India Surfactants Market Research Report: Forecast (2025-2030)

India Surfactants Market - By Type (Anionic Surfactants, Nonionic Surfactants, Cationic Surfactants, Amphoteric Surfactants, Others), By Origin (Synthetic Surfactants, Bio-based Su...rfactants), By End-User (Pharmaceuticals, Cosmetics, Household & Industrial Cleaning, Textile, Elastomers & Plastics, Agrochemicals, Oilfield, Paints & Coatings, Others), and others Read more

- Chemicals

- Aug 2025

- Pages 130

- Report Format: PDF, Excel, PPT

India Surfactants Market

Projected 9.49% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2025)

USD 2.11 Billion

Market Size (2030)

USD 3.32 Billion

Base Year

2024

Projected CAGR

9.49%

Leading Segments

By End-User: household & industrial cleaning

Market Insights & Analysis: India Surfactants Market (2025-30):

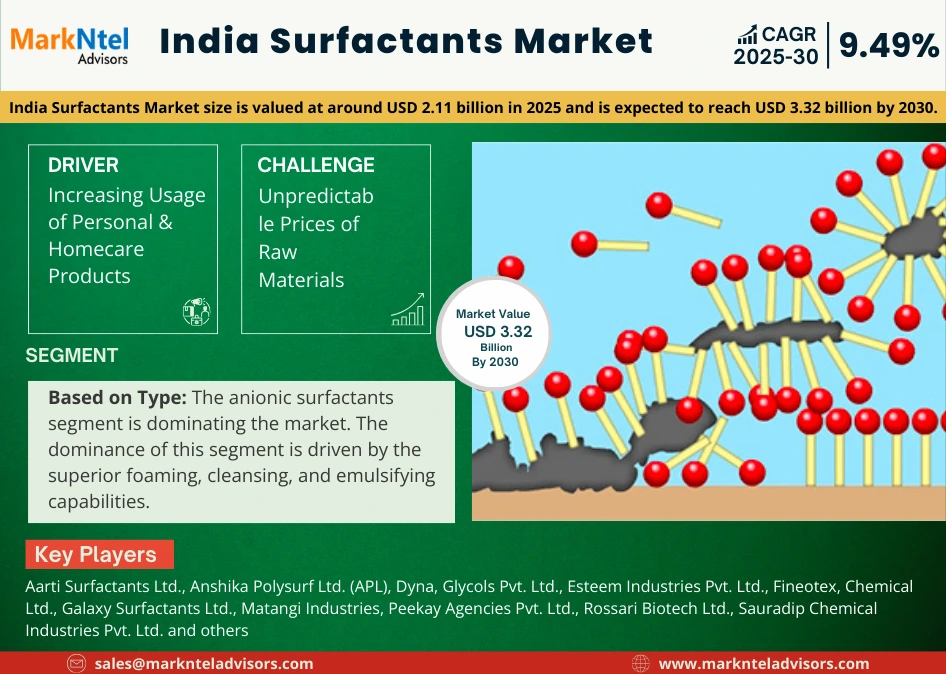

The India Surfactants Market size is valued at around USD 2.11 billion in 2025 and is expected to reach USD 3.32 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 9.49% during the forecast period, i.e., 2025-30. The growth of the market is driven by the increasing application of surfactants in the various sectors of the country, such as in its commercial, residential, and industrial sectors. This increasing application is directly attributed to the versatility and indispensable nature of surfactants. Additionally, there is rapid urbanization and growth of the middle-class demographic in the country, thereby leading to market growth. For instance, the urban household in India is projected to reach over 300 million by 2035.

Moreover, the agricultural sector of the country is expanding, which has led to an increase in the application of surfactants for improving the effectiveness of pesticides. Similarly, there is an increase in the demand for surfactants in the pharmaceutical industry, for the solubility of drugs and delivery. For instance, India supplies approximately 70% of vaccines produced in accordance with the World Health Organization’s (WHO) essential immunization schedule, thereby showcasing the important role that surfactants play in the healthcare sector in the country.

Furthermore, there is an increasing demand for eco-friendly and bio-based surfactants, which is driven by the increasing environmental awareness and regulations against products that are non-biodegradable. This is driving the need for manufacturers to offer innovative formulations in the market. For instance, BASF's Plantopon Soy, which is an anionic bio surfactant, was derived from renewable resources such as coconut oil and non-GMO soybeans. Therefore, the continuous research and development activities, which are supported by government funding, are driving the innovation in the products, which include surfactants that are multi-functional. This is helping the market to grow in the country in the forecast period.

