Maintenance

Of them all, the 'New Installation' segment dominates the UAE Elevator and Escalator market. It is due to various ongoing & upcoming large-scale infrastructure projects to boost the country's construction sector, which, in turn, would propel new installations of elevators & escalators in the coming years. Additionally, the rising tourism sector in the country is also augmenting the construction of new buildings like restaurants & hotels, which shall further soar the need for new installations of elevators & escalators.

On the other hand, maintenance services of existing elevators & escalators are expected to witness significantly growing demand during the forecast period. Since it is impossible to access most high-rise buildings without using elevators & escalators, their frequent use results in severe wear & tear and makes them prone to breakdowns, which, as a result, fuels the need for routine maintenance services.

Moreover, the surging trend of integrating advanced technologies into elevators & escalators to improve their efficiency and save costs are the key factors fueling the demand for modernization of existing systems through 2026.

By End-User

- Residential

- Healthcare

- Commercial

- Retail

- Govt. & Transportation

- Hospitality

Here, the commercial sector, which includes malls, offices, hospitals, hotels, etc., holds the largest market share. Most of these buildings have more than 2 floors. Thus, the need for elevators & escalators is significantly high in them. The introduction of projects like Dubai Expo 2020 and the expansion of metro lines in Dubai & Abu Dhabi are the prime aspects that boost the market around the commercial sector.

Additionally, the increasing trend of self-employment has propelled the construction of multiple co-work spaces in the country, which, as a result, is fueling the need for installing elevators & escalators in those structures.

Further, the booming tourism industry in the country is accelerating the construction of various new hostels, hotels, & restaurants, which would boost the need for well-maintained elevators & escalators, thereby contributing to the overall market growth.

Market Trends:

Mounting Shift toward Green Elevators & Escalators

The leading players in the UAE Elevator & Escalator Market are increasingly focusing on building sustainable products due to the increasing awareness among end-users about environmental concerns. It has led to the idea of manufacturing green elevators with recycled materials, LED lights, and water-soluble paints. In addition, various manufacturers are also seeking alternatives to pulley & rope systems like magnetic motors, thereby adhering to environment-friendly norms and contributing to the overall market growth.

Integration of the Internet of Things (IoT) into Elevators & Escalators

With the surging demand for energy-efficient escalators & elevators, the need for integrating advanced technologies like the IoT(Internet of Things) in these systems is becoming crucial. IoT-powered elevators & escalators enable storage, sharing, & analysis of operational data with their manufacturers for the efficient working of these systems. Further, these systems respond to the traffic in real-time, interact with service providers, and allow customers to call for these systems through a mobile application, thereby reducing their waiting time.

Regional Landscape:

- Dubai

- Sharjah & North Emirates

- Abu Dhabi & Ain

Of them all, Dubai captured the largest share in the UAE Elevator and Escalator Market owing to various initiatives by the Dubai government toward infrastructural developments. Projects like the Dubai Expo and the expansion of metro lines are leading to numerous construction activities in Dubai.

Additionally, the Dubai 2040 Urban Master Plan for sustainable urban developments in Dubai centers on transforming Dubai into a global destination for visitors, citizens, & residents in the next 20 years. It is estimated that the population of Dubai has multiplied 80 times from 40,000 in 1960 to 3.3 million in 2020. Hence, it has fueled the need for a strategic structural layout for infrastructural developments. This surge in construction projects will further propel the installation of elevators & escalators in the coming years.

Moreover, a boost in Dubai's tourism sector is augmenting various new installations of elevators & escalators in newly-constructed buildings. In addition, the rapidly increasing modernization & maintenance of old systems to enhance the overall experience of tourists is also contributing to the market growth in Dubai.

Furthermore, Abu Dhabi is likely to experience the fastest market growth in the coming years, mainly due to the launch of the country's long-term plan, ‘Abu Dhabi Economic Vision 2030.' The plan aims to transform the emirate economy by reducing reliance on the oil sector and focusing more on other verticals like the construction industry, which, as a result, would expand the Elevator & Escalator Market in the years to come.

Market Dynamics:

Key Drivers

Burgeoning Investments in Infrastructural Developments

The numerous infrastructural developments in line with the project, 'UAE Vision 2021,' is the prime factor likely to drive the Elevator & Escalator Market. It further boosts the government initiatives & investments toward driving the UAE's economy by focusing on constructing new infrastructure projects in the country. Dubai's project, the construction of Burj Jumeira, launched in 2019, is expected to be 550 meters tall. Such a high-rise building will require new installations of elevators & escalators, which, as a result, will augment the overall growth of the Escalator & Elevators Market in the UAE during 2021-26.

