India Renewable Energy Market Research Report: Forecast (2025-2030)

India Renewable Energy Market Report - By Source (Solar, Wind, Hydro, Others (Biomass, geothermal, etc.)), By End User (Residential, Commercial, Industrial), and Others... Read more

- Energy

- Nov 2024

- Pages 123

- Report Format: PDF, Excel, PPT

Market Definition

Renewable energy is energy from replenishable sources that can easily recover due to their near-unlimited supply, such as sun and wind. Renewable Energy includes solar, wind, hydro, biomass, and geothermal energy.

Market Insights & Analysis: India Renewable Energy Market (2025-30):

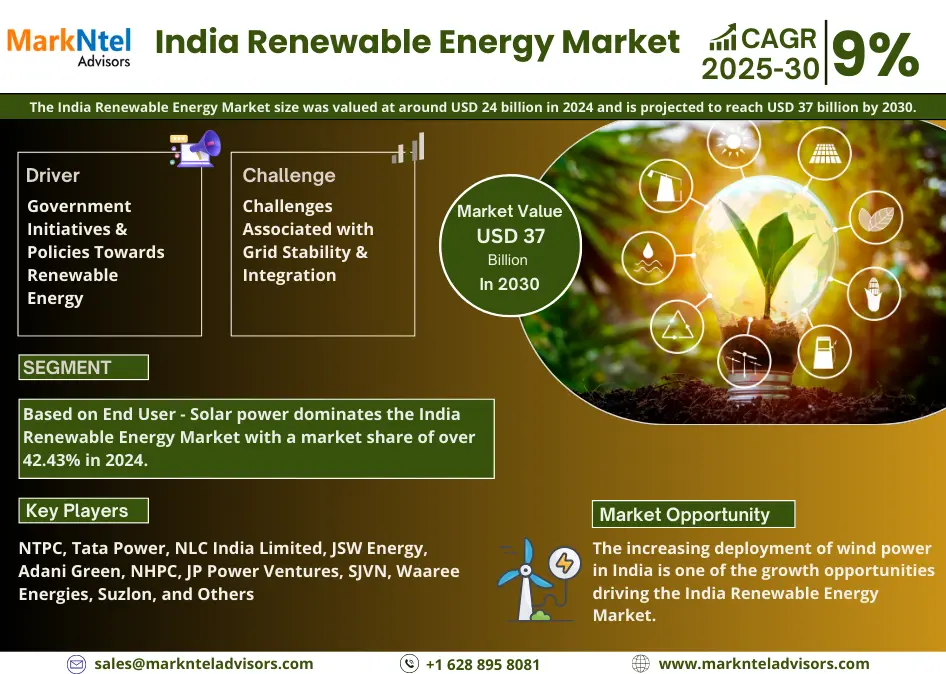

The India Renewable Energy Market size was valued at around USD 24 billion in 2024 and is projected to reach USD 37 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 9% during the forecast period, i.e., 2025-30. This growth in the market is attributed to the increasing government efforts to push renewable energy usage for power generation in India. This has resulted in the government launching various schemes, initiatives, and policy implementations such as PM KUSUM yojna, Roof Top Solar Program, PM - Surya Ghar: Muft Bijli Yojna, etc., which are driving the demand for renewable in the country.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 24 Billion |

| Market Value By 2030 | USD 37 Billion |

| CAGR (2025-30) | 9% |

| Leading Region | West India |

| Top Key Players | NTPC, Tata Power, NLC India Limited, JSW Energy, Adani Green, NHPC, JP Power Ventures, SJVN, Waaree Energies, Suzlon, and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

As per, India's New and Renewable Energy Ministry (MNRE) since FY20, India’s installed renewable energy has grown by over 50% from nearly 134,000 MW to over 200,000 MW as of July 2024. Apart from this, the Indian government has decided to accept the tender bids related to 50,000 MW of renewable energy capacity between FY24 and FY28. These will also comprise at least 10,000 MW of wind power projects annually in the same period. These developments are in line with the government’s aim of achieving energy independence by 2047 and net zero emissions by 2070. The country is switching to renewable energy fairly fast to ensure its energy security, as India imports most of its fossil fuels.

The electricity demand in the country is rapidly surging. As per report from the Central Electricity Authority India, the electricity demand has reached new peak of 243,000 MW during FY24 which is further expected to reach 446,000 MW by 2030. These highlight a healthy growth outlook in the market over the forecasted period.

