Global Plasma Fractionation Market Research Report: Forecast (2026-2032)

Plasma Fractionation Market - By Product Type Immunoglobulins (Intravenous Immunoglobulin (IVIG), Subcutaneous Immunoglobulin (SCIG), Hyperimmune Globulins), Coagulation Factor Con...centrates (Factor VIII, Factor IX, Von Willebrand Factor, Prothrombin Complex Concentrates (PCC), Fibrinogen Concentrates, Others), Albumin, Protease Inhibitors, (Alpha-1 Antitrypsin, C1 Esterase Inhibitors, Others) By Application (Hematology, Immunology, Neurology, Oncology, Critical Care & Trauma, Pulmonology, Rheumatology, Dermatology, Infectious Diseases, Others), By Processing Technology (Chromatography, Ultrafiltration & Microfiltration, Nanofiltration & Viral Inactivation, Recombinant / Hybrid Processing, Others) By Disease Indication (Primary Immunodeficiency Diseases, Secondary Immunodeficiency, Hemophilia A & B, Hypogammaglobulinemia, Immune Thrombocytopenic Purpura (ITP), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), Kawasaki Disease, Hereditary Angioedema, Others), By End-User (Academic Institutes, Clinical Research Laboratories, Hospitals and Clinics), and others Read more

- Healthcare

- Jan 2026

- Pages 189

- Report Format: PDF, Excel, PPT

Global Plasma Fractionation Market

Projected 6.86% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 32.1 Billion

Market Size (2032)

USD 51.06 Billion

Largest Region

North America

Projected CAGR

6.86%

Leading Segments

By Application: Immunology

Global Plasma Fractionation Market Report Key Takeaways:

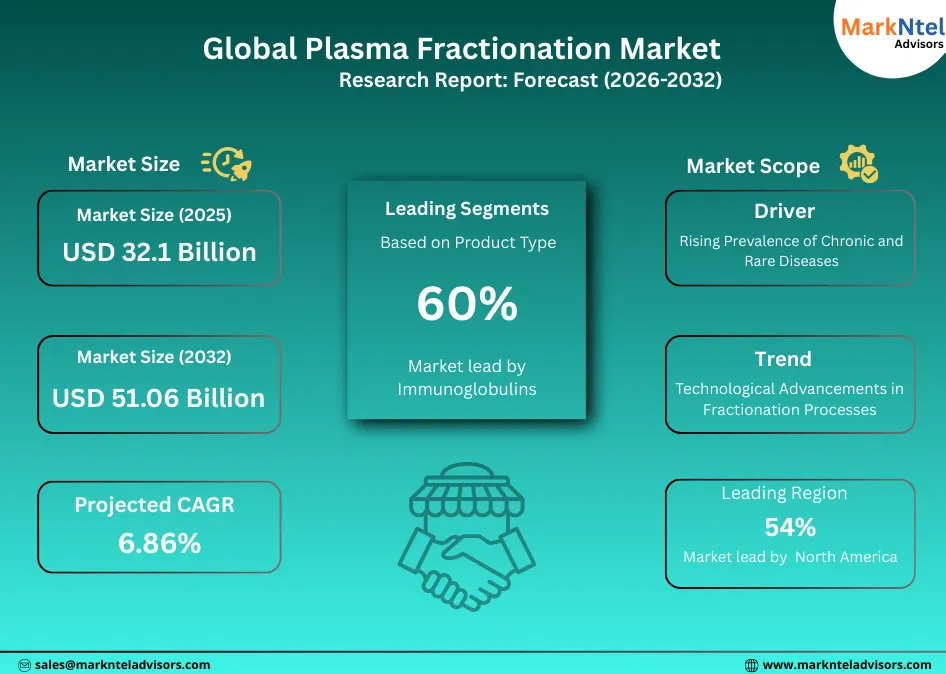

- The Global Plasma Fractionation Market size was valued at around USD 32.1 billion in 2025 and is projected to reach USD 51.06 billion by 2032. The estimated CAGR from 2026 to 2032 is around 6.86%, indicating strong growth.

- By Product Type, the immunoglobulins segment represented 60% of the Global Plasma Fractionation Market size in 2025.

- By Application, the immunology represented 36% of the Global Plasma Fractionation Market size in 2025.

- By Region, North America leads the Global Plasma Fractionation Market with a dominant 54% share in 2025.

