India Dishwashers Market Research Report: Forecast (2025-2030)

India Dishwashers Market Size - By Category (Built-in Dishwasherss, Freestanding Dishwasherss), By Connected Appliances (Smarts, Non-Smarts), By Size (Full Size, Slimline, Dishdraw...er), By Distribution Channel (Retail Channelss [Retail Offlines, Retail E-Commerces], Non-Retail Channelss [Builder Merchants and Constructions]), By Price Range (Economy, Mid-range, Luxury), By End Use (Commercial, Residential) and others Read more

- FMCG

- Apr 2025

- Pages 132

- Report Format: PDF, Excel, PPT

India Dishwashers Market Statistics

- In 2025, the Dishwasher penetration in Indian households was less than 0.5%

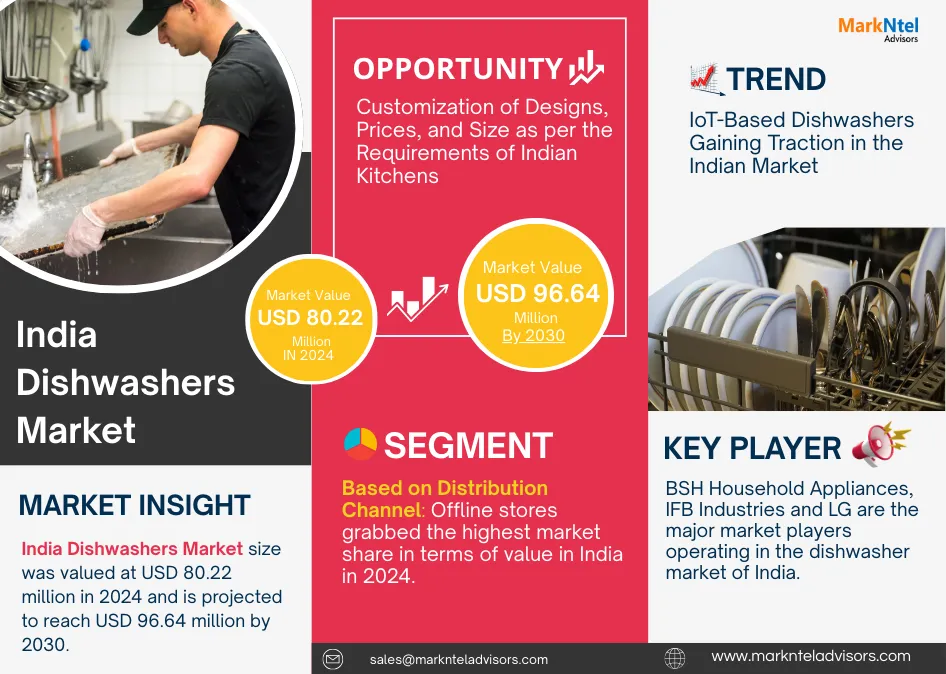

- The Dishwashers market size was estimated at USD 80.22 million in 2024

- By 2030, the market size is expected to touch USD 96.64 million, registering a CAGR of around 3.2%

- The dishwashers’ sales in India are expected to exceed 185,000 units by 2030

- The full-sized dishwashers recorded a market share of more than 90%

- Freestanding dishwashers grabbed a market share of more than 95%

- BSH Household Appliances Mfg Pvt Ltd and IFB Industries Ltd are the major players with a combined market share of more than 80%.

- The Non-Smart dishwasher is dominating the market with 90% market share

- Offline Retail captured more than 90% of the market share in sales channel categories

- Delhi NCR and Mumbai registered around 40% of the dishwasher sales in India

Market Overview

The Dishwashers Market is anticipated to grow at a CAGR of around 3.2% during 2025-2030. The India Dishwashers Market was estimated at USD 80.22 million in 2024 and is anticipated to exceed USD 96.64 million by 2030. More than 90% of dishwashers were sold via offline channels in India. The Multibrand appliances outlets sold more than 85% of the dishwashers in the offline channel category. In 2025, the dishwasher market in India is in the state of infancy due to unfamiliarity with Indian consumers. Moreover, the high prices of dishwashers limit their penetration to Tier 1 cities of the country in 2025. However, with the expansion of high-rise buildings across Tier 2, 3, and 4 cities and growing participation of women in the workforce, the demand for dishwashers is set to grow gradually in the coming years.

The Non Smart Dishwashers have around 90% of the market share, being the dominant segment. The full-sized dishwashers have captured more than 90% of the market as of 2024 and have been consistent with this market share throughout the past couple of years. The free-standing category of dishwashers is playing a significant role in uplifting the market with the maximum share, but soon the built-in dishwashers are anticipated to catch up in the given forecast period.

Market Opportunities: Customization of Designs, Prices, and Size as per the Requirements of Indian Kitchens

According to the Ministry of Statistics and Programme Implementation (MOSPI), there are around 300 million households in India in 2025. And, the penetration of dishwashers in these households is less than 0.5%. This is because the average population of India has significantly small kitchens. The standard dishwashers offered in the market are comparatively bigger in size, due to which the dishwashers didn’t find integration in the kitchens of the majority of the households. Additionally, the dishwashers were expensive and were not able to fully clean the dishes properly due to the tough stains caused by the Indian spices. So, localisation is anticipated to be the most important factor for the customers who are purchasing the dishwasher in India during the forecast period 2025-30. So, the companies operating in this industry are looking at modifications of designs and size to meet the requirements of the Indian market.

