Global In-Orbit Satellite Services Market Research Report: Forecast (2025-2030)

By Type of Services (Life Extension, Salvage Operation, Satellite Repair & Alteration, Refueling of Satellites & Others), By Orbit (High Earth Orbit, Medium Earth Orbit, Low Earth ...Orbit), By End User (Commercial, Government) and Others Read more

- Aerospace & Defense

- Jan 2025

- Pages 198

- Report Format: PDF, Excel, PPT

Market Definition

In-orbit satellite services refer to the maintenance, refueling, upgradation, orbit change, and other critical mid & end-life upgrade of satellites in space. The respective services help in improving the efficiency of the satellites as well as reducing the cost of launching newer satellites. The innovative and advanced technological developments in In-orbit satellite services by the companies are assumed to captivate the satellite operators to opt for the services in the future.

Market Insights

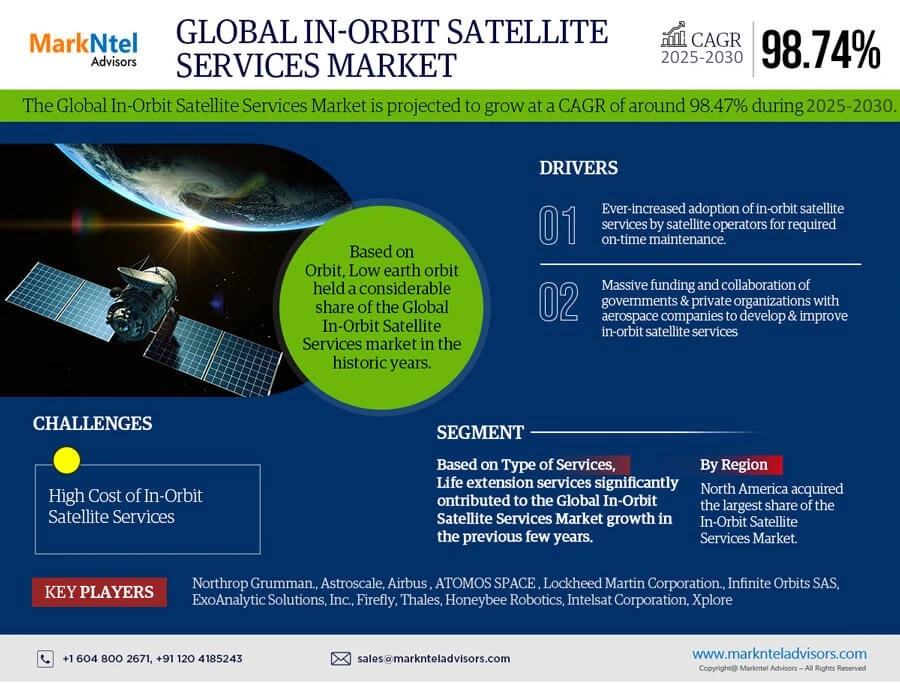

The Global In-Orbit Satellite Services Market is projected to grow at a CAGR of around 98.47% during the forecast period, i.e., 2025-30. The market has witnessed steady growth in the historical years, owing to the increased adoption of in-orbit satellite services by satellite operators for required on-time maintenance. In-orbit satellite services are the technological transformation in the NewSpace sector that aims to replace the damaged parts on satellites, enhance the life span of satellites, and reduce the cost of launching new satellites, further bolstering the market growth.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2020-23 |

| Base Year: 2024 | |

| Forecast Period: 2025-30 | |

| CAGR (2025-2030) | 98.47% |

| Regions Covered | North America: The US |

| Europe: Germany, The UK, France, Russia, Rest of Europe | |

| Asia-Pacific: India, China, Japan, South Korea, Rest of Asia-Pacific | |

| Rest of World | |

| Key Companies Profiled |

Northrop Grumman., Astroscale, Airbus , ATOMOS SPACE , Lockheed Martin Corporation., Infinite Orbits SAS, ExoAnalytic Solutions, Inc., Firefly, Thales, Honeybee Robotics, Intelsat Corporation, Xplore and Others |

| Unit Denominations | USD Million/Billion |

Furthermore, there has been an increasing influx of funds and collaboration of private & government organizations with aerospace companies to develop and improve in-orbit satellite services, further contributing to the market expansion. For instance,

- In 2021, European Commission awarded a contract of around USD3.5 million to prepare a Low-Earth demonstration project. This project is expected to spend around two years developing a concept to manufacture & assemble satellites in space and test the advanced in-orbit satellite services. With the help of this project, Europe is targeting to lead the market of in-orbit satellite services worldwide.

