UAE MRO Services Market Research Report: Forecast (2026-2032)

UAE MRO Services Market - By MRO Service Type Line Maintenance, (Transit Checks, Daily and Weekly Checks, AOG Support), Base Maintenance (Heavy Checks (C-Checks, D-Checks), Schedul...ed Hangar Maintenance), Engine Maintenance, Component Maintenance, (Avionics, Landing Gear, Wheels & Brakes, Electrical & Mechanical Components, Airframe Maintenance, (Structural Repairs, Corrosion Control, Airframe Inspections, Modifications & Upgrades, Cabin Retrofits, Avionics Upgrades, Aircraft Conversion (P2f, Special Missions), By Aircraft Type (Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, Business Jets, Helicopters, Military Aircraft), By Contract Type (Short-Term / Ad-Hoc Contracts, Long-Term Maintenance Contracts, Power-By-The-Hour (Pbh) Contracts), By Organization Type (Airline-Affiliated MRO Providers, Independent MRO Providers, OEM-Affiliated MRO Providers), By End User (Commercial Passenger Airlines, Cargo & Freight Operators, Business & General Aviation, Military & Government Aviation, Oil & Gas Aviation Operators), and others Read more

- Aerospace & Defense

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

UAE MRO Services Market

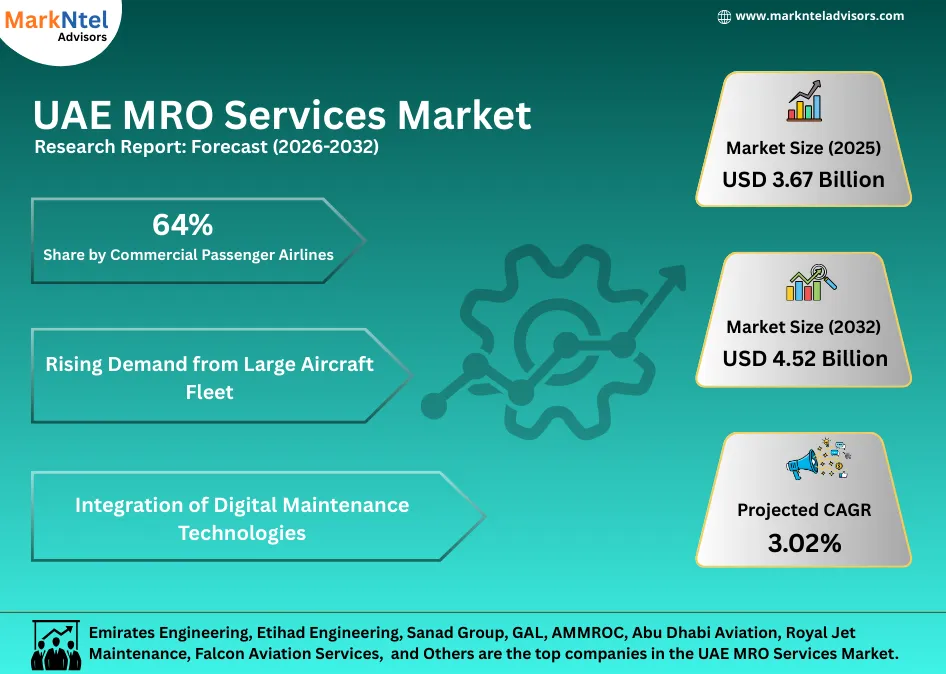

Projected 3.02% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 3.67 Billion

Market Size (2032)

USD 4.52 Billion

Base Year

2025

Projected CAGR

3.02%

Leading Segments

By MRO Service Type: Engine Maintenance

UAE MRO Services Market Report Key Takeaways:

- Market size was valued at around USD3.67 billion in 2025 and is projected to reach USD4.52 billion by 2032. The estimated CAGR from 2026 to 2032 is around 3.02%, indicating strong growth.

- By City, Dubai holds the largest market share of about 55% in the UAE MRO Services Market in 2025.

- By MRO Service Type, the Engine Maintenance segment represented a significant share of about 37% in the UAE MRO Services Market in 2025.

- By End-User, the Commercial Passenger Airlines segment represented a significant share of about 64% in the UAE MRO Services Market in 2025.

- Leading MRO Services companies in the UAE are Emirates Engineering, Etihad Engineering, Sanad Group, GAL, AMMROC, Abu Dhabi Aviation, Royal Jet Maintenance, Falcon Aviation Services, JAS Aircraft Maintenance, Global Air Support, ExecuJet Middle East, DC Aviation Al-Futtaim, Gulf Aircraft & Engineering Services, and Others.