Market Challenges: Inflationary Concerns and Reliance of Indian Consumers on Domestic Help

Inflationary pressures and domestic help are major challenges impeding the sales of dishwashers in India. The rise in manufacturing costs in China, ASEAN, Japan, etc., and tariffs on imports, higher taxation on appliances like dishwashers have adversely impacted the market growth. The price point is a major concern for the Indian population. The prices of such appliances soared in the range of 30% to 55% during 2022-24. Moreover, the Government of India imposes Goods and Services Tax (GST) of around 28% on dishwashers. These dynamics considerably increase the retail price of dishwashers in the Indian market. Hence, the population prefers house help due to low cost, easy availability, and hands-on cleaning, which makes washing the dishes more effective.

Market Trends: IoT-Based Dishwashers Gaining Traction in the Indian Market

The market is gradually shifting towards IoT-based dishwashers to reduce human intervention and increase efficiency. The dishwashers can be used from anywhere, but can be accessed through an application. This is fuelled by the new residences being built with modular kitchens. The automated dishwashers are well equipped with Error Diagnosis and Preventive Monitoring, load detection sensors, dishwasher cycle process notifications, etc. As a result, the dishwashers have a longer life span because all these features help the consumer detect the issues well in advance. Prominent players like BSH Household Appliances Mfg Pvt Ltd and IFB have introduced some Wi-Fi-enabled variants to target tech-conscious buyers. As awareness and affordability grow, the demand for IoT-capable dishwashers will be on the rise.

Market Segmentation Analysis (Distribution Channel):

With more than 90% of dishwashers being sold via the Appliances and Electronics Specialists under the Retail Offline channel in 2024. The main reason for this channel to dominate the market is the unfamiliarity of the product in the Indian market. With such products, the Indian population have a tendency to physically touch and see the product first before buying it. Moreover, getting some additional guidance from assistants to get to know about different features of dishwashers, providing help to choose the best dishwasher brand, that too in their budget.

Top Companies Operating in the Market:

BSH, IFB Industries, LG, and Samsung are the major market players operating in the Dishwashers Market of India.

India Dishwashers Market Recent Development:

- 2024: Elista introduced EDC12P, EDC12SS, and EDC12SP dishwashing machines tailored to the Indian market in the price range of USD 250 to USD 350 per unit

- 2024: BSH Home Appliances launched the state-of-the-art dishwashers with a 15-place setting capacity and featuring a sleek stainless-steel base. It also includes advanced features such as built-in Home Connect technology, allowing remote monitoring and control via smartphone. The dishwasher saves more than 80% of the water when compared to handwashing and removes 99.99% of viruses and bacteria, as verified by the Institute for Integrative Hygiene and Virology in Germany.

Gain a Competitive Edge with Our India Dishwashers Market Report.

- The India Dishwashers Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The India Dishwashers Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Dishwashers Market Policies, Regulations, and Product Standards

- India Dishwashers Market Supply Chain Analysis

- India Dishwashers Market Trends & Developments

- India Dishwashers Market Dynamics

- Growth Drivers

- Challenges

- India Dishwashers Market Hotspot & Opportunities

- India Dishwashers Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenue (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Outlook

- By Category

- Built-in Dishwashers- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Freestanding Dishwashers- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Connected Appliances

- Smart- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Non-Smart- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Size

- Full Size- Market Size & Forecast 2020-2030, USD Million & Thousand Unit

- Slimline- Market Size & Forecast 2020-2030, USD Million & Thousand Unit

- Dishdrawer- Market Size & Forecast 2020-2030, USD Million & Thousand Unit

- By Distribution Channel

- Retail Channels- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Retail Offline- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Grocery Retailers- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Hypermarkets- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Non-Grocery Retailers- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Appliances and Electronics Specialists- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Home Products Specialists- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Grocery Retailers- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Retail E-Commerce- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Retail Offline- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Non-Retail Channels- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Builder Merchants and Construction- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Retail Channels- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Price Range

- Economy

- Mid-range

- Luxury

- By End Use

- Commercial

- Residential

- By Region

- North

- Delhi- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- UP- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Lucknow- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Kanpur- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Punjab- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Haryana- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Rest of North- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- South

- Karnataka- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Tamil Nadu- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Telangana- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Rest of South- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- East

- West Bengal- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Bihar- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Rest of East- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- West

- Maharashtra- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Gujarat- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Rajasthan- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Madhya Pradesh- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Rest of West- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- North

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Category

- Market Size & Outlook

- India Built-in Dishwashers Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenue (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Outlook

- By Connected Appliances- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Size- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Distribution Channel- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Price Range- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By End Use- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Region- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Market Size & Outlook

- India Freestanding Dishwashers Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenue (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Outlook

- By Connected Appliances- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Size- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Distribution Channel- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Price Range- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By End Use- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- By Region- Market Size & Forecast 2020-2030, USD Million & Thousand Units

- Market Size & Outlook

- India Dishwashers Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- BSH Household Appliances Mfg Pvt Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- IFB Industries Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- LG Electronics India Pvt Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Samsung India Electronics Pvt Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Electrolux AB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- BSH Household Appliances Mfg Pvt Ltd

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making