North America Skid Steer & Compact Track Loader Market Research Report: Forecast (2024-2030)

North America Skid Steer & Compact Track Loader Market Report - By Type (Skid Steer, Compact Track Loader), By Application (Construction, Agriculture, Others), By Capacity (Upto 20...00 lbs, 2001 to 2700 lbs, Above 2700 lbs), By Engine Power (Upto 65 HP, 65-80 HP, Above 80 HP), and Others Read more

- Buildings, Construction, Metals & Mining

- Aug 2024

- Pages 187

- Report Format: PDF, Excel, PPT

Market Definition

Skid steer and compact track loader is a type of compact heavy machinery with lift arms that are capable of attaching multiple buckets allowing the loader to work various kinds of tasks like moving dirt, leveling, digging, lifting, site preparation, and grading. Skid Steer type loaders use wheels, while compact track uses tracks for their movement. Also, the skid steer and compact track loader use differential steering rather than a conventional one allowing it to make a zero radius turn.

Market Insights & Analysis: North America Skid Steer & Compact Track Loader Market (2024-30):

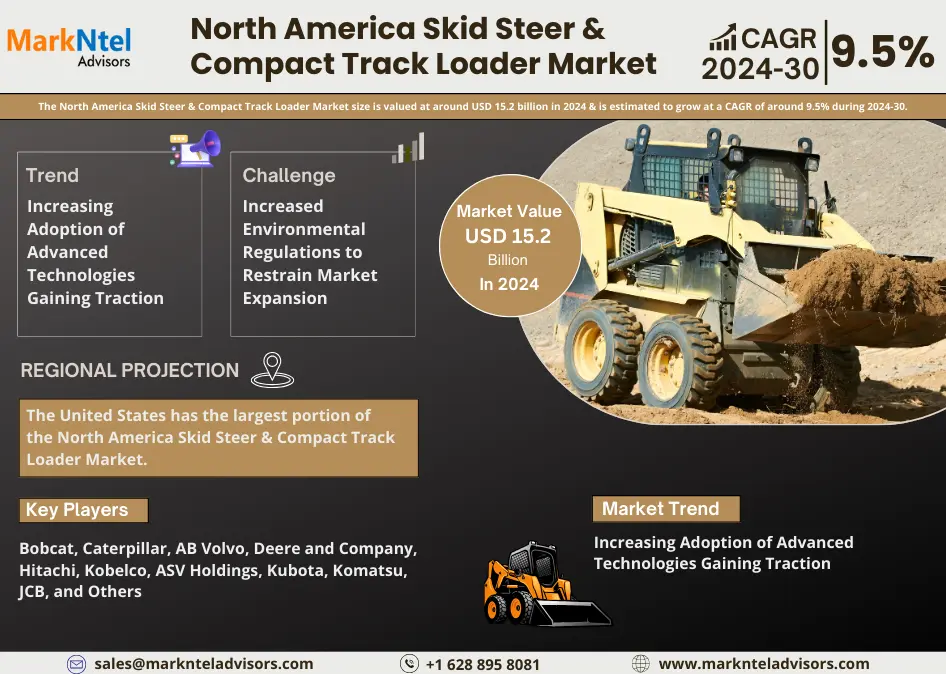

The North America Skid Steer & Compact Track Loader Market size is valued at around USD 15.2 billion in 2024 & is estimated to grow at a CAGR of around 9.5% during the forecast period, i.e., 2024-30. The growth in the market is primarily driven by the increase in agricultural, landscaping, construction, and mining activities. The market growth is closely in sync with the growth in these industries. In North America, the boom in agriculture and farming productivity, rise in infrastructure development, and increase in mining activities can potentially provide huge growth to the market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 9.5% |

| Country Covered | United States, Canada, Mexico |

| Key Companies Profiled | Bobcat, Caterpillar, AB Volvo, Deere and Company, Hitachi, Kobelco, ASV Holdings, Kubota, Komatsu, JCB, and Others |

| Market valuee (2024) | USD 15.2 Billion |

The skid-steer and compact tracker loader are used for clearing out and leveling the ground. It can be used for pushing materials or objects from one direction to another, carrying, loading, and unloading materials, as well as for various other operations such as digging and grinding. The ability to execute all these varied tasks is due to the equipment’s ability to integrate a varied range of buckets with it. Also, due to the equipment being capable of differential steering, it is capable of making a zero turn. This makes it an absolutely useful tool when working in a very compact region, such as mine.

