Global Light and Ultralight Aircraft Market Research Report: Forecast (2026-2032)

Global Light and Ultralight Aircraft Market - By Type (Light Aircraft, Ultralight Aircraft), By Flight Operation (CTOL, VTOL), By Application (Civil & Commercial, Military & Gover...nment), By Propulsion Type Electric/Hybrid, (Hybrid, Fully Electric), Conventional, By Technology (Manned Aircraft, Unmanned Aircraft (UAV), By System (Airframe, Avionics, Cabin Interiors, Aircraft Systems), By Material (Aluminium, Composites, Other materials), and others Read more

- Aerospace & Defense

- Jan 2026

- Pages 195

- Report Format: PDF, Excel, PPT

Global Light and Ultralight Aircraft Market

Projected 10.69% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 10.75 Billion

Market Size (2032)

USD 21.89 Billion

Largest Region

North America

Projected CAGR

10.69%

Leading Segments

By Flight Operation: CTOL

Global Light and Ultralight Aircraft Market Report Key Takeaways:

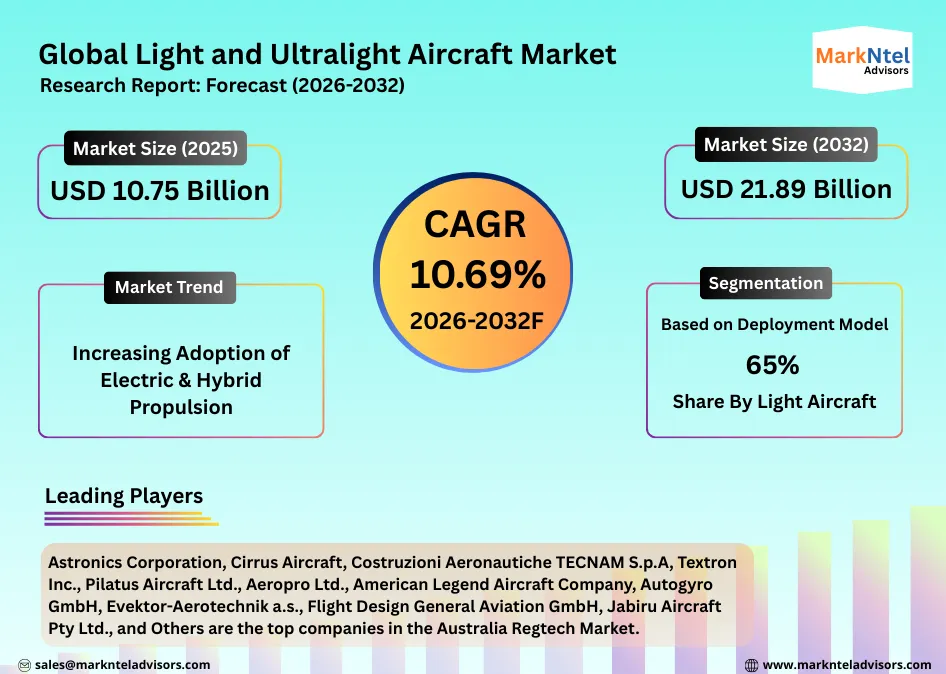

- The Global Light and Ultralight Aircraft Market size was valued at around USD 10.75 billion in 2025 and is projected to reach USD 21.89 billion by 2032. The estimated CAGR from 2026 to 2032 is around 10.69%, indicating strong growth.

- By type, the Light Aircraft represented 65% of the Global Light and Ultralight Aircraft Market size in 2025.

- By flight operation, the CTOL represented 74% of the Global Light and Ultralight Aircraft Market size in 2025.

- By Region, North America leads the global light and ultralight aircraft industry with a dominant 37% share in 2025.

- The leading light and ultralight aircraft companies are Astronics Corporation, Cirrus Aircraft, Costruzioni Aeronautiche TECNAM S.p.A, Textron Inc., Pilatus Aircraft Ltd., Aeropro Ltd., American Legend Aircraft Company, Autogyro GmbH, Evektor-Aerotechnik a.s., Flight Design General Aviation GmbH, Jabiru Aircraft Pty Ltd., CubCrafters, Inc., Pipistrel d.o.o., Quicksilver Aircraft, Air Création, and others.