Market Insights & Analysis: UAE MRO Services Market (2026-32):

The UAE MRO Services Market size was valued at around USD3.67 billion in 2025 and is projected to reach USD4.52 billion by 2032. Along with this, the market is estimated to grow at a CAGR of around 3.02% during the forecast period, i.e., 2026-32.

The UAE MRO (Maintenance, Repair & Overhaul) services industry is positioned for sustained growth through the mid-2020s, driven by expanding long-haul operations and steadily deepening technical capability across airframe, engine, and component segments. For instance, Dubai International Airport handled 46 million passengers in the first half of 2025 alone, marking its busiest six-month period on record and signaling persistently high aircraft utilization levels. This intensity directly reinforces continuous demand for scheduled and unscheduled maintenance across wide-body fleets.

Additionally, large local operators with in-house engineering capabilities, such as Emirates and Etihad Airways, anchor baseline MRO demand while attracting third-party work from international carriers operating through UAE hubs. As fleet complexity rises, infrastructure expansion is keeping pace. For reference, UAE aviation authorities and airport operators are investing in new hangars, workshops, and support facilities to accommodate larger fleets and next-generation aircraft.

Similarly, Abu Dhabi is strengthening its depth in high-value maintenance. Sanad Group reported USD870 million in H1 2025 revenue, up 39 % year-on-year, reflecting strong engine MRO utilization and growing third-party demand. Meanwhile, regional platforms such as the Dubai Airshow continue to facilitate partnerships, technology transfer, and long-term MRO investment, reinforcing the UAE’s trajectory as a globally competitive, full-service aerospace maintenance hub.

UAE MRO Services Market Recent Developments:

- 2025: Sanad unveiled its new asset management strategy to integrate engine leasing, parts trading, and lifecycle support, expanding its role across the global aftermarket and supporting broader aviation MRO growth.

- 2025: Etihad Engineering partnered with EDGE's EPI business to enhance local aircraft component MRO capabilities, including advanced wheel hub machining and maintenance, strengthening UAE self-reliance in aerospace MRO services.

UAE MRO Services Market Scope:

| Category | Segments |

|---|---|

| By MRO Service Type | Line Maintenance, (Transit Checks, Daily and Weekly Checks, AOG Support), Base Maintenance (Heavy Checks (C-Checks, D-Checks), Scheduled Hangar Maintenance), Engine Maintenance, Component Maintenance, (Avionics, Landing Gear, Wheels & Brakes, Electrical & Mechanical Components, Airframe Maintenance, (Structural Repairs, Corrosion Control, Airframe Inspections, Modifications & Upgrades, Cabin Retrofits, Avionics Upgrades, Aircraft Conversion (P2f, Special Missions), |

| By Aircraft Type | Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, Business Jets, Helicopters, Military Aircraft |

| By Contract Type | Short-Term / Ad-Hoc Contracts, Long-Term Maintenance Contracts, Power-By-The-Hour (Pbh) Contracts |

| By Organization Type | Airline-Affiliated MRO Providers, Independent MRO Providers, OEM-Affiliated MRO Providers |

| By End User | Commercial Passenger Airlines, Cargo & Freight Operators, Business & General Aviation, Military & Government Aviation, Oil & Gas Aviation Operators), and others |

UAE MRO Services Market Driver:

Rising Demand from Large Aircraft Fleet

The UAE MRO services market is primarily driven by its large and intensively operated wide-body aircraft fleet, which creates continuous and high-value maintenance demand. For instance, Emirates operates the world’s largest fleet of Airbus A380s along with more than 120 Boeing 777s, making Dubai one of the most wide-body-dense aviation hubs globally. These aircraft fly long-haul routes exceeding 12–15 hours, accelerating engine cycles, structural inspections, and component wear.

For instance, Etihad Airways operates a wide-body-focused fleet including B787s, A350s, and B777s, supporting Abu Dhabi’s demand for advanced airframe and engine MRO services. Similarly, Dubai International Airport handled over 92 million passengers in 2024, forcing airlines to maintain extremely high aircraft availability and reliability, which directly increases scheduled and unscheduled maintenance activity.

Additionally, wide-body aircraft generate significantly higher MRO spend per aircraft than narrow-bodies due to complex engines, composite materials, and advanced avionics. As a result, airlines rely heavily on local MRO capacity to minimize Aircraft-On-Ground time.