Additionally, the rise in consumption of consumer electronics and the increasing adoption of electric vehicles can fuel the demand for rare earth materials resulting in boosting of mining activities in the region. The development of such scenarios can potentially lead to a boost in the skid-steer and compact track loader market of North America. However, any slowdown in these supporting industries can affect the market. Also, the changing policy and strict environmental regulations can significantly impact the market as the companies now need to heavily invest in developing technology to align with the necessary compliance which can shrink their margins. Also, there might be a possibility that the major companies that manufacture consumer electronics, and electric vehicles might outsource their manufacturing or source the raw materials from outside the region of North America, leading to a decline in mining activity in the region.

The innovation and rise of advanced technologies such as 5G, Artificial Intelligence, Machine learning, and Augmented and Virtual Reality can help enable the remote-controlled capabilities in skid steer and compact track and with enough data can automate the whole or part of their work process. Such developments in the skid steer and compact track market indicate its future growth outlook over the forecasted period.

North America Skid Steer & Compact Track Loader Market Driver:

A Rise in Agriculture, Construction, and Mining Activities – Demand for skid-steer and compact track loaders is in close positive correlation with the changing dynamics of agriculture & farming, landscaping construction, and mining industries which extensively use this machinery. They are used for performing many functions like material handling, land clearing, site preparation, and excavation in these industries. In the farming and agriculture industry, skid-steer and compact loaders are used to plow snow, move hay bales (mulchers), lift materials into trucks or down from stacks, etc., and clean up debris. The equipment is deployed in construction and mining industries for its adaptable working nature as it can access confined spaces with ease owning to its compact size. These machines are capable of adding multiple buckets to it so that at once a single machine can able to do different types of work. Furthermore, because of its maneuverability, it is used for extraction, excavation, and transport of materials in mining operations.

North America Skid Steer & Compact Track Loader Market Challenge:

Increased Environmental Regulations to Restrain Market Expansion – The rise in regulatory compliance by North American countries to meet their emission targets and sustainability goals can significantly impact the revenue growth of the skid steer and compact track industry in the region. This is due to the companies now having to invest more in their environment-friendly product development to comply with the policy changes. This could not just impact the margins of the companies but also their future expansion plans.

Additionally, given that mining activities and the extraction of rare earth elements, are very polluting activities, the enforcement of environment-friendly regulations will significantly impact the growth of the mining industry. The countries might even choose to source these materials from outside the region. The development of such scenarios will act as a double-whammy for the growth of the skid-steer and compact loader industry in the coming years.

North America Skid Steer & Compact Track Loader Market Trend:

Increasing Adoption of Advanced Technologies Gaining Traction – The loaders will be built to comply with environmentally friendly regulations and the companies are doing so by developing electric versions of not just skid steers but compact track loaders. For instance,

- In Jan. 2024, Bobcat disclosed the world’s first all-electric skid loader called the S7X, boasting a single charge of up to eight hours in run-time.

This, in combination with the latest technologies like 5G, artificial intelligence (AI), machine learning, and augmented & virtual reality can expand the capabilities of the skid-steer and compact track loader exponentially. The addition of these types of technologies can bring remote-operated functionality, autonomy, and smart connectivity to the skid loaders. The skid-steer loaders will be operating more productively due to the improved capability. An increase in productivity from technology enhancement is important because the region is already facing falling fertility rates, which means fewer numbers of workers will be available for work.

North America Skid Steer & Compact Track Loader Market (2024-30): Segmentation Analysis

The North America Skid Steer & Compact Track Loader Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the regional level. Based on the analysis, the market has been further classified as:

Based on Type:

- Skid-Steer

- Compact Track Loader

Based on type, the compact track loader segment presently holds the largest share of the North America Skid Steer & Compact Track Loader Market. There were several factors involved that allowed compact track loaders to take market share from skid steer loaders such as improved ground-to-ground traction offered by tracks which apply a much lower pressure on the ground, allowing it to work in softer and soggier grounds. Additionally, compact track loaders create a lot less vibrations compared to skid-steer loaders. These advantages of compact loaders were enough to make it a market leader despite it being more expensive than the skid-steer loader.