- The leading plasma fractionation companies are CSL Behring, ADMA Biologics, Inc., Intas Pharmaceuticals Ltd., Bharat Serums and Vaccines Limited, Grifols, S.A., Octapharma AG, Shanghai RAAS Blood Products Co., Ltd., Kedrion Biopharma, PlasmaGen BioSciences Pvt. Ltd., LFB, Takeda Pharmaceutical Company Limited, Merck KgaA, Biotest AG, Emergent BioSolutions Inc., Kamada Ltd., GC Biopharma Corp., Syntegon, and others.

Market Insights & Analysis: Global Plasma Fractionation Market (2026- 2032):

The Global Plasma Fractionation Market size was valued at around USD 32.1 billion in 2025 and is projected to reach USD 51.06 billion by 2032. Along with this, the market is estimated to grow at a CAGR of around 6.86% during the forecast period, i.e., 2026-32.

The Global Plasma Fractionation Market is experiencing rapid growth, primarily driven by the rising prevalence of chronic and rare diseases and continuous technological advancements in fractionation processes, which are enhancing production efficiency, safety, and the availability of high-quality plasma-derived therapies worldwide.

According to the U.S. Centers for Disease Control and Prevention (CDC), an estimated 129 million individuals live with at least one major chronic condition, including cardiovascular disease, cancer, diabetes, and hypertension. These conditions often require long-term therapeutic management, significantly increasing demand for plasma-derived biologics such as immunoglobulins and albumin.

Beyond chronic illnesses, rare diseases represent a substantial and growing patient population worldwide. A recent systematic review published in 2025 estimates that approximately 446 million people globally live with one of 3,585 identified rare disorders, many of which require specialized plasma protein–based therapies.

Specific conditions such as hereditary angioedema, which is treated using plasma-derived products, affect 1–2 individuals per 100,000 people globally, underscoring persistent demand for fractionated plasma therapies.

Governments and public health agencies are reinforcing this demand through long-term investments in research and clinical infrastructure. In the United States, the National Institutes of Health’s Rare Diseases Clinical Research Network (RDCRN) supports clinical studies across more than 200 rare diseases, enhancing diagnostics, treatment development, and patient access well beyond 2025.

At a global level, the 78th World Health Assembly (May 2025) recognized rare diseases as a public health priority, estimating that 300 million people worldwide live with one or more of over 7,000 rare diseases. The Assembly mandated the development of a 10-year Global Action Plan on Rare Diseases (2026–2035) to improve diagnosis, care pathways, research, and access to treatments, including plasma-derived therapies.

Technological advancements further strengthen market prospects. Leading manufacturers are adopting automation and advanced purification technologies to expand capacity and improve efficiency. For example, Grifols received U.S. FDA approval to expand immunoglobulin purification and filling capacity at its Clayton, North Carolina, facility by an additional 16 million grams per year, driven by process upgrades. The company also plans to increase its European fractionation capacity from 22 million liters to 26 million liters by 2026, reflecting continued investment in advanced engineering and process optimization.

Future policy initiatives are expected to significantly accelerate market growth. For instance, in May 2025, the World Health Assembly recognized rare diseases as a global health priority and mandated the World Health Organization to develop a 10-year Global Action Plan on Rare Diseases (2026–2035), focused on awareness, early diagnosis, research, and equitable access to care, including plasma-derived therapies.

At the national level, the UK is advancing initiatives through 2026 to strengthen clinical research, diagnostics, and targeted therapies, supported by expanded genomics infrastructure. Similarly, Ireland’s National Rare Disease Strategy 2025–2030 emphasizes improved diagnosis, coordinated care, treatment access, and innovation.

Overall, the convergence of rising disease prevalence, supportive global health policies, and continuous technological advancements is expected to sustain strong growth and long-term expansion of the global plasma fractionation market.

Global Plasma Fractionation Market Recent Developments:

- July 2025: Takeda announced that the U.S. FDA has granted 510(k) clearance for its HyHub™ and HyHub™ Duo vial access devices, designed to streamline administration of HYQVIA®, a plasma-derived immunoglobulin therapy, by reducing preparation steps for subcutaneous infusion in home and clinical settings. These single-use devices, developed with patient and caregiver input, are expected to be available in the U.S. in H2 2025, enhancing convenience for individuals requiring facilitated immunoglobulin treatment

- June 2025: CSL announced that the U.S. Food and Drug Administration has approved ANDEMBRY® (garadacimab-gxii) for prophylactic treatment of hereditary angioedema (HAE) in patients aged 12 years and older, marking the first therapy targeting factor XIIa at the start of the HAE cascade. The once-monthly, subcutaneous autoinjector regimen significantly reduces HAE attacks and expands preventative treatment options for this rare, potentially life-threatening condition.

