Global Radiation Hardened Electronics Market Research Report: Forecast (2022-2028)

By Component (Microprocessors & Controllers, Sensors, Memory, Power Sources, Discrete Semiconductors, Application Specific Integrated Circuits), By Manufacturing Techniques (Rad Ha...rd By Design (RHBD), Rad Hard By Process (RHBP), Rad Hard By Software (RHBS)), By End-User (Space Applications {Satellites, Launch Vehicles}, Military Applications {Missiles, Defense Systems, Arms and Ammunition, Military Aviation}, Nuclear Power Plants) Read more

- ICT & Electronics

- Nov 2021

- Pages 210

- Report Format: PDF, Excel, PPT

Radiation Hardened Electronics refers to the electronic components (circuits, resistors, transistors, capacitors, diodes, etc.), single-board computer CPUs, packages, and products primarily used for satellite, space, nuclear plant, and military applications. They are designed to withstand exposure to radiation and extreme temperatures (-55°C to 125°C). The process of hardening helps in preventing electronics from damage, melting, or breaking.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-28 | |

| CAGR (2022-2027) | 4.1% |

| Regions Covered | North America: USA, Canada, Mexico |

| Europe: Germany, UK, France, Spain, Russia | |

| Asia-Pacific: China, India, Japan, South Korea, Australia | |

| South America: Brazil, and Argentina | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Israel | |

| Key Companies Profiled | HEICO Corporation, Analog Devices Inc., Anaren Inc., BAE Systems, Cobham PLC, Data Device Corp., Honeywell International Inc., IBM Corp, Infineon Technologies, Microchip Technologies Inc., Micropac Technology Inc., Renesas Electronics Corporation, Solid State Devices Inc., ST Microelectronics N.V., Texas Instruments, Teledyne Technologies Inc., The Boeing Company, Xilinx Inc |

| Unit Denominations | USD Million/Billion |

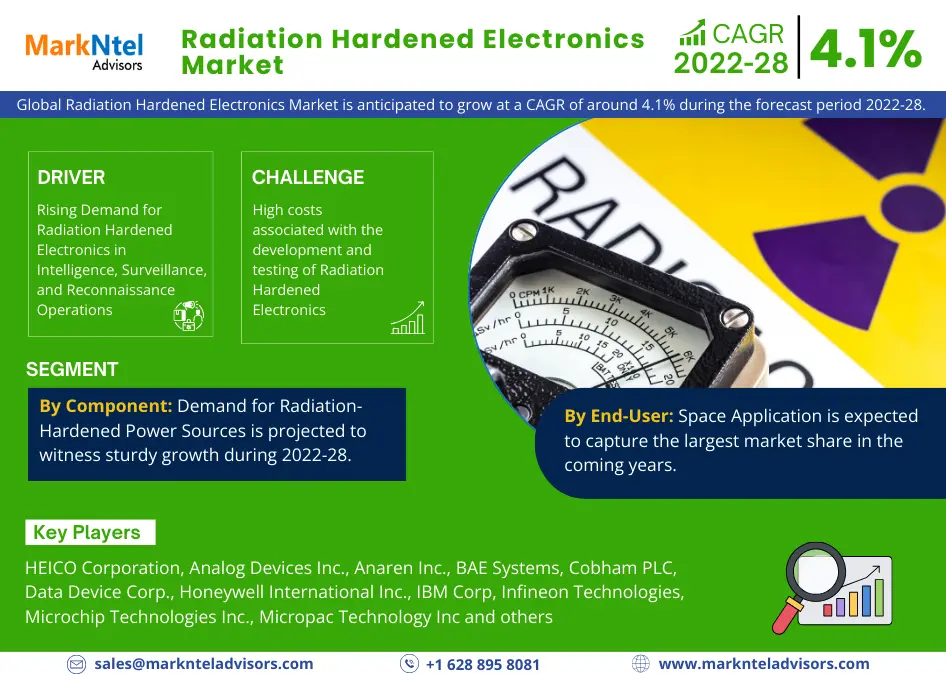

The Global Radiation Hardened Electronics Market is anticipated to grow at a CAGR of around 4.1% during the forecast period, i.e., 2022-28, says MarkNtel Advisors. Radiation-hardened electronics are widely used in industries to protect devices from extreme radiation exposure. Radiation hardening is used across the electronic industry to develop components like power-management devices, microprocessors, and solid-state memory that are economical to buy yet strong enough to survive in space for years.

