Middle East Lactose-Free Food Market Research Report: Forecast (2023-2028)

By Type (Milk, Bread, Soups and Sauces, Desserts, Others [Yoghurts, Cheese, Non-Dairy Products, etc.]), By Source (Soy, Rice, Coconut, Almond, Hemp Milk, Oat Milk, Others [Hazelnut... milk, Cashew milk, etc.]), By Nature (Organic, Inorganic), By Distribution Channel (Retail Offline [Grocery Retailers, Non-Grocery Retailers], Retail E-Commerce), By Country (The UAE, Saudi Arabia, Qatar, Egypt, Turkey, Rest of Middle East), By Company (Nestlé Middle East FZE, The Danone Company Inc., Arla Foods, Dean’s Food, Shamrock Foods, Kolita Foods, McNeil Nutrionals, Valio, OMIRA Oberland-Milchverwertung (OMIRA), Parmalat, Alpro, Cabot Creamery, Others [Galaxy Nutritional Foods, Green Valley Organics, etc.]) Read more

- Food & Beverages

- Mar 2023

- Pages 156

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: The Middle East Lactose-Free Food Market (2023-28)

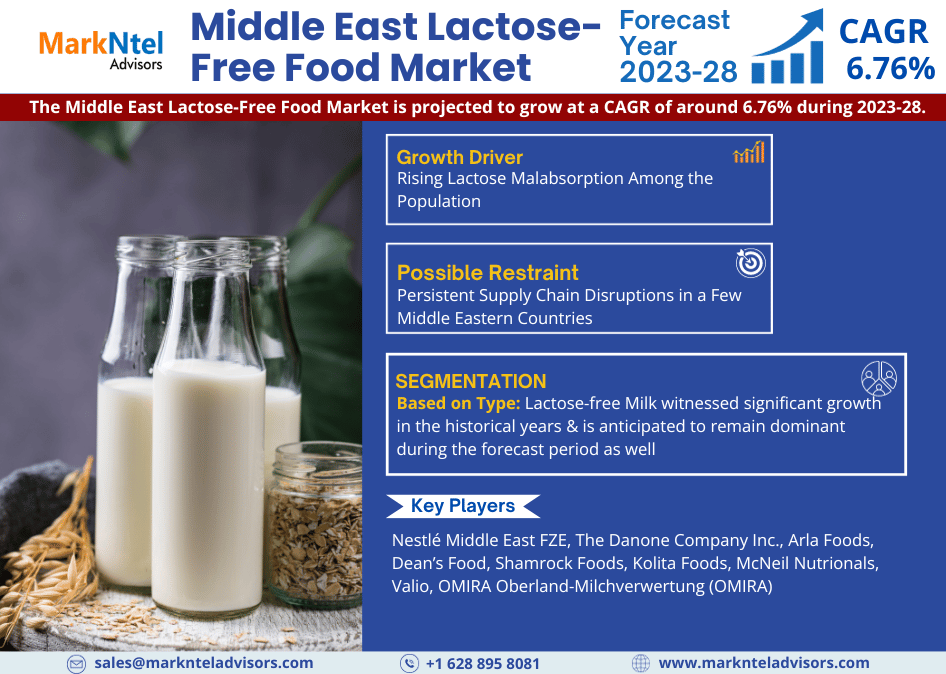

The Middle East Lactose-Free Food Market is projected to grow at a CAGR of around 6.76% during the forecast period, i.e., 2023-28. Lactose-free food is referred to as food products that are devoid of the protein called 'lactose'. These specific food products are generally formulated using the technologies such as Chromatographic Separation, Acid Hydrolysis, Membrane Reactor, and others. In the Middle East, a growing population of lactose-intolerant individuals is driving the demand for these foods.

The factors attributing to the market growth in the UAE are the rising prevalence of lactose intolerance among individuals and the growing consciousness among consumers regarding their health & wellness. According to independent research conducted in 2022 by a food manufacturing company Al Ain Farms, more than 25% of individuals suffer from stomach rumbling, and over 22% of the users suffer from stomach cramps & pains after the consumption of lactose-based products.

Several researches & studies have shown that people with self-perceived lactose intolerance may be at risk of poor bone health & higher rates of diabetes & hypertension because of lower calcium intake. As a result of this, individuals are becoming more & more conscious about their health & are seeking these food products such as lactose-free milk, cheese, bread, etc.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 6.76% |

| Country Covered | The UAE, Saudi Arabia, Qatar, Egypt, Turkey, Rest of Middle East |

| Key Companies Profiled | Nestlé Middle East FZE, The Danone Company Inc., Arla Foods, Dean’s Food, Shamrock Foods, Kolita Foods, McNeil Nutrionals, Valio, OMIRA Oberland-Milchverwertung (OMIRA), Parmalat, Alpro, Cabot Creamery, Others [Galaxy Nutritional Foods, Green Valley Organics, etc.] |

| Unit Denominations | USD Million/Billion |

Moreover, the initiatives led by the government of the countries such as the UAE, Saudi Arabia, etc., to boost awareness about the impact of food on health & to address the growing obese population is also encouraging consumers to opt for plant-based food products like soy milk, almond milk, etc. Along with this, food manufacturing companies, including Nestle, Perfect Day, etc., are also partnering together to develop & launch lactose-free products to cater to the growing demand of consumers. Thus, the new innovative products, specifically made to address the lactose intolerant population would further enhance the Middle East Lactose-Free Food Market size in the upcoming years.

