Global Subsea (Underwater) Robotics Market Research Report: Forecast (2023-2028)

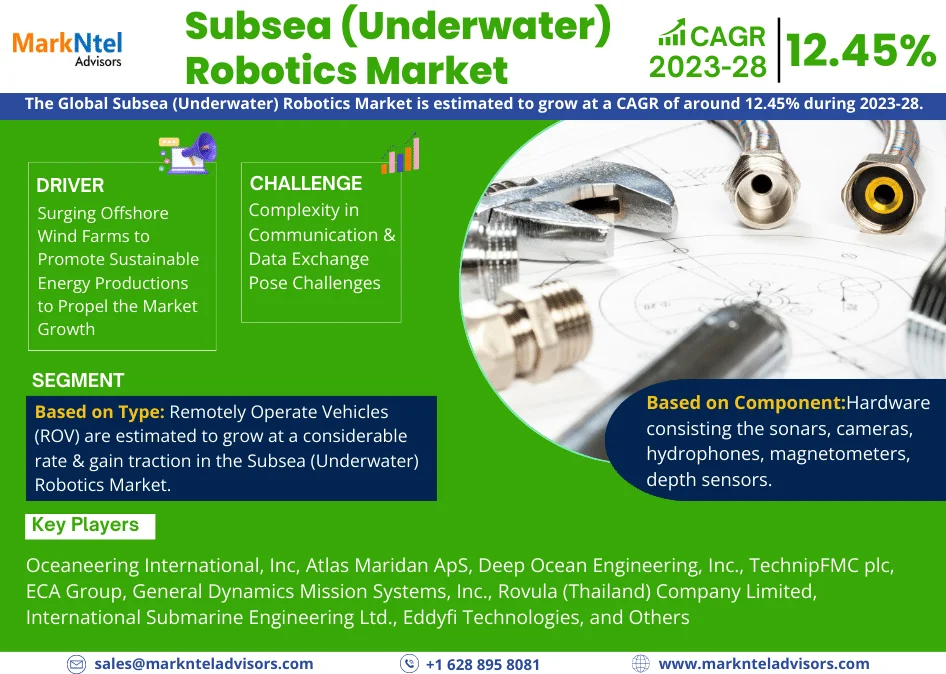

By Type (Remotely Operate Vehicles (ROV), Autonomous Underwater Vehicles (AUVs)), By Component (Hardware, Software), By End User (Marine & Defense, Oil & Gas Industry, Telecommunic...ation, Power Generation, Others (Shipping, Municipal Infrastructure, etc.,)), By Depth Range (Shallow Water Robotics, Medium Water Robotics, Deep Water Robotics), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Competitors (Oceaneering International, Inc, Atlas Maridan ApS, Deep Ocean Engineering, Inc., TechnipFMC plc, ECA Group, General Dynamics Mission Systems, Inc., Rovula (Thailand) Company Limited, International Submarine Engineering Ltd., Eddyfi Technologies, Soil Machine Dynamics Ltd., Acergy S.A. (Subsea 7), and others) Read more

- ICT & Electronics

- Aug 2023

- 188

- IT22015

Market Definition

Subsea Robotics focuses on the development & utilization of robotics systems for underwater applications such as offshore infrastructure maintenance, environmental monitoring, underwater exploration, etc. These robotic systems are specifically designed to operate in challenging & often harsh subsea environments, such as deep oceans, underwater infrastructure, and offshore oil & gas installations.

It includes a variety of remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), unmanned surface vehicles (USVs), and other specialized robots. These systems are equipped with advanced sensors, cameras, manipulators, thrusters, and communication systems to perform tasks such as inspection, maintenance, repair, surveying, and data collection in underwater locations.

Market Insights & Analysis: Global Subsea (Underwater) Robotics Market (2023-28):

The Global Subsea (Underwater) Robotics Market is estimated to grow at a CAGR of around 12.45% during the forecast period, i.e., 2023-28. The expansion of offshore oil & gas industries, growth in the defense budgets of different countries, and ongoing scientific research & exploration missions have been the leading factors for the market growth.