High Demand for Energy-Efficient Elevators & Escalators

Elevators consume around 4-7% of a building's total energy. However, with the integration of advanced technologies like IoT & sensors, this percentage has significantly reduced. Hence, manufacturers are actively working on developing new machines that would require minimum energy for their operation. Moreover, the rising focus of the UAE government on promoting the use of energy-efficient products is also projected to contribute to the market growth in the coming years.

Possible Challenge: Surging Accidents Associated With Elevators & Escalators

With the surging trend of high-rise buildings and the frequent use of elevators & escalators, the wear & tear of these machines is becoming very common across the UAE. As a result, there are mounting concerns over elevator & escalator accidents. In fact, there were incidents reported where workers, while doing maintenance & repair services, were caught in between the moving parts of escalators. Hence, these aspects might act as growth restraints for the UAE Elevator and Escalator Market in the coming years.

Competitive Landscape

According to MarkNtel Advisors, the key players with a considerable market share in the UAE elevator and escalator industry include Thyssenkrupp Elevator, Otis Elevator, AG Melco Elevator, Hyundai Elevator, Toshiba Elevator, Hitachi Elevator, etc. These companies are launching new products and technology to gain an advantage over their competitors.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the UAE Elevator and Escalator Market?

- What is the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the UAE Elevator and Escalator Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the UAE Elevator and Escalator Market based on a competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the UAE Elevator and Escalator Market study?

Market Outlook, Segmentation and Statistics

- Impact of COVID-19 on UAE Elevator and Escalator Market

- Market Size & Analysis

- Market Revenues

- By Unit Sold

- Market Share & Analysis

- By Type

- Elevator

- Escalator

- By Service

- New Installation

- Modernization

- Maintenance

- By End User

- Residential

- Commercial

- Retail

- Health Care

- Hospitality

- Government & Transportation

- Others

- By Region

- Abu Dhabi & Al Ain

- Dubai

- Sharjah & Northern Emirates

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Type

- UAE Elevator & Escalator Market Regulations, Norms, & Product Standards

- UAE Elevator & Escalator Imports Exports Statistics

- UAE Elevator & Escalator Market Winning Strategies, 2020

- Investment Scenario

- Hotspots

- Tax Structure

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Expert Verbatim- What our Experts Say?

- Macroeconomic Outlook

- UAE Elevator & Escalator Market Analysis, 2016- 2026F

- Market Size & Analysis

- Market Revenues

- By Unit Sold

- Market Share & Analysis

- By Type

- Elevator

- Escalator

- By Service

- New Installation

- Modernization

- Maintenance

- By End User

- Residential

- Commercial

- Retail

- Health Care

- Hospitality

- Government & Transportation

- Others

- By Region

- Abu Dhabi & Al Ain

- Dubai

- Sharjah & Northern Emirates

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Type

- Market Size & Analysis

- UAE Elevator Market Analysis, 2016- 2026F

- Market Size & Analysis

- Market Revenues

- Units Sold

- Market Share & Analysis

- By Type

- Traction

- Hydraulic

- Machine Room less

- By Service

- By End User

- By Type

- Market Size & Analysis

- UAE Escalator Market Analysis, 2016- 2026F

- Market Size & Analysis

- Market Revenues

- Unit Sold

- Market Share & Analysis

- By Type

- Moving Walkway

- Moving Stairs

- By Service

- By End User

- By Type

- Market Size & Analysis

- UAE Elevator & Escalator Market Attractiveness Indexing

- By Type

- By Service

- By Region

- By End User

- UAE Elevator & Escalator Market Regulations, Norms, & Product Standards

- UAE Elevator & Escalator Market Trends & Developments

- UAE Elevator & Escalator Market Dynamics

- Impact Analysis

- Drivers

- Challenges

- UAE Elevator & Escalator Imports Exports Statistics

- UAE Elevator & Escalator Market Winning Strategies, 2020

- Investment Scenario

- Hotspots

- Tax Structure

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc)

- Thyssenkrupp Elevator UAE

- Otis Elevator

- AG MELCO Elevator Co. LLC.

- Hyundai Elevator

- Toshiba Elevator and Building Systems Corporation

- Hitachi Elevator

- Kone Middle East LLC

- Fujitec Co. Ltd.

- Schindler Pars International

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making