UAE MRO Services Market Trend:

Integration of Digital Maintenance Technologies

The UAE MRO services market is increasingly integrating digital maintenance technologies to manage rising fleet complexity and utilization. For instance, Emirates has deployed Airbus Skywise digital analytics across its wide-body fleet, enabling real-time monitoring of aircraft systems and predictive fault detection. This allows engineers to address component issues before failure, significantly reducing unscheduled Aircraft-On-Ground (AOG) events on A380 and B777 aircraft.

For reference, Emirates Engineering has publicly stated that predictive analytics and digital inspection tools shorten troubleshooting cycles and improve maintenance planning accuracy, helping manage one of the world’s largest wide-body fleets, exceeding 260 aircraft. Similarly, Etihad Engineering uses advanced digital maintenance tracking and condition-based monitoring to support both in-house and third-party aircraft, improving turnaround time reliability for long-haul fleets.

For instance, Abu Dhabi-based Sanad Group integrates digital engine health monitoring and data-driven shop-visit forecasting within its engine MRO operations, enabling better lifecycle planning for high-value engines. For reference, engine digital diagnostics reduce unnecessary removals and optimize parts consumption, directly lowering overhaul costs.

UAE MRO Services Market Challenges:

Shortage of Skilled and Licensed Aviation Workforce

The shortage of skilled and licensed aviation personnel is the most persistent challenge facing the UAE MRO Services Market, directly affecting capacity expansion and service reliability. As aircraft fleets grow and maintenance cycles become more complex, demand for GCAA- and EASA-licensed engineers is rising faster than training output. For reference, Emirates Group publicly announced plans to recruit more than 17,000 aviation professionals in 2024–25, including engineers and technicians, highlighting immediate labor pressure within Dubai’s MRO ecosystem.

Additionally, the UAE’s MRO ecosystem is heavily oriented toward wide-body and next-generation aircraft, which require highly specialized skills in avionics, composite structures, and advanced engines. This raises qualification thresholds and lengthens certification timelines, limiting short-term workforce availability. Similarly, strong airline expansion in Dubai and Abu Dhabi increases maintenance workloads, tightening labor supply further.

For instance, reliance on expatriate engineers remains high, exposing MRO providers to visa constraints, wage inflation, and retention risks. At the same time, national Emiratization policies, while strategically important, add complexity to staffing roles that require years of technical experience.

UAE MRO Services Market (2026-32) Segmentation Analysis:

The UAE MRO Services Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on MRO Service Type:

- Line Maintenance

- Base Maintenance

- Engine Maintenance

- Component Maintenance

- Airframe Maintenance

- Modifications & Upgrades

Engine Maintenance is the most dominant and highest-value segment within the UAE MRO Services Market, accounting for about 37% because engines account for the largest share of lifecycle maintenance costs and are heavily stressed by long-haul operations. For instance, the UAE’s aviation system is built around wide-body aircraft flying intercontinental routes, which subjects engines to long flight hours, high thrust settings, and frequent cycle accumulation, accelerating overhaul requirements.

Additionally, Emirates operates large fleets of long-range wide-body aircraft powered by high-thrust engines such as the GE90 and Trent series, which require periodic heavy overhauls and advanced diagnostics. For instance, Emirates has invested heavily in predictive maintenance and digital engine health monitoring to manage reliability and reduce unscheduled removals.

Moreover, the UAE’s geographic hub role intensifies engine utilization, as high aircraft availability is essential to protect global schedules. As a result, airlines and lessors prioritize local engine MRO capability over other maintenance segments.

Based on the End-User:

- Commercial Passenger Airlines

- Cargo & Freight Operators

- Business & General Aviation

- Military & Government Aviation

- Oil & Gas Aviation Operators

Commercial Passenger Airlines dominate the UAE MRO Services Market with a market share of about 64% because their scale, fleet composition, and operational intensity directly determine maintenance demand and local capacity investment. For instance, Emirates announced a USD2 billion aircraft retrofit programme covering more than 190 passenger aircraft, including cabin, avionics, and structural upgrades. This multi-year programme alone is generating sustained heavy-maintenance and component-level work within Dubai, reinforcing the central role of passenger airlines in MRO activity.

For example, Emirates is also developing a USD950 million engineering complex at Dubai World Central, designed to support airframe, component, and line maintenance for its passenger fleet, signaling airline-led expansion rather than third-party demand. Similarly, Etihad Airways operates a passenger-focused wide-body fleet of A350s, B787s, and B777s, driving advanced composite, engine, and avionics maintenance requirements handled largely through local engineering capability. As a result, commercial passenger airlines act as both the largest consumers and enablers of MRO services, making them the dominant force shaping the UAE MRO services market.

