Global Metal Fabrication Market Research Report: Forecast (2025-2030)

Metal Fabrication Market - By Metal Type (Steel, Aluminum, Titanium, Copper, Nickel), By Services (Cutting, Welding, Forming, Machining, Assembly), By End-User (Automotive, Constru...ction, Aerospace, Energy, Medical) and Other Read more

- Energy

- Apr 2025

- Pages 196

- Report Format: PDF, Excel, PPT

Market Definition

Metal fabrication is a course of action of forming metallic structures and parts through cutting, shaping, and joining of metallic parts. This is a process that comprises several activities that take metal in its most basic form and alter it through several processes to produce a usable product or part that can be used in construction, automobile, aerospace, and manufacturing industries, among others.

Market Insights & Analysis: Global Metal Fabrication Market (2025-30):

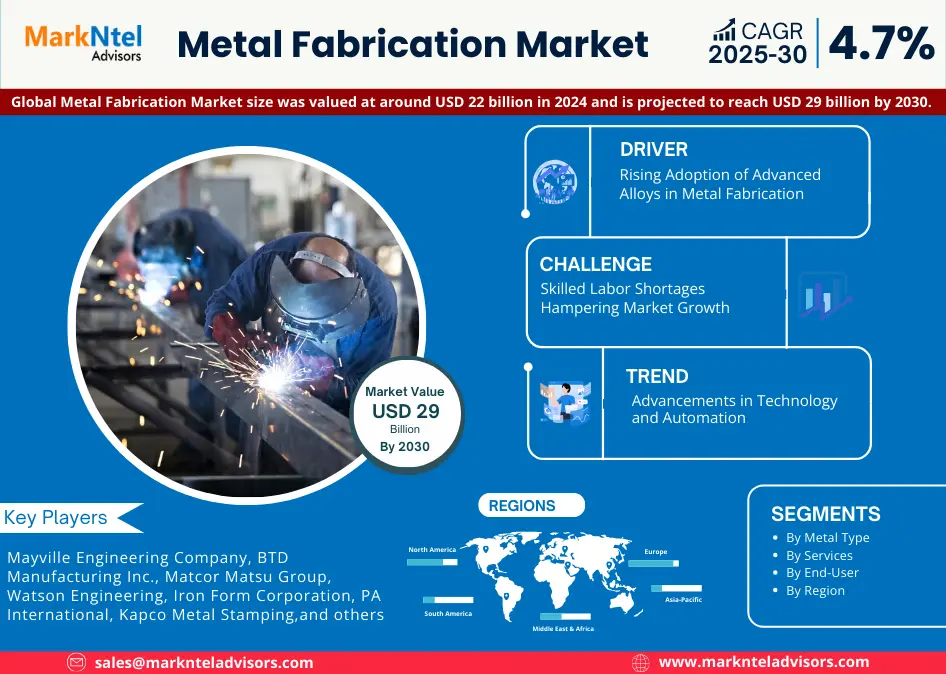

The Global Metal Fabrication Market size was valued at around USD 22 billion in 2024 and is projected to reach USD 29 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 4.7% during the forecast period, i.e., 2025-30. The metal fabrication market is growing at a high rate, driven by multiple factors. Including Economic growth and infrastructure development. The expansion of automotive and aerospace sectors further creates the demand for constructing essential elements through metal fabrication. Projects on water conservation, renewable energy initiatives, and transportation contribute to market growth.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 22 Billion |

| Market Value in 2030 | USD 29 Billion |

| CAGR (2025-30) | 4.7% |

| Leading Region | North America |

| Top Key Players | Mayville Engineering Company, BTD Manufacturing Inc., Matcor Matsu Group, Watson Engineering, Iron Form Corporation, PA International, Kapco Metal Stamping, Komaspec, United States Steel Corporation, Nippon Steel Corporation, Aperam, Standard iron and wire works, A.K Steel Holding Corporation, Allegheny Ludlum, Mueller Industries, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

For instance, governments across the globe invest in different transportation projects, like the ongoing upgrades project in Europe, one of the largest ports that require fabricated metals for cranes, storage facilities, and dock construction. These projects collectively highlight the integral role of metal fabrication in building and modernizing transportation infrastructure worldwide. This is because fabricated metals are extensively being used in the expansion of railway and road infrastructure. Its use cases are in the development of metal structures for bridges, tunnels & other support frameworks. For instance, in the global transport industry, the structural steel demand is expected to rise to USD 166 billion in 2033, led by this widespread application.

The renewable energy sector is also driving the demand for the Global Metal Fabrication Market, as fabricated metal components are used to create wind turbines, solar panels, and other renewable energy infrastructure. Wind turbines are made of high-strength steel that provides reliability in the long run. Solar panel frames use aluminum, which is resistant to corrosion. Investment in green energy and advanced infrastructure means increasing demand for fabricated metal parts in their development. For instance, in 2023, wind energy contributed 29% of the electricity produced in the United Kingdom, requiring widespread deployment of steel structures for turbine bases and transmission grids.

