Middle East Cement Market Research Report: Forecast (2025-2030)

Middle East Cement Market - By Type (Portland Blended Others (White, Pozzolanic, etc)) By Application (Residential Non-Residential) and others... Read more

- Buildings, Construction, Metals & Mining

- Apr 2025

- Pages 154

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Middle East Cement Market (2025-30):

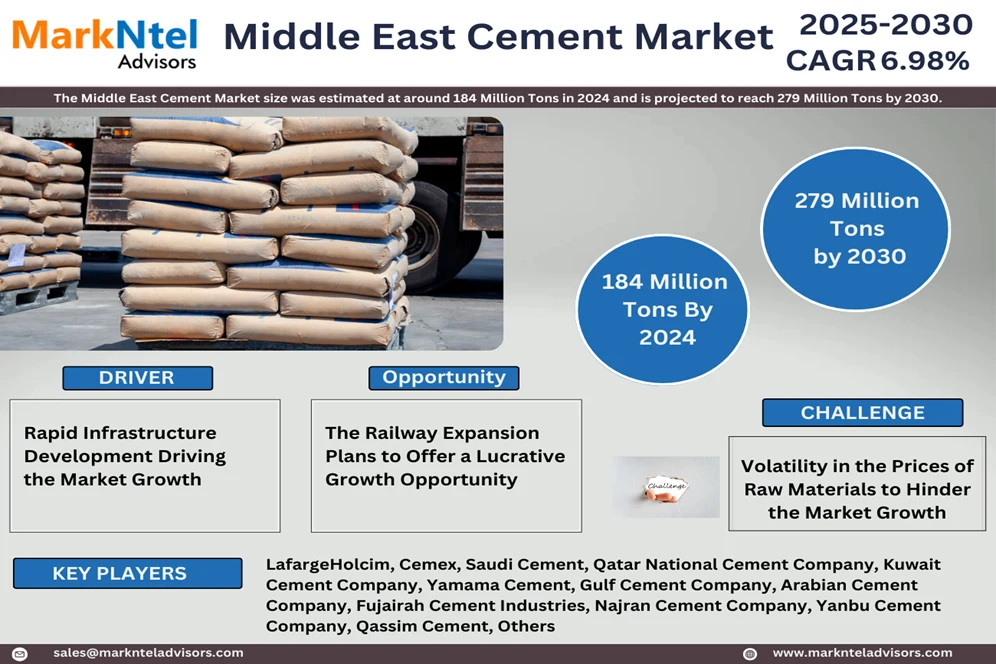

The Middle East Cement Market size was estimated at around 184 Million Tons in 2024 and is projected to reach 279 Million Tons by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.98% during the forecast period, i.e., 2025-30. The main factors behind this growth are increasing construction activities, expanding population, the rapid shift towards sustainability, and expansion in rails & road networks. This is because all such activities require cement to ensure strength and durability in their constructions. As a result, the sales of cement have increased in the study period. As per Global Cement, the industry in Saudi Arabia has experienced a growth of about 12% in the 4th quarter of 2024.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | 184 Million Tons |

| Market Value By 2030 | 279 Million Tons |

| CAGR (2025-30) | 6.98% |

| Leading Region | Middle East |

| Top Key Players | LafargeHolcim, Cemex, Saudi Cement, Qatar National Cement Company, Kuwait Cement Company, Yamama Cement, Gulf Cement Company, Arabian Cement Company, Fujairah Cement Industries, Najran Cement Company, Yanbu Cement Company, Qassim Cement, Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Moreover, the market is fueled by continuous government support in this region. Using tax advantages and attractive enticements, they strive to reduce their dependence on oil and motivate many businesses and industrial sectors in the country. The escalation in the number of companies, factories, and commercial buildings developing in this region has increased the requirement for Cement applications. Governments are also continually working on restaurants, hotels, resorts, entertainment, and theme parks to draw visitors, which thus elevates the need for concrete. Government-funded infrastructure improvements therefore fuel local demand for concrete.