Global Plasma Fractionation Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Immunoglobulins (Intravenous Immunoglobulin (IVIG), Subcutaneous Immunoglobulin (SCIG), Hyperimmune Globulins), Coagulation Factor Concentrates (Factor VIII, Factor IX, Von Willebrand Factor, Prothrombin Complex Concentrates (PCC), Fibrinogen Concentrates, Others), Albumin, Protease Inhibitors, (Alpha-1 Antitrypsin, C1 Esterase Inhibitors, Others |

| By Application | Hematology, Immunology, Neurology, Oncology, Critical Care & Trauma, Pulmonology, Rheumatology, Dermatology, Infectious Diseases, Others), |

| By Processing Technology | Chromatography, Ultrafiltration & Microfiltration, Nanofiltration & Viral Inactivation, Recombinant / Hybrid Processing, Others) |

| By Disease Indication | Primary Immunodeficiency Diseases, Secondary Immunodeficiency, Hemophilia A & B, Hypogammaglobulinemia, Immune Thrombocytopenic Purpura (ITP), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), Kawasaki Disease, Hereditary Angioedema, Others), |

| By End-User | Academic Institutes, Clinical Research Laboratories, Hospitals and Clinics), and others |

Global Plasma Fractionation Market Drivers:

Rising Prevalence of Chronic and Rare Diseases

The rising burden of chronic and rare diseases across major healthcare regions is significantly increasing long-term treatment needs, driving sustained demand for plasma-derived therapies and accelerating growth in the global plasma fractionation market.

In the United States, chronic diseases are widespread. CDC data show that 76.4% of adults (194 million people) had at least one chronic condition, while 51.4% (130 million) lived with multiple conditions. Diseases such as diabetes, cardiovascular disorders, and kidney disease drive sustained demand for plasma-derived biologic therapies.

In parallel, rare diseases represent a significant and sustained therapeutic demand. In the U.S., rare diseases are defined as conditions affecting fewer than 200,000 people per disease, yet collectively impact millions of Americans, many of whom require lifelong treatment and specialized plasma-based therapies.

Europe carries a significant disease burden. WHO data indicate that non-communicable diseases cause about 1.8 million avoidable deaths annually in the European Region, led by cardiovascular disease, cancer, respiratory disorders, and diabetes. In parallel, 20–30 million people live with rare diseases, many requiring lifelong plasma-derived therapies.

The widespread and growing prevalence of chronic and rare diseases in the U.S. and Europe significantly expands the patient base requiring plasma-derived therapies. This sustained clinical need is expected to accelerate plasma fractionation demand and support robust market growth in the coming years.

Global Plasma Fractionation Market Trends:

Technological Advancements in Fractionation Processes

Technological innovation is transforming plasma fractionation by improving efficiency, purity, and safety. Advanced chromatography, ultrafiltration, and optimized downstream processing now enable higher recovery of immunoglobulins and albumin while reducing impurities and viral risks, supporting consistent, high-quality plasma-derived biologics to meet growing clinical demand.

Regulatory authorities, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), continue to enforce stringent quality, safety, and traceability standards for plasma-derived medicinal products. These regulatory expectations are accelerating the adoption of advanced manufacturing technologies, as companies must invest in sophisticated purification, validation, and monitoring systems to ensure compliance with evolving regulatory benchmarks.

Large-scale infrastructure investments further highlight this trend. In 2023, CSL commissioned a USD 504 million plasma fractionation facility in Marburg, Germany, incorporating high levels of automation and state-of-the-art processing technologies to expand production capacity for albumin and immunoglobulin therapies. Additionally, during 2024, industry focus has intensified on digital transformation, including real-time process monitoring, data-driven quality control, and automated batch analytics, which help reduce production variability and minimize batch failures.

