Global Plastic Pigments Market Research Report: Forecast (2025-2030)

Plastic Pigments Market - By Type (Organic, [Phthalocyanine Pigments, High-Performance Pigments, Inorganic, (Titanium Dioxide, Iron Oxide Pigments, Chromium Oxide, Carbon Black, Ca...dmium Pigments]), By End User (Packaging, [Food & Beverage Packaging, Consumer Goods Packaging, Healthcare & Pharmaceutical Packaging], (Building & Construction, Consumer Goods, Automotive, Others (Healthcare, Textiles, Electronics, etc.)) and others Read more

- Chemicals

- May 2025

- Pages 204

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Global Plastic Pigments Market (2025-30):

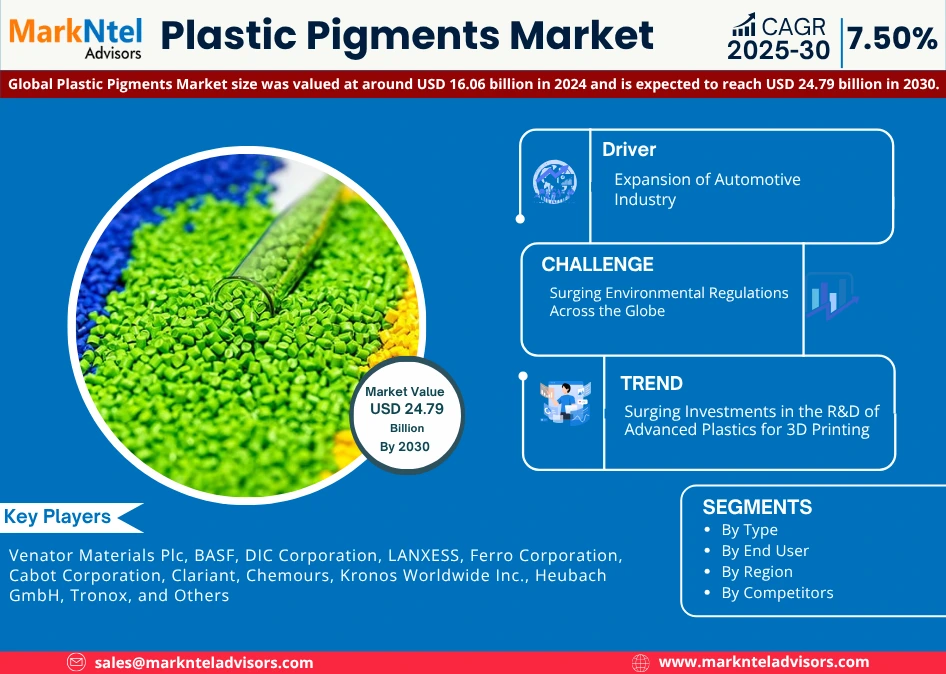

The Global Plastic Pigments Market size was valued at around USD 16.06 billion in 2024 and is expected to reach USD 24.79 billion in 2030. Along with this, the market is estimated to grow at a CAGR of around 7.50% during the forecast period, i.e., 2025-30.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 16.06 Billion |

| Market Value by 2030 | USD 24.79 Billion |

| CAGR (2025–30) | 7.50% |

| Leading Region | North America |

| Top Key Players | Venator Materials Plc, BASF, DIC Corporation, LANXESS, Ferro Corporation, Cabot Corporation, Clariant, Chemours, Kronos Worldwide Inc., Heubach GmbH, Tronox, and Others |

| Segmentation | By Type (Organic, [Phthalocyanine Pigments, High-Performance Pigments, Inorganic, (Titanium Dioxide, Iron Oxide Pigments, Chromium Oxide, Carbon Black, Cadmium Pigments]), By End User (Packaging, [Food & Beverage Packaging, Consumer Goods Packaging, Healthcare & Pharmaceutical Packaging], (Building & Construction, Consumer Goods, Automotive, Others (Healthcare, Textiles, Electronics, etc.)) and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

This flourishing growth is significantly driven by the expanding automotive industry. These pigments are the colorants that are used to provide colors to the plastics and come in both liquid & powder formats. In automotive, lightweight & durable materials are in high demand as they can help in improving fuel efficiency & enable better performance. Plastic-based automotive parts such as the bumper & dashboard require these pigments to make the overall look of the vehicle different & attractive. There is a growing inclination towards electric vehicles among consumers, as a result, the demand for e-vehicles is gradually growing, further propelling the need for these pigments in the coming years.