Additionally, food-serving places in the Middle East region, such as cafeterias & restaurants like Mandarin Oriental Jumeira, Dubai, Moon Shell, and Saudi Arabia, have also gradually started offering meat-free, dairy-free, and plant-based options, owing to which the sales of lactose-free food products such as almond milk, cottage cheese, etc., is anticipated to rise in the forecast years. According to the survey conducted by the plant-based consumer goods company, over 45% of the UAE diners replaced traditional dairy with a plant-based meal in 2021. Therefore, the gradual shift of the hospitality sector to replace conventional dairy products with dairy-free, lactose-free food is anticipated to augment the demand for these food products in the UAE.

Market Dynamics

Key Driver: Rising Lactose Malabsorption Among the Population

The rising prevalence of lactose intolerance & the boosting requirement for products with little or no added sugar has been driving the demand for lactose-free products such as milk in the Middle East during the historical period. According to the statistics published by the National Center for Biotechnology in 2021, over 68% of the world's population is susceptible to lactose intolerance & Middle Eastern countries such as Egypt & Oman have a majority of around 68% & 96%. Owing to the rising prevalence, consumers are becoming more aware of their health & well-being, consequently switching towards alternative food products, thereby driving the market in the Middle East.

Moreover, food manufacturing companies like Al Ain farms, Nurishh, etc., are launching new lactose-free dairy products which would give consumers the nutritional & taste benefits of dairy without the discomfort associated with lactose intolerance. Hence, these new product innovations cater to the growing demand for these food products in the upcoming years.

Possible Restraint: Persistent Supply Chain Disruptions in a Few Middle Eastern Countries

Middle Eastern countries, such as Kuwait, Bahrain, and others, are primary sources, the raw materials like coconut, rice, etc., used for producing lactose-free food products from Asian & European countries. Consequently, the prices of commodities vary according to the international market, which leads to fluctuations in the prices of raw materials and food products. Moreover, the unavailability of the raw material in stock causes disruption in both operations & the supply chain, which impacts the market.

In addition, a few Middle Eastern countries face fluctuations in oil prices, which impedes transportation & overall supply of both end-product & raw materials. As a result, the product remains inaccessible to individuals in those countries, limiting the market in the forthcoming years.

Growth Opportunity: Expansion of Food Manufacturing Companies in the Middle East

The evolving consumer need based on the health & wellness trend has propelled food manufacturing companies to set up their manufacturing unit in regional countries. The majority of the countries adhere to the zero taxation policy, which seems to be a lucrative offer, hence the food manufacturing units are being set up in the region.

Similarly, in 2022, the Change Foods Company unveiled its plans to open an animal-free dairy manufacturing plant in the UAE under the NextGen FDI initiative laid by the government of the UAE. These units would primarily upscale the production and thereby reduce the prices of these products. Owing to this, lactose-free food would become more accessible to the lower- & middle-class populations across the region. Hence, the expansion of the dairy manufacturing units would result in more consumer penetration, further amplifying the growth of the market in the forthcoming years.

Key Trend: Shift of Consumers Towards Dairy-free & Plants-based Food Products

Consumers nowadays are shifting towards dairy alternatives owing to the growing health consciousness & concerns regarding the adverse effects of unhealthy lifestyles & dietary patterns. Excessive milk consumption could result in severe side effects such as bloating, cramps, diarrhea, and others as the digestive system fails to properly break down the lactose. Therefore, individuals are turning more often to milk substitutes to meet their nutritional needs while maintaining their health. Companies have begun to offer vegan or plant-based lactose-free food products in response to emerging consumer concerns. For instance:

- In 2022, the company “Bel Middle East” launched a new product range called “Nurrish,” which is a plant-based alternative to cheese & is free from lactose, soya, gluten, etc.

Therefore, a consumer-centric approach by food manufacturing companies to innovate dairy products to meet evolving demands is gaining traction in the Middle East.

Market Segmentation

Based on Type:

- Milk

- Bread

- Soups and Sauces

- Desserts

- Others (Yoghurts, Cheese, Non-dairy Products, etc.)

Of them all, Lactose-free Milk witnessed significant growth in the historical years & is anticipated to remain dominant during the forecast period as well, owing to its surging adoption among the residents as a substitute for conventional dairy milk. Consumers are frequently opting for lactose-free milk to meet their nutritional needs without experiencing unpleasant symptoms, which is driving lactose-free milk sales. Furthermore, countries in the Middle East, such as Bahrain, Kuwait, and others, are experiencing economic growth, which has boosted net disposable income, as well as a rise in dining out and a shift toward higher protein diets.