India Renewable Energy Market Driver:

Government Initiatives & Policies Towards Renewable Energy – India generates most of its electricity from traditional fossil fuels-based energy sources. The production of electricity using fossil fuels consumes a lot of water and generates substantial greenhouse gas emissions, contributing to climate change. The changing global energy dynamics are increasingly causing countries to adopt cleaner energy sources to reduce their emissions. India aims to achieve its net zero emission target of 2070 and thus launched various schemes to promote electricity generation from renewable energy sources. These schemes include the New Solar Power Scheme, with an outlay of around USD 61 million under PM JANMAN to provide electricity to the un-electrified remote households of vulnerable tribal communities in India.

Additionally, schemes like PM KUSUM help farmers with financing for the installation of small standalone solar plants of a capacity of up to 2MW for solar pumps to ensure energy security for farmers. As per MNRE, under Component A of the PM KUSUM, around 300 MW of solar capacity has already been installed, with total sanctioned solar capacity standing at 9,110 MW as of September 2024. Furthermore, the Roof Top Solar (RTS) Programme aims to install a capacity of 40,000 MW worth of grid-connected rooftop solar panels. The RTS program has achieved a total installed rooftop solar capacity of around 11,870 MW by the end of FY24. The government of India plans to achieve a total non-fossil sources capacity of 500,000 MW by 2030, with renewable accounting for nearly 450,000 MW from the current of just over 200,000 MW in 2024 to ensure its energy security is driving the growth in the market.

India Renewable Energy Market Opportunity:

Increasing Deployment of Wind Power in India – India ranks fourth in total installed capacity of wind power. Wind power in India has witnessed a rapid escalation due to geography and growing emphasis on renewable energy in the country. As per MNRE, the overall wind capacity in India has surged by over 21%, expanding to 45,886 MW by FY24 from 37,693 MW in FY20. The western region of India is anticipated to have an overall operational wind capacity of around 22,127 MW by the end of FY24. Moreover, in the west region, Gujarat is leading at the forefront with an impressive 11,723 MW of operational wind capacity by the end of March 2024, with around 1,744 MW of new capacity added in FY24.

Apart from this, the Central Electricity Authority (CEA) expects it to grow to around 73,000 MW by FY27 and 122,000 MW by FY32. The Crisil Ratings expects that over 25,000 MW of wind power capacity would involve a capital expenditure of around 23.7 billion between FY25 and FY28. The rapidly changing landscape of wind power in India provides huge growth opportunities in India's renewable energy industry.

India Renewable Energy Market Challenge:

Challenges Associated with Grid Stability & Integration – The energy generated from standalone solar and wind power plants is unreliable due to their seasonal or intermittent nature. This would create instability in the grid in case of interruption to power generation by renewable energy sources. In India, the grid infrastructure is majorly built based on traditional energy sources, which possess grid inertia leading to grid stability, which variable renewable energy sources lack. For instance,

- In May 2024, Tamil Nadu Generation and Distribution Corporation curtailed the production of wind power to protect the stability of the grid.

These developments prevent renewable energy from significantly increasing its optimal contribution to the grid, which could restrain the market growth over the forecasted period.

India Renewable Energy Market Trend:

Deployment of Hybrid Renewable Energy Solutions – There is an increasing deployment of wind plus solar power hybrid renewable energy solutions in the country. This is largely due to standalone wind and solar power being variable renewable energy, which would show fluctuation and seasonality in energy generation. This led to a decline in the reliability of the power generated from the standalone wind and solar power plants. This was also observed in the fall of the annual tenders for Variable Renewable Energy to 28 GW in 2022 from 40 GW in 2019. Companies operating in the market are increasingly looking to deploy hybrid renewable energy like wind and solar energy to offset the intermittency in power generation. Moreover, these hybrid solutions come with storage capabilities that allow for higher power stability. For instance,

- In September 2024, Tata Power won a 400 MW hybrid renewable energy project from the Maharashtra government.

The rapidly growing shift towards renewable energy will boost the demand for hybrid renewable energy solutions due to reliability, thereby contributing to market growth & expansion.

India Renewable Energy Market (2025-30): Segmentation Analysis

The India Renewable Energy Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Source:

- Solar

- Wind

- Hydro

- Others (Biomass, Geothermal, etc.)

Solar power dominates the India Renewable Energy Market with a market share of over 42.43% in 2024. This is primarily because out of over 200,000 MW of total installed renewable energy capacity of India, 85,470 MW belongs to solar power, as per the Ministry of New and Renewable Energy (MNRE) of India. Thus, since 2014, the country’s solar power has rapidly grown from 2,820 MW in March 2014 to 85,470 MW in June 2024. The repeated government efforts towards incentivizing solar power played a crucial role in its rapid deployment.

