Malaysia Two-wheeler Tire Market Research Report: Forecast (2024-2030)

Malaysia Two-wheeler Tire Market Report - By Vehicle Type (Scooter and Moped, [Internal Combustion Engine (ICE), {Upto 100 cc, 101 cc to 125 cc, 126 cc to 150 cc, Above 150 cc}, El...ectric], Motorcycle, [Internal Combustion Engine (ICE), {Upto 100 cc, 101 cc to 125 cc, 126 cc to 150 cc, Above 150 cc}, Electric], By Tire Size (70/90-17, 80/90-17, 110/80-14, 130/70-13, 100/80-17, 140/70-17, 110/70-17, 120/70 R17, Others), By Tire Type (Radial, Bias), By Price Category (Budget (Upto USD10), Economy (USD11-USD30), Premium (Above USD31)), By Tire Pattern (Symmetrical Tire, Asymmetrical Tire, Directional Tire), By Sales Channel (Online, Direct Sales, Multi Brand Stores, Exclusive Outlets), By Demand Type (OEM, Replacement), Read more

- Tire

- Jan 2024

- Pages 114

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Malaysia Two-wheeler Tire Market (2024-30):

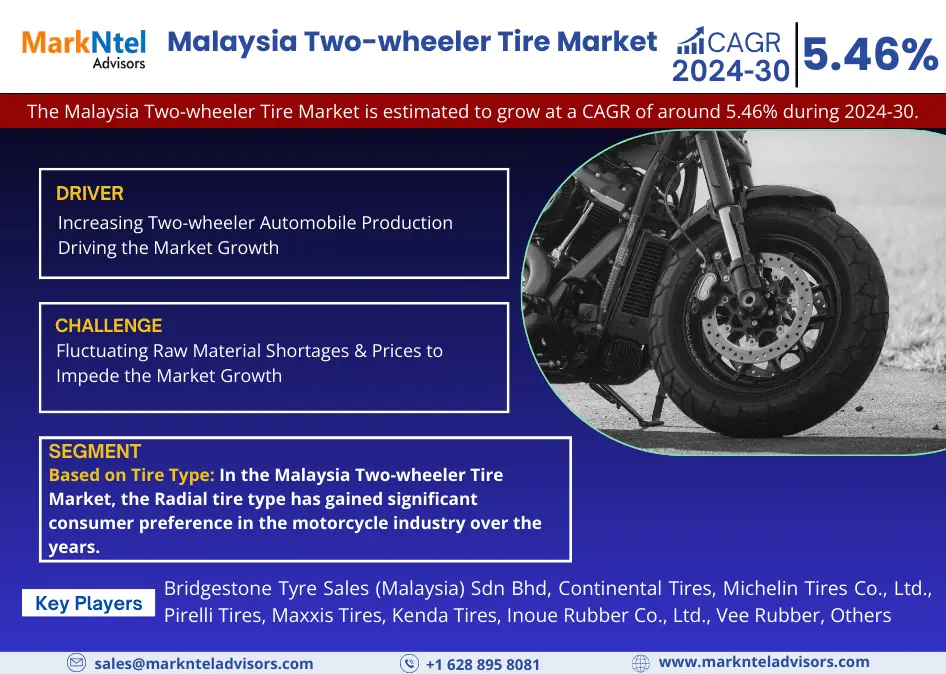

The Malaysia Two-wheeler Tire Market is estimated to grow at a CAGR of around 5.46% during the forecast period, i.e., 2024-30. The market has grown considerably over the historical years due to the growing preference of individuals to use motorcycles and scooters for daily commuting purposes. The city lanes in Malaysia are narrow, which leads to high traffic congestion and road blockages. As a result, daily commuters prefer to travel using two-wheelers because it is easy and flexible to maneuver them.

