India Rubber Processing Chemicals Market Research Report: Forecast (2025-2030)

India Rubber Processing Chemicals Market Outlook - By Product Type (Accelerators, Anti-degradants [Antioxidants, Antiozonants], Vulcanizing Agents, Processing Aids/Plasticizers, Re...tarders, Blowing Agents, Others), By Distribution Channel (Direct Sales, Distributors/Wholesalers, Online Retail, Industrial Traders), By End-User (Automotive & Tire, Industrial Rubber Products, Footwear, Consumer Goods, Construction) and Others Read more

- Chemicals

- Sep 2025

- Pages 109

- Report Format: PDF, Excel, PPT

India Rubber Processing Chemicals Market

Projected 6.39% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2025)

USD 408 Million

Market Size (2030)

USD 556 Million

Base Year

2024

Projected CAGR

6.39%

Leading Segments

By Product Type: Anti-degradants

Market Insights & Analysis: India Rubber Processing Chemicals Market (2025-30):

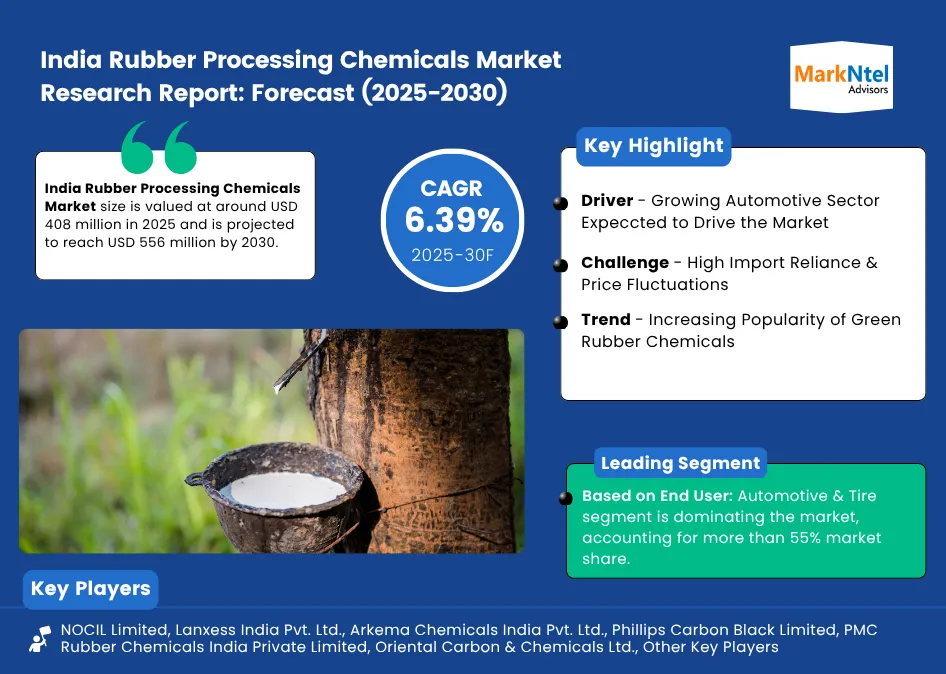

The India Rubber Processing Chemicals Market size is valued at around USD 408 million in 2025 and is projected to reach USD 556 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.39% during the forecast period, i.e., 2025-30. The India Rubber Processing Chemicals Market is significantly growing due to several growth factors, including the well-established automotive & tire manufacturing, the rising incentives by the Indian government, the expansion of local production facilities to increase the manufacturing of rubber processing chemicals in India, the adoption of biodegradable and organic chemicals for rubber processing, etc. One of the most prominent growth factors is the growing industrial rubber production in India, which consists of hoses, rubber flooring, conveyor belts, and many more, which utilizes more than 30% of the total rubber consumption in India, further increasing the demand for processing chemicals used for rubber production in the country.

Additionally, the various state governments are actively supporting the rubber cultivation in the country by drafting various incentives, such as the Chief Minister's Rubber Mission (Tripura, 2022), CM’s Rubber Mission Phase II (Mizoram, 2025), etc. These factors are actively contributing to the potential market growth. Moreover, the widespread acceptance of the biodegradable chemicals used for rubber processing in India is positively shaping the growth trajectory, as these chemicals are supporting environmental & public health to achieve the sustainability goals. However, the high import reliance and high price volatility are hindering the pace of the market growth & expansion.

