Latin America Carbon Trading Market Research Report: Forecast (2024-2030)

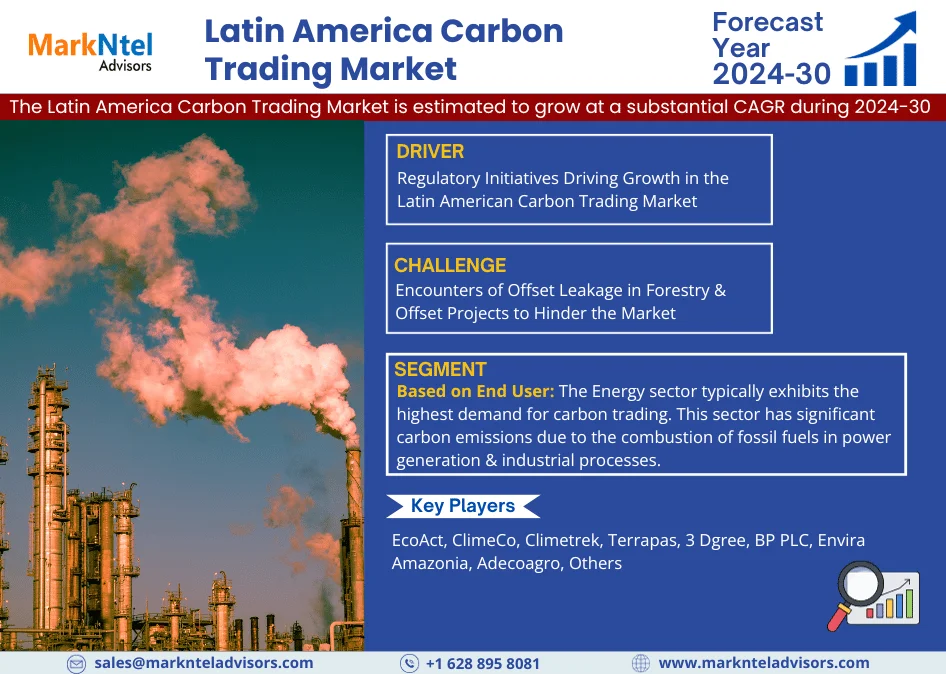

By Source (Forest, Agriculture, Carbon Capture and Storage, Others), By Platform (Compliance, Voluntary), By System (Cap & Trade, Baseline & Credit), By End-User (Oil & Gas, Energy..., Utility, Chemical, Automotive, Others), By Country (Brazil, Argentina, Mexico, Rest of Latin America), By Company (EcoAct, ClimeCo, Climetrek, Terrapas, 3 Dgree, BP PLC, Envira Amazonia, Adecoagro, Others) Read more

- Energy

- Oct 2023

- Pages 155

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Latin America Carbon Trading Market (2024-30):

The Latin America Carbon Trading Market is estimated to grow at a substantial CAGR during the forecast period, i.e., 2024-30. The region is witnessing a continuous increase in the demand for carbon trading, primarily due to rising levels of greenhouse gas (GHG) emissions, contributing to a global temperature increase & significant environmental impacts. Countries like Brazil, Argentina, and others are actively transitioning towards low-carbon economy strategies, further fueling the demand & supply of carbon credits in the market. In response, numerous carbon-emitting companies are making investments in carbon trading, purchasing carbon credits to reduce & mitigate their environmental emissions. For instance:

- In 2023, Petrobras acquired carbon credits totaling 175,000 tons, worth USD 120 million, in a concerted effort to curb carbon emissions & promote sustainability initiatives while striving for a net-zero target.

Furthermore, with companies worldwide facing increasingly urgent imperatives to reduce their global carbon emissions, many developed nations, including Canada, China, and others, are channeling investments into Latin American countries to secure carbon credits. In response to this influx of foreign investment, countries such as Argentina & Mexico have registered numerous projects aimed at generating carbon credits, thereby attracting additional capital from international corporations.

| Report Coverage | Details |

|---|---|

| Historical Years | 2019-22 |

|

Base Years

|

2023

|

|

Forecast Years

|

2024-30

|

| Leading Region | Brazil |

| Top Key Players | EcoAct, ClimeCo, Climetrek, Terrapas, 3 Dgree, BP PLC, Envira Amazonia, Adecoagro, Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Consequently, the Latin America Carbon Trading Market is in a phase of robust expansion, driven by the region's commitment to combat climate change, transition towards low-carbon economies, and foster corporate sustainability initiatives. As both businesses & governments emphasize environmental stewardship, the demand for carbon trading continues to soar, playing a pivotal role in propelling sustainable development across the region.

Latin America Carbon Trading Market Driver

Regulatory Initiatives Driving Growth in the Latin American Carbon Trading Market – Regulatory initiatives are playing a pivotal role in shaping the Latin America Carbon Trading Market. Governments across the region are increasingly recognizing the urgent need to address climate change and reduce greenhouse gas emissions.

Due to this, they are implementing and strengthening regulations aimed at limiting emissions from various sectors, including energy, industry, and transportation. These regulations are creating a framework for emissions reduction and provide incentives for businesses & industries to actively participate in carbon trading. For instance:

- In 2023, the Rio de Janeiro city council introduced a fiscal incentive program aimed at drawing companies involved in the carbon credit industry to the city. This initiative offers substantial tax rebates of up to USD 12.3 million per year to companies that offset their emissions by utilizing carbon credits.