Based on Application:

- Construction

- Agriculture

- Others

The usage of skid steers and compact track loaders in the construction sector occupies the largest market share. The primary reason is due increase in construction activities in the region. For instance,

- In Feb 2024, the United States Census Bureau reported that on a YoY basis from Dec 22 to Dec 23, there was a 14% jump in the total construction activity in the country.

The rise in activities related to construction, maintenance, and upgradation of residential, non-residential, manufacturing, highway & streets, power, and healthcare has fueled the growth of the construction sector, thereby increasing the demand for the skid-steer and compact track loader. Construction activities will continue to boost the growth in the skid-steer and compact track industry over the forecasted period as well.

North America Skid Steer & Compact Track Loader Market (2024-30): Regional Projections

Geographically, the North American Skid Steer & Compact Track Loader Market expands across:

- United States

- Canada

- Mexico

- Others

The United States has the largest portion of the North America Skid Steer & Compact Track Loader Market. The main reason for this is the US economy, which is the largest in the region and also has the highest population in the region. Such scenarios create a strong demand for loader machinery in the country, hence nearly all major manufacturers of both skid steers and compact track loaders are in the United States. This scenario will continue to play a positive role over the forecasted period as well because no other country in North America comes anywhere close to the size of the economy and population and also the ability to drive major consumption to fuel the growth in the skid steer and compact track industry.

North America Skid Steer & Compact Track Loader Industry Recent Development:

- June 2024: Bobcat a leading player in the skid steer and compact track loader market, is building a new factory in Mexico, by investing around USD 300 million. This will increase the production capacity of Bobcat by 20%.

- March 2024: JCB announced that it has secured a contract from the United States Marine Corps, worth around USD 29 million to supply them 206 3TS-8T Teleskid telescopic compact track loaders.

Gain a Competitive Edge with Our North America Skid Steer & Compact Track Loader Market Report

- The North America Skid Steer & Compact Track Loader Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The North America Skid Steer & Compact Track Loader Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- North America Skid Steer & Compact Track Loader Market Policies, Regulations, Product Standards

- North America Skid Steer & Compact Track Loader Market Trends & Development

- North America Skid Steer & Compact Track Loader Market Dynamics

- Growth Drivers

- Challenges

- North America Skid Steer & Compact Track Loader Market Hotspot & Opportunities

- North America Skid Steer & Compact Track Loader Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Units Sold (Thousand)

- Market Share & Analysis

- By Type

- Skid Steer- Market Size & Forecast 2019-2030, USD Million

- Compact Track Loader- Market Size & Forecast 2019-2030, USD Million

- By Application

- Construction- Market Size & Forecast 2019-2030, USD Million

- Agriculture- Market Size & Forecast 2019-2030, USD Million

- Others- Market Size & Forecast 2019-2030, USD Million

- By Capacity

- Upto 2000 lbs- Market Size & Forecast 2019-2030, USD Million

- 2001 to 2700 lbs- Market Size & Forecast 2019-2030, USD Million

- Above 2700 lbs- Market Size & Forecast 2019-2030, USD Million

- By Engine Power

- Upto 65 HP- Market Size & Forecast 2019-2030, USD Million

- 65-80 HP- Market Size & Forecast 2019-2030, USD Million

- Above 80 HP- Market Size & Forecast 2019-2030, USD Million

- By Country

- United States

- Canada

- Mexico

- Company

- Competition Characteristics

- Market Share and Analysis

- By Type

- Market Size & Analysis

- The United States Skid Steer & Compact Track Loader System Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Units Sold (Thousand)

- Market Share & Analysis

- By Application- Market Size & Forecast 2019-2030, USD Million

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Capacity- Market Size & Forecast 2019-2030, USD Million

- By Engine Power- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Canada Skid Steer & Compact Track Loader System Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Units Sold (Thousand)

- Market Share & Analysis

- By Application- Market Size & Forecast 2019-2030, USD Million

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Capacity- Market Size & Forecast 2019-2030, USD Million

- By Engine Power- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Mexico Skid Steer & Compact Track Loader System Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Units Sold (Thousand)

- Market Share & Analysis

- By Application- Market Size & Forecast 2019-2030, USD Million

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Capacity- Market Size & Forecast 2019-2030, USD Million

- By Engine Power- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- North America Skid Steer & Compact Track Loader Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Bobcat

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Caterpillar

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AB Volvo

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Deere and Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hitachi

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kobelco

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ASV Holdings

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kubota

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Komatsu

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JCB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Bobcat

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making