Also, Metal imports have increased over the years because of growth in industry and economic development in developing countries. For instance, the value of general imports of minerals and metals in the US increased by USD 57.6 billion to USD 261.5 billion from 2020 to 2021, showing a growth of around 28.3%. It indicates heightened demand for metal products, among steel products and synthetic gemstones, copper, and aluminum products.

Similarly, India's steel imports have reached record levels. From 2024, imports increased by 42.25% year-on-year to 4.7 million metric tons, with China being the leading exporter. This shows the growing need for metal components in developing economies, which will help in the further growth of the metal fabrication market in these economies.

Global Metal Fabrication Market Driver:

Rising Adoption of Advanced Alloys in Metal Fabrication – Advanced materials like titanium, aluminum, and high-tensile strength structural steel are highly used in metal fabrication. They are driving the market demand due to their exclusive features like corrosion resistance, low density, and high tensile strength. This has created their intensive use case in numerous industries like aerospace, automobile, and construction. For instance, the U.S. Department of Energy cites an increasing demand for lightweight materials driven by improved car powertrain efficiency, mainly in electric vehicles. This has implications for the increased production of Aluminum and advanced steel alloys for automobile structures and body panels.

Similarly, aerospace manufacturers, such as those in the aviation industry, have been undergoing demand for high-strength alloys from the Federal Aviation Administration. It is to satisfy a burgeoning demand for more efficient and durable lightweight aircraft. Also, the growing use of advanced alloys in construction is considerably driving the demand for metal fabrication. The most considerable example is the widespread entry of pre-engineered buildings that use structural steel, where sectors such as logistics and real estate have experienced both cost reductions and shortened construction time.

Global Metal Fabrication Market Opportunity:

Leveraging Renewable Energy Growth for Metal Fabrication – The growth of renewable energy is driving significant demand for the metal fabrication market. Components like wind turbine towers, solar panel mounts, and electric vehicle parts require large quantities of fabricated metals such as steel and aluminum. The Indian Ministry of New and Renewable Energy has reported a 26% growth in solar energy capacity, similar to the trends worldwide. This is fueling the need for precision metal cutting, welding, and assembly.

In addition, wind energy generation increased by 11% within the U.S. in 2023, using heavy metal fabrication for blades and nacelles. The metal fabrication market gets a great opportunity as the governments of all countries support green infrastructure by providing subsidies and incentives for renewable projects. As industries are embracing greener solutions, metal fabricators should take up new technologies, such as automation and robotics. This will help them to respond quickly to augmented demands, ensuring sustained market growth.

Global Metal Fabrication Market Challenge:

Skilled Labor Shortages Hampering Market Growth – The metal fabrication industry is currently experiencing a supply-side shortage of skilled labor, such as welders and computer numerical control machinists. This is due to an aging workforce close to retirement without the younger generation entering into the business. In 2022, around 8,000 training positions in mechanical engineering-related fields were unfilled, indicating the increasing gap between demand & supply. This has a direct impact on production capabilities. In a 2024 report, 90% of manufacturers reported direct production issues due to labor shortages. Also, about 41% said the labor shortage prevents the transfer of critical operational knowledge from delivery-oriented veteran employees to new hires. With hindrance to current operations, it also threatens all the future growth and innovation in the sector.

Moreover, the scarcity of qualified personnel has led to increased competition among companies, driving up wages and operational costs. Still, the industry continues to face challenges to attract adequate talent even after offering higher compensation along with training programs.

Global Metal Fabrication Market Trend:

Advancements in Technology and Automation – Technological advancements in areas such as robotics, artificial intelligence, and computer-aided engineering are transforming the manufacturing industry with enhancements in metalworking operations to boost productivity, precision, and safety. The technologies enhance production efficiency and accuracy while reducing operational costs and minimizing the rates of human errors. Along with providing a secure work environment, these advancements reduce risky tasks and lessen the occurrence of accidents.

Additionally, the implementation of computer numerical control machines, automated cutting technologies, and robotic welding has enhanced the efficiency and precision of manufacturing. The metal fabrication industry represented around 10% of the working stock of industrial robots in 2022, reflecting the sector's embrace of automation. Research shows that implementing automation can lower manufacturing costs by as much as 20%, mainly by decreasing manual labor and enhancing efficiency. Progress in technology allows producers to satisfy the rising need for intricate and tailored metal items, consequently fostering expansion in the metal fabrication sector.

Global Metal Fabrication Market (2025-30): Segmentation Analysis

The Global Metal Fabrication Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the global level. Based on the analysis, the market has been further classified as follows:

Based on Metal Type:

- Steel

- Aluminum

- Titanium

- Copper

- Nickel

By material type, Steel holds the highest market share of about 45% of the Global Metal Fabrication Market due to its anti-rust property. Its tensile strength and longevity make it the choice in most industries. Its tensile strength and longevity are high, hence its popularity in most industries. The automobile industry relies on steel for crash bodies that ensure safety and longevity. Steel is utilized in the building industry to construct frames, bridges, and infrastructure projects. It has an excellent capacity for loads and is used to construct huge buildings. Steel is also utilized to construct ships and aircraft because of its resilience. Also, advancements in technology in the production of steel, like high-strength, low-alloy steel, have made it more versatile.