Hence, such strategies by the associations in the NewSpace market are estimated to maintain the demand frequency of in-orbit satellite services in the forthcoming years. Thereby, augmenting the growth of the Global In-Orbit Satellite Services market.

Market Segmentation

Based on Type of Services:

- Life Extension

- Salvage Operation

- Satellite Repair & Alteration

- Refueling of Satellites

Here, Life extension in-orbit satellite services witnessed significant growth in the past years and are expected to demonstrate consistent growth in the forecast years. One of the prominent factors backing the growing demand for life extension in-orbit satellite services is reduced investments in launching new satellites by increasing the life cycle of existing satellites in space.

Moreover, since the life span of in-orbit satellites is limited by the amount of fuel the spacecraft’s tanks can hold, the satellite operators would require solutions for refueling satellites in the coming years, in turn creating lucrative opportunities for Life extension in-orbit satellite services. Further, the extensive involvement of satellite service providers in the research and development of refueling in-orbit satellite services to meet customer expectations, propels market growth. For instance:

- In 2020, Northrop Grumman successfully demonstrated the solution for refueling satellites with the help of their Mission Extension Vehicle (MEV).

Based on Orbit:

- High Earth Orbit

- Medium Earth Orbit

- Low Earth Orbit

Among all, Low earth orbit held a considerable share in the Global In-Orbit Satellite Services market in the historical years. It owes principally to the growing number of satellites in low earth orbit. The prominent reason for such a large sustaining ratio of satellites in low earth orbit would be the lesser cost of launching satellites in low earth orbit due to its closest distance from earth.

On the other hand, the high earth orbit is estimated to experience notable growth in the forecast years, due to the increasing launch of geosynchronous satellites in space. The countries like the US, India, etc., are launching geosynchronous satellites for various purposes such as enhancing global communications, television broadcasting, weather forecasting, etc. Therefore, the launch of more geosynchronous satellites is anticipated to emerge as an opportunity area for in-orbit satellite services providers.

Based on End Users:

- Commercial

- Government

Here, the commercial segment grabbed a sizeable share in the Global In-Orbit Satellite Services market. It owes principally to the rapidly growing presence of commercial satellites in space. Several countries, such as the US, China, the UK, etc., are working to strengthen their communication systems, further driving the need for better commercial satellites. In addition, the fast emergence and deployment of 5G network connectivity worldwide have also been amplifying the demand for commercial satellites for the last few years, thereby strengthening the industry.

Moreover, the increasing automotive applications of satellite connectivity, including connected cars, have positively influenced the demand for commercial satellites. Therefore, wide applications of commercial satellites and their increasing deployment rate for navigation, path correction, etc., would fuel the demand for in-orbit satellite services during the forecast period.

- Northrop Grumman Offers space technologies to both government & civil customers including satellite mid-life extension.

Regional Projection

Geographically, the Global In-Orbit Satellite Services Market expands across:

- North America

- Europe

- Asia-Pacific

Here, North America acquired the largest share of the market in the previous years and is anticipated to prevail in the same trend during the forecast years. This dominance attributes principally to the active participation of countries like the US and Canada through various space launch services and their upcoming projects in the line. In addition, the government of the US laying out favorable policies to attract key players with investments in several research & development activities for in-orbit satellite services is also making substantial contributions to the industry growth. For instance:

- Nasa has apparently raised the total Commercial Crew Transportation Capability of SpaceX by granting the International Space Station Crew-7, Crew-8, and Crew-9 missions.

- After the Russian Satellite industry received a sanction, US rocket companies Astra Space, SpaceX, and Rocket Lab expect to launch hundreds of satellites to space in the coming years.