Market Insights & Analysis: Global Light and Ultralight Aircraft Market (2026-2032):

The Global Light and Ultralight Aircraft Market size was valued at around USD 10.75 billion in 2025 and is projected to reach USD 21.89 billion by 2032. Along with this, the market is estimated to grow at a CAGR of around 10.69% during the forecast period, i.e., 2026-32. The Global Light and Ultralight Aircraft Market is expected to witness robust growth through 2032, fueled by increasing recreational flying, regulatory support, and advancements in propulsion technologies. According to the Federal Aviation Administration (FAA) Aerospace Forecast, light-sport aircraft flight hours are projected to grow approximately 2.2% annually, reflecting expanding use among recreational pilots.

The FAA’s Modernization of Special Airworthiness Certification (MOSAIC), effective October, 2025, expanded sport pilot privileges, enabling pilots to operate larger and more capable aircraft under sport rules. This regulatory change increases accessibility and encourages ownership of light and ultralight aircraft.

Technological innovations are accelerating market growth, particularly through electric and hybrid propulsion systems. In February 2025, the European Union Aviation Safety Agency (EASA) certified Safran’s ENGINeUS 100 electric motor, the first of its kind to power electrified aviation platforms after extensive flight testing, paving the way for future light aircraft with sustainable propulsion.

Similarly, at the Avalon Airshow 2025, Dovetail Electric Aviation unveiled DovePower, an electric propulsion system designed to retrofit existing aircraft for zero-emission operations, showcasing industry movement toward cleaner and quieter flight.

Government-backed infrastructure and regulatory initiatives across North America, Europe, and Asia-Pacific are enhancing airfield access and pilot training opportunities, supporting recreational and sport aviation. Combined with advancements in electrification and hybrid technologies, these developments are expected to expand operational versatility, lower emissions, and attract new participants, ensuring sustained market growth.

Global Light and Ultralight Aircraft Market Recent Developments:

- July 2025: The U.S. Federal Aviation Administration (FAA) broadened light-sport aircraft regulations, allowing pilots to fly larger aircraft like the Piper Cherokee under sport rules. This expansion can boost demand for light aircraft training and recreational flying, potentially increasing market value for certified light aircraft by reducing barriers to ownership and flight.

- July 2025: TL Sport introduced the Sirius BackCountry, a short take-off and landing (STOL) light aircraft engineered to meet the FAA’s MOSAIC standards. Such product debuts highlight innovation and expanding product portfolios, underpinning increased industry activity and potential revenue growth.

Global Light and Ultralight Aircraft Market Scope:

| Category | Segments |

|---|---|

| By Type | Light Aircraft, Ultralight Aircraft |

| By Flight Operation | CTOL,VTOL |

| By Application | Civil & Commercial, Military & Government |

| By Propulsion Type | Electric/Hybrid, (Hybrid, Fully Electric), Conventional |

| By Technology | Manned Aircraft, Unmanned Aircraft (UAV) |

| By System | Airframe, Avionics, Cabin Interiors, Aircraft Systems |

| By Material | Aluminium, Composites, Other materials), and others |

Global Light and Ultralight Aircraft Market Drivers:

Growing Recreational & Sport Aviation Driving Market Demand

The expansion of recreational and sport aviation is a key driver of the Global Light and Ultra-Light Aircraft Market. Government data shows steadily rising participation. In the United States alone, active sport pilot certificates reached 7,309 by the end of 2024, and light sport aircraft flight hours are forecast to increase about 2.2% annually, primarily due to growth in the fleet and recreational usage. Light and ultra-light aircraft appeal strongly to recreational flyers because they are more affordable to purchase and operate than larger general aviation aircraft, making them accessible to aviation enthusiasts and private owners. These aircraft are widely used for leisure flying, sightseeing, and hobby aviation across North America, Europe, and increasingly in Asia-Pacific, supported by robust general aviation infrastructure. For example, FAA records indicate continual increases in private pilot certificates, up to 172,012 in 2024, reflecting broader interest in flying as a hobby that directly supports demand for small aircraft.

Furthermore, planned investments in aviation leisure infrastructure, including the expansion of airfields, flying clubs, and community pilot training programs in regions such as Asia and the Middle East, are anticipated to further stimulate recreational aviation interest. Additionally, initiatives to simplify sport pilot certification and improve accessibility will likely expand the pilot base.

In conclusion, growing recreational flying participation fosters sustained demand for light and ultralight aircraft, bolstering fleet growth, supporting manufacturers, and expanding flight training and leisure aviation networks worldwide, thereby significantly contributing to long-term market expansion.