The oil & gas industries consist of huge offshore infrastructure across the world, which has been requiring subsea robotics technology for subsea inspections, maintenance, and repairs purposes. According to the International Energy Agency (IEA), in the New Policies Scenario, natural gas production from offshore facilities is forecasted to grow from 26.4 mboe/d in 2016 to 29.6 mboe/d in 2040. In addition, the rising R&D for the discovery of new oil & gas wells, coupled with the presence of existing offshore oil & gas reserves would boost the adoption of subsea robotics in the forecast period.

- In 2023, the Oil & Natural Gas Corporation of India announced an investment of USD2 billion for drilling 103 wells on its main gas-bearing asset in the Arabian Sea.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 12.45% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, Netherlands, Norway, Spain, Rest of Europe | |

| Asia-Pacific: China, India, Indonesia, Thailand, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, Rest of GCC, Rest of MEA | |

| Key Companies Profiled | Oceaneering International, Inc, Atlas Maridan ApS, Deep Ocean Engineering, Inc., TechnipFMC plc, ECA Group, General Dynamics Mission Systems, Inc., Rovula (Thailand) Company Limited, International Submarine Engineering Ltd., Eddyfi Technologies, Soil Machine Dynamics Ltd., Acergy S.A. (Subsea 7), and Others |

| Unit Denominations | USD Million/Billion |

Furthermore, the surge in the defense budgets of global economies like the US, France, India, China, and many others would also contribute to the expansion of the Global Subsea (Underwater) Robotics market during the forecast period. According to the Stockholm International Peace Research Institute, the World Military Expenditure increased by 3.7% in 2022 to reach a record high of USD 2240 billion.

Countries have been increasing their defense budgets, including the navy to increase national security amid the rising geopolitical tensions across the globe. Thus, the increase in defense budgets would require subsea robotics for mine countermeasures, surveillance, and search and rescue operations.

Global Subsea (Underwater) Robotics Market Drivers:

Surging Offshore Wind Farms to Promote Sustainable Energy Productions to Propel the Market Growth – The importance of sustainable energy is burgeoning globally due to climate change mitigations, energy security, independence, economic opportunities, etc. This has created a rising deployment of renewable energy sources like solar & wind farms across the globe. Additionally, the deployment of renewable energy sources was further boosted, owing to the rising government carbon emission policies such as the REPower of the EU, the Inflation Reduction Act of the USA, China’s 14th Five-Year Plan for Renewable Energy, etc.

Consequently, there is a wide addition of offshore wind farms globally. This expansion would have been expected to generate a heightened demand for subsea robots in the coming years, as these wind farms require inspections, maintenance, and other operations that pose challenges for companies to undertake operations efficiently, therefore creating a barrier to the Global Subsea (Underwater) Robotics Market growth.

Global Subsea (Underwater) Robotics Market Opportunities:

Growing Initiatives for Seafloor Mapping – Seafloor mapping by countries & research organizations is increasing globally owing to resource exploration, biodiversity & conservations, climate change & environmental impact, marine medicine, biotechnology, etc. According to the General Bathymetric Chart of the Oceans (GEBCO) in 2022, only around 20% of the ocean floor has so far been mapped in detail. Further, to explore these unmapped ocean floors, there is a growing initiative by countries like the US, India, the UK, etc. Additionally, international organizations like the UN, GEBCO, etc., are also accelerating sea mapping efforts.

- In 2021, the Nippon Foundation and GEBCO initiated Seabed 2030 Project to accelerate ocean mapping efforts. This project has set an ambitious goal of mapping the entire ocean floor by 2030.

Hence, this surge in seafloor mapping would necessitate the utilization of subsea robotics, including autonomous underwater vehicles (AUVs) & remotely operated vehicles (ROVs), which are equipped with advanced sensors & imaging systems. The growing demand for high-quality data collection would directly drive the expansion of the Subsea Robotics Market in the forecast period.

Global Subsea (Underwater) Robotics Market Challenges:

Complexity in Communication & Data Exchange Pose Challenges – Underwater acoustic communication is inclined to communication losses & multi-path effects caused by sound reflections & scattering in the water medium. This could result in difficulties transmitting large amounts of data reliably between underwater robots & surface stations, impacting real-time control, data collection, and mission coordination. Moreover, underwater acoustic communication is prone to losses & multi-path effects, which can lead to unreliable or distorted communication.