Strong and portable material requirements are also fueling greater steel consumption. Its strength, affordability, and versatility are also making it the go-to choice in industries. All this reinforces its number one position in the industry.

Based on End-User:

- Automotive

- Construction

- Aerospace

- Energy

- Medical

Based on end-users, the automotive industry has the largest market share at around 45%. The automotive industry creates high demand through a constant process of driving change in its design and technological innovations. Lightweight metals have become quite common already for their energy-saving aspects. This industry is sustained by fabricated metallic components. Body panels, frames, and intricate custom parts are essential for achieving performance and design requirements. Manufacturers insist on both functionality and aesthetics, thus accentuating the need for precision in metal cutting, welding, and assembly as the sector advances with modernization and customization, allowing the metal fabrication market to grow robustly, fueled by the importance attached to the automotive industry.

Global Metal Fabrication Market (2025-30): Regional Projections

Geographically, the Global Metal Fabrication Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Out of these, North America has the largest market share, around 46%, because of the growth in its Automotive, Aerospace, and Construction sectors. For instance, as per the Census Bureau information, the manufacturing sector that encompasses metals in the United States contributes more than USD 2 trillion in GDP per year. The automotive industry is responsible for most of this growth through new demands reported by the U.S. Department of Commerce in the use of lightweight, efficient fuel-consuming vehicles pegged on the need for improved metal parts.

Additionally, due to the increasing need for transportation and defense, the aerospace industry in the region is relying heavily on advanced metal fabrication processes. The United States Department of Defense remains one of the largest purchasers of goods built by these techniques. This supports the modernization of defense systems and military aircraft, as they require high-strength metal alloys and metals through precision fabrication to strengthen the aircraft. The region will continue to dominate the market during the forecast period.

Global Metal Fabrication Industry Recent Development:

- August 2024: Nippon Steel Corp plans to invest an additional USD 1.3 billion in the United States Steel Corporation to upgrade or replace the existing hot strip mill and other facilities.

Gain a Competitive Edge with Our Global Metal Fabrication Market Report

- The Global Metal Fabrication Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & market share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Metal Fabrication Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumptions

- Executive Summary

- Global Metal Fabrication Market Trends & Developments

- Global Metal Fabrication Market dynamics

- Drivers

- Challenges

- Global Metal Fabrication Market Regulations, Policies, & Standards

- Global Metal Fabrication Market Hotspot & Opportunities

- Global Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Size & Analysis

- By Metal Type

- Steel - Market Size & Forecast 2020-2030 USD Billion

- Aluminum - Market Size & Forecast 2020-2030, USD Billion

- Titanium- Market Size & Forecast 2020-2030, USD Billion

- Copper-Market Size & Forecast 2020-2030, USD Billion

- Nickel- Market Size & Forecast 2020-2030, USD Billion

- By Services

- Cutting-Market Size & Forecast 2020-2030, USD Billion

- Welding-Market Size & Forecast 2020-2030, USD Billion

- Forming- Market Size & Forecast 2020-2030, USD Billion

- Machining- Market Size & Forecast 2020-2030, USD Billion

- Assembly-Market Size & Forecast 2020-2030, USD Billion

- By End-User

- Automotive

-Market Size & Forecast 2020-2030, USD Billion - Construction- Market Size & Forecast 2020-2030, USD Billion

- Aerospace-Market Size & Forecast 2020-2030, USD Billion

- Energy-Market Size & Forecast 2020-2030, USD Billion

- Medical-Market Size & Forecast 2020-2030, USD Billion

- Automotive

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Revenue Shares

- By Metal Type

- Market Size & Analysis

- North America Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- By Country

- The US

- Canada

- Mexico

- The US Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Canada Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Mexico Metal Fabrication Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Market Size & Analysis

9.5.3.3 By End-User-Market Size & Forecast 2020-2030, USD Billion

- South America Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services-Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- By Country

- Brazil

- Argentina

- Rest of South America

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- Brazil Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Argentina Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- Europe Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- The UK Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- France Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Italy Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Spain Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- By Country

- Saudi Arabia

- The UAE

- South Africa

- Rest of Middle East & Africa

- Saudi Arabia Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- The UAE Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- South Africa Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-Use-Market Size & Forecast 2020-2030, USD Billion

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- China Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Japan Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- India Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- South Korea Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Australia Metal Fabrication Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Metal Type- Market Size & Forecast 2020-2030, USD Billion

- By Services- Market Size & Forecast 2020-2030, USD Billion

- By End-User-Market Size & Forecast 2020-2030, USD Billion

- Market Size & Analysis

- Market Size & Analysis

- Global Metal Fabrication Market Key Strategic Imperatives for Success & Growth

- Company Profile

- Mayville Engineering Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BTD Manufacturing Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Matcor Matsu Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Watson Engineering

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Iron Form Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PA international

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kapco Metal Stamping

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Komaspec

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- United States Steel Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nippon Steel Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aperam

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Standard iron and wire works

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- A.K Steel Holding Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Allegheny Ludlum

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mueller Industries

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Mayville Engineering Company

- Company Profile

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making