By setting emission reduction targets and incorporating carbon pricing mechanisms, governments are encouraging market players to adopt cleaner technologies and invest in emissions reduction projects. Due to this, companies are driven by both regulatory compliance & the financial benefits of trading carbon credits, which bodes well for the region's efforts to mitigate climate change while promoting sustainable economic growth.

Latin America Carbon Trading Market Challenge

Encounters of Offset Leakage in Forestry & Offset Projects to Hinder the Market – Forestry projects are susceptible to a phenomenon known as offset leakage, which presents challenges in accurately measuring and quantifying this phenomenon in both forestry and other offset projects. The quantification of leakage varies across different protocols, contributing to a lack of consensus on the validity of these projects. As a consequence, these projects have often resulted in a mere relocation of emissions, failing to achieve a net reduction in carbon emissions, thus impeding the Latin America Carbon Trading Market.

Latin America Carbon Trading Market (2024-30): Segmentation Analysis

The Latin America Carbon Trading Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment & includes predictions for the period 2024–2030 at the regional level. In accordance to the analysis, the market has been further classified as:

Based on End User:

- Oil & Gas

- Energy

- Utility

- Chemical

- Automotive

- Others

The Energy sector typically exhibits the highest demand for carbon trading. This sector has significant carbon emissions due to the combustion of fossil fuels in power generation & industrial processes. As governments in the region implement emissions reduction targets & regulations, energy companies seek carbon credits to offset their emissions & comply with these mandates.

Additionally, the growing emphasis on clean energy & sustainability in Latin America has further increased the demand for carbon trading in the energy sectors as they strive to transition to low-carbon & renewable energy sources.

Latin America Carbon Trading Market (2024-30): Regional Projection

Geographically, the Latin America Carbon Trading Market expands across:

- Brazil

- Argentina

- Mexico

Brazil’s vast and diverse economy encompasses agriculture, manufacturing, energy, and transportation, all of which contribute substantially to greenhouse gas emissions. The country's prominent role in the agricultural & forestry sectors, often associated with deforestation & land-use changes, necessitates a strong reliance on carbon trading to counteract emissions.

With ambitious climate goals in place and a commitment to reducing emissions, particularly in deforestation & the energy sector, Brazil actively seeks carbon credits to meet its targets. Additionally, the nation's rich renewable energy potential, in the form of hydropower and biomass, attracts investments in clean energy projects, further driving the demand for carbon credits.

Moreover, the country's active participation in international climate agreements combined with regional cap-and-trade programs, underscores its dedication to carbon mitigation. Consequently, accelerating the Latin America Carbon Trading Market growth in the region.

Gain a Competitive Edge with Our Latin America Carbon Trading Market Report

- Latin America Carbon Trading Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Latin America Carbon Trading Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address

Frequently Asked Questions

Latin America Carbon Trading Market Research Report (2024-2030) - Table of Contents

- Executive Summary

- Market Outlook

- Key Facts and Figures

- Latin America Carbon Trading Market Dynamics

- Growth Driver

- Restrains

- Hotspot & Opportunities

- Trends & Developments

- Latin America Carbon Trading Market Overview

- Porter’s Five Forces Analysis

- Market Start-Up Ecosystem

- Entrepreneurial Activity

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series Wise Funding Received

- Carbon Credit Developments/Programs

- Private Entity

- Public Entity

- Value Chain Analysis

- List of Manufacturers

- List of Potential Customers

- Latin America Carbon Trading Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- By Source

- Forest

- Agriculture

- Carbon Capture and Storage

- Others

- By Platform

- Compliance

- Voluntary

- By System

- Cap & Trade

- Baseline & Credit

- By End-User

- Oil & Gas

- Energy

- Utility

- Chemical

- Automotive

- Others

- By Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- By Competition

- Competition Characteristics

- Market Share of Top Companies

- By Source

- Market Size & Analysis

- Brazil Carbon Trading Market Outlook, 2019-2029F

- Regulations, Policy & Standards

- Government Initiatives

- Market Size & Analysis

- By Revenues USD Million

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Source

- By Platform

- By System

- By End-User

- Regulations, Policy & Standards

- Argentina Carbon Trading Market Outlook, 2019-2029F

- Regulations, Policy & Standards

- Government Initiatives

- Market Size & Analysis

- By Revenues USD Million

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Source

- By Platform

- By System

- By End-User

- Regulations, Policy & Standards

- Mexico Carbon Trading Market Outlook, 2019-2029F

- Regulations, Policy & Standards

- Government Initiatives

- Market Size & Analysis

- By Revenues USD Million

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Source

- By Platform

- By System

- By End-User

- Regulations, Policy & Standards

- Competitive Outlook

- Company Profiles

- EcoAct

- Business Description

- Product Portfolio

- Key executives

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details*

- Others

- ClimeCo

- Business Description

- Product Portfolio

- Key executives

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details*

- Others

- Climetrek

- Business Description

- Product Portfolio

- Key executives

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details*

- Others

- Terrapas

- Business Description

- Product Portfolio

- Key executives

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details*

- Others

- 3 Dgree

- Business Description

- Product Portfolio

- Key executives

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details*

- Others

- BP PLC

- Business Description

- Product Portfolio

- Key executives

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details*

- Others

- Envira Amazonia

- Business Description

- Product Portfolio

- Key executives

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details*

- Others

- Adecoagro

- Business Description

- Product Portfolio

- Key executives

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details*

- Others

- Others

- EcoAct

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making