Global Light and Ultralight Aircraft Market Trends:

Increasing Adoption of Electric & Hybrid Propulsion

The increasing adoption of electric and hybrid propulsion systems is a defining technological trend in the global light and ultra‑light aircraft market, driven by government research initiatives and certification activities aimed at sustainability and operational efficiency. NASA’s Electrified Aircraft Propulsion (EAP) program is actively developing technologies for electrified flight, advancing concept vehicles, flight demonstrations, and system testbeds to reduce energy consumption and emissions across aviation sectors with applications anticipated into the mid‑2030s.

In 2025, the FAA announced the Electric Vertical Takeoff and Landing (eVTOL) and Advanced Air Mobility Integration Pilot Program (eIPP) to accelerate safe operations of electric and hybrid aircraft, forming public‑private partnerships to pave the regulatory pathway. This reflects broader government intent to integrate electric propulsion into national airspace and future mobility solutions. Increased flight testing milestones by major eVTOL developers in 2025, supported by the FAA’s framework, suggest electric propulsion technologies are nearing operational reality.

Furthermore, electric aircraft achievements exemplify this trend. In June 2025, Beta Technologies became the first U.S. company to land a passenger‑carrying all‑electric aircraft at a New York‑area airport, demonstrating practical application of electric propulsion in real flight conditions.

Overall, continued government programs, infrastructure support, and regulatory transitions are expected to drive broader adoption of electric and hybrid powertrains, enhancing fuel efficiency, lowering noise and emissions, and stimulating demand for next‑generation light aircraft. In summary, electric and hybrid propulsion is reshaping market expectations and catalyzing investment in sustainable aviation innovation.

Global Light and Ultralight Aircraft Market Challenges:

Stringent and Fragmented Regulatory Frameworks

A significant challenge facing the Global Light and Ultra‑Light Aircraft Market is the stringent and fragmented regulatory landscape across countries, which complicates aircraft certification, pilot licensing, and international operations. The International Civil Aviation Organization (ICAO) notes that the lack of harmonization between States on approval procedures limits industry development and imposes barriers to international trade for light aircraft categories like light‑sport and ultralight aircraft. Differences in technical standards, airworthiness requirements, and national procedures force manufacturers to adapt aircraft designs and compliance actions country by country, increasing costs and time to market.

In addition, ICAO’s World Aviation Policy Working Papers highlight that some countries accept certain electric engines and variable pitch propellers, while others require full type certification, illustrating how procedural disparities hinder global adoption of innovative light aircraft and propulsion systems.

Pilot licensing also varies substantially. For example, under the European Union Aviation Safety Agency (EASA), recreational pilot licences like the Light Aircraft Pilot Licence (LAPL) follow specific regional training and medical requirements that differ from U.S. FAA standards, necessitating pilots to meet dual or separate regulatory criteria when operating across jurisdictions.

Organizations such as the International Council of Aircraft Owner and Pilot Associations (IAOPA) have acknowledged that the absence of a uniform international framework for light‑sport aircraft certification and pilot licenses increases operational costs and reduces global mobility for pilots and aircraft owners.

Conclusion: These regulatory inconsistencies create a complex patchwork of requirements that raise compliance costs, delay certification, and constrain market growth, particularly for manufacturers seeking global scale and operators wishing to fly across borders.

Global Light and Ultralight Aircraft Market (2026-32) Segmentation Analysis:

The Global Light and Ultralight Aircraft Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Type:

- Light Aircraft

- Ultralight Aircraft

The light aircraft segment dominates the Global Light and Ultralight Aircraft Market with an estimated 65% share, primarily due to its broad applicability, higher payload capacity, and regulatory acceptance across regions. Light aircraft are widely used in pilot training, recreational flying, aerial surveying, regional connectivity, and special-mission operations, giving them a much larger addressable customer base compared to ultralight aircraft. Their ability to carry multiple passengers, advanced avionics, and greater fuel range makes them suitable for both civil-commercial and government applications.

In addition, light aircraft are more commonly certified under established aviation authorities, enabling easier integration into controlled airspace and commercial operations. Flight schools and aviation academies also prefer light aircraft because they meet standardized training requirements and offer better safety margins. Furthermore, light aircraft benefit from stronger aftermarket demand for maintenance, upgrades, and avionics retrofitting, increasing lifecycle value. These combined factors support higher unit deliveries and revenue contribution, reinforcing the segment’s leading position.