UAE MRO Services Market (2026-32): Regional Projection

Dubai’s global aviation connectivity is a major reason it leads the UAE MRO services industry with a market share of about 55%. Dubai International Airport (DXB) connects to over 270 destinations worldwide via more than 8,500 weekly flights operated by more than 100 airlines, making it one of the most connected hubs on the planet. This extensive network generates huge aircraft utilization, which in turn fuels consistent demand for heavy maintenance, repairs, and overhaul services locally, reinforcing Dubai’s MRO ecosystem.

Additionally, DXB can now accommodate 115 million passengers annually after infrastructure upgrades, and the city’s second airport, Dubai World Central (DWC), reported passenger growth of 36.6% year-on-year, expanding capacity and connectivity for both passengers and cargo. Also, in 2025 alone, DXB recorded 46 million passengers in the first half, reaffirming sustained growth in travel demand. The scale of connectivity also supports cargo operations, making Dubai a central logistics and parts distribution hub that benefits engine and component MRO cycles. Therefore, Dubai is leading this market.

Gain a Competitive Edge with Our UAE MRO Services Market Report

- UAE MRO Services Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- UAE MRO Services Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- UAE MRO Services Market Regulations, Policies & Standards

- UAE MRO Services Market Trends & Developments

- UAE MRO Services Market Dynamics

- Growth Drivers

- Challenges

- UAE MRO Services Market Hotspots & Opportunities

- UAE MRO Services Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By MRO Service Type- (USD Million)

- Line Maintenance

- Transit Checks

- Daily and Weekly Checks

- AOG Support

- Base Maintenance

- Heavy Checks (C-Checks, D-Checks)

- Scheduled Hangar Maintenance

- Engine Maintenance

- Component Maintenance

- Avionics

- Landing Gear

- Wheels & Brakes

- Electrical & Mechanical Components

- Airframe Maintenance

- Structural Repairs

- Corrosion Control

- Airframe Inspections

- Modifications & Upgrades

- Cabin Retrofits

- Avionics Upgrades

- Aircraft Conversion (P2f, Special Missions)

- Line Maintenance

- By Aircraft Type- (USD Million)

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Aircraft

- Business Jets

- Helicopters

- Military Aircraft

- By Contract Type- (USD Million)

- Short-Term / Ad-Hoc Contracts

- Long-Term Maintenance Contracts

- Power-By-The-Hour (Pbh) Contracts

- By Organization Type- (USD Million)

- Airline-Affiliated MRO Providers

- Independent MRO Providers

- OEM-Affiliated MRO Providers

- By End User- (USD Million)

- Commercial Passenger Airlines

- Cargo & Freight Operators

- Business & General Aviation

- Military & Government Aviation

- Oil & Gas Aviation Operators

- By Country

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By MRO Service Type- (USD Million)

- Market Size & Analysis

- UAE Commercial Passenger Airlines MRO Services Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By MRO Service Type- (USD Million)

- By Aircraft Type- (USD Million)

- By Contract Type- (USD Million)

- By Organization Type- (USD Million)

- Market Size & Analysis

- UAE Cargo & Freight Operators MRO Services Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By MRO Service Type- (USD Million)

- By Aircraft Type- (USD Million)

- By Contract Type- (USD Million)

- By Organization Type- (USD Million)

- Market Size & Analysis

- UAE Business & General Aviation MRO Services Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By MRO Service Type- (USD Million)

- By Aircraft Type- (USD Million)

- By Contract Type- (USD Million)

- By Organization Type- (USD Million)

- Market Size & Analysis

- UAE Military & Government Aviation MRO Services Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By MRO Service Type- (USD Million)

- By Aircraft Type- (USD Million)

- By Contract Type- (USD Million)

- By Organization Type- (USD Million)

- Market Size & Analysis

- UAE Oil & Gas Aviation Operators MRO Services Market Outlook, 2022-2032

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By MRO Service Type- (USD Million)

- By Aircraft Type- (USD Million)

- By Contract Type- (USD Million)

- By Organization Type- (USD Million)

- Market Size & Analysis

- UAE MRO Services Market Key Strategic Imperatives for Growth & Success

- Competitive Outlook

- Company Profiles

- Emirates Engineering

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Etihad Engineering

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sanad Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gal

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ammroc

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Abu Dhabi Aviation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Royal Jet Maintenance

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Falcon Aviation Services

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jas Aircraft Maintenance

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Global Air Support

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Execujet Middle East

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dc Aviation Al-Futtaim

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gulf Aircraft & Engineering Services (Gaes)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Emirates Engineering

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making