India Rubber Processing Chemicals Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Accelerators, Anti-degradants [Antioxidants, Antiozonants], Vulcanizing Agents, Processing Aids/Plasticizers, Retarders, Blowing Agents, Others |

| By Distribution Channel | Direct Sales, Distributors/Wholesalers, Online Retail, Industrial Traders |

| By End-User | Automotive & Tire, Industrial Rubber Products, Footwear, Consumer Goods, Construction, Others |

India Rubber Processing Chemicals Market Driver:

Growing Automotive Sector – The market growth is driven by the strong automotive and tire manufacturing in India, which is highly reliant on rubber components, such as tires, seals, gaskets, dampers, mounts, and many more. Such components require high-quality rubber, thereby increasing rubber processing activities in the country. This, in turn, further accelerates the demand for rubber processing chemicals, such as anti-degradants, antioxidants, antiozonants, etc., which are the essential elements to increase the safety, strength, durability, and flexibility of the rubber-derived products. For instance, on average, India annually produces approximately 30 million vehicles and more than 190 million tires, which utilize a substantial amount of rubber-processing chemicals, thus actively augmenting the size & volume of the Rubber Processing Chemicals Industry.

India Rubber Processing Chemicals Market Opportunity:

Government Incentives to Increase Local Rubber Production – The active support by the Indian government through significant investments under various policies and incentives is offering ample growth opportunities in this market. For instance, in 2024, the Union government improved a scheme called the Sustainable & Inclusive Development of Natural Rubber Sector (SIDNRS) scheme, and started allocating 23% higher incentives, valued at over USD 8 million, for increasing rubber cultivation in India. Additionally, in 2024, the Union government allocated around USD 3.5 million to the Rubber Research Institute India (RRII) for rubber R&D, providing ample growth opportunities to the market players to grow & flourish.

Moreover, the government is financially supporting the farmers to grow rubber in the country by forming Rubber Producers Societies (RPS) and groups. For instance, in 2024, 250 new RPS were formed, and each gets around USD 400-USD 700 for tools, machines, and testing equipment required in the rubber production. These kinds of efforts are opening new growth avenues for the key players of the Rubber Processing Chemicals Market.

India Rubber Processing Chemicals Market Challenge:

High Import Reliance & Price Fluctuations – The market growth is hindered by the limited production facilities in the country to produce rubber processing chemicals, which results in high import reliance, about 65-70% from international markets, such as Thailand, Vietnam, Indonesia, etc. For instance, in 2023, India imported about 25,000 tons of prepared rubber accelerators, valued at over USD 300 million, mainly from China. Similarly, in 2023, the unvulcanised rubber was imported about 480 tons with a total spending of about USD 280 million, showing a high import dependence for these chemicals, hindering smooth market progression. Additionally, the price of raw materials is highly fluctuating, and frequent policy changes by the country’s government increase the overall costs of the chemicals to be imported, which leads to supply chain disruptions, ultimately causing losses to manufacturers & market players.

India Rubber Processing Chemicals Market Trend:

Increasing Popularity of Green Rubber Chemicals – The adoption of green, organic, and biodegradable chemicals, including the rubber processing chemicals, is actively transforming the market growth, as these have better performance, higher efficiency, less ecological footprint, low carbon emissions, and are highly cost-effective as compared to the conventional chemicals, thus highly preferred and driving the market growth.

Several key companies, such as Finorchem, Singh Plasticers & Resins, Green Petro, RubberIndia polymer Products, etc., are actively manufacturing green and highly sustainable rubber chemicals in the country. For instance, in 2025, a startup company called Biopole introduced two bio-based rubber processing chemicals, named Biozone 200 (antiozonants) and Biovive 300 (antioxidants). Similarly, in 2025, ARLANXEO launched bio-based chemicals, such as Eco-B and Eco-BC grades for rubber processing under its Keltan Eco product range. These kinds of products are gaining momentum and uplifting the market size & volume.

India Rubber Processing Chemicals Market (2025-30): Segmentation Analysis

The India Rubber Processing Chemicals Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Product Type:

- Accelerators

- Anti-degradants

- Vulcanizing Agents

- Processing Aids/Plasticizers

- Retarders

- Blowing Agents

- Others (Antioxidants)

Among these, the anti-degradants segment holds the largest market share of more than 40%. The dominance is due to the highly protective nature of anti-degradants to protect the rubber materials from oxidation, UV damage, Ozone, etc., as rubber easily gets degraded naturally, thus a highly preferred chemical over other types of products in this market. With the rising demand for these chemicals, the country is expanding its local production to meet the growing needs. For instance, NOCIL Limited (Gujarat) is planning to increase production capacity by investing about USD 3 million. Additionally, Aditya Birla Chemicals (2023) announced plans to increase the production capacity for rubber antioxidants production in Gujarat, thus contributing to the growth & expansion of the Indian Rubber Processing Chemicals Industry.