Energy management is another crucial aspect, as subsea robotics systems require efficient power consumption strategies & alternative power sources to sustain prolonged operations. Additionally, the need for dynamically adapting communication networks to changing conditions adds complexity to the market. As a result, these factors could collectively restrain the Subsea (Underwater) Robotics Market growth in the coming years by limiting their communication capabilities, energy efficiency, and adaptability.

Global Subsea (Underwater) Robotics Market Trends:

Increasing Investment in Research & Development – The Subsea (Underwater) Robotics Market is witnessing a surge in investment in R&D from both public & private entities. These investments aim to advance technology & enhance the capabilities of underwater robots. The increasing demand for underwater robotics across sectors such as oil & gas, offshore wind farms, defense, and marine industries, coupled with rapid technological advancements, has fuelled the need for research & development funding.

These investments are mainly focused on the development of new sensors & actuators, new communication technologies, safety & security technologies, and software algorithms. The investment is primarily directed toward the development of cutting-edge sensors, actuators, communication technologies, safety and security systems, and software algorithms.

- In 2023, Advanced Navigation, a leader in artificial intelligence (AI) for robotic & navigation technologies, announced the largest R&D subsea robotics facility in Australia. This focuses on the production of the company's underwater technologies, including its autonomous underwater robot.

Furthermore, the growing R&D investments in subsea robotics signify a promising trend for the industry as it fosters innovation & augments the functionalities of underwater robots. Consequently, this will enable wider adoption & broaden the range of applications for these robots in the coming years.

Global Subsea (Underwater) Robotics Market (2023-28): Segmentation Analysis

The Global Subsea (Underwater) Robotics Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–2028 at the global, regional, and national levels. Based on the analysis, the market has been further classified as:

Based on Type:

- Remotely Operate Vehicles (ROV)

- Autonomous Underwater Vehicles (AUVs)

Remotely Operate Vehicles (ROV) are estimated to grow at a considerable rate & gain traction in the Subsea (Underwater) Robotics Market, owing to their extensive utilization for underwater exploration & surveys. Object identification (for submerged navigation hazards) & vessel hull inspections have been the major application areas for the ROV. ROVs equipped with sensors & cameras help in mapping the seafloor, locating resources, studying marine life, and conducting scientific research.

Additionally, the real-time control offered by the ROV has been the prime factor for its growing utilization in the market as it allows the operators to actively navigate, manipulate objects, and respond to changing conditions. Moreover, the easy maintenance, repair, and upgradation of the ROV over the AUV also provides an opportunity for the growth of ROV in the Global Subsea (Underwater) Robotics market during the forecast period.

Based on Component:

- Hardware

- Software

Hardware consisting the sonars, cameras, hydrophones, magnetometers, depth sensors, and others would surge in the coming years & are presumed to capture the potential share of the Subsea (Underwater) Robotics Market. Continuous technological advancements, including materials, sensors, imaging systems, power systems, and communication technologies, would drive the development of hardware components.

Improved sensors enable better data collection, while advancements in materials & manufacturing techniques enhance the durability & performance of underwater robotic systems. Thus, it is estimated that hardware share would continue to grow in the future years due to the growth in manufacturing of new subsea robotics as well as the replacement or upgradation of existing underwater robotics.

Global Subsea (Underwater) Robotics Market (2023-28): Regional Analysis

Geographically, the Global Subsea (Underwater) Robotics Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

The Middle East & Africa is expected to hold a major share of the Global Subsea (Underwater) Robotics Market in the forecast period. This is due to the increasing demand for ROVs in offshore oil & gas industries and its essential need for sea exploration & scientific research. The region's offshore oil & gas industry is witnessing surging growth owing to the new project investments and expansion activities in Israel, Qatar, Saudi Arabia, UAE, etc.

These countries are tapping into their vast offshore resources to meet rising global oil demand, backed by the necessary capital & infrastructure to outpace other producers. As a result, there would be a growing requirement for subsea robots in the coming years for new offshore exploration projects. Furthermore, growing deep sea exploration in Egypt, Saudi Arabia, Israel, etc., is expected to foster the market in the region in the coming years.