In addition, expanding demand for lactose-free food products such as milk, bread, and others is compelling companies such as Al Ain Farms, Arla Foods, etc., to broaden their product portfolio. As a result, more innovative product launches in the milk category are expected in the coming years to meet the growing demand.

Based on Source:

- Soy

- Rice

- Coconut

- Almond

- Hemp Milk

- Oat Milk

- Others (Hazelnut milk, Cashew milk, etc.)

Almond milk sources gained a significant share as compared to other products in the historical years owing to the higher production of this source in the region. The geographical locations of the Middle Eastern nations facilitate the cultivation of almonds in the countries such as the UAE, Turkey, and Saudi Arabia. As a result, the growth of almonds in these countries is significantly higher. Therefore, the usage of the almond in the production of almond-based lactose-free milk is notably substantial. Furthermore, soy milk is inexpensive, which is another key factor driving sales in the region, which makes it appealing to individuals with low incomes.

Further, Middle East countries have been largely dependent on Asian countries, such as India, and several others, for the import of coconuts, & rice grains, due to which the production of lactose-free food based on these raw materials is remarkably lower. This is due to the fluctuations in the prices of the raw materials in the international market, which leads to a high production cost of the milk derived from these sources. As a result, the sources, such as coconut & rice, gained moderate growth in the market.

Regional Projection

Geographically, the Middle East Lactose-Free Food Market expands across:

- The UAE

- Saudi Arabia

- Qatar

- Egypt

- Turkey

- Rest of the Middle East

Of all the countries across the Middle East, the UAE recorded the maximum share of sales of lactose-free food in the historical years. The rising population of the UAE, the emerging health consciousness among individuals, and the increasing prevalence of lactose intolerance in the country are stimulating the growth of these food products in the UAE.

Moreover, several hotels in the UAE have started offering lactose-free food, vegan food, etc., owing to the prevailing trend toward healthy eating. Therefore, the booming hospitality sector of the UAE & establishments of hotels/restaurants in the country is anticipated to fuel the growth of the market in the forecast years.

Recent Developments of the Leading Companies

- 2023: The company Nestlé Middle East FZE announced investing about USD1.86 billion in the food industries in Saudi Arabia for the upcoming 10 years. This strategic plan was developed together with the Saudi Ministry of Investment’s food department, reflecting solid investor confidence in the country & its long-term prospects.

Gain a Competitive Edge with Our Middle East Lactose-Free Food Market Report

- The Middle East Lactose-Free Food Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The Middle East Lactose-Free Food Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Impact of COVID-19 on the Middle East Lactose-Free Food Market

- The Middle East Lactose-Free Food Market Trends & Insights

- The Middle East Lactose-Free Food Market Dynamics

- Growth Drivers

- Challenges

- The Middle East Lactose-Free Food Market Policies & Regulations

- The Middle East Lactose-Free Food Market Supply Chain Analysis

- The Middle East Lactose-Free Food Market Patented Technologies

- The Middle East Lactose-Free Food Market Hotspot & Opportunities

- The Middle East Lactose-Free Food Market Outlook, 2018-2028F

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Type

- Milk

- Bread

- Soups and Sauces

- Desserts

- Others (Yoghurts, Cheese, Non-Dairy Products, etc.)

- By Source

- Soy

- Rice

- Coconut

- Almond

- Hemp Milk

- Oat Milk

- Others (Hazelnut milk, Cashew milk, etc.)

- By Nature

- Organic

- Inorganic

- By Distribution Channel

- Retail Offline

- Grocery Retailers

- Convenience Stores

- Supermarkets

- Hypermarkets

- Non-Grocery Retailers

- Grocery Retailers

- Retail E-Commerce

- Retail Offline

- By Country

- The UAE

- Saudi Arabia

- Qatar

- Egypt

- Turkey

- Rest of Middle East

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Type

- Market Size & Analysis

- The UAE Lactose-Free Food Market Outlook, 2018-2028F

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Source

- By Nature

- By Distribution Channel

- Market Size & Analysis

- Saudi Arabia Lactose-Free Food Market Outlook, 2018-2028F

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Source

- By Nature

- By Distribution Channel

- Market Size & Analysis

- Qatar Lactose-Free Food Market Outlook, 2018-2028F

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Source

- By Nature

- By Distribution Channel

- Market Size & Analysis

- Egypt Lactose-Free Food Market Outlook, 2018-2028F

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Source

- By Nature

- By Distribution Channel

- Market Size & Analysis

- Turkey Lactose-Free Food Market Outlook, 2018-2028F

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Source

- By Nature

- By Distribution Channel

- Market Size & Analysis

- The Middle East Lactose-Free Food Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Nestlé Middle East FZE

- The Danone Company Inc.

- Arla Foods

- Dean’s Food

- Shamrock Foods

- Kolita Foods

- McNeil Nutrionals

- Valio

- OMIRA Oberland-Milchverwertung (OMIRA)

- Parmalat

- Alpro

- Cabot Creamery

- Others (Galaxy Nutritional Foods, Green Valley Organics, etc.)

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making