India Surfactants Market Driver Scope:

| Category | Segments |

|---|---|

| By Type | Anionic Surfactants, Nonionic Surfactants, Cationic Surfactants, Amphoteric Surfactants, Others |

| By Origin | Synthetic Surfactants, Bio-based Surfactants |

| By End-User | Pharmaceuticals, Cosmetics, Household & Industrial Cleaning, Textile, Elastomers & Plastics, Agrochemicals, Oilfield, Paints & Coatings, Others), and others |

India Surfactants Market Driver:

Increasing Usage of Personal & Homecare Products – The growth of the market in India is driven by the increasing demand for personal and homecare products such as shampoos, soaps, cleansers, detergents, etc., in which surfactants are an essential compound or ingredient for the effective cleaning of surfaces, dirt, and emulsion. The growing demand for these products is driven by the rising disposable incomes of consumers within the country as well as its expanding middle class.

Moreover, the constant change in the lifestyle of consumers is contributing to the increase in the demand for surfactants in the market. This is due to consumers placing greater importance on personal grooming and self-care. For instance, the country’s beauty market expanded from USD12.3 billion in 2018 to USD15.6 billion in 2022, which is largely attributed to strong sales of shampoos, soaps, and skincare products. Additionally, the consistent demand for these products is making way for local manufacturers to export internationally. This is driving the size & volume of the Surfactants Industry in the country.

India Surfactants Market Opportunity:

India’s Expanding Industrial Sector – There is an increasing emphasis on the application of surfactants in the industrial sector of India, particularly in sectors like oil exploration, thereby increasing the demand for the production of surfactants. For instance, India’s strategic initiatives like the “Make in India” campaign has increased the domestic production across various industries. Similarly, there is an increasing emphasis on on-shore and off-shore oil exploration as evidenced by India offering 23 blocks or areas for finding and producing oil and gas in a mega offshore bid round to reduce its reliance on imports. These factors have increased the demand for surfactants in the Indian market.

Moreover, surfactant is an essential component in drilling fluids for reducing friction and in lubrication, as well as in easing seamless subsea operations. This industrial expansion is increasing the avenues for volume-based growth and increasing the investment in specialized surfactant formulations, which are tailored for these demanding industrial environments. Therefore, the versatility of surfactants in the industrial sector ensures that there are ample opportunities for surfactant manufacturers.

India Surfactants Market Challenge:

Unpredictable Prices of Raw Materials – The market is facing a challenge of quick, unpredictable change in the price of raw materials in the surfactants industry, such as the fluctuating costs of essential inputs, such as fatty alcohols and linear alkyl benzene (LAB), which are essential in the production of surfactants. For instance, lauryl alcohol alone constitutes approximately 60% of a manufacturer's raw material needs. Additionally, high-impact geopolitical events such as the Russia-Ukraine war have caused instability in the price of crude oil, thereby influencing the production costs for feedstocks such as benzene and kerosene.

Moreover, there is high pressure faced by the manufacturers as they cannot fully pass on the increasing costs to the consumers, thereby leading to a decrease in profitability and constrained margins. Therefore, this fluctuation is creating uncertainty in the production of surfactants, which is impacting both the manufacturers as well as end-users. Additionally, this unpredictability is hindering investments and restricting the market growth by disrupting supply chains and complicating long-term strategic planning for the industry in the country.

India Surfactants Market Trend

Technological Innovation & Advanced R&D – The market dynamics are changing due to the increasing focus on innovating technology and advancing research and development activities in the country, which is driven by the ever-changing preferences of consumers and the need for market players to differentiate their offerings in the competitive market. For instance, national initiatives such as the “Startup India” campaign increased the funding for chemical research, which reached over USD22.8 million in recent budgets. This financial support is driving collaborative efforts between industry giants such as Tata Chemicals and AkzoNobel, as well as local academic institutions, to enhance the efficiency of surfactants.

Moreover, manufacturers are introducing new commodities and diversified product lines, including multifunctional surfactants, to meet the performance demanded. For instance, companies such as Galaxy Surfactants are investing in R&D, securing patents, and launching products to increase the demand in the market. Therefore, this trend is positively shaping the growth trajectory of the market.

India Surfactants Market (2025-30): Segmentation Analysis

The India Surfactants Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Type:

- Anionic Surfactants

- Nonionic Surfactants

- Cationic Surfactants

- Amphoteric Surfactants

- Others

Among these, the anionic surfactants segment is dominating the market. The dominance of this segment is driven by the superior foaming, cleansing, and emulsifying capabilities, which are essential for its use across the various sectors in the country. Additionally, this surfactant is particularly demanded in products such as laundry detergents, dishwashing liquids, and various cleaning formulations, where there is a need for removing unwanted substances for consumer satisfaction.