Based on Flight Operation:

- CTOL

- VTOL

The conventional take-off and landing (CTOL) segment accounts for approximately 74% of the market, driven by its operational simplicity, widespread infrastructure availability, and proven reliability. CTOL aircraft can operate from existing runways, small airstrips, and regional airports, eliminating the need for specialized vertical-lift infrastructure. This makes them highly cost-effective for flight training, recreational aviation, and regional transport. Most legacy and newly manufactured light and ultralight aircraft are designed around CTOL configurations due to lower design complexity, reduced certification challenges, and better fuel efficiency compared to VTOL systems. CTOL aircraft also offer longer flight endurance and higher payload efficiency, making them more suitable for cross-country flying and commercial use.

Additionally, pilot training programs globally are structured around CTOL aircraft operations, ensuring consistent demand. The maturity of CTOL technology, combined with lower acquisition and operating costs, continues to support its dominant market position.

Global Light and Ultralight Aircraft Market (2026-32): Regional Projection

North America dominates the Global Light and Ultralight Aircraft Market, accounting for approximately 37% of total demand. The region’s leadership is supported by a mature general aviation ecosystem, strong recreational flying culture, and extensive flight training infrastructure. The United States hosts the world’s largest population of private and sport pilots, along with thousands of registered light and ultralight aircraft operating from well-developed regional airports and airstrips. Favorable regulatory frameworks, including streamlined certification pathways and ongoing modernization of light aircraft regulations, encourage ownership and operational flexibility.

North America is also home to several leading aircraft manufacturers, avionics suppliers, and propulsion technology developers, enabling faster adoption of advanced designs and electric or hybrid systems. Additionally, strong demand from flight schools, aero clubs, agricultural aviation, and surveillance applications sustains consistent aircraft utilization. Government-supported investments in aviation safety, airport infrastructure, and pilot training reinforce North America’s position as the leading global market.

Gain a Competitive Edge with Our Global Light and Ultralight Aircraft Market Report

- Global Light and Ultralight Aircraft Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Light and Ultralight Aircraft Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Light and Ultralight Aircraft Market Policies, Regulations, Product Standards

- Global Light and Ultralight Aircraft Market Trends & Development

- Global Light and Ultralight Aircraft Market Dynamics

- Growth Drivers

- Challenges

- Global Light and Ultralight Aircraft Market Hotspot & Opportunities

- Global Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- Light Aircraft

- Ultralight Aircraft

- By Flight Operation- (USD Million & Thousand Units)

- CTOL

- VTOL

- By Application- (USD Million & Thousand Units)

- Civil & Commercial

- Military & Government

- By Propulsion Type- (USD Million & Thousand Units)

- Electric/Hybrid

- Hybrid

- Fully Electric

- Conventional

- Electric/Hybrid

- By Technology- (USD Million & Thousand Units)

- Manned Aircraft

- Unmanned Aircraft (UAV)

- By System- (USD Million & Thousand Units)

- Airframe

- Avionics

- Cabin Interiors

- Aircraft Systems

- By Material- (USD Million & Thousand Units)

- Aluminium

- Composites

- Other materials

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- Market Size & Analysis

- North America Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- By Country

- The US

- Canada

- Mexico

- The US Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Canada Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Mexico Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Market Size & Analysis

- South America Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Argentina Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Market Size & Analysis

- Europe Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- By Country

- The UK

- Italy

- Germany

- France

- Spain

- BENELUX

- Rest of Europe

- The UK Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Italy Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Germany Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- France Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Spain Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- BENELUX Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- By Country

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

- Saudi Arabia Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- UAE Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- South Africa Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of APAC

- China Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Japan Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- India Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- South Korea Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Australia Light and Ultralight Aircraft Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Units)

- Market Share & Analysis

- By Type- (USD Million & Thousand Units)

- By Flight Operation- (USD Million & Thousand Units)

- By Application- (USD Million & Thousand Units)

- By Propulsion Type- (USD Million & Thousand Units)

- By Technology- (USD Million & Thousand Units)

- By System- (USD Million & Thousand Units)

- By Material- (USD Million & Thousand Units)

- Market Size & Analysis

- Market Size & Analysis

- Global Light and Ultralight Aircraft Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Astronics Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CIRRUS AIRCRAFT

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Costruzioni Aeronautiche TECNAM S.p.A

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Textron Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pilatus Aircraft Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aeropro Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- American Legend Aircraft Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Autogyro GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Evektor-Aerotechnik a.s

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Flight Design General Aviation GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jabiru Aircraft Pty Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CubCrafters, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pipistrel d.o.o.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Quicksilver Aircraft

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Air Création

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Astronics Corporation

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making