India Weeders & Tillers Market Research Report: Forecast (2023-2028)

By HorsePower (Below 10 HP, 10.1-20 HP, 20.1-30 HP, 30.1-40 HP, Above 40 HP), By Fuel Type, (Petrol, Diesel, Electric), By Handling, (Self-Handling Tillers, Automotive Power Tiller...s), By Application, (Agriculture, Horticulture/Gardening, Forestry), By End-User, (Residential, Commercial), By Sales Channel, (Online, Offline), By Region, (North, South, West, East), By Company (VST Tillers & Tractors Ltd., Kisankraft Limited, Shrachi Agrimech, Andreas Stihl Pvt. Ltd., Kerala Agro Machinery Corporation Ltd. (KAMCO), Kirloskar Oil Engines Ltd., Honda India Power Products Ltd., Greaves Cotton Ltd., Kubota Agricultural Machinery India Pvt. Ltd., E-agro Care Machineries & Equipments Pvt. Ltd., and Btl Epc Ltd., Others) Read more

- Environment

- May 2023

- Pages 95

- Report Format: PDF, Excel, PPT

Market Definition

Weeders & tillers are the equipment used to weed, hoe, plow, or crumble soil. They loosen the ground under the topsoil to help crop roots develop quickly & reach farther into the earth. They are used for gardening, horticultural, forestry, and agriculture purposes.

Market Insights

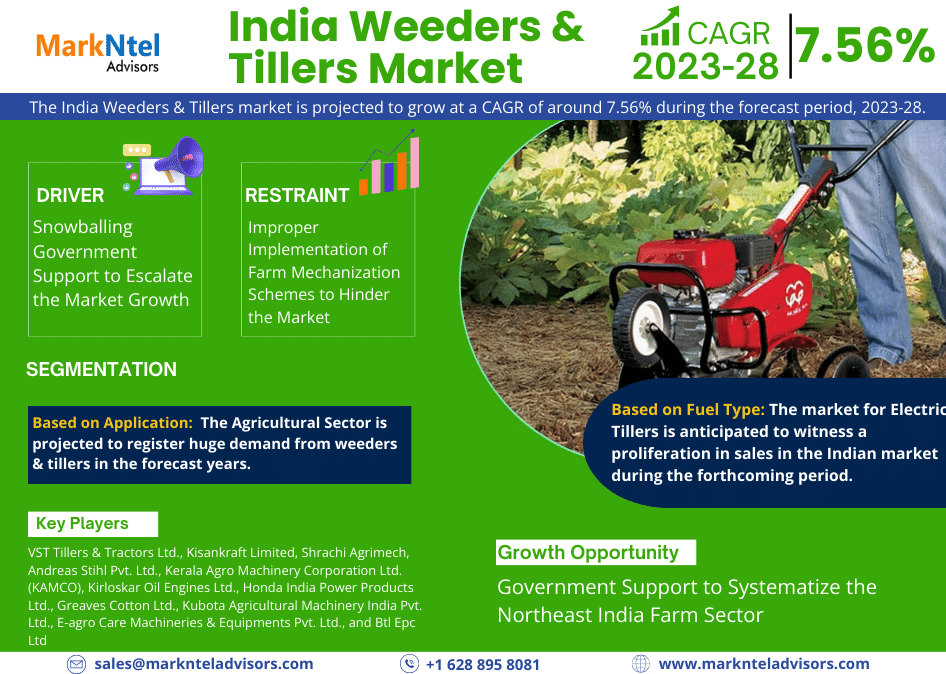

The India Weeders & Tillers market is projected to grow at a CAGR of around 7.56% during the forecast period, i.e., 2023-28. The major factor responsible for the growth is the huge government support for increasing the productivity of India. This includes farm mechanization schemes & direct benefit transfers to farmers to support mechanization. The growing number of small landholdings in the country is raising the demand for small farm machinery, such as handheld machines like brush cutters, hedge trimmers, and chain saws in the country. According to VST Tillers Tractors Ltd., the small farm machinery sector has grown at a CAGR of about 30% to 40% in 2020 & 2021.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 7.56% |