Furthermore, the market is highly boosted by the foreign direct investments made in the real estate sector of this region. As per the Abu Dhabi Real Estate Centre, around 225% growth was noticed in FDI in the first half of 2024 as compared to the previous years. Similarly, Oman has experienced a growth of around 29.5% in 2024 as compared to 2023, mainly attributed to the FDIs. This is because of the tax benefits and significant economic growth in this region. As a result, the construction of such real estate properties has to be increased to meet this growing demand. This will further increase the demand for cement as it is the main component required. Such FDIs are expected to increase in the future, thus showing a good growth opportunity. Therefore, construction activities have increased in the past years in the Middle East due to increasing FDIs and continuous government support, and this trend is expected to continue in the forecast period as well thus promising a growing environment for the market in the coming years.

Middle East Cement Market Driver:

Rapid Infrastructure Development Driving the Market Growth – This region is experiencing rapid development in its infrastructure. This is because most of the countries in this region are reducing their dependency on oil, and attracting multiple other sectors to support their economy. Several commercial infrastructural developments, including commercial parks, sectors, tourist attractions, hotels, resorts, and others, are thus occurring in this area. Furthermore, the road network in this sector is expanding to have better linkages for several points. The UAE roads would cover roughly 634 km in 2023 under the USD1 billion development project. Thus boosting demand for cement in the region as all scheduled projects use concrete in their building to ensure durability and long life. Due to the increase in infrastructural projects in the region, demand for cement has seen a boost, and this trend shall continue in the forecast period as well.

Middle East Cement Market Opportunity:

The Railway Expansion Plans to Offer a Lucrative Growth Opportunity – Various plans are being introduced in this region to expand the connectivity of railways. For instance, the Gulf Railway proposes a railway network to connect all six countries of the GCC region. The length of this network will be around 2,100 Km and is expected to be completed before 2030. Also, Hafeet Rail started the construction of a rail network that will link the UAE and OMAN in 2024, which will cost the company around USD3 billion. Such projects further increase the need for cement as it is used in making concrete which is used in the construction of bridges, tunnels, stations & terminals, etc., and in the slabs that tie the tracks together. Therefore, the railways are expected to create a high demand for cement in multiple countries of this region in the forecast years, thus presenting a good growth opportunity for the market.

Middle East Cement Market Challenge:

Volatility in the Prices of Raw Materials to Hinder the Market Growth – The prices of raw materials are highly prone to fluctuations due to multiple factors such as geopolitical tensions, wars, shortages in production, trade regulations, etc. The materials required including limestone, gypsum, clay, iron ore, etc., are widely available in a few countries of this region such as the UAE, Egypt, Saudi Arabia, and Jordan. However, these are imported by other countries. Hence, the fluctuations in their global prices can decrease the production of cement, which will result in increased prices. Moreover, the fluctuations also affect the consumption rates as volatility in oil prices can prevent or halt the construction of various ongoing projects. Such factors decrease the sales of cement. Therefore, volatility in global prices can affect the demand and supply rates of cement thus presenting a challenge for the growth of the market.

Middle East Cement Market Trend:

The Cement Industry’s Commitment to Environmental Sustainability Gaining Traction – The focus of various companies in reducing the discharge of carbon while producing cement has seen a significant rise in the past years. For instance, LafargeHocim has an “ECOPlanet” range of cement that is produced while reducing 30% of the carbon dioxide emissions. Also, Cemex has adopted sustainable measures to reduce its carbon footprint including the use of alternate clean fuels, dried raw materials, etc. Similar trends have been noticed in multiple other companies as well. This not only helps the companies align with emission norms but also provides financial benefits due to low-energy consumption, government incentives, etc. This lowers the price of cement, thus attracting more consumers. Therefore, sustaining the operations of cement manufacturing has boosted the market in recent years, and this trend is expected to remain in the coming years as well.

Middle East Cement Market (2025-30): Segmentation Analysis

The Middle East Cement Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–30 at the regional level. Based on the analysis, the market has been further classified as:

Based on Type:

- Portland

- Blended

- Others

Based on the type of cement, the Portland segment leads the market with a share of around 75%. The main reasons behind this growth are the wider availability, superior strength, and low price of Portland cement. In 2022, the UAE exported limestone worth around USD695 million, which makes it the largest exporter of limestone in the world. Similarly, other compounds, including clay, shell, gypsum, etc., are also present in vast quantities in this region. This helps the cement companies easily get the best quality raw material in their desired quantities, and that too at reasonable prices. This further leads to the reduced price of Portland cement, thus attracting more consumers.