Among the many government schemes, one scheme, PM - Surya Ghar: Muft Bijli Yojna, launched in February 2024, aims to provide 40% of the total installation cost of residential rooftop solar panels. Under this, the Indian government plans to target 10 million households who will receive 300 units of free electricity every month. The strong government support, the escalating energy demand, and the declining cost of solar panels will allow solar power to remain a dominating segment in India's renewable energy industry.

India Renewable Energy Market (2025-30): Regional Projections

Geographically, the India Renewable Energy Market expands across:

- North & Central India

- South India

- East India

- West India

West India holds the largest share, around 39%, in the India Renewable Energy Market. This is largely due to the fact that this region has a total installed capacity of approximately 78,733 MW as of October 24, from renewable energy as per National Power Portal. Moreover, the region houses states like Rajasthan and Maharashtra, each having about a 15% share in the total renewable energy installed capacity of India. The region has geographical advantages, like huge empty land areas or coastlines, that make it suitable for deploying solar and wind power plants.

Apart from this, the region also faces water shortages, and thermal energy-based power plants have a significant water requirement. This scenario led the region to pivot itself towards renewable energy sources. Furthermore, the growing energy demands of the region will boost the installation of renewable energy, thereby fuelling market growth. For instance,

- In September 2024, the Maharashtra government signed MOUs worth USD 5.6 billion towards its renewable energy sector. The underlying projects will support the state government’s aim to achieve 50% energy from renewable sources by 2030.

India Renewable Energy Industry Recent Development:

- September 2024: NLC India Limited will invest nearly USD 6 billion to raise its renewable energy capacity to 10.11 GW from 1.43 GW.

- April 2024: NHPC has partnered with Norwegian company Ocean Sun for the implementation of floating solar panel technology.

Gain a Competitive Edge with Our India Renewable Energy Market Report

- India Renewable Energy Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The India Renewable Energy Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Market Definition

- Assumption

- Executive Summary

- India Renewable Energy Investment 2020-2030F

- India Renewable Energy Market Trends & Development

- India Renewable Energy Market Dynamics

- Growth Drivers

- Challenges

- India Renewable Energy Market Hotspots & Opportunities

- India Renewable Energy Market Value Chain Analysis

- India Renewable Energy Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Installed Capacity (MW)

- Market Share & Analysis

- By Source

- Solar – Market Size & Forecast, 2020-2030, MW

- Wind – Market Size & Forecast, 2020-2030, MW

- Hydro – Market Size & Forecast, 2020-2030, MW

- Others (Biomass, geothermal, etc.) – Market Size & Forecast, 2020-2030, MW

- By End User

- Residential – Market Size & Forecast, 2020-2030, MW

- Commercial – Market Size & Forecast, 2020-2030, MW

- Industrial – Market Size & Forecast, 2020-2030, MW

- By Region

- North & Central India

- South India

- East India

- West India

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Source

- Market Size & Analysis

- North & Central India Renewable Energy Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Installed Capacity (MW)

- Market Share & Analysis

- By Source – Market Size & Forecast, 2020-2030, MW

- By End User – Market Size & Forecast, 2020-2030, MW

- By State & Union Territory

- Himachal Pradesh

- Punjab

- Haryana

- Uttarakhand

- Madhya Pradesh

- Others

- Market Size & Analysis

- South India Renewable Energy Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Installed Capacity (MW)

- Market Share & Analysis

- By Source – Market Size & Forecast, 2020-2030, MW

- By End User – Market Size & Forecast, 2020-2030, MW

- By State & Union Territory

- Tamil Nadu

- Andhra Pradesh

- Karnataka

- Telangana

- Kerala

- Others

- Market Size & Analysis

- East India Renewable Energy Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Installed Capacity (MW)

- Market Share & Analysis

- By Source – Market Size & Forecast, 2020-2030, MW

- By End User – Market Size & Forecast, 2020-2030, MW

- By State & Union Territory

- Assam

- Meghalaya

- West Bengal

- Jharkhand

- Odisha

- Chhattisgarh

- Bihar

- Others

- Market Size & Analysis

- West India Renewable Energy Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Installed Capacity (MW)

- Market Share & Analysis

- By Source – Market Size & Forecast, 2020-2030, MW

- By End User – Market Size & Forecast, 2020-2030, MW

- By State & Union Territory

- Rajasthan

- Gujarat

- Maharashtra

- Others

- Market Size & Analysis

- India Renewable Energy Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- NTPC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tata Power

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- NLC India Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JSW Energy

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Adani Green

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- NHPC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JP Power Ventures

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SJVN

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- WAAREE Energies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Suzlon

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- NTPC

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making