| Region Covered | North, East, West, South |

| Key Companies Profiled | VST Tillers & Tractors Ltd., Kisankraft Limited, Shrachi Agrimech, Andreas Stihl Pvt. Ltd., Kerala Agro Machinery Corporation Ltd. (KAMCO), Kirloskar Oil Engines Ltd., Honda India Power Products Ltd., Greaves Cotton Ltd., Kubota Agricultural Machinery India Pvt. Ltd., E-agro Care Machineries & Equipments Pvt. Ltd., and Btl Epc Ltd., Others |

| Unit Denominations | USD Million/Billion |

Moreover, intercropping in flat arial areas in many Indian states, such as Madhya Pradesh and Uttar Pradesh, drives the demand for tillers in these regions. Also, the high cost of labor in these areas, coupled with the presence of high humidity in fields, including sugarcane crops, encouraged the use of weeders to reduce the cost of labor in recent years. The regional differentiation in farm mechanization in the country is raising the demand for the equipment owing to the rising efforts to develop & improve the productivity of northeastern agriculture farms.

Hence, a high requirement for farm mechanization in India is presumed during the forthcoming period due to the decreasing number of small land holdings & government support to strengthen the Indian agriculture sector & farmers.

Market Dynamics:

Growth Driver: Snowballing Government Support to Escalate the Market Growth

India's agriculture sector has been the leading industry in terms of employment over the historical years. This is attributable to the presence of the majority of the rural population in the country. Thus, the government of India initiates several schemes that assist to ease the cultivation process by replacing the tedious traditional manual labor with quick & efficient machine work.

Similarly, various state governments have also been providing support to farm mechanization in the country, in the form of schemes & subsidies to provide assistance to farmers to purchase farm apparatuses such as mini tractors, power weeders, trans-planters, etc. Thus, consistent government initiatives to support the farmers owing to the dependency of the Indian economy on agriculture have been driving the India Weeders & Tillers market growth.

Possible Restraint: Improper Implementation of Farm Mechanization Schemes to Hinder the Market

Improper implementation & execution of the farm schemes framed by the government are negatively affecting the Weeders & Tillers market. The government of India is the major buyer in the market as it is the key concern of the government to provide support to small & marginal landholders in the country. The loopholes present in the execution system & the improper implementation would stymie the market growth in India.

Growth Opportunity: Government Support to Systematize the Northeast India Farm Sector

The presence of several challenges in the agricultural fields of Northeastern states of India, like hilly topography & the non-availability of suitable machinery, reduces the overall productivity of the region. The presence of farm mechanization in the area is minimal when compared to other parts of India. For instance, as per NABARD, the level of farm mechanization in the country stands at about 40-45%, with states such as UP, Haryana, and Punjab having very high mechanization levels, however, Northeastern states have minor mechanization. Therefore, the government is raising its concentration on these states to support agricultural production in this region of the country.

As a part of the development efforts, the government provides a major share of assistance to states under Centrally Sponsored Schemes such as the Mission for Integrated Development of Horticulture (MIDH), Pradhan Mantri Krishi Sinchai Yojana (PMKSY), etc. Thus, the continuous development efforts of the government to raise the productivity of Northeastern states present a huge opportunity for revenue generation for the India Weeders & Tillers market in the forthcoming years.

Key Trend: Increasing Modernization of Small Landholdings

The country’s requirement for small farm machines has been on the rise in the last few years as the size of landholding is getting divided, and farms are increasingly becoming smaller. Thus, people venturing into small-scale farming are inclined towards the usage of small weeders & tillers. The people looking for mechanization in these farms that are less than 5 acres in size can’t afford a 40 horsepower plus tractor that costs anywhere upwards of USD6760 to USD8116, raising the demand for the equipment in recent years. For instance:

- In 2022, VST Tillers Tractors Ltd., the small-farm mechanization industry, has continued to witness a double-digit growth indicating hyper-action in small-scale farming & changing dynamics in the country’s agriculture sector.

Hence, the upscaling percentage of small-scale farming in the country is augmenting the level of mechanization on a small level owing to changing country dynamics. Therefore, further expected to escalate the demand for small farm machinery, such as weeders & tillers in the agricultural sector during the forecast period.