Recent Developments in the Global In-Orbit Satellite Services Market

Northrop Grumman, provides cooperative space logistics and in-orbit satellite servicing to geosynchronous satellite operators using its fleet of commercial servicing vehicles—the Mission Extension Vehicle, the Mission Robotic Vehicle, and the Mission Extension Pods. Recently, the company announced to launch new satellite-servicing mission in 2024, in which the company has planned to send a servicing vehicle on a SpaceX rocket.

In 2016, Intelsat, one of the biggest satellite fleet operators globally, endorsed the state-of-the-art satellite servicing capabilities of Orbital ATK on an enormous level. Such an endorsement might be the prominent factor backing the acquisition of Orbital ATK by Northrop Grumman last year.

Market Dynamics

Key Driver

- Rising Demand for Geostationary Satellites Globally

Geostationary satellites are placed in Earth’s orbit at the height of 35,800 km directly over the equator that revolves from east to west consequently keeping it in the same position above Earth. The rising demand for geostationary satellites in several countries such as the US, India, the UK, China, etc., for various purposes such as monitoring volcanic ash, measuring cloud temperatures and water vapor, oceanography, measuring land temperature and vegetation coverage, etc., has been fueling the demand for in-orbit satellite services. In addition to this, satellite operators have started adopting in-orbit satellite services in order to reduce their operating costs as well as to extend the life span of their launched satellites.

- Burgeoning Investments in Military Space Communications

Furthermore, the demand for geo satellites has also been growing, owing to the concerns of predicting and monitoring natural disasters like a cyclone. This has led to a sizable investment being done in the launch and operations of geo satellites. Therefore, the increasing launch of geo satellites for the respective reasons would require in-orbit satellite services such as life extension, refueling, repair, etc., in the forecast years.

Possible Restraint

- High Cost of In-Orbit Satellite Services

As satellite maintenance services are extensively expensive due to the requirement of launch systems & precision expertise in the satellite and other allied technologies to be maintained in space, the capital requirement has been on the higher side for the new players. Therefore, the higher cost of In-orbit satellite services is posing a threat to new entrants in the industry.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global In-Orbit Satellite Services Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global In-Orbit Satellite Services Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global In-Orbit Satellite Services Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global In-Orbit Satellite Services Market study?

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global In-Orbit Satellite Services Market: Newly Launched Satellites

- Global In-Orbit Satellite Services Market Trends & Development

- Global In-Orbit Satellite Services Market Dynamics

- Drivers

- Challenges

- Global In-Orbit Satellite Services Market Regulations & Policies

- Global In-Orbit Satellite Services Market Hotspots & Opportunities

- Global In-Orbit Satellite Services Market Start-up Ecosystem

- Global In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type of Services

- Life Extension- Market Size & Forecast 2020-2030, USD Million

- Salvage Operation- Market Size & Forecast 2020-2030, USD Million

- Satellite Repair & Alteration- Market Size & Forecast 2020-2030, USD Million

- Refueling of Satellites & Others- Market Size & Forecast 2020-2030, USD Million

- By Orbit

- High Earth Orbit- Market Size & Forecast 2020-2030, USD Million

- Medium Earth Orbit- Market Size & Forecast 2020-2030, USD Million

- Low Earth Orbit- Market Size & Forecast 2020-2030, USD Million

- By End User

- Commercial- Market Size & Forecast 2020-2030, USD Million

- Government- Market Size & Forecast 2020-2030, USD Million

- By Region

- North America

- Europe

- Asia Pacific

- Rest of World

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Type of Services

- Market Size & Analysis

- North America In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type of Services- Market Size & Forecast 2020-2030, USD Million

- By Orbit- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- The US

- The US In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type of Services- Market Size & Forecast 2020-2030, USD Million

- By Orbit- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- Germany

- The UK

- France

- Russia

- Rest of Europe

- Germany In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The UK In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- France In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Russia In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia Pacific In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type of Services- Market Size & Forecast 2020-2030, USD Million

- By Orbit- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- China In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Japan In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Korea In-Orbit Satellite Services Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global In-Orbit Satellite Services Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Northrop Grumman.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Astroscale

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Airbus

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ATOMOS SPACE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lockheed Martin Corporation.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Infinite Orbits SAS

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ExoAnalytic Solutions, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Firefly

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Thales

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Honeybee Robotics

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Intelsat Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Xplore

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Northrop Grumman.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making