Advancements in purification technologies, automation, and digital quality systems are transforming plasma fractionation efficiency and reliability. These innovations are strengthening supply capabilities and regulatory compliance, thereby accelerating long-term growth of the plasma fractionation market.

Global Plasma Fractionation Market Challenges:

High Capital and Operational Costs Impeding Market Growth

High capital intensity and elevated operating expenses remain a key structural challenge for the plasma fractionation market, as complex infrastructure, strict regulatory compliance, and continuous quality assurance significantly raise entry barriers and limit scalability for manufacturers.

Establishing compliant facilities requires specialized purification systems, aseptic processing, viral inactivation technologies, and cold-chain infrastructure. Due to this complexity, biopharmaceutical plants comparable to plasma fractionation facilities typically require capital investments of USD 200–400 million, along with lengthy validation and regulatory approval timelines before production begins.

Operational costs further compound this challenge. Plasma fractionation manufacturers must comply with stringent Good Manufacturing Practice (GMP) requirements enforced by global health authorities. The World Health Organization highlights that GMP compliance demands continuous investment in skilled personnel, process validation, quality assurance systems, and biosafety controls. These fixed costs significantly increase per-unit production expenses, particularly when capacity utilization is suboptimal, limiting the economic viability of smaller or new entrants.

Collectively, high upfront capital requirements and sustained GMP-driven operating costs create significant entry and expansion barriers, slowing capacity additions, limiting participation by smaller manufacturers, and ultimately constraining the overall growth potential of the plasma fractionation market.

Global Plasma Fractionation Market (2026-32) Segmentation Analysis:

The Global Plasma Fractionation Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Product Type:

- Immunoglobulins

- Intravenous Immunoglobulin (IVIG)

- Subcutaneous Immunoglobulin (SCIG)

- Hyperimmune Globulins

- Coagulation Factor Concentrates

- Factor VIII

- Factor IX

- Von Willebrand Factor

- Prothrombin Complex Concentrates (PCC)

- Fibrinogen Concentrates

- Others

- Albumin

- Protease Inhibitors

- Alpha-1 Antitrypsin

- C1 Esterase Inhibitors

- Others

The immunoglobulins segment holds the top spot in the Global Plasma Fractionation Market with a market share of around 60%, reflecting their broad clinical applicability, rising disease burden, and sustained therapeutic demand.

Immunoglobulin therapies, particularly Intravenous Immunoglobulin (IVIG) and Subcutaneous Immunoglobulin (SCIG), are cornerstone treatments for primary and secondary immunodeficiency disorders, autoimmune diseases, neurological conditions, and inflammatory disorders. The expanding prevalence of chronic immune-mediated and rare diseases globally has significantly increased long-term dependence on these therapies.

IVIG remains widely used in acute and hospital-based settings due to rapid systemic efficacy, while SCIG adoption is accelerating as it supports home-based administration, improved patient compliance, and reduced healthcare system burden. Additionally, hyperimmune globulins play a critical role in post-exposure prophylaxis and treatment of specific infectious diseases, further strengthening demand.

From a manufacturing perspective, immunoglobulins offer higher clinical value and consistent utilization compared to other plasma-derived products, enabling better capacity utilization for fractionators. Continuous improvements in fractionation, purification, and viral inactivation technologies have also enhanced yields and safety profiles, supporting scalable production.

Collectively, their essential role across multiple therapeutic areas and chronic treatment pathways firmly positions immunoglobulins as the leading product segment in the plasma fractionation market.

Based on Application:

- Hematology

- Immunology

- Neurology

- Oncology

- Critical Care & Trauma

- Pulmonology

- Rheumatology

- Dermatology

- Infectious Diseases

- Others

The immunology category leads the Global Plasma Fractionation Industry with a substantial 36% market share. Market Dominance is driven by the widespread and growing use of plasma-derived immunoglobulins in the treatment of primary and secondary immunodeficiency disorders, autoimmune diseases, and certain inflammatory conditions.

Rising diagnosis rates of immune-related disorders, supported by improved screening and awareness programs across developed and emerging healthcare systems, continue to expand the patient pool requiring long-term immunoglobulin therapy.

Immunology applications benefit from the chronic nature of many immune disorders, where patients often require lifelong or recurrent dosing, ensuring consistent and predictable demand for plasma-derived products.

In addition, immunoglobulins are increasingly used in hospital settings for managing immune complications associated with cancer therapies, organ transplantation, and severe infections, further strengthening volume consumption.