Further, the growing shift towards personal mobility at a competitive cost among the middle-income groups for greater flexibility compared to public transport has led to a surge in the sales of two-wheelers in the country. For instance, according to the Ministry of Transport, Malaysia, in 2022, the sales of motorcycles grew by nearly 36.4% compared to 2021 levels. Thus, the growing use of two-wheelers for daily commuting purposes has resulted in a rise in wear and tear of tires due to the poor road infrastructure in the country, thereby contributing to a higher demand for two-wheeler tires in Malaysia.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 5.46% |

| Region Covered | West, South, East, Central, East Coast |

| Key Companies Profiled | Bridgestone Tyre Sales (Malaysia) Sdn Bhd, Continental Tires, Michelin Tires Co., Ltd., Pirelli Tires, Maxxis Tires, Kenda Tires, Inoue Rubber Co., Ltd., Vee Rubber, TVS Eurogrip, Yokohama TWS, Others |

| Unit Denominations | USD Million/Billion |

The increasing usage of two-wheelers for business purposes, which includes last-mile delivery services, is another factor supporting the sales of scooters and motorbike tires in the country. Moreover, some of the prominent players that are actively using two-wheelers for business operations in Malaysia include DHL & Hock Cheong Logistics, etc. Simultaneously, the transition towards e-mobility for personal use is emerging as an opportunity for the unit sales of two-wheeler tires in the country.

The Malaysian government, in 2021, announced its target to achieve carbon neutrality by the year 2050, under which the government is encouraging individuals and end-users to gradually shift to electric two-wheelers by offering them incentives such as tax benefits and waivers. This initiative is creating growth trajectory for the Malaysia Two-wheeler Tire Market in the years ahead.

Malaysia Two-wheeler Tire Market Driver:

Increasing Two-wheeler Automobile Production Driving the Market Growth – Two-wheeler production is increasing due to traffic congestion and growth in investment by manufacturers in the two-wheeler industry for superior performance and comfort. The growing production of two-wheelers increases the demand for tires as the demand for tires is linked with production when the production increases the requirement for tires would automatically increase. According to the Motorcycle & Scooter Assemblers and Distributors Association of Malaysia, the production of two-wheelers was 4,96,136, 6,85,828, and 5,61,077 units in the years 2021, 2022, and 2023 respectively, which indicates the increasing demand for tires in the country. Therefore, the growing two-wheeler production increases the demand for tires, further driving the Malaysia Two-wheeler Tire Market.

Malaysia Two-wheeler Tire Market Challenge:

Fluctuating Raw Material Shortages & Prices to Impede the Market Growth – The automotive sector is facing a natural rubber shortage due to climate change and leaf disease ravaging the supply. This issue is a multi-year issue that impacts tire production. The production of tires is heavenly dependent on natural rubber for tire manufacturing. Therefore, due to the shortage of rubber production, tire production was put to a halt, which led to a decline in the Malaysia Two-wheeler Tire Market growth. Also, due to the shortage of raw materials for tires, the prices of tires tend to be more expensive than they used to be due to the limited supply, hence hindering the market growth.

Malaysia Two-wheeler Tire Market Trend:

Government Policies & Initiatives for Promoting the Use of Electric Two-wheelers to Strongly Contribute to Tire Sales – The Electric Vehicle (EV) Market is rapidly increasing in the country due to government support & initiatives. To promote the growth of EVs in the country, Malaysia’s Ministry of Investment, Trade and Investment (MITI) Introduced the battery Electric Vehicle Global Leader Initiative (BEV GLI). This BEC GLI program allows foreign companies to sell their car in Malaysia without Approved Permit (AP) rules, thus making imported vehicles cheaper. This initiative aims to help boost EV demand in the local market and further promote the demand for tires in the country, boosting the Malaysia Two-wheeler Tire Market share.

Malaysia Two-wheeler Tire Market (2024-30): Segmentation Analysis

The Malaysia Two-wheeler Tire Market study by MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment & includes predictions for the period 2024-2030 at the national levels. In accordance to the analysis, the market has been further classified as:

Based on Demand Type:

- OEM

- Replacement

The Replacement tire segment is predicted to account for the potential share of the Malaysia Two-wheeler Tire Market in the projected years. The high ownership rate of two-wheelers in the country and the continuously booming sales of scooters and motorbikes in Malaysia are the key factors leading to a substantial share of the replacement segment in the market.

Moreover, the Malaysian government is aiming to have penetration of over 100,000 electric motorcycles in the country with an intent to promote economic sustainability. This would further augment the unit sales of two-wheeler tires from replacements in the coming years. In addition, the enhanced government initiatives to escalate the adoption of electric scooters have further improved their sales across the country. Hence, with improved sales and excessive usage of scooters and mopeds, the demand for their replacement tires would increase.