Apart from it, packaging is another major sector that has a high demand for plastic-based packing material in the form of sheets, boxes, and several others. There are different packing materials for different categories of an article, such as food packaging, order packaging, etc. These plastic-based packaging materials come in various sizes & colors to offer a different & attractive look. Further, the construction sector is also another major domain, with a high demand for plastics to manufacture doors, window panels, roofs, etc. Thus, the expansion within the automotive sector, the packaging industry, and the construction sector would propel the growth of the market during the coming years.

Global Plastic Pigments Market Driver:

Expansion of Automotive Industry – There is an increasing demand for lightweight materials in the automotive industry, as they can help reduce the weight of vehicles & improve fuel efficiency. Plastic pigments are used to produce lightweight plastic components that are utilized in automobiles for bumpers, dashboards, and door panels. The automotive industry is increasingly focusing on the customization of automotive components to differentiate its products from competitors. These pigments offer a wide range of color options, which can help manufacturers create customized parts attracting customers.

Moreover, many countries, like China, the US, Japan, Germany, etc., are experiencing a surge in automobile production due to ascending demand & expanding government support. Hence, this surge in automobile production across the globe is significantly contributing to the requirement for plastic pigments. Furthermore, the demand for electric vehicles is advancing rapidly, which can boost the need for these pigments. Hence, plastic components are used extensively in the production of electric vehicles, therefore their demand is expected to supplement in the coming years.

Global Plastic Pigments Market Opportunity:

Rising Construction Sector – The construction industry has been a significant contributor to the growth of the Plastic Pigments market, as plastic materials such as PVC, polyethylene, and polypropylene are widely used in the construction of various products like pipes, windows, and doors. They are used to provide color & UV resistance to these products. Furthermore, many countries, such as the UAE, Qatar, Saudi Arabia, Singapore, India, etc., are investing in tourism infrastructure, including hotels, resorts, theme parks, etc., to support economic growth & development. This has led to an upsurge in construction activity in many countries & would contribute to the market growth during the forecast period. Further, the rising construction of residential buildings is positively impacting the market. Moreover, the new buildings require the fitting of PVC pipes, window panels, roofing, and other plastic-based structures. Hence, this, in turn, requires such pigments to provide color & aesthetic looks to the plastic.

Global Plastic Pigments Market Challenge:

Surging Environmental Regulations Across the Globe – Plastics are synthetic products that have several hazardous impacts on human health as well as on the environment. As a result, governments have set up stringent regulations to regulate the production & usage of plastics among several end-user groups.

In addition to it, there has been growing prominence for using biodegradable or eco-friendly materials to replace plastic products. The packaging industry is increasingly adopting wood-based or paper-based cutlery instead of traditional plastic packaging to reduce the environmental degradation caused by the usage of plastics. Further, there is a growing consumer preference for edible packaging materials or cutlery, which are initially used to pack food and may afterward be consumed. As a result, severe laws & the availability of substitutes in some industries are restricting demand for plastics. This, in turn, is hampering the growth of the Plastic Pigments market globally.

Global Plastic Pigments Market Trend:

Surging Investments in the R&D of Advanced Plastics for 3D Printing – With the constant technological advancements & upgradation in technology, advanced painting solutions are being developed to be utilized in 3D printing. These paints are specially designed with UV-resistant characters so that the structure produced using 3D printing can sustain for a longer time with improved versatility. This category of plastic material is used as ink in 3D printing & uses specialized plastic pigments, which make the plastic & the color safe for use. The growing use of 3D printing in various domains, such as real estate, healthcare, automobile, and many others, would enhance the demand for plastic-based inks, thus influencing market growth in the coming years.

Global Plastic Pigments Market (2025-30): Segmentation Analysis

The Global Plastic Pigments Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025–2030 at the global level. Based on the analysis, the market has been further classified as:

Based on Type:

- Organic

- Inorganic

Organic plastic pigments are made from carbon-based molecules & offer a broader range of color options, improved durability, and better lightfastness compared to inorganic pigments. They are widely used in various applications, including automotive coatings, packaging, and textiles. The growing demand for high-performance pigments with superior color strength & stability has been a key driver for growth in the Organic Pigments market. The requirement for organic plastic pigments is also growing in the textile industry, as they are used in the production of colored fibers, fabrics, and textiles & are becoming increasingly popular due to their environmental friendliness & safety.