Technological advancements in fractionation and purification processes have improved the yield and safety of immunoglobulin products, enabling manufacturers to scale production efficiently to meet rising immunology-driven demand.

Collectively, the high clinical reliance on immunoglobulins, expanding therapeutic indications, and long-term treatment requirements underpin the dominant position of immunology within the plasma fractionation market.

Global Plasma Fractionation Market (2026-32): Regional Projection

The Global Plasma Fractionation Market is dominated by the North America region, which holds a commanding 54% share. North American dominance is driven by its advanced healthcare infrastructure, strong regulatory frameworks, and high prevalence of chronic and rare diseases requiring plasma-derived therapies.

The region benefits from a well-established plasma collection network, particularly in the United States, which accounts for a substantial portion of global plasma donations due to a large donor base and supportive reimbursement policies.

In addition, North America hosts several major plasma fractionation and biopharmaceutical manufacturers with large-scale, technologically advanced facilities, enabling high production capacity and consistent product quality.

Robust regulatory oversight by authorities such as the U.S. Food and Drug Administration ensures stringent quality, safety, and efficacy standards, fostering trust and widespread clinical adoption of plasma-derived products, including immunoglobulins, albumin, and coagulation factors.

Furthermore, strong government and private investments in rare disease research, advanced biologics, and healthcare innovation support sustained demand growth. High healthcare expenditure, broad insurance coverage for biologic therapies, and early adoption of advanced fractionation technologies further reinforce North America’s dominance, positioning the region as the global hub for plasma fractionation development and commercialization.

Gain a Competitive Edge with Our Global Plasma Fractionation Market Report

- Global Plasma Fractionation Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Plasma Fractionation Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Plasma Fractionation Market Policies, Regulations, and Product Standards

- Global Plasma Fractionation Market Trends & Developments

- Global Plasma Fractionation Market Dynamics

- Growth Drivers

- Challenges

- Global Plasma Fractionation Market Hotspot & Opportunities

- Global Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- Immunoglobulins

- Intravenous Immunoglobulin (IVIG)

- Subcutaneous Immunoglobulin (SCIG)

- Hyperimmune Globulins

- Coagulation Factor Concentrates

- Factor VIII

- Factor IX

- Von Willebrand Factor

- Prothrombin Complex Concentrates (PCC)

- Fibrinogen Concentrates

- Others

- Albumin

- Protease Inhibitors

- Alpha-1 Antitrypsin

- C1 Esterase Inhibitors

- Others

- Immunoglobulins

- By Application – Market Size & Forecast 2022-2032, USD Million

- Hematology

- Immunology

- Neurology

- Oncology

- Critical Care & Trauma

- Pulmonology

- Rheumatology

- Dermatology

- Infectious Diseases

- Others

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- Chromatography

- Ultrafiltration & Microfiltration

- Nanofiltration & Viral Inactivation

- Recombinant / Hybrid Processing

- Others

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- Primary Immunodeficiency Diseases

- Secondary Immunodeficiency

- Hemophilia A & B

- Hypogammaglobulinemia

- Immune Thrombocytopenic Purpura (ITP)

- Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

- Kawasaki Disease

- Hereditary Angioedema

- Others

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Academic Institutes

- Clinical Research Laboratories

- Hospitals and Clinics

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- Market Size & Outlook

- North America Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Canada Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Mexico Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Argentina Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- By Country

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Germany Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- France Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Italy Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Spain Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- By Country

- Saudi Arabia

- The UAE

- South Africa

- Egypt

- Rest of the Middle East and Africa

- Saudi Arabia Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- The UAE Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- South Africa Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Egypt Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- China Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Japan Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- India Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- South Korea Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Australia Plasma Fractionation Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By Processing Technology – Market Size & Forecast 2022-2032, USD Million

- By Disease Indication – Market Size & Forecast 2022-2032, USD Million

- By End-User – Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Plasma Fractionation Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- CSL Behring

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ADMA Biologics, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Intas Pharmaceuticals Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bharat Serums and Vaccines Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Grifols, S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Octapharma AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Shanghai RAAS Blood Products Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kedrion Biopharma

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PlasmaGen BioSciences Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- LFB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Takeda Pharmaceutical Company Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Merck KGaA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Biotest AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Emergent BioSolutions Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kamada Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- GC Biopharma Corp.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Syntegon

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- CSL Behring

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making