Based on Tire Type:

-

Radial

-

Bias

In the Malaysia Two-wheeler Tire Market, the Radial tire type has gained significant consumer preference in the motorcycle industry over the years. Both original equipment manufacturers (OEMs) and replacement demand have driven the widespread adoption of radial tires in the country. This preference has been attributed to their improved stability, enhanced traction, longer tread life, and superior fuel efficiency.

In addition, there is a rising focus of manufacturers across Malaysia for the production of premium-range motorcycles. For instance, in 2023, Hong Leong Industries Bhd announced to strategically shift its focus to high-margin premium motorcycle models. By emphasizing premium models with better margins, Hong Leong Industries aims to mitigate the effects of the impact of macroeconomic headwinds. Hence, as most premium models are equipped with radial tires, their improved production would further support the sales of radial tires among OEMs in the coming years.

Gain a Competitive Edge with Our Malaysia Two-wheeler Market Report

-

Malaysia Two-wheeler Tire Market Report by MarkNtel Advisors provides a detailed and thorough analysis of the market size and share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

-

This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Malaysia Two-wheeler Tire Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Assumptions

- Market Definition

- Executive Summary

- Malaysia Two-Wheeler Tire Market Import & Export Statistics, 2019-2023

- Malaysia Two-Wheeler Production Outlook

- Overall Production Statistics, 2019-2023

- Leading Company’s Manufacturing Capabilities

- Malaysia Two-Wheeler Market Outlook, 2023

- Market Size & Analysis

- By Units Sold (Thousand)

- By Company

- Competition Characteristics

- Market Share

- Market Size & Analysis

- Malaysia Two-Wheeler Tire Market Pricing Analysis, Channel Vs Consumer

- Malaysia Two-Wheeler Tire Market Analysis, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand)

- Market Share & Analysis

- By Vehicle Type

- Scooter and Moped

- Internal Combustion Engine (ICE)

- Upto 100 cc

- 101 cc to 125 cc

- 126 cc to 150 cc

- Above 150 cc

- Electric

- Internal Combustion Engine (ICE)

- Motorcycle

- Internal Combustion Engine (ICE)

- Upto 100 cc

- 101 cc to 125 cc

- 126 cc to 150 cc

- Above 150 cc

- Electric

- Internal Combustion Engine (ICE)

- Scooter and Moped

- By Tire Size

- 70/90-17

- 80/90-17

- 110/80-14

- 130/70-13

- 100/80-17

- 140/70-17

- 110/70-17

- 120/70 R17

- Others

- By Tire Type

- Radial

- Bias

- By Price Category

- Budget (Upto USD10)

- Economy (USD11-USD30)

- Premium (Above USD31)

- By Tire Pattern

- Symmetrical Tire

- Asymmetrical Tire

- Directional Tire

- By Sales Channel

- Online

- Direct Sales

- Multi Brand Stores

- Exclusive Outlets

- By Demand Type

- OEM

- Replacement

- By Region

- East

- West

- South

- Central

- East Coast

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Vehicle Type

- Market Size & Analysis

- Malaysia Scooter & Moped Tire Market Analysis, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand)

- Market Share & Analysis

- By Tire Size

- By Tire Type

- By Price Category

- By Tire Pattern

- By Sales Channel

- By Demand Type

- Market Size & Analysis

- Malaysia Motorcycle Tire Market Analysis, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand)

- Market Share & Analysis

- By Tire Size

- By Tire Type

- By Price Category

- By Tire Pattern

- By Sales Channel

- By Demand Type

- Market Size & Analysis

- Competition Outlook

- Company Profiles

- Bridgestone Tyre Sales (Malaysia) Sdn Bhd

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Continental Tyre PJ Malaysia Sdn Bhd

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Michelin Siam Co., Ltd

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Pirelli Tires SpA

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Maxxis Tyres

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Kenda Tires

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Inoue Rubber Co., Ltd.

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Vee Rubber Co. Ltd.

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- TVS Srichakra Limited

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Yokohama TWS

- Product Portfolio

- Strategic Alliances or Partnerships

- Financial Details

- Bridgestone Tyre Sales (Malaysia) Sdn Bhd

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making