Additionally, organic pigments are used in the production of synthetic fibers such as polyester & nylon, which are widely used in the textile industry. By using organic pigments in the production of synthetic fibers, manufacturers can create more sustainable & eco-friendly products.

Based on End User:

- Packaging

- Building & Construction

- Consumer Goods

- Automotive

- Others (Healthcare, Textile, Electronics, etc.)

Here, the Packaging Industry has played a significant role in supporting the growth of the market globally. Plastic pigments are widely used in the production of packaging materials such as films, bags, bottles, and containers. The expansion of food & beverage production units has played a significant role in supporting the adoption of these pigments for packaging. The food & beverage industry is one of the largest consumers of packaging materials, and these pigments are widely used in the production of packaging to provide color & enhance their visual appeal.

Moreover, the growth of the industry has augmented the demand for high-performance packaging materials that can preserve the freshness & quality of food products during transportation, storage, and handling. These pigments provide superior color performance, stability, and durability to packaging materials, ensuring that the packaging maintains its appearance & protective properties.

Global Plastic Pigments Market (2025-30): Regional Projection

Geographically, the Global Plastic Pigments Market expands across:

- North America

- South America

- Europe

- The Middle East and Africa

- Asia-Pacific

Among all the regions, North America holds the leading share of the Plastic Pigments Market, mainly due to the extensive presence of end-user groups such as automobiles, construction, and healthcare, among many others. As a result of which, there is a higher demand for plastics, which, in turn, requires this pigment to make the plastic usable. Further, the growth within the packaging industry & construction within North America would generate increased demand for plastic products, hence upscaling revenue growth of the market in the upcoming years.

Global Plastic Pigments Industry Recent Development:

- 2024: Sudarshan Chemical Industries Ltd. agreed to acquire Germany-based Heubach Group through a mix of asset and share purchases. It expands SCIL’s global footprint to 19 sites and bolsters its portfolio with Heubach’s advanced pigment technologies and presence in Europe and the Americas. The deal is contingent upon regulatory approvals and shareholder consent. This merger strengthens SCIL’s position in the global pigments market, enhances technological capabilities, and aligns with its ambitions to become a major player outside Asia.

Gain a Competitive Edge with Our Global Plastic Pigments Market Report

- Global Plastic Pigments Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Plastic Pigments Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Plastic Pigments Market Porter’s Five Forces Analysis

- Global Plastic Pigments Market Trends & Insights

- Global Plastic Pigments Market Dynamics

- Growth Drivers

- Challenges

- Global Plastic Pigments Market Hotspot & Opportunities

- Global Plastic Pigments Market Policies & Regulations

- Global Plastic Pigments Market Supply Chain Analysis

- Global Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- Organic

- Phthalocyanine Pigments

- High-Performance Pigments

- Inorganic

- Titanium Dioxide

- Iron Oxide Pigments

- Chromium Oxide

- Carbon Black

- Cadmium Pigments

- Organic

- By End User

- Packaging

- Food & Beverage Packaging

- Consumer Goods Packaging

- Healthcare & Pharmaceutical Packaging

- Building & Construction

- Consumer Goods

- Automotive

- Others (Healthcare, Textiles, Electronics, etc.)

- Packaging

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Type

- Market Size & Analysis

- North America Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- By Country

- The US

- Canada

- Mexico

- The US Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Canada Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Mexico Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Market Size & Analysis

- South America Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Brazil

- Argentina

- Chile

- Rest of South America

- Brazil Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Argentina Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Chile Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Market Size & Analysis

- Europe Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- By Country

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Germany Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- France Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Italy Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Spain Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- By Offering

- By Type

- By Lighting

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- The UAE Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Saudi Arabia Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- South Africa Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- By Country

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- China Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Japan Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- South Korea Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- India Plastic Pigments Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type

- By End User

- Market Size & Analysis

- Market Size & Analysis

- Global Plastic Pigments Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Venator Materials Plc

- BASF

- DIC Corporation

- LANXESS

- Ferro Corporation

- Cabot Corporation

- Clariant

- Chemours

- Kronos Worldwide Inc.

- Heubach GmbH

- Tronox

- Sudarshan Chemical Industries Ltd

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making