Moreover, it is economical to produce anionic surfactants, which is further driving their adoption in the industries countrywide, which accounts for close to 50% of overall industrial surfactant output. Additionally, the price competition within this segment is high, which has led to the increasing need for surfactant manufacturers to prioritize management of costs to maintain viable margins. Therefore, these factors are contributing to the dominance of this segment in the market.

Based on End-User:

- Pharmaceuticals

- Cosmetics

- Household & Industrial Cleaning

- Textile

- Elastomers & Plastics

- Agrochemicals

- Oilfield

- Paints & Coatings

- Others

Out of these, the household & industrial cleaning segment holds the largest market share. The market lead of this segment is driven by the consistent demand for daily cleanliness and hygiene across the residential and industrial environments. This regular cleaning, which is required in both households and industries, is creating a stable revenue stream for surfactant manufacturers as they are a core component in the formulations of detergents and various cleaning agents. This is due to the requirement for effectively removing dirt in other cleaning tasks. For instance, the demand and usage of liquid detergents and dishwashing liquids were at their peak during COVID, which led to the increased production of surfactants in that period.

Additionally, the continuous demand in this segment is driving the need for large-scale manufacturing capabilities, distribution networks, and innovation in cleaning products. Therefore, these factors are contributing to the market dominance of this segment.

India Surfactants Industry Recent Development:

- 2025: Galaxy Surfactants Ltd. has received the globally recognized International Sustainability and Carbon Certification (ISCC) PLUS certification for its manufacturing facilities in Taloja (Maharashtra) and Jhagadia (Gujarat) for its key performance products. With this key milestone, Galaxy becomes one of the pioneers among Indian chemical companies to be recognized under this certification system.

- 2025: Godrej Industries Limited (Chemicals Division) acquired Savannah Surfactants' Food Additives Business to expand its global offerings in the Food & Beverages Industry. Located in Goa, Savannah boasts a manufacturing capacity of 5,200 MTPA. The acquisition aligns with Godrej's strategy for sustainable growth.

Gain a Competitive Edge with Our India Surfactants Market Report

- India Surfactants Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Surfactants Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Surfactants Market Policies, Regulations, and Product Standards

- India Surfactants Market Supply Chain Analysis

- India Surfactants Market Trends & Developments

- India Surfactants Market Dynamics

- Growth Drivers

- Challenges

- India Surfactants Market Hotspot & Opportunities

- India Surfactants Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Type

- Anionic Surfactants – Market Size & Forecast 2020–2030, USD Million

- Nonionic Surfactants – Market Size & Forecast 2020–2030, USD Million

- Cationic Surfactants – Market Size & Forecast 2020–2030, USD Million

- Amphoteric Surfactants – Market Size & Forecast 2020–2030, USD Million

- Others – Market Size & Forecast 2020–2030, USD Million

- By Origin

- Synthetic Surfactants – Market Size & Forecast 2020–2030, USD Million

- Bio-based Surfactants – Market Size & Forecast 2020–2030, USD Million

- By End-User

- Pharmaceuticals – Market Size & Forecast 2020–2030, USD Million

- Cosmetics – Market Size & Forecast 2020–2030, USD Million

- Household & Industrial Cleaning – Market Size & Forecast 2020–2030, USD Million

- Textile – Market Size & Forecast 2020–2030, USD Million

- Elastomers & Plastics – Market Size & Forecast 2020–2030, USD Million

- Agrochemicals – Market Size & Forecast 2020–2030, USD Million

- Oilfield – Market Size & Forecast 2020–2030, USD Million

- Paints & Coatings – Market Size & Forecast 2020–2030, USD Million

- Others

- By Region

- North

- East

- South

- West

- Central

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Type

- By Revenues (USD Million)

- Market Size & Outlook

- India Anionic Surfactants Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Origin – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- India Nonionic Surfactants Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Origin – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- India Cationic Surfactants Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Origin – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- India Amphoteric Surfactants Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Origin – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- India Surfactants Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Aarti Surfactants Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Anshika Polysurf Ltd. (APL)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dyna Glycols Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Esteem Industries Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Fineotex Chemical Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Galaxy Surfactants Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Godrej Industries Limited (Chemicals Division)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- HROC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Matangi Industries

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Peekay Agencies Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rossari Biotech Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sauradip Chemical Industries Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sihauli Chemicals Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Supreme Surfactants Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- UPL Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ultramarine & Pigments Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Venus Ethoxyethers Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Aarti Surfactants Ltd.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making