Additionally, the high strength of Portland cement makes it the best choice in normal constructions where advanced properties like heat resistance, sulfur resistance, etc., are not required. Therefore, due to wider availability and the desired characteristics offered by Portland cement at low prices, this segment leads the market.

Based on Application:

- Residential

- Non-Residential

Based on the application of cement, it is the most used in non-residential constructions and has a market share of around 60%. The main reason behind this dominance is the governmental efforts to diversify its economy. As more companies and industries are attracted to this region, they establish their workplaces, thus increasing the demand for cement. As per the Dubai Chamber of Commerce, around 30,000 new businesses were registered in Dubai only in the first half of 2023. Moreover, continuous investments have been made in the expansion of rail and road networks, that further increased the demand for cement in various constructions such as terminals, stations, roads, footpaths, etc. Therefore, the continuous government efforts towards economic diversification and development of its infrastructure have made the non-residential segment the market leader, and this dominance is expected to remain in the future as well.

Middle East Cement Market (2025-30): Regional Projections

Geographically, the Middle East Cement Market expands across:

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

- Egypt

- Israel

- Turkey

- Rest of the Middle East

Regionally, the UAE dominated the market with a share of around 26%. This is because the UAE has experienced a very high development in its infrastructure in the past decades. Various iconic structures such as Burj Khalifa, Palm Jumeirah, etc., have been established along with a very high number of luxurious hotels and resorts. All such infrastructures have used cement in very high quantities. Moreover, the government of this country is highly focused on expanding tourism, which will increase the construction of hotels, resorts, amusement places, smart cities, etc., thus increasing the demand for cement. Additionally, the number of FDI in the real estate sector of the UAE has increased over the years and is expected to increase in the future as well, thus creating a high demand for residential properties that require cement in their construction. Therefore, the UAE has established the highest number of constructions, thus using the highest quantity of cement, which makes it the segment leader.

Middle East Cement Industry Recent Development:

- 2024: Najran Cement Company launched an application named “Wasel”, the first of its kind. This application is introduced to digitalize the selling and delivery of cement to consumers. This also helps consumers in the process of ordering, delivering, and receiving cement, and ensuring that it arrives quickly and professionally.

Gain a Competitive Edge with Our Middle East Cement Market Report

- The Middle East Cement Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & market share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The Middle East Cement Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Middle East Cement Market Trends & Developments

- Middle East Cement Start-Up Ecosystem

- Middle East Cement Market Dynamics

- Drivers

- Challenges

- Middle East Cement Market Regulations, Policies & Standards

- Middle East Cement Market Hotspot & Opportunities

- Middle East Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity sold (Million Tons)

- Market Size & Analysis

- By Type

- Portland- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Blended- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Others (White, Pozzolanic, etc.)- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application

- Residential - Market Size & Forecast 2020-2030, USD Million, Million Tons

- Non-Residential- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Country

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

- Egypt

- Israel

- Turkey

- Rest of the Middle East

- By Competition

- Competition Characteristics

- Market Share Analysis

- By Type

- Market Size & Analysis

- The UAE Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Saudi Arabia Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Qatar Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Kuwait Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Oman Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Bahrain Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Egypt Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Israel Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Turkey Cement Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity sold (Million Tons)

- Market Size & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million, Million Tons

- By Application- Market Size & Forecast 2020-2030, USD Million, Million Tons

- Market Size & Analysis

- Middle East Cement Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- LafargeHolcim

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cemex

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Saudi Cement

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Qatar National Cement Company

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kuwait Cement Company

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Yamama Cement

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gulf Cement Company

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Arabian Cement Company

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Fujairah Cement Industries

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Najran Cement Company

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Yanbu Cement Company

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Qassim Cement

- Business Description

- Operation Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- LafargeHolcim

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making