Market Segmentation

Based on HorsePower (HP):

- Below 10 HP

- 10-20 HP

- 20-30 HP

- 30-40 HP

- Above 40 HP

The demand for tillers between 10-20 HP is estimated to witness a positive graph in the forecast years owing to an upsurge in the number of small & fragmented land holdings in the country. As these weeders & tillers consist of a single-cylinder, the water-cooled diesel engine can work in both wet & dry fields without changing blades. Also, these tillers have small turning radius tires designed for narrow spaces, small fields, and corners as well. The cost efficiency of these tillers for small farmers is raising the market demand & is expected to do the same in the upcoming years. Moreover, the lightweight of tillers/weeders of approximately 4-5 HP weeders which are around 60-70kg for weeders & nearly 200-500kg for tillers, makes them suitable to be used in the farming process in hilly areas, thus influencing their demand & further positively affecting the market expansion during 2023-28.

Based on Fuel Type:

- Petrol

- Diesel

- Electric

The market for Electric Tillers is anticipated to witness a proliferation in sales in the Indian market during the forthcoming period. This is due to the multiple uses & benefits associated with electric tillers. They help in preparing the soil, sowing seeds, planting seeds, and adding & spraying fertilizers, herbicides & water. It also helps in pumping water, harvesting, threshing & transporting crops. An electric tiller is ideal where the land side is small & in hilly regions, where only terrace farming is possible, farmers find electric tillers to be extraordinarily useful. Hence, these factors are estimated to raise the demand for electric power tillers in India in the upcoming years.

Based on Application:

- Agriculture

- Horticulture/Gardening

- Forestry

The Agricultural Sector is projected to register huge demand from weeders & tillers in the forecast years. This is owing to the dependence of the Indian economy on the agricultural sector. The agricultural sector employs the largest number of the Indian population, which makes it the biggest market for farm equipment. Furthermore, the rising number of government schemes & subsidies to support the agriculture sector & increase farm mechanization is lifting the revenue generation for the market in India, which would also provide support in the forecast years.

Recent Developments by the Leading Companies

- In 2022, VST Tillers & Tractors Ltd, unveiled New Power Weeders, which is ideal for inter-cultivation, land preparation, bund construction, and de-weeding. It has a powerful 175 CC vertical engine suitable for the hilly region & used for any kind of horticulture crop, vegetable crop, and floricultural crops.

Do you require further assistance?

- The sample report seeks to acquaint you with the layout and the overall research content.

- The deliberate utilization of the report may further streamline operations while maximizing your revenue.

- To gain an unmatched competitive advantage in your industry, you can customize the report by adding more segments and specific countries suiting your needs.

- For a better understanding of the contemporary market scenario, feel free to connect to our knowledgeable analysts.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Agriculture Industry Outlook

- By Crops

- By Equipment Technology

- By Region

- By Government Initiatives

- India Weeders & Tillers Market Porters Five Forces Analysis

- India Weeders & Tillers Market Supply Chain Analysis

- India Weeders & Tillers Market Trends & Insights

- India Weeders & Tillers Market Dynamics

- Drivers

- Challenges

- India Weeders & Tillers Market Growth Opportunities & Hotspots

- India Weeders & Tillers Market Policy & Regulations

- India Weeders & Tillers Market Outlook, 2017-2027F

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold (Thousands)

- Market Share & Outlook

- By HorsePower

- Below 10 HP

- 10.1-20 HP

- 20.1-30 HP

- 30.1-40 HP

- Above 40 HP

- By Fuel Type

- Petrol

- Diesel

- Electric

- By Handling

- Self-Handling Tillers

- Automotive Power Tillers

- By Application

- Agriculture

- Horticulture/Gardening

- Forestry

- By End-User

- Residential

- Commercial

- By Sales Channel

- Online

- Offline

- By Region

- North

- South

- West

- East

- By Company

- Market Share

- Competition Characteristics

- By HorsePower

- Market Size & Outlook

- India Weeders & Tillers Market Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- VST Tillers & Tractors Ltd.

- Kisankraft Limited

- Shrachi Agrimech

- Andreas Stihl Pvt. Ltd.

- Kerala Agro Machinery Corporation Ltd. (KAMCO)

- Kirloskar Oil Engines Ltd.

- Honda India Power Products Ltd.

- Greaves Cotton Ltd.

- Kubota Agricultural Machinery India Pvt. Ltd.

- E-agro Care Machineries & Equipments Pvt. Ltd.

- Btl Epc Ltd.

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making