Based on End User:

- Automotive & Tire

- Industrial Rubber Products

- Footwear

- Consumer Goods

- Construction

- Others

Out of these, the automotive & tire segment is dominating the market, accounting for more than 55% market share. This segment is leading due to the large-scale manufacturing of tires and automobiles in India, which requires a substantial amount of rubber, which has further increased the demand for rubber processing chemicals. For instance, in 2024, India produced over 2 million units of all kinds of automobiles, which has increased the demand for rubber processing chemicals in the country. Similarly, in the FY 2022-23, India produced over 25 million units of tires in the country, making it a substantial count of the tires and contributing to the market growth.

Additionally, the rising collaborations of the tire and automobile manufacturing companies with the rubber processing units are increasing the market growth and showing the dominance of the automotive and tire segment as a leading end user of this market. For instance, in 2023, an active automotive manufacturer, the Goodyear company, collaborated with a rubber processing chemical manufacturer called Visolis to produce bio-based isoprene rubber on a commercial scale, thus leading the market segment.

India Rubber Processing Chemicals Industry Recent Development:

- 2024: Lanxess India Pvt. Ltd. expanded its antioxidant production facility in India by adding a new automated packaging unit, increasing throughput capacity by 12% and reducing manual handling risks.

- 2024: Phillips Carbon Black Limited (PCBL) is constructing its sixth plant in Naidupeta, India, with an initial capacity of 150,000 MT per annum for rubber-grade carbon black.

Gain a Competitive Edge with Our India Rubber Processing Chemicals Market Report

- India Rubber Processing Chemicals Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Rubber Processing Chemicals Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Rubber Processing Chemicals Market Policies, Regulations, and Product Standards

- India Rubber Processing Chemicals Market Supply Chain Analysis

- India Rubber Processing Chemicals Market Trends & Developments

- India Rubber Processing Chemicals Market Dynamics

- Growth Drivers

- Challenges

- India Rubber Processing Chemicals Market Hotspot & Opportunities

- India Rubber Processing Chemicals Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Product Type

- Accelerators– Market Size & Forecast 2025–2030, USD Million

- Anti-degradants– Market Size & Forecast 2025–2030, USD Million

- Antioxidants– Market Size & Forecast 2025–2030, USD Million

- Antiozonants– Market Size & Forecast 2025–2030, USD Million

- Vulcanizing Agents– Market Size & Forecast 2025–2030, USD Million

- Processing Aids/Plasticizers– Market Size & Forecast 2025–2030, USD Million

- Retarders– Market Size & Forecast 2025–2030, USD Million

- Blowing Agents– Market Size & Forecast 2025–2030, USD Million

- Others – Market Size & Forecast 2025–2030, USD Million

- By Distribution Channel

- Direct Sales– Market Size & Forecast 2025–2030, USD Million

- Distributors/Wholesalers– Market Size & Forecast 2025–2030, USD Million

- Online Retail– Market Size & Forecast 2025–2030, USD Million

- Industrial Traders– Market Size & Forecast 2025–2030, USD Million

- By End-User

- Automotive & Tire– Market Size & Forecast 2025–2030, USD Million

- Industrial Rubber Products– Market Size & Forecast 2025–2030, USD Million

- Footwear– Market Size & Forecast 2025–2030, USD Million

- Consumer Goods– Market Size & Forecast 2025–2030, USD Million

- Construction– Market Size & Forecast 2025–2030, USD Million

- Others– Market Size & Forecast 2025–2030, USD Million

- By Region

- East

- West

- North

- South

- Central

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Product Type

- Market Size & Outlook

- India Rubber Processing Accelerators Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million

- By End-User – Market Size & Forecast 2025–2030, USD Million

- Market Size & Outlook

- India Rubber Processing Anti-Degradants Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million

- By End-User – Market Size & Forecast 2025–2030, USD Million

- Market Size & Outlook

- India Rubber Processing Vulcanizing Agents Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million

- By End-User – Market Size & Forecast 2025–2030, USD Million

- Market Size & Outlook

- India Rubber Processing Aids/Plasticizers Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million

- By End-User – Market Size & Forecast 2025–2030, USD Million

- Market Size & Outlook

- India Rubber Processing Retarders Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million

- By End-User – Market Size & Forecast 2025–2030, USD Million

- Market Size & Outlook

- India Rubber Processing Blowing Agents Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million

- By End-User – Market Size & Forecast 2025–2030, USD Million

- Market Size & Outlook

- India Rubber Processing Chemicals Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- NOCIL Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lanxess India Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Arkema Chemicals India Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Phillips Carbon Black Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PMC Rubber Chemicals India Private Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oriental Carbon & Chemicals Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jiangsu Sinorgchem Technology India Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sennics Co. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- NOCIL Limited

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making