Global Subsea (Underwater) Robotics Industry Recent Development:

- 2023: Oceaneering International Inc., collaborated with Ocyan, an offshore oil & gas company, to support a decommissioning project offshore Brazil. By this agreement the company provide specialized personnel, ROV decommissioning tooling, and technical support to cut & remove the assets.

Gain a Competitive Edge with Our Global Subsea (Underwater) Robotics Market Report

- Global Subsea (Underwater) Robotics Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Subsea (Underwater) Robotics Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

Global Subsea (Underwater) Robotics Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Oil & Gas Industry Outlook, 2023

- Oil & Gas Pipeline Projects

- Ongoing

- Upcoming

- Emerging Trends in the Oil & Gas Industry

- Renewable Energy Integration

- Digitalization and Automation

- Environmental and Social Governance (ESG)

- Oil & Gas Exploration and Production (E&P), By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- Oil & Gas Pipeline Projects

- Global Subsea (Underwater) Robotics Market Trends & Development

- Global Subsea (Underwater) Robotics Market Dynamics

- Growth Drivers

- Challenges

- Global Subsea (Underwater) Robotics Market Hotspot & Opportunities

- Global Subsea (Underwater) Robotics Market Policies & Regulations

- Global Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Remotely Operate Vehicles (ROV)- Market Size & Forecast 2018-2028, (USD Million)

- Autonomous Underwater Vehicles (AUVs)- Market Size & Forecast 2018-2028, (USD Million)

- By Component

- Hardware- Market Size & Forecast 2018-2028, (USD Million)

- Software- Market Size & Forecast 2018-2028, (USD Million)

- By End User

- Marine & Defense- Market Size & Forecast 2018-2028, (USD Million)

- Oil & Gas Industry- Market Size & Forecast 2018-2028, (USD Million)

- Telecommunication- Market Size & Forecast 2018-2028, (USD Million)

- Power Generation- Market Size & Forecast 2018-2028, (USD Million)

- Others (Shipping, Municipal Infrastructure, etc.,)- Market Size & Forecast 2018-2028, (USD Million)

- By Depth Range

- Shallow Water Robotics- Market Size & Forecast 2018-2028, (USD Million)

- Medium Water Robotics- Market Size & Forecast 2018-2028, (USD Million)

- Deep Water Robotics- Market Size & Forecast 2018-2028, (USD Million)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Type

- Market Size & Analysis

- North America Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By Component- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- By Depth Range- Market Size & Forecast 2018-2028, (USD Million)

- By Country

- The US

- Canada

- Mexico

- The US Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Canada Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Mexico Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- South America Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By Component- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- By Depth Range- Market Size & Forecast 2018-2028, (USD Million)

- By Country

- Brazil

- Rest of South America

- Brazil Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Europe Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By Component- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- By Depth Range- Market Size & Forecast 2018-2028, (USD Million)

- By Country

- The UK

- Germany

- The Netherlands

- Norway

- Spain

- Rest of Europe

- The UK Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Germany Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- The Netherlands Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Norway Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Spain Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By Component- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- By Depth Range- Market Size & Forecast 2018-2028, (USD Million)

- By Country

- The UAE

- Saudi Arabia

- Rest of GCC

- Rest of Middle East & Africa

- The UAE Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Saudi Arabia Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Rest of GCC Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By Component- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- By Depth Range- Market Size & Forecast 2018-2028, (USD Million)

- By Country

- China

- India

- Indonesia

- Thailand

- Australia

- Rest of Asia Pacific

- China Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- India Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Indonesia Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Thailand Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Australia Subsea (Underwater) Robotics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028, (USD Million)

- By End User- Market Size & Forecast 2018-2028, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Global Subsea (Underwater) Robotics Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Oceaneering International, Inc.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Atlas Maridan ApS

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Deep Ocean Engineering, Inc.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TechnipFMC plc

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ECA Group

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- General Dynamics Mission Systems, Inc.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rovula (Thailand) Company Limited

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- International Submarine Engineering Ltd.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Eddyfi Technologies

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Saab AB

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Soil Machine Dynamics Ltd.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Acergy S.A. (Subsea 7)

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Oceaneering International, Inc.

- Company Profiles

- Disclaimer