Moreover, the surge in Intelligence, Surveillance, & Reconnaissance (ISR) operations and the booming demand for electronic components that can withstand radiations in the nuclear power industry & military applications are other crucial aspects expected to drive the market in the coming years.

The Impact of COVID-19 on the Global Radiation Hardened Electronics Market

- The COVID-19 pandemic in 2020 amplified the risk & uncertainties among several industries worldwide, and the Global Radiation Hardened Electronics Market was no exception.

- The US is one the prime importers of semiconductors.

- High import tariffs owing to China-US trade tensions had a severe impact on the imports of radiation-hardened components in the US.

- Moreover, the disruptions in the supply chain negatively affected the US-based market leaders and caused supply-demand imbalances.

- Further, an unexpected halt in production plants also severely impacted the overall market growth.

- However, in the coming years, the market is likely to witness a slow recovery.

Market Segmentation

By End-User:

- Space Applications

- Satellites

- Launch Vehicles

- Military Applications

- Missiles

- Defense Systems

- Arms & Ammunition

- Military Aviation

- Nuclear Power Plants

Of them all, the Space Application is expected to capture the largest market share in the coming years. It owes to the mounting demand for radiation-hardened electronics for TV broadcasting, telephone satellites, nanosatellites & microsatellites, etc., and the surging global requirements for earth observation satellites, space-based military, and agriculture surveillance & monitoring. Radiation protection is a crucial design aspect for electronic components used in space-based applications.

Satellites need to withstand extreme space environments like rapidly changing temperatures, high-energy particle attacks, satellite body charging effects, and radiations. These dynamics fuel the requirement for highly reliable system components that can overcome the damaging effects, thereby propelling the demand for Radiation-Hardened Electronics for space applications.

By Component:

- Microprocessors & Controllers

- Sensors

- Memory

- Power Sources

- Discrete Semiconductors

- Application Specific Integrated Circuits

Of them all, the demand for Radiation-Hardened Power Sources is projected to witness sturdy growth during 2022-28, mainly due to the rising need for MOSFETs and switches for space & defense applications. Power MOSFETs are used as a highly reliable component in the outer space requirements since they pose excellent durability characteristics against ionizing radiations & high-energy-charged particles.

Additionally, power supplies in space applications require enhanced components to tolerate extreme solar & electromagnetic effects and particle interactions. The electromagnetic & solar events degrade the quality & operation of space-based systems. Hence, the demand for radiation-hardened Power Sources is expected to increase significantly in the forecast period.

Regional Landscape:

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

Here, North America attained the largest market share in recent years. Being an ardent user of satellite-based communication systems, the US is the major contributor to the regional market growth. It owes to the development of integrated technology for making advanced weapons that use radiation-hardened electronics to increase resistance against damage.

Besides, the extensive presence of leading defense & space research institutes in the country is another crucial factor driving the regional market. In addition, the US is investing massively to upgrade fabrication facilities for making radiation-hardened chips used in the nuclear arsenal. It is spending up to $170 million to improve the ability of SkyWater Technology Foundry in Bloomington, Minn, to enhance its radiation-hardened-chip line for the requirements for the Defense Department.

Market Dynamics

Key Drivers

Rising Demand for Radiation Hardened Electronics in Intelligence, Surveillance, and Reconnaissance Operations through 2028

The defense sector depends on electromagnetic radiation mainly for various Intelligence, Surveillance, and Reconnaissance (ISR) applications like Signals Intelligence (SIGINT) & missile early warning. Using electromagnetic radiation helps the military enable communications, navigation, radar, and non-intrusive inspection of aircraft & other equipment.

The increasing ISR operations in the military to monitor & handle the actions of enemies is the prime aspect expected to drive the Global Radiation-Hardened Market in the coming years. To make an ISR operation successful, all systems used in the process should be of high quality & exceptionally reliable. Hence, the demand for radiation-hardened electronics is burgeoning rapidly since they are preferred profoundly for space, military, & maritime applications during ISR operations.

Possible Growth Challenges

- High costs associated with the development and testing of Radiation Hardened Electronics

- Increasing demand for customization from high-end customers for military & space missions

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Radiation Hardened Electronics Market?

- What is the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Radiation Hardened Electronics Market?

- Who are the key competitors, their key strengths & weaknesses, and how they perform in the Global Radiation Hardened Electronics Market based on a competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Radiation Hardened Electronics Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Impact of COVID-19 on Global Radiation Hardened Electronics

- Global Radiation Hardened Electronics Market Policies & Regulations

- Global Radiation Hardened Electronics Market Supply Chain Analysis

- Global Radiation Hardened Electronics Market Intellectual Property Rights Analysis

- Year on Year Patents Filed & Approved

- Key Strategic Imperatives for Success & Growth in Radiation Hardened Electronics Market

- Global Radiation Hardened Electronics Market Trends & Insights

- Global Radiation Hardened Electronics Market Dynamics

- Impact Analysis

- Drivers

- Challenges

- Global Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- Microprocessors & Controllers

- Sensors

- Memory

- Power Sources

- Discrete Semiconductors

- Application Specific Integrated Circuits

- By Manufacturing Techniques

- Rad Hard By Design (RHBD)

- Rad Hard By Process (RHBP)

- Rad Hard By Software (RHBS)

- By End-User

- Space Applications

- Satellites

- Launch Vehicles

- Military Applications

- Missiles

- Defense Systems

- Arms and Ammunition

- Military Aviation

- Nuclear Power Plants

- Space Applications

- By Competition

- Competition Characteristics

- Market Share of Leading Competitors

- Key Strategic Initiatives Undertaken by the Competitors

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

- By Component

- Market Size & Analysis

- North America Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End-User

- By Country

- US

- Canada

- Mexico

- The US Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Canada Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Mexico Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Market Size & Analysis

- South America Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End-User

- By Country

- Brazil

- Argentina

- Others

- Brazil Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Argentina Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Market Size & Analysis

- Europe Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End-User

- By Country

- The UK

- France

- Germany

- Spain

- Russia

- Others

- The UK Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- France Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Germany Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Spain Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Russia Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End-User

- By Country

- Saudi Arabia

- The UAE

- Israel

- South Africa

- Others

- Market Size & Analysis

- Asia Pacific Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End-User

- By Country

- India

- China

- Japan

- South Korea

- Australia

- Others

- China Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- India Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Japan Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- South Korea Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Australia Radiation Hardened Electronics Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- By Manufacturing Techniques

- By End Users

- Market Size & Analysis

- Market Size & Analysis

- Competitive Benchmarking

- Competition Matrix

- Company Overview

- Product/Business Segment Overview

- Regulatory & Legal Development

- Company Strategies

- SWOT Analysis

- Competition Matrix

- Company Profile

- HEICO Corporation

- Analog Devices Inc

- Anaren Inc

- BAE Systems

- Cobham PLC

- Data Device Corp.

- Honeywell International Inc

- IBM Corp

- Infineon Technologies

- Microchip Technologies Inc

- Micropac Technology Inc

- Renesas Electronics Corporation

- Solid State Devices Inc

- ST Microelectronics N.V.

- Texas Instruments

- Teledyne Technologies Inc

- The Boeing